Key Observations:

- Tariff implementation starts and stops creating uncertainty

- Federal job cuts and immigration enforcement could affect growth and inflation

- GDP models signaling slowdown, some more than others

- Consumer spending has become increasingly, structurally top heavy, and vulnerable to the wealth effect

- We see little evidence to date of imminent recession

We are increasing our recession scenario probability from 10 per cent to 20 per cent and reducing our reacceleration scenario from 20 per cent to 10 per cent, leaving slowing growth/slowing inflation as our base case at 70 per cent.

Tariff Implementation Starts and Stops Creating Uncertainty

President Trump’s ramped-up tough tariff talk aimed at our three largest trading partners – Mexico, Canada and China – has not been playing well on Wall Street. Some tariffs on Mexico and Canada covered by the USMCA have been suspended until April 2, highlighting that tariff implementation has been characterized by starts and stops that have created heightened uncertainty. The President downplayed recession fears in a recent Fox News interview, describing the current situation as a “period of transition” while the economy adjusts to his policies, stating, “We’re bringing wealth back to America”, and adding, “It takes a little time.”

Stock Retreat Has Wiped Out Election-to-Date Gains

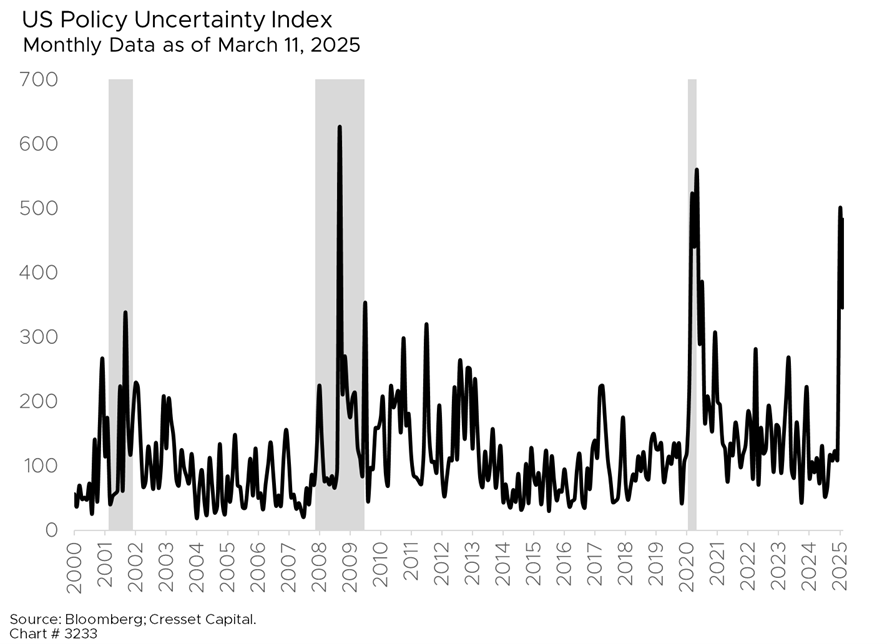

The market response has been decidedly negative. The US Policy Uncertainty Index is flirting with an all-time high. The Index is currently situated higher it was at the depths of the pandemic and nearing the peak of the financial crisis. The S&P 500 has experienced its worst weekly loss since the Silicon Valley Bank crisis two years ago, wiping out all post-election gains. The tech-heavy NASDAQ Composite has fallen around 10 per cent from its recent peak. Bank stocks have been among the biggest decliners over the last two weeks. Meanwhile, investors have flocked to traditional safe havens, like bonds and gold.

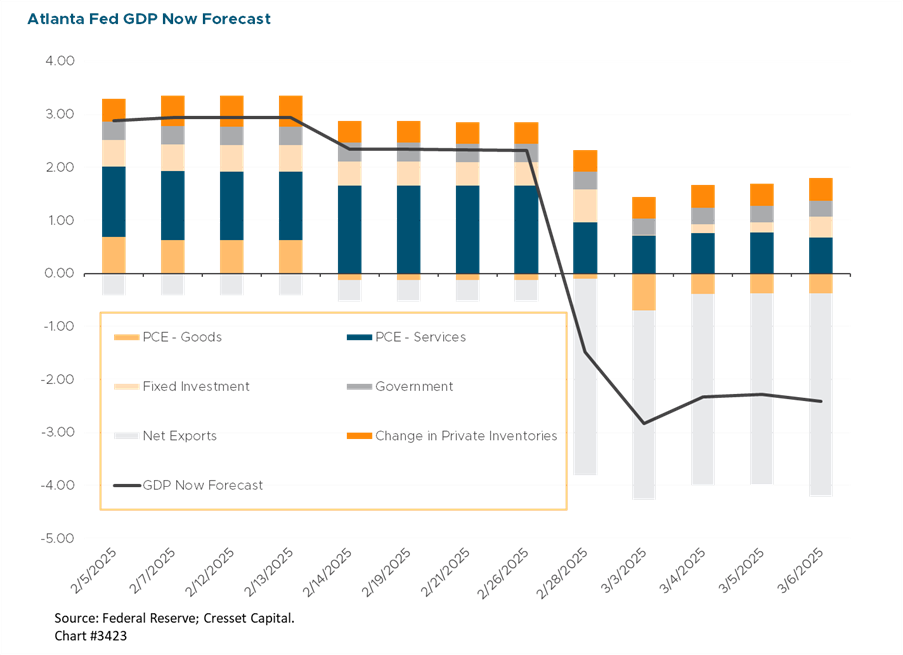

GDP Models Signaling Slowdown, Some More than Others

On top of the recent headlines, several forward-looking economic indicators are signaling a slowdown. The Atlanta Fed’s GDPNow tracker projects first-quarter GDP could contract by 2.8 per cent annualized, fueled by a surge of imports in anticipation of future tariffs. Note that imports are deducted from GDP growth, since sales are generated overseas. Other GDP models, however, are not as negative. Meanwhile, both consumer and business confidence are declining. The Conference Board Consumer Confidence Index in February posted its largest monthly decline since 2021. Manufacturing surveys, moreover, point to steep declines in new orders alongside rising input costs.

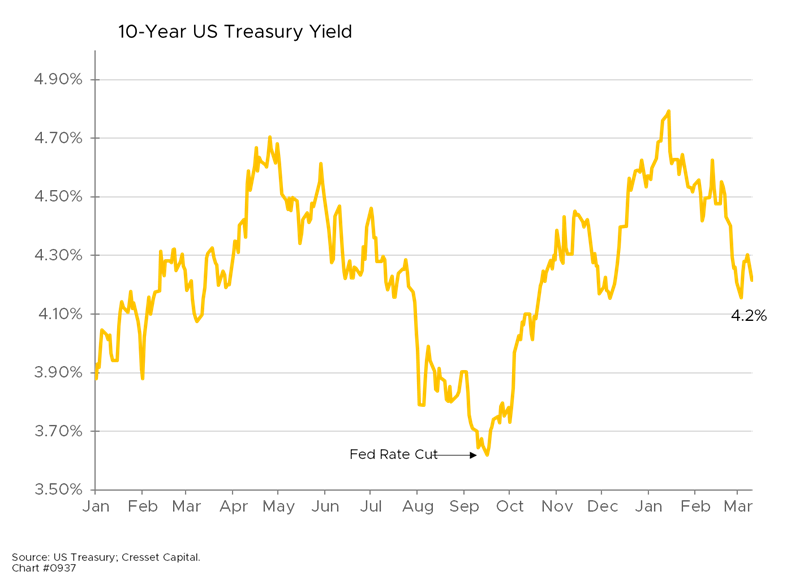

Bond Market also Signaling a Slowdown

The 10-year Treasury yield, a barometer of economic growth prospects, has slid over the last six weeks to December levels. Traders are increasingly betting the Federal Reserve will resume cutting interest rates as soon as June to keep the economy from deteriorating. Fed fund futures currently imply three rate cuts this year, up from just one cut about a month ago.

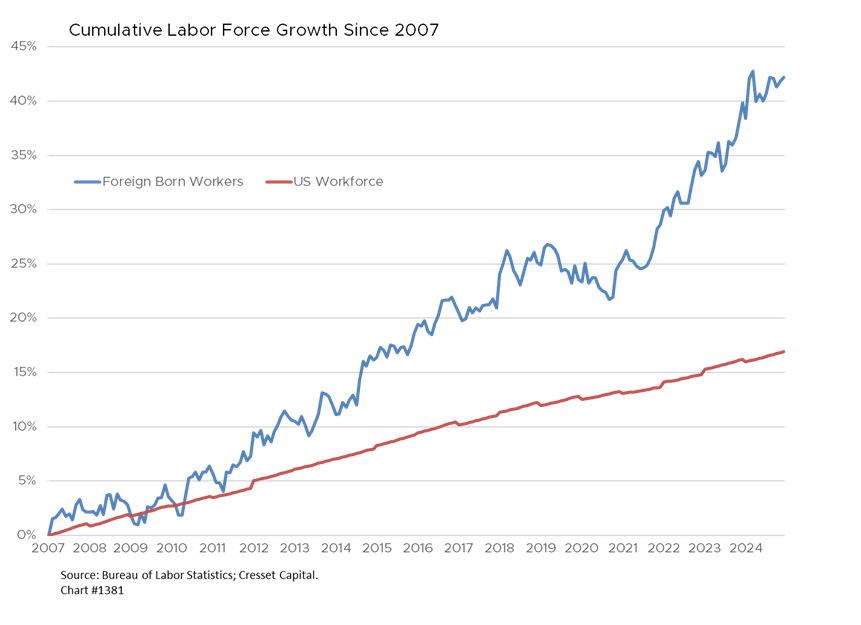

Federal Job Cuts and Immigration Enforcement Could Also Affect Growth and Inflation

Beyond implementing trade tariffs – a policy designed to crimp demand with higher import prices – other policies also have the potential to reduce growth and raise prices. The Department of Government Efficiency (DOGE) led by Elon Musk is pursuing aggressive federal job cuts, the 300,000 to 500,000 targeted job cuts could induce near-term spending cuts and private sector layoffs. While the job cuts will have an impact on spending in the near term, over time we expect highly skilled federal workers to successfully integrate into the private sector where there remain millions of job openings. Immigration enforcement could drive up labor costs in industries that rely on immigrant workers, like agriculture, construction and hospitality. Most of the labor market growth in recent years was attributable to foreign-born workers, according to the Bureau of Labor Statistics.

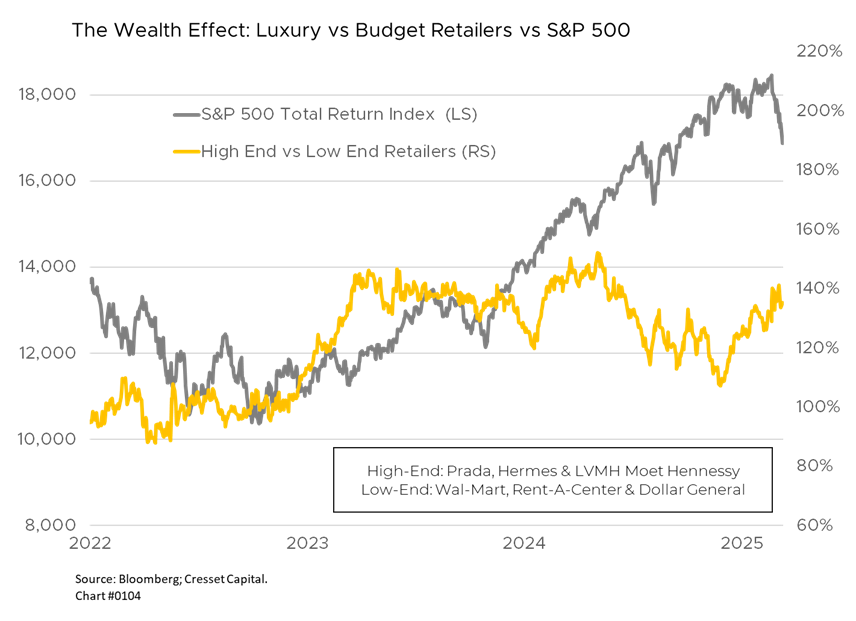

Consumer Spending Has Become Increasingly, Structurally Top Heavy

A recent Wall Street Journal report revealed that the top 10 per cent of earners – households making about $250,000/year or more – now account for 49.7 per cent of all spending, a record in data going back to 1989 and up from 36 per cent three decades ago. Between September 2023 and September 2024, high earners increased their spending by 12 per cent, while spending by working-class and middle-class households declined, according to the report. The share of discretionary spending by high earners for restaurants, travel and high-end retail is substantially higher. It also suggests that about one-third of US GDP growth depends on 10 per cent of American households.

Never have US economic fortunes been so reliant on such a small segment of the population. This concentration creates a specific vulnerability – the wealth effect. A stock market selloff or decline in home values that rattles the confidence of wealthy Americans could have an outsized impact on overall economic activity.

The challenge for the Fed is that while economic growth might slow, tariffs could simultaneously push up inflation, creating a difficult policy environment. Some economists predict the Fed might need to cut rates as soon as May or June if consumer confidence deteriorates significantly.

Bottom Line:

Recent market turbulence is a natural reaction to a relatively expensive market overlaid with uncertainty. But there’s little tangible evidence to date that the US economy is slowing, or that the threat of recession is imminent. While we remain on the lookout for weakening, our base-case scenario of slowing growth coupled with easing inflation remains in place. Given the performance moves over the past several years, investors should take the opportunity to rebalance their equity holdings towards their longer-term targets to maintain proper diversification for the times ahead.