Key Observations:

- In a worst-case scenario, US growth could be cut in half

- Tariffs would disrupt integrated North American supply chains, particularly for autos

- Tariffs raise concerns about inflation, including higher prices for lumber, oil and gas

- Ironically, Trump himself might be a mitigating factor in restraining tariff policy

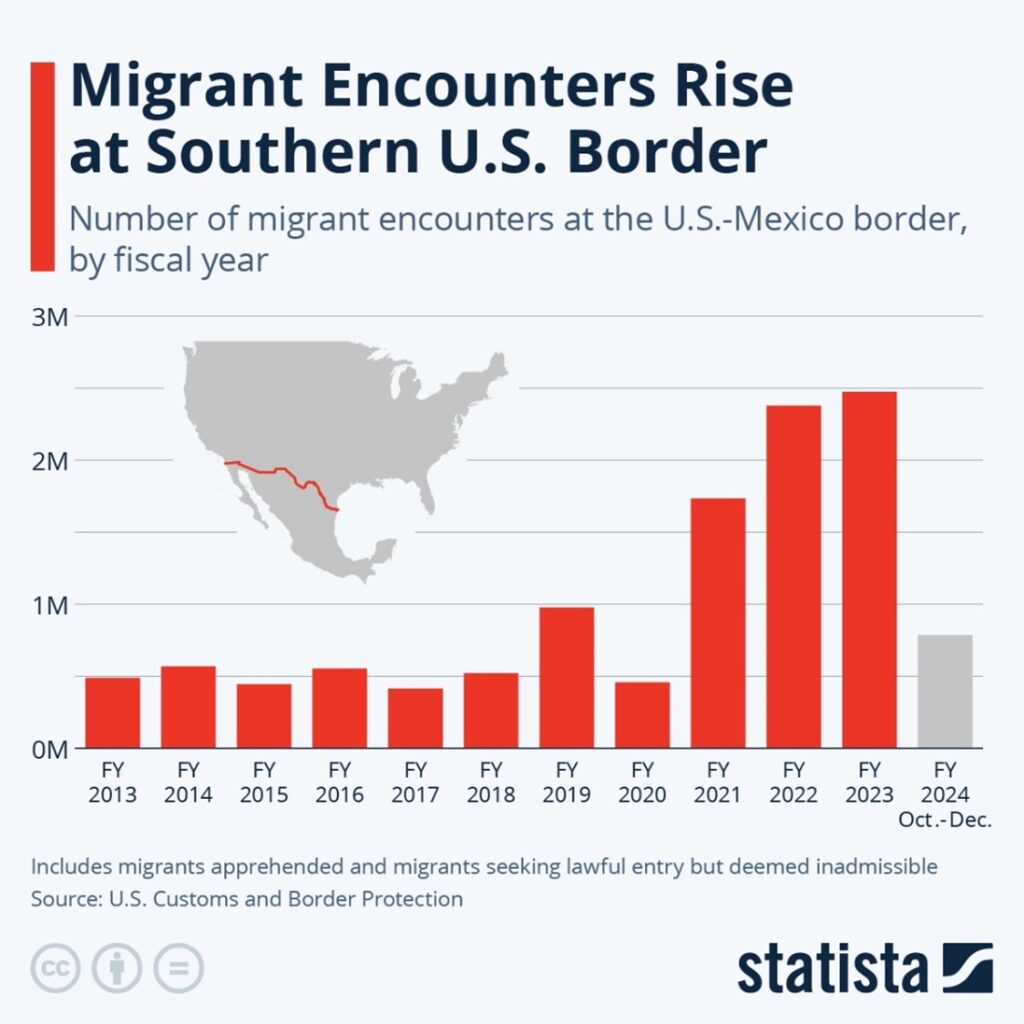

President Trump signed an executive order over the weekend that targets Canada and Mexico with 25 percent across-the-board tariffs under the International Emergency Economic Powers Act. He also imposed a 10 percent tariff on Chinese goods entering the U.S., and a “discounted” 10 percent tariff on Canadian energy imports. The news caught investors by surprise, who then summarily sold equities. By Monday, President Trump agreed to delay imposing tariffs on Canada and Mexico after speaking with their respective leaders and extracting concessions related to border security. Are we on the verge of a protracted trade war?

Tariff Policy as Leverage

The Trump administration voiced several objectives behind the moves. The President wants our neighbors to address illegal immigration and drug trafficking, especially fentanyl from Mexico. The White House says measures will remain under review/in place until the “crisis is alleviated.” Moreover, Trump claims tariffs will boost US manufacturing and revenue – revenue that will be used to fund domestic tax cuts. Trade tariffs are expected to replace traditional sanctions as leverage in international negotiations.

The initial international response was swift. Canada announced planned retaliatory 25 percent tariffs on $106 billion of U.S. goods, and Mexico promised retaliation but didn’t specify the details. Canada’s and Mexico’s retaliatory moves were also delayed 30 days to match the U.S.’s tariff delay. China, meanwhile, levied targeted tariffs of 15 percent on less than $5 billion of energy imports and a 10 percent fee on imports of American oil and agricultural equipment. Beijing has also launched an anti-trust investigation of Google.

Tariffs Would Disrupt Integrated North American Supply Chains

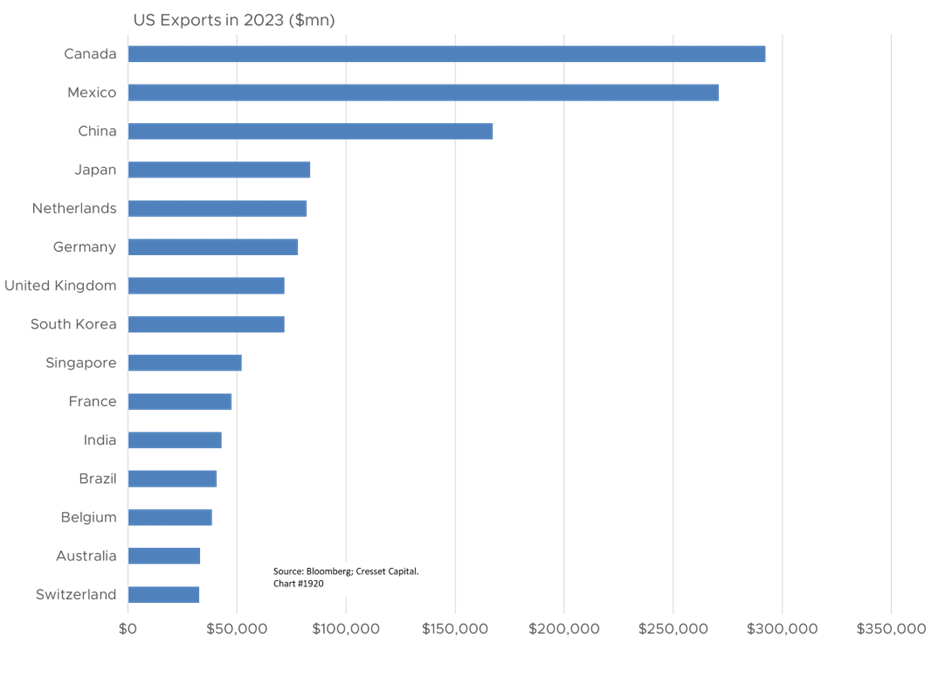

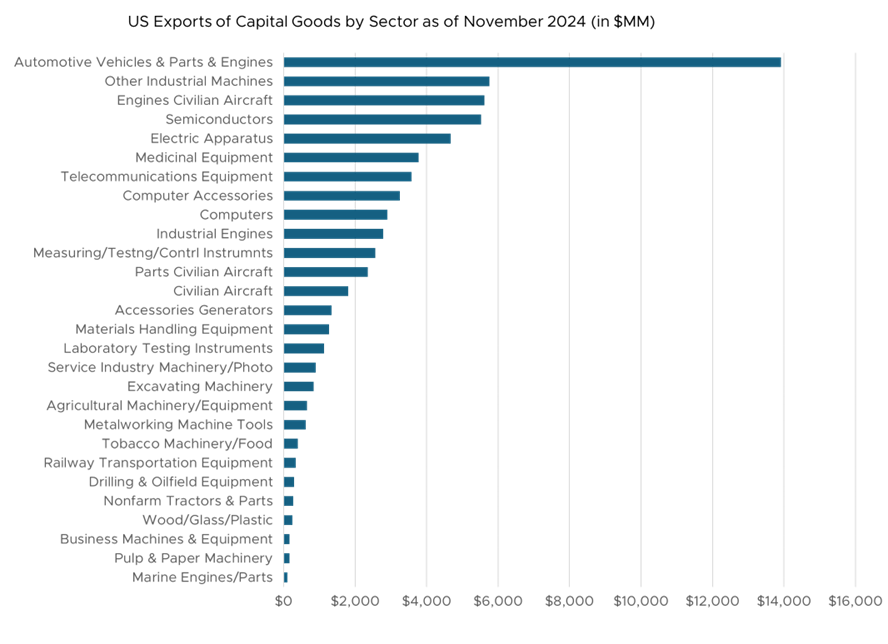

From a macro perspective, tariffs represent a transaction cost that attenuates the free flow of goods globally. Trade levies simultaneously raise the cost of imported goods to customers while reducing the demand for exported goods to suppliers. Import-oriented countries would suffer from higher inflation, while exporters would bear a burden of weaker growth. Since most countries both import and export, widespread tariffs tend to raise inflation and reduce growth. US exports include automotive products, aircraft, pharmaceuticals, oil and gas, and agricultural products, most of which would be vulnerable to international competition if our trading partners were to decide to shop elsewhere. Moreover, tariffs imposed on Canada and Mexico would significantly disrupt integrated North American supply chains, especially in the auto industry.

Worst Case: US Growth Could Be Cut in Half

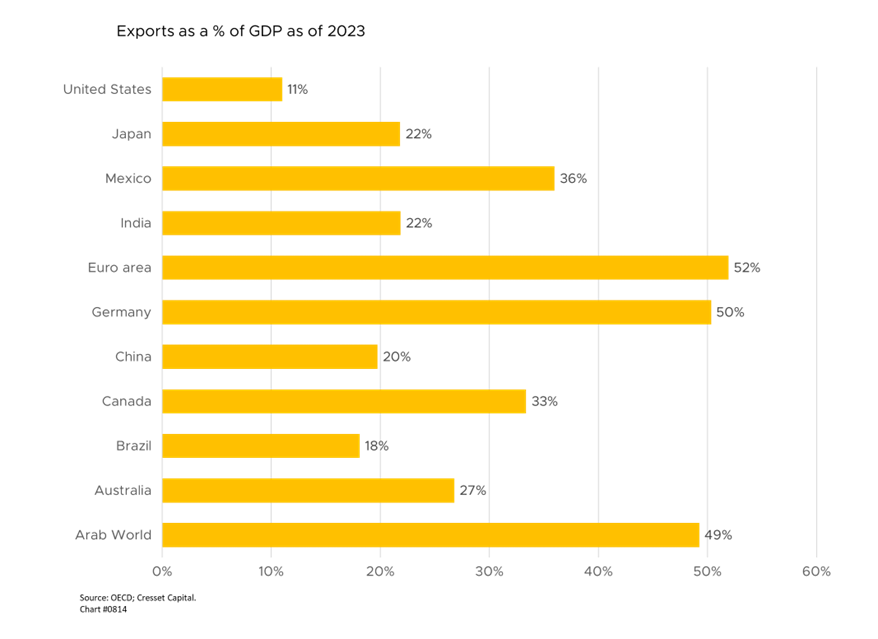

Economists estimate that, if the Trump tariffs are fully implemented, they could reduce U.S. growth by 1.2 percentage points, taking 2025 real GDP estimates from 2.2 percent to one per cent. At the same time, they would raise the inflation rate by 0.7 per cent, from the 2.6 percent currently forecast for 2025 to 3.3 percent, costing American households hundreds of dollars annually. Export-oriented markets, like the European Union and the Arab world, would be particularly vulnerable to a global trade war, since exports represent around half of their respective GDPs.

Potential Tariffs Raise Concerns About Inflation

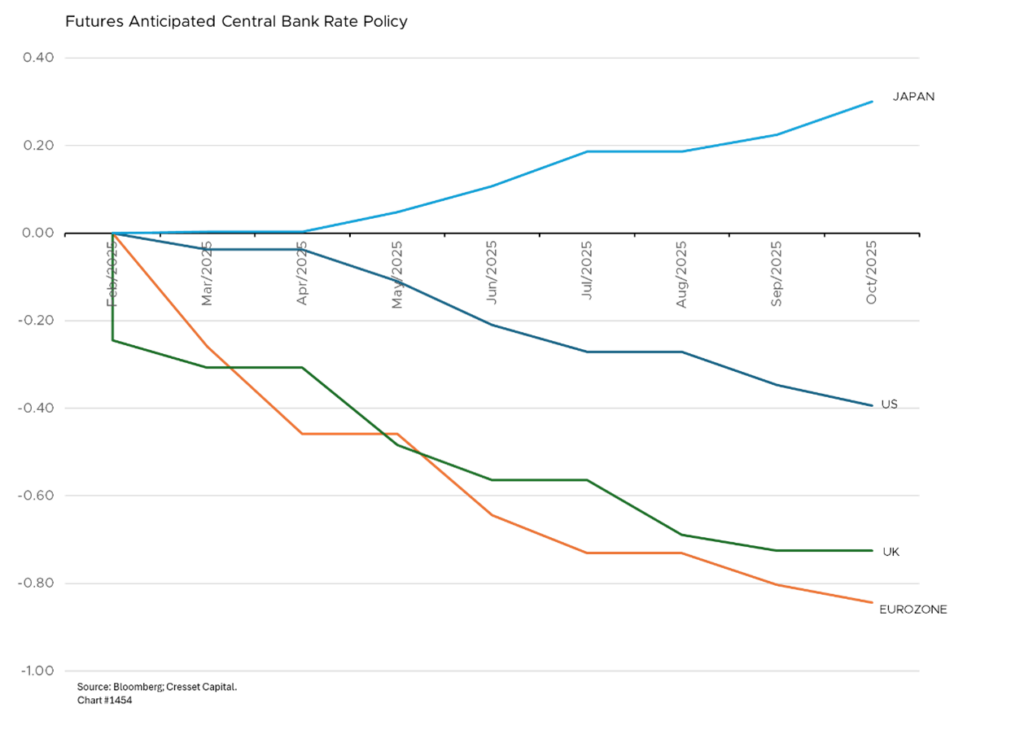

This news also comes at a delicate time for monetary policymakers, as inflation was progressing slowly toward the Fed’s two percent target. Tariffs could upend that progress, with consumer prices reversing course across both staples and discretionary sectors; car prices are expected to increase by $3,000 on average. Chairman Powell recently noted today’s heightened price environment is different from Trump’s first term when inflation was low. There’s a renewed concern about a potential “massive supply shock” like that suffered during the pandemic lockdowns if trade were to grind to a standstill.

Possible Supply Chain Disruption, Particularly in Autos

Several US sectors have outsized exposure to trade, having optimized their business for globalization. The automotive sector, for example, would face a severe disruption from a protracted trade war, particularly between the US and its North American neighbors. The US imported about $147 billion in vehicles and parts from Mexico and $60 billion from Canada in 2023. Companies like GM, with half their pickup trucks made in these countries, could see earnings cut by half. Suppliers are scrambling to rework contracts and find alternative sources, but many say quick adjustments are impossible. Volkswagen is most exposed, with 42 percent of the vehicles they sell in the US actually coming from Mexico or Canada. The integrated North American supply chain means components often cross borders multiple times.

Potential for Higher Oil and Gas Prices

The oil industry also faces significant uncertainty under Trump’s new trade policies. Wall Street banks have raised their oil price forecasts, with Brent crude expected to average $73.01/bbl and WTI at $68.96/bbl in 2025. The prospect of 10 percent tariffs on Canadian and Mexican energy imports could significantly affect gasoline prices, especially in the Midwest, which is the largest consumer of Canadian crude. The situation is further complicated by potential sanctions on Russia and Iran, and Trump’s pressure on OPEC to increase output in order to lower prices.

US Farmers Brace for Retaliation

Agricultural trade within North America would also feel the effects of a global trade dispute. The US imported over $45 billion in agricultural products from Mexico in 2023, including strawberries, raspberries, tomatoes and beef, and another $40 billion from Canada, including beef, pork, grains, and potatoes. American farmers are likely bracing for retaliatory tariffs, as Canada and Mexico historically target agricultural products for maximum political impact. Mexico has announced a “carousel retaliation” strategy that would periodically rotate targeted products to create uncertainty, particularly affecting agriculture sectors that lobby Congress. Previous retaliations have successfully targeted products like grapes, cherries, and pork.

Construction Costs Could be Affected

Homebuilders could see significant increases in construction materials from tariffs. About one-third of softwood lumber used in the U.S. is imported from Canada. Together, Canada and Mexico account for over 20 percent of US cement imports. These materials could soon face 25 percent tariffs, with no exemptions mentioned. Construction industry groups have not been granted carve-outs despite lobbying efforts. We expect most of the increased costs will be passed on to U.S. consumers, where housing costs are already prohibitively high. The tariffs will likely disrupt established supply chains that the US construction industry has relied on for decades under free-trade agreements.

Impact of a Trade War

Trade wars rarely create winners, as higher prices are met with weaker demand. The combination of inflation pressure and weaker growth is a troublesome combination for both investors and the Fed. Higher real rates will weigh on public and private sector borrowers, including the U.S. Treasury. Companies, meanwhile, must scramble to relocate production and set up alternative supply chains to keep costs contained. A prolonged trade war would weigh on profit margins and crimp profit growth. In an environment in which stretched valuations must rely on robust profit growth and quiescent rates, the prospect of escalating trade tension presents downside market risk. An escalating trade war would also harm our trading partners who have built export-oriented economies, particularly Europe.

But Not Everyone Would Lose

U.S. domestic manufacturers could be potential winners, particularly those with low reliance on cross-border supply chains, as they would gain a competitive advantage against imports. For domestic manufacturers which source their inputs domestically, for example, tariffs would represent a pricing umbrella under which they could raise prices. US domestic steel producers and raw material suppliers would benefit as alternative sources to imports from Mexico and Canada. US industrial real estate could also benefit from increased demand from reshoring. Additionally, alternative trading partners like Thailand could stand to gain as well as a potential new source for auto parts as companies seek “trade-friendly countries.”

Bottom Line: Don’t underestimate a “Trump Put.”

A worldwide trade war would hurt equity markets as rates rise in response to higher prices and earnings and profits decline due to weaker demand, leaving equity investors and the Fed in a bind. The conundrum is exacerbated by already stretched valuations, particularly among U.S. large caps. The S&P 500 is priced to perfection and must rely on increased profit growth and tame interest rates to move higher. Ironically, Donald Trump himself could serve as a mitigating factor. The President and his team continually monitor U.S. equity market performance as a real-time approval indicator. It’s possible Trump was motivated to delay the implementation of the tariffs earlier this week by a 600-point market decline on Monday. The President could back away from his aggressive policymaking if U.S. equities decline too quickly. He wouldn’t want a bear market named after him.