Key Observations

- Interval and closed-end fund structures enable investors to optimally align their liquidity needs and long-term growth potential

- Interval funds offer periodic liquidity, no capital calls, low minimums

- Most private credit and PE secondaries strategies well-suited for interval funds

- Private equity and private real estate more suitable for closed-end funds

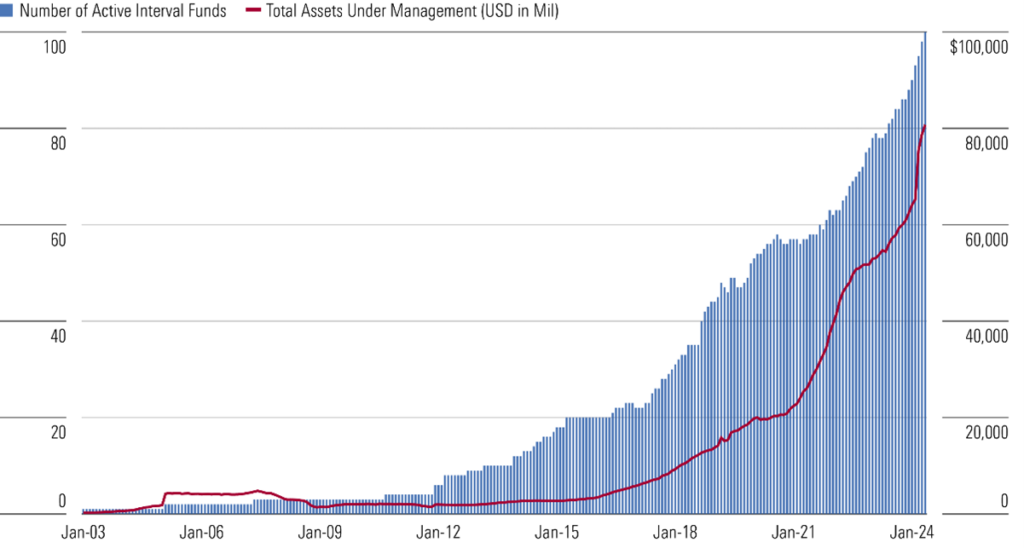

Evergreen fund structures, like interval funds, are on the rise as some of the largest private fund managers eye the $8 trillion opportunity in the private wealth space. As of last year, there are about 100 active interval funds in the market, representing about $80 billion in assets under management, according to Morningstar. This amount has doubled over the last four years, but still has far to go before the proportion of individual investor wealth devoted to alternatives approaches that held by institutional investors. How can interval funds help investors diversify and optimize their exposure to alternative investments?

Private Market Managers Used to Prefer Closed-End Funds

Traditionally, closed-end funds were the preferred structure of most private market managers, having a finite lifespan – typically 10-12 years, but as many as 15-20 years – with limited liquidity options for investors. The closed-end fund liquidity profile matches the illiquid nature of the underlying investments, like private equity (PE) or real estate. By contrast, evergreen funds, like mutual funds, are perpetual in nature with no fixed end date, which allows continuous capital raising and investment.

Interval Funds Offer Partial Liquidity, no Capital Calls, Low Minimums

Interval funds offer investors periodic (also referred to as partial) liquidity, often quarterly and sometimes monthly. The interval fund sponsor does reserve the right to limit, or “gate,” redemptions to preserve the integrity of the fund. However, periodic liquidity makes interval funds more appealing to individual investors who are accustomed to the daily liquidity of public markets. Closed-end funds do not offer liquidity, since the fund is matched against the underlying investments. Distributions, depending on the underlying investment, could occur right away as income distributions, or not until the underlying investment is sold, which could not occur until several years in the future.

Interval funds, unlike closed-end funds, don’t require capital calls, making investing in them similar to investing in public funds. Investments are made up front. The advantage is that new investors own shares of the existing portfolio immediately, rather than waiting to become invested. On the other hand, closed-end funds require investors to make an investment commitment up front, allowing the manager to call capital as opportunities present themselves. However, investment periods can be between three and five years, creating opportunity costs from uninvested capital that investors must keep liquid to meet future capital calls.

Interval funds have other features that appeal to individual investors, like low minimums – often as little as $25,000-$50,000 – and many issue 1099 tax forms, rather than K-1 partnership documents, which makes tax reporting easier.

Negatives Include Vintage-Year Risk

While closed-end funds are typically invested over a two-to-four year period by management, interval funds – due to their evergreen nature – offer investors diversification by “vintage” (issue year). Vintage-year risk can be significant in certain asset classes in which valuations can span cheap to expensive. For example, among private equity funds, it’s likely that the 2009 vintage, when initial valuations were cheap, outperformed the 2007 vintage, when initial valuations were stretched.

Interval funds can offer distinct advantages for investors, depending on the underlying investment, particularly in private credit and the secondary market for private equity and real estate. But in the cases of private equity and private real estate, the advantages of interval funds must be balanced against their disadvantages.

Most Private Credit and PE Secondaries Strategies Well-Suited to Interval Funds

Private credit – direct loans made by private funds to companies or against collateralized assets – is often beyond the scope of traditional bank lending. Private credit typically comprises floating-rate loans with maturities often between three and five years. Private credit is a broad category, however, that can also include specialty assets, like music royalties, life insurance settlements and litigation finance. Most private credit assets are well-suited for the interval fund structure, since most of the underlying assets pay a regular interest coupon and are relatively straight forward to value.

Interval funds are well-suited for PE secondaries strategies, which provide liquidity to fund holders in otherwise illiquid strategies by buying limited partnership shares of closed-end funds in the secondary market, often at a discount to their net asset value. They often enjoy an immediate return boost when funds mark their discounted purchases at fair value. In addition, interval PE secondaries funds offer instant diversification, seasoned exposure, and the opportunity to re-price assets based on current market conditions. The greatest returns in interval PE secondaries strategies occur when the funds are growing. Thanks to their evergreen nature, interval funds can grow indefinitely. Closed-end PE secondaries funds, meanwhile, have a fixed number of shares and can only offer their fundholders the liquidity discount benefit during their initial investment period. Once the investments are funded, the rates of returns of closed-end secondaries funds typically trend lower.

Private Equity and Private Real Estate More Suitable for Closed-End Funds

Long-term investments, like private equity and opportunistic real estate, are typically better suited to closed-end funds, where liquidity terms are aligned with the underlying assets. While interval funds offer lower minimums, vintage-year diversification and periodic liquidity, problems can arise when investors redeem their holdings. This occurred in early 2023 after publicly traded real estate values had plunged in 2022 while private values held steady or, in some cases, were marked slightly higher. Investors, reacting to divergent performance, raced to redeem, prompting some evergreen funds to limit redemptions to protect the portfolios. While large performance divergences between public and private investments are rare, the 2023 experience highlights the liquidity mismatch risk.

Bottom Line

Interval funds, due to their many advantages, are on the rise across a variety of strategies as private managers move into the wealth space. We welcome that evolution. For investors who are seeking portfolio diversification but are not comfortable with long-term illiquidity or with locking up their wealth for a decade or more, we recommend interval structures to gain access to private credit and private equity secondaries. Interval funds are better suited for strategies that have consistent cash flows, either contractually or by virtue of diversification and maturity, creating a comfortable match between the strategy inside the fund and the fund structure. Long-dated assets in more concentrated portfolios, however, tend to have a harder time aligning with a semi-liquid fund structure. In general, for private equity and opportunistic private real estate, we tend to focus on more closed-end fund structures for better alignment of liquidity with the underlying assets. This approach can help ensure that investors align their liquidity needs with the right fund structure, optimizing both flexibility and long-term growth potential.