Key Observations:

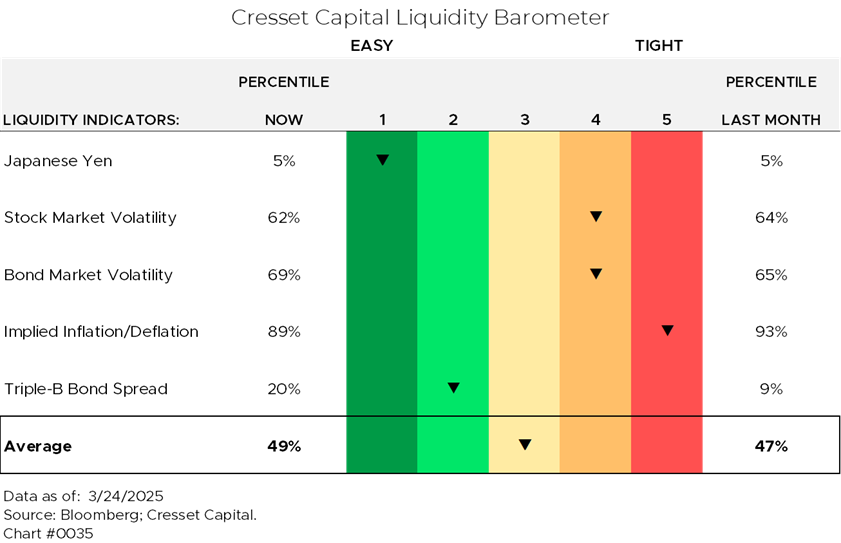

- Cresset’s Liquidity Barometer monitors JPY/USD, inflation expectations, stock and bond market volatility, and corporate bond spreads

- The BBB bond spread is an excellent real-time liquidity measure

- Widening spreads are an early warning signal of economic and market troubles

- For now, our Barometer reading is neutral

Liquidity – the availability of money to borrow, spend and invest – is one of Cresset’s critical metrics in evaluating the investment environment. Liquidity is like the circulatory system of the economy: the easier liquidity flows, the healthier the economy is. And except for 2022, liquidity has been easy for most of the last decade. Over time, liquidity indicators have often presaged risk-off markets.

Cresset’s Liquidity Barometer monitors several metrics:

The JPY/USD exchange rate. The yen, given its low yield, has been a carry-trade funding vehicle. The yen is currently very weak versus the dollar, implying carry traders are comfortable. Historically, in periods of stress, investors buy back their short yen positions, forcing the currency higher.

Stock and bond market volatility. Liquidity falls as volatility rises, as lenders pull back on lending against securities. The recent spike in policy uncertainty has pushed stock and bond volatility into the fourth quintile of their historical ranges, implying tighter liquidity.

Rising inflation expectations. If investors expect higher inflation – and a loss of purchasing power over time – they will demand a higher liquidity premium as compensation. They also anticipate the Fed to raise short-term interest rates. Though this metric has moved into its top quintile, credit spreads remain quiescent by historical standards.

Corporate bond spread. The yield premium lenders require to extend credit to investment grade borrowers is one of the best real-time measures of liquidity. Sanguine lenders, not worried about the risk of credit deterioration or default, require a small yield premium over equivalent maturity Treasurys. In times of uncertainty, however, yield premiums expand to compensate lenders for their perceived increase in credit risk.

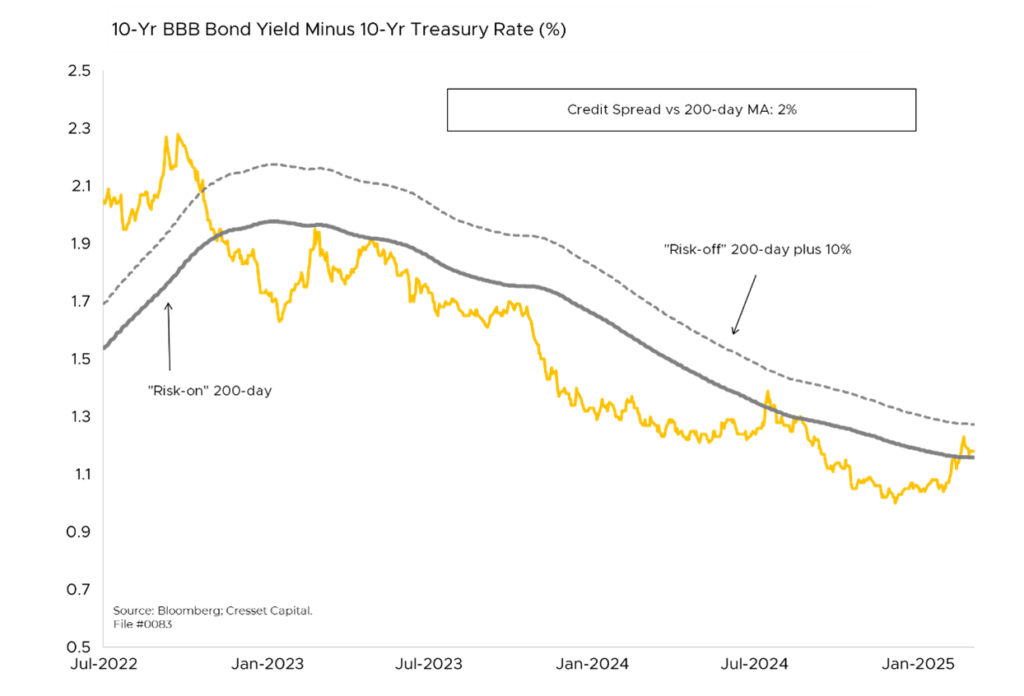

Corporate Bond Spread Excellent Real-Time Liquidity Measure

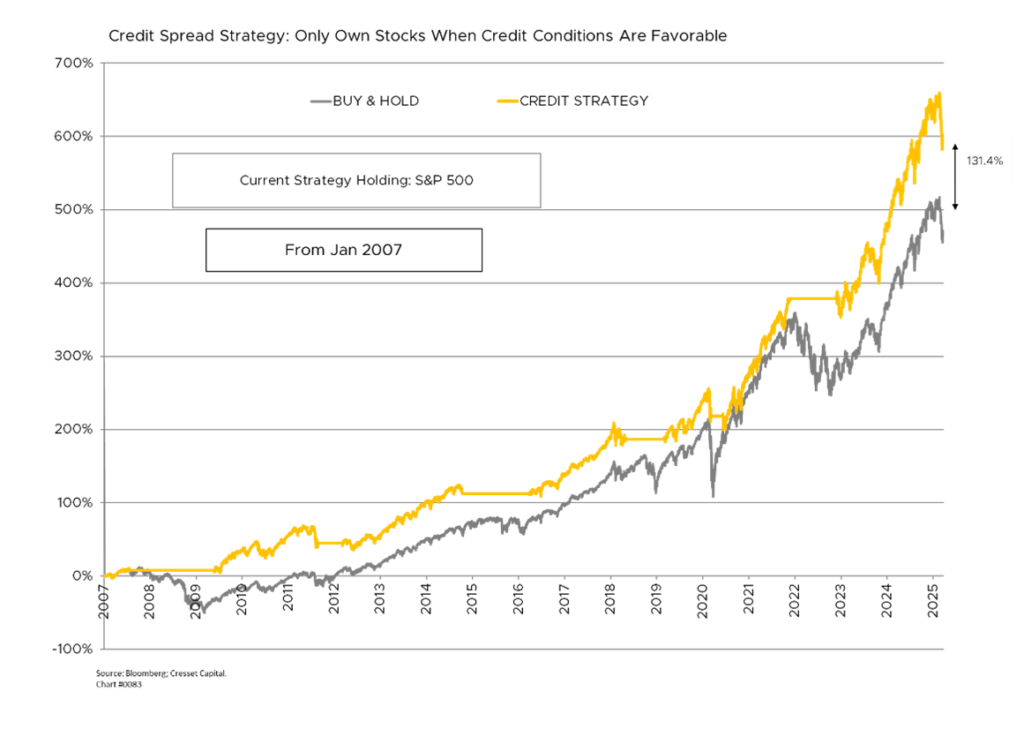

At more than $10 trillion, the US corporate bond market is about one-quarter of the size of the US public equity market, but is priced efficiently thanks to its institutional nature. We track the 10-year, BBB corporate bond spread, since roughly half the corporate bond market is BBB rated. Cresset’s credit spread metric measures the 10-year, BBB bond spread relative to its 200-day moving average. A break more than 10 per cent above the moving average is a risk-off signal, while a move below its moving average is a risk-on indicator.

Widening Corporate Bond Spreads Early Warning of Economic and Market Troubles

History has shown that the widening of corporate bond spreads has been an early warning indicator of trouble brewing in the economy and in stocks. For example, credit broke down in July 2007, long before the financial crisis erupted, and credit remained “risk off” until May 2009. The credit indicator broke down again in early March 2020 in response to pandemic uncertainties and before the 25 per cent equity market pullback later that month. “Risk-on” was restored by June of that year.

Bottom Line:

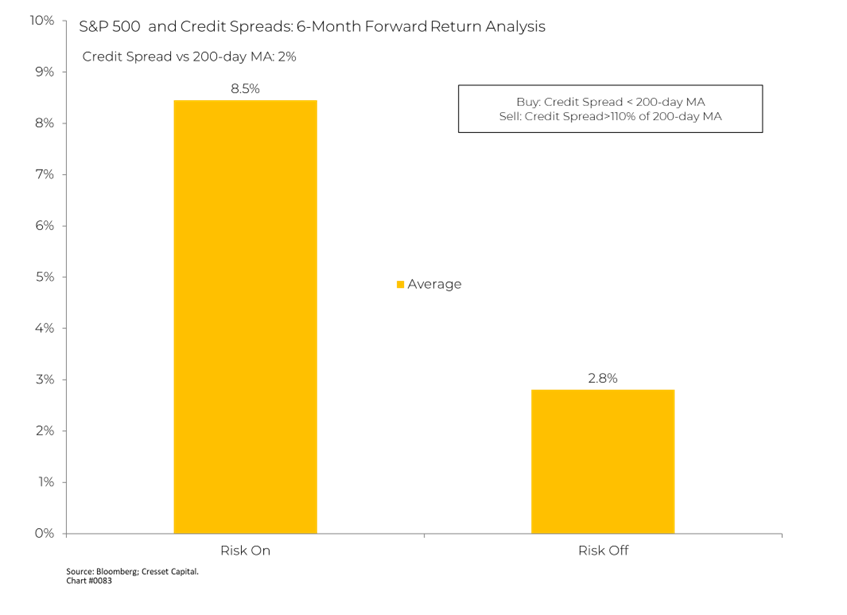

The combination of an expensive market and an uncertain policy environment has raised the market’s risk level. Liquidity, one of our critical market metrics, suggests bond investors remain comfortable with credit risk. The chart below shows six-month market returns are more than triple in risk-on credit environments on average as compared to risk-off environments. We will continue to monitor bond market behavior as an early warning indicator to further reduce portfolio risk. For now, Cresset’s Liquidity Barometer reads neutral.