Key Observations:

- Stocks Have Reacted Negatively to Administration Policies

- Consumer Sentiment Taking a Hit Even Among High Earners

- Market Decline Beginning to Affect Investment Behavior and Spending Behavior

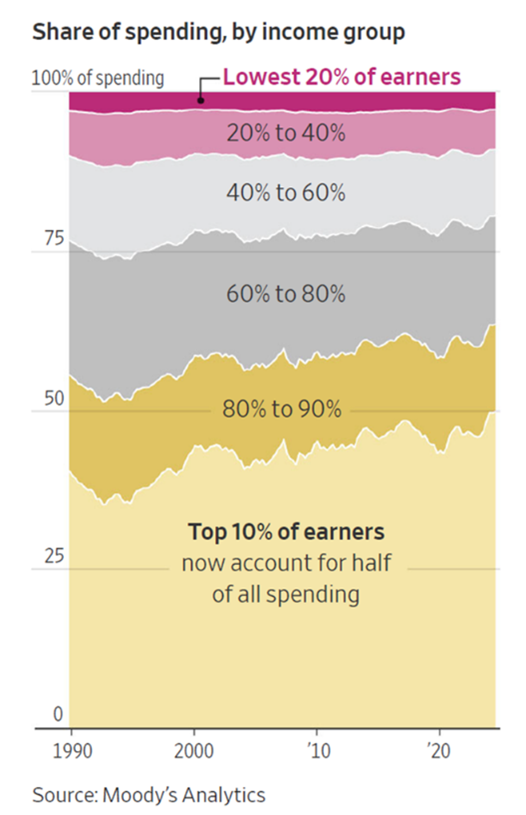

A recent report in The Wall Street Journal, citing a Moody’s Analytics study, revealed that 10 per cent of America’s highest-income households account for about half of overall spending. That’s significantly higher than numbers from older, official US Census data indicating the top 20 per cent of households account for 40 per cent of spending. This remarkable statistic has two major implications for today’s economy:

- Because consumption accounts for two-thirds of GDP growth, it means that 10 per cent of American households account for 33 per cent of GDP growth.

- Most discretionary spending – such as travel, dining, and entertainment – is concentrated among this very small group, whose attitudes toward spending could change.

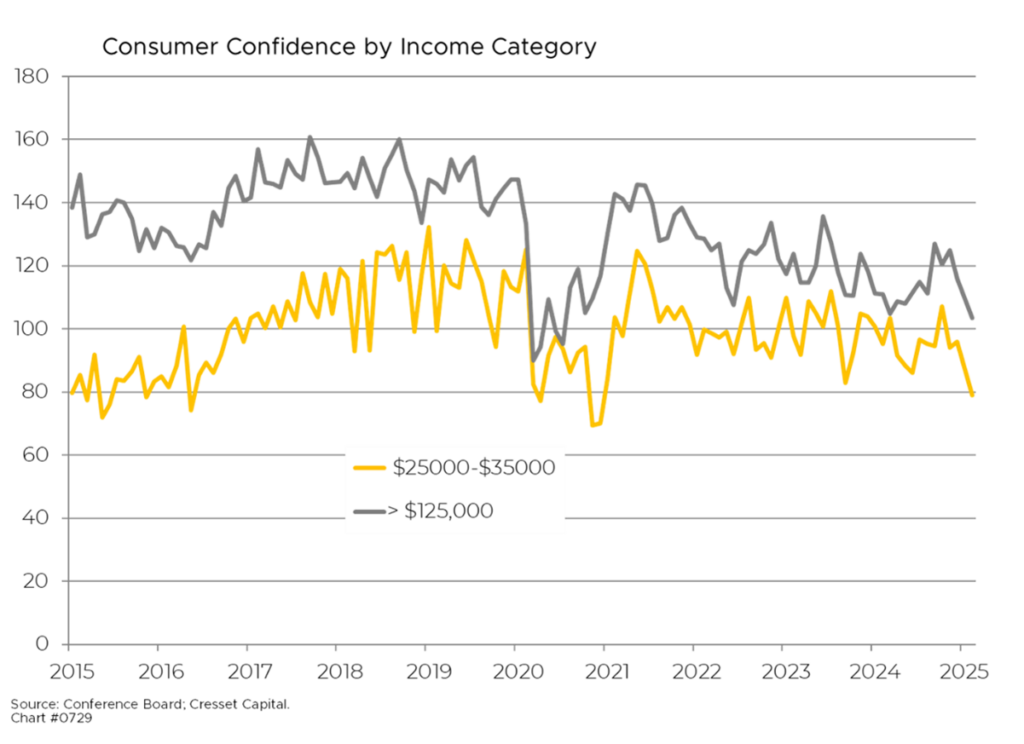

Confidence among this cohort, a vital directional indicator of growth, is very dependent on the “wealth effect”: how positive they feel about their home values, stock portfolios and job security.

Economic Uncertainty on the Rise

The US economy is showing significant signs of uncertainty two months into President Donald Trump’s second term, with consumer confidence plunging and markets experiencing substantial volatility in response to new trade policies and economic direction. Trump has implemented his most aggressive trade policies to date, targeting America’s three largest trading partners. In early March, the administration imposed 25 per cent tariffs on imports from Canada and Mexico, while also adding another 10 per cent tariff on Chinese goods. These measures threaten to disrupt established supply chains, particularly in the automotive industry where parts may cross borders multiple times during production of a single vehicle.

Consumer Sentiment Taking a Hit Even Among High Earners

The University of Michigan’s Consumer Sentiment Index fell 11 per cent to 57.9 in mid-March from 64.7 in February, hitting its lowest level since November 2022. This represents a 27 per cent decline from a year earlier, with sentiment among Democrats reaching record lows and even Republicans showing decreased confidence despite typically rallying behind their party’s president.

Confidence among the highest-earning households has slipped in sympathy. Confidence among those earning $125,000 and more has fallen 30 per cent from its post-pandemic peak reached in June 2021, according to Conference Board data. That compares to a 36 per cent slide among households earning between $25,000 and $35,000.

Pessimism Could Affect Future Spending

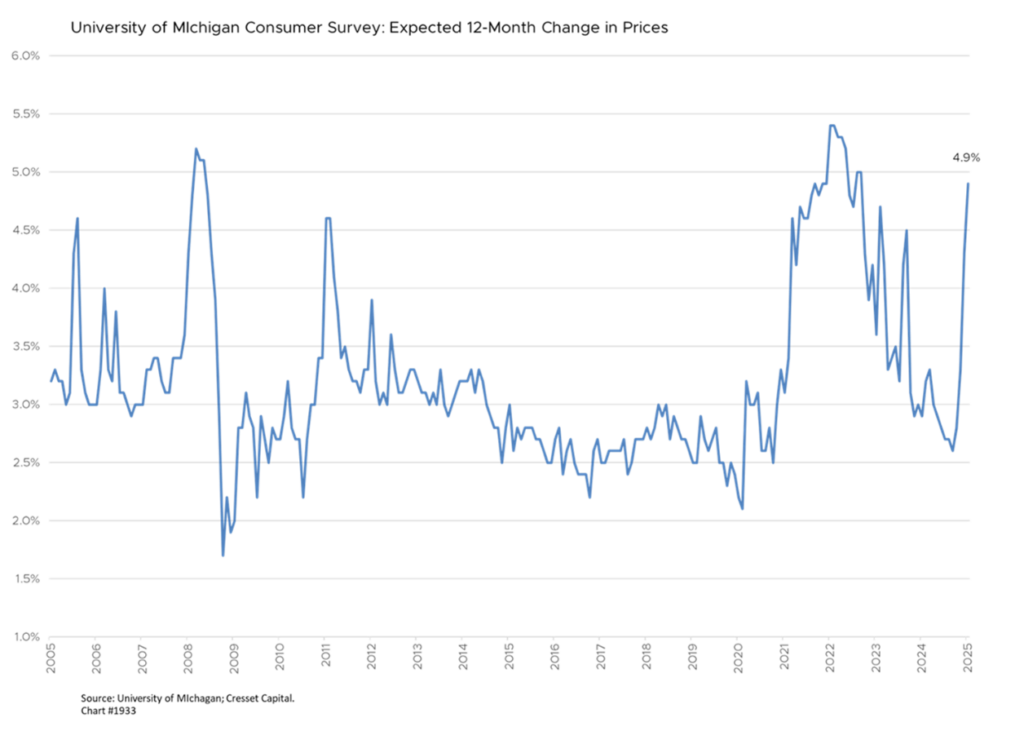

The expectations component of the Index, which has been found to predict future spending, fell by 15 per cent. Consumers across political affiliations expressed concern about personal finances, labor markets, business conditions, and stock markets. At the same time, inflation expectations for next year have spiked significantly since the election. Households are bracing for 4.9 per cent inflation next year, its highest reading since late 2022. That’s up from 2.3 per cent as recently as November, according to the University of Michigan. Rising inflation expectations complicates the Federal Reserve’s decision-making strategy. The Fed may be reluctant to cut interest rates to stimulate the economy against a backdrop of rising inflation expectations

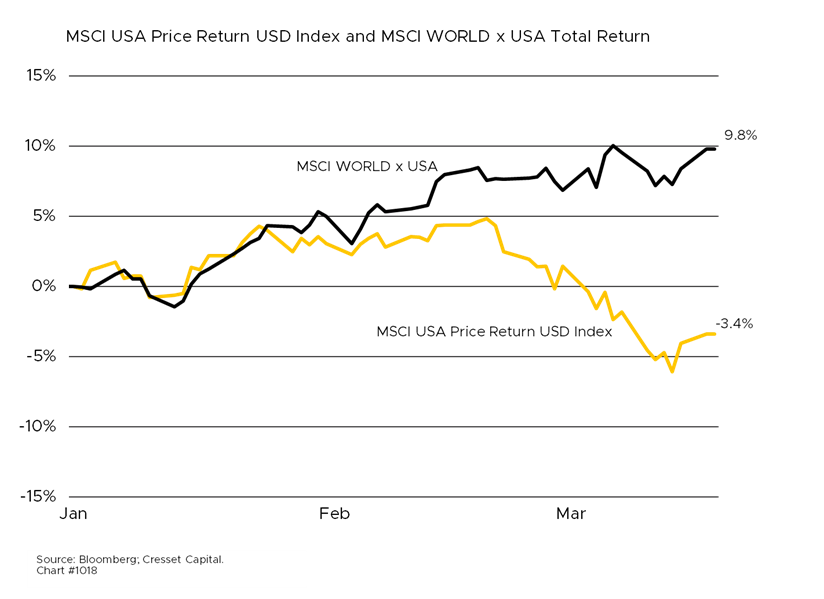

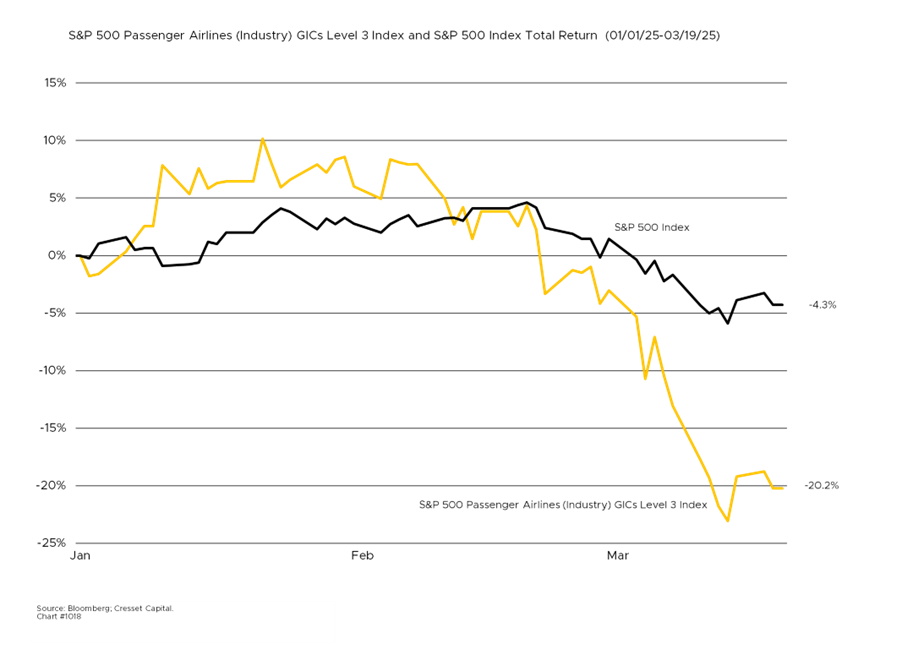

Stocks Have Reacted Negatively to Administration Policies

The S&P 500 has fallen into correction territory, down more than 10 per cent from its recent peak in mid-February. The Russell 2000 Index of smaller companies, which are more sensitive to domestic economic conditions, has fallen over 16 per cent from its November peak, potentially signaling broader economic concerns beyond tech-sector adjustments. Not all equity markets are regressing, however: foreign markets are nearly 10 per cent higher for the year.

Market Decline Beginning to Affect Investment Behavior

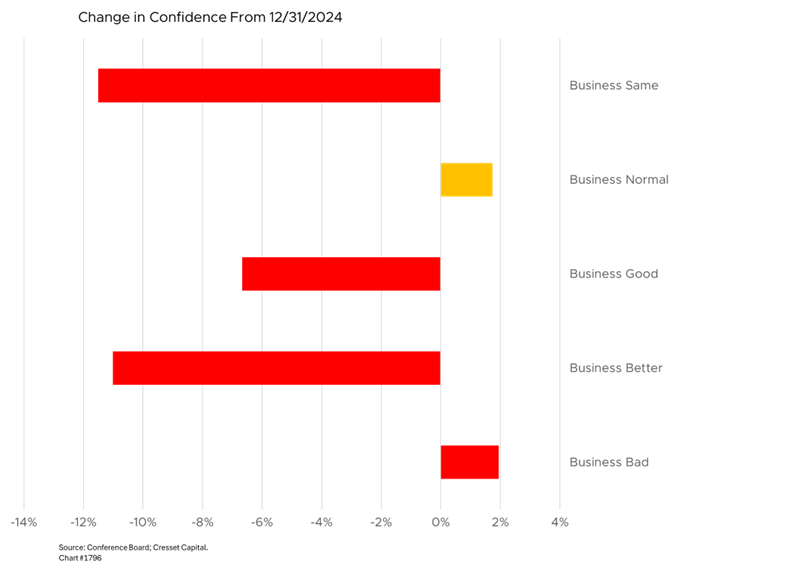

Some investors, particularly those nearing or already in retirement, are shifting assets from stocks to safer options like bonds and Treasury funds, with many believing “this time is different.” The business community is also on high alert, as gauged by recent surveys. A Conference Board survey of small business owners shows meaningful slippage in business confidence, with an 11 per cent drop from the beginning of the year in “business better,” and a two percent increase in “business bad.” Overall, small business uncertainty recently reached its second-highest level in over 50 years.

‘Wealth Effect’ of Falling Stock Prices Starting to Affect Spending

The wealth effect caused by declining stock prices could force an increasing share of Americans to sit on their wallets. Roughly 43 per cent of American households’ financial assets are in stocks – the highest share ever. Consumers, feeling the pinch, have adapted to the uncertain economic environment by pulling back on discretionary spending for things like travel and home improvements. Airlines, including Delta, have cut quarterly guidance due to declining leisure travel activity. Walmart is catering to an increasing share of price-sensitive, higher-income customers.

Economy Still Expected to Expand, but at Slower Pace

Though we have raised our recession probability from 10 per cent to 20 per cent for 2025, our base case calls for the economy to expand, albeit at a slower pace. Bank economists have similarly revised their GDP growth projections down to one per cent for both the first and second quarters, compared to earlier forecasts of 1.8 per cent and two per cent, respectively.

The economic anxiety stems not only from tariffs but also from government spending cuts, federal workforce reductions, and general policy uncertainty. We remain the lookout for further wealth-effect-related spending cuts. If stocks were to fall 20 per cent in 2025, it could reduce economic growth by as much as one percentage point this year due to consumer cutbacks. Animal spirits drive growth and uncertainty spurs caution.

Bottom Line:

While US large-cap valuation remains stretched, other markets – most notably high-quality small caps and international equities – are closer to fair value. We recommend investors diversify their equity holdings after considering their tax situation. In the meantime, we will be on the lookout for further economic deterioration by looking for clues in the credit markets.