Key Observations:

- Last week’s simultaneous selloff of stocks, bonds, and the dollar is highly unusual

- Tariffs on all but China were paused 90 days to quell bond market dysfunction

- Several reasons for the sell-offs, but the biggest was likely the basis trade

- No evidence that stagflation is on the horizon

- US dollar status as reserve currency unlikely to be threatened

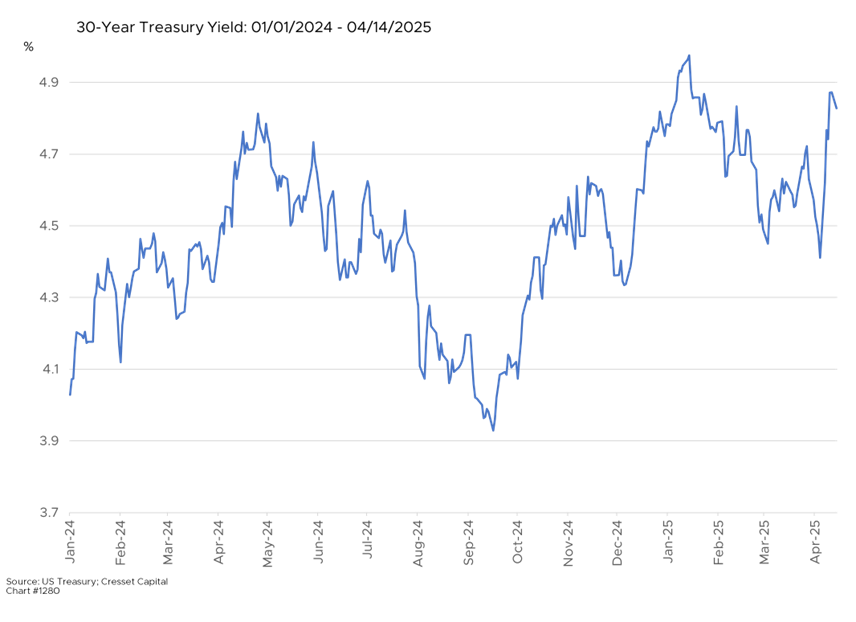

Earlier this month, when President Trump announced steep tariffs against US trading partners, their unexpected scale shocked markets and caused the S&P 500 to fall 12.1 per cent over four days. Though the equity market pullback was precipitous, it was understandable given the abrupt turnaround of our long-standing global trade policy. But the jaw-dropping reaction of the Treasury market caught most observers off guard. The yield on the 10-year Treasury rose sharply from under four per cent to approximately 4.5 per cent, while the 30-year bond pushed five per cent. Is the world starting to turn its back on dollar assets?

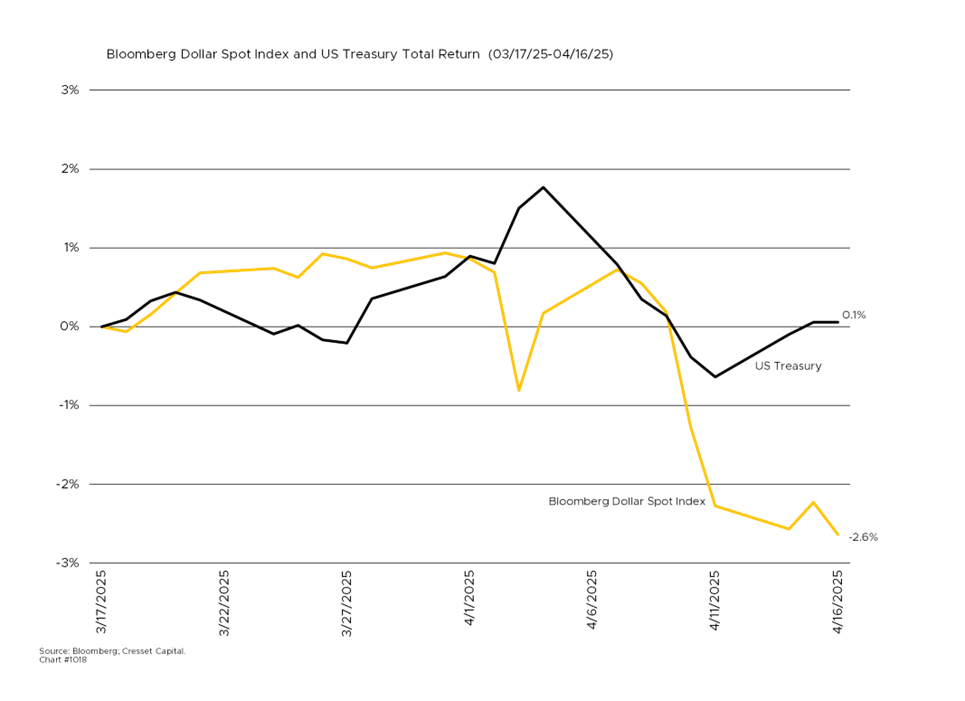

Treasury bonds, traditionally considered safe-haven assets during market turbulence, were sold off simultaneously with stocks. This rare combination, along with a weakening US dollar, appeared to signal a troubling global capital shift away from US financial assets. The prospect of the world turning its back on dollar assets sent traders home for a weekend of worry.

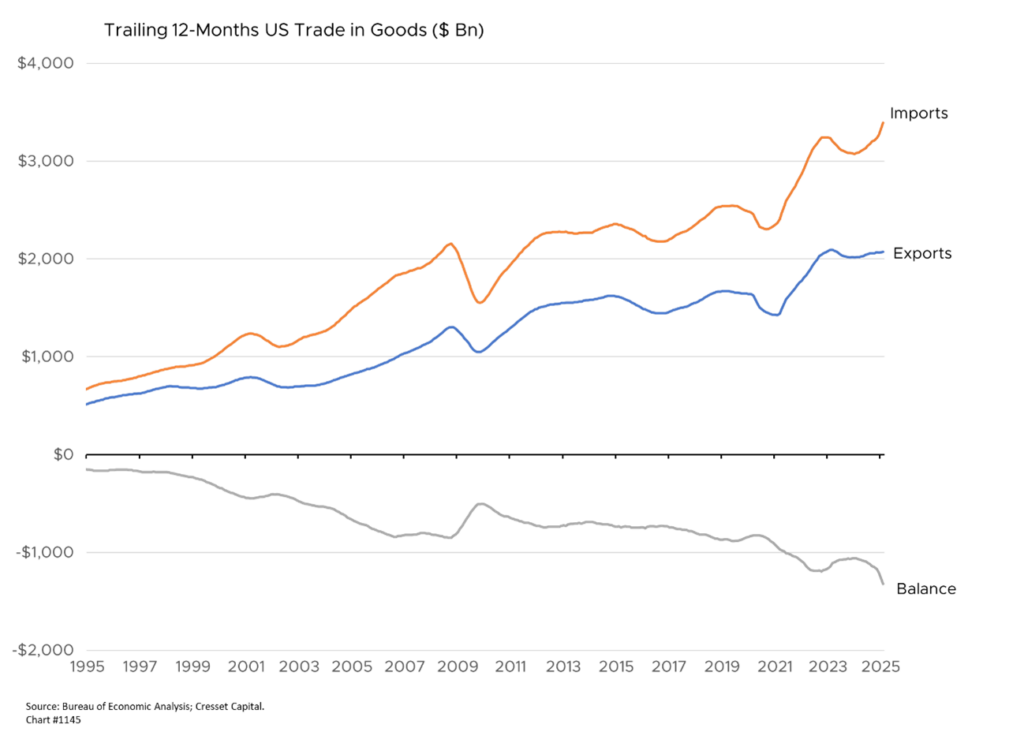

US Trading Partners Recycle Dollars into Treasurys

As the US runs trillion-dollar-plus trade deficits, it’s important to note that the other side of the trade deficit coin is our current account surplus. This means that while US consumers rely on foreign goods for consumption, US investors rely on our trading partners purchasing US financial assets. In other words, dollars sent to our foreign trading partners in exchange for goods have traditionally been recycled into Treasury purchases and other dollar-based investments. Those Treasury purchases tend to keep our interest rates relatively low. As of February, the US imported $1.3 trillion more goods than it exported over the previous 12 months – meaning that $1.3 trillion dollars moved from the US to our foreign trading partners over that period.

Tariffs Paused 90 Days to Quell Bond Market Dysfunction

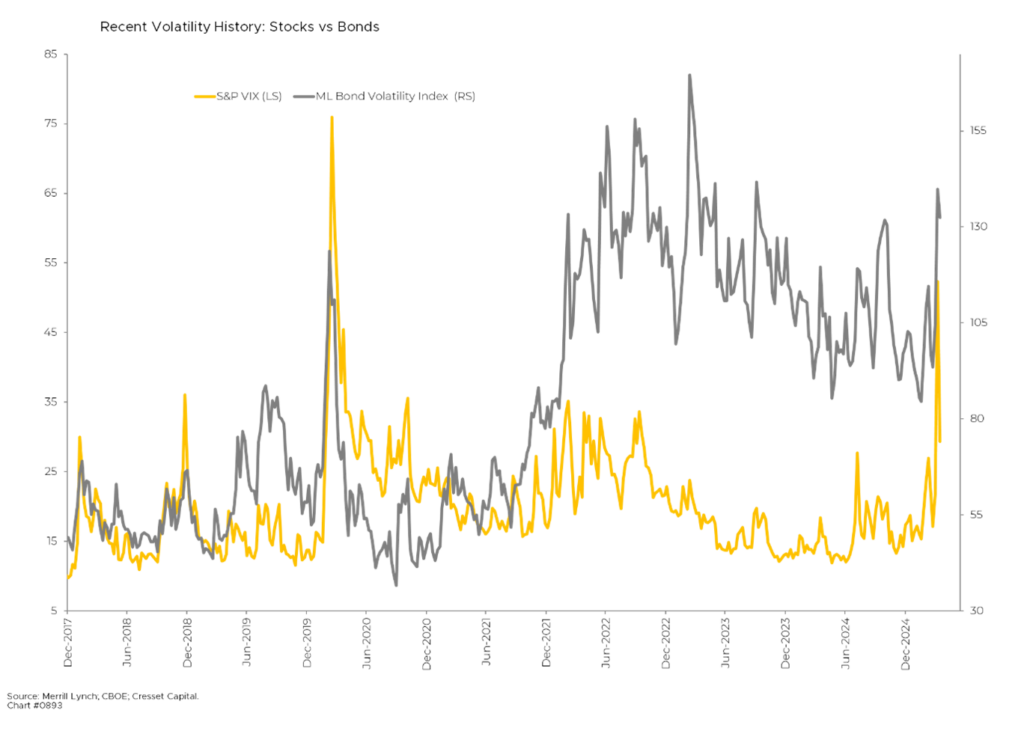

Last week’s Treasury market dysfunction apparently concerned the Trump team enough that the President announced a 90-day pause on reciprocal tariffs for most countries on April 9, though he maintained universal 10 per cent tariffs and escalated tariffs against China. Despite this partial reprieve, Treasury yields remained elevated, and market volatility heightened.

Several Reasons for the Selloffs, but the Biggest Was the Basis Trade

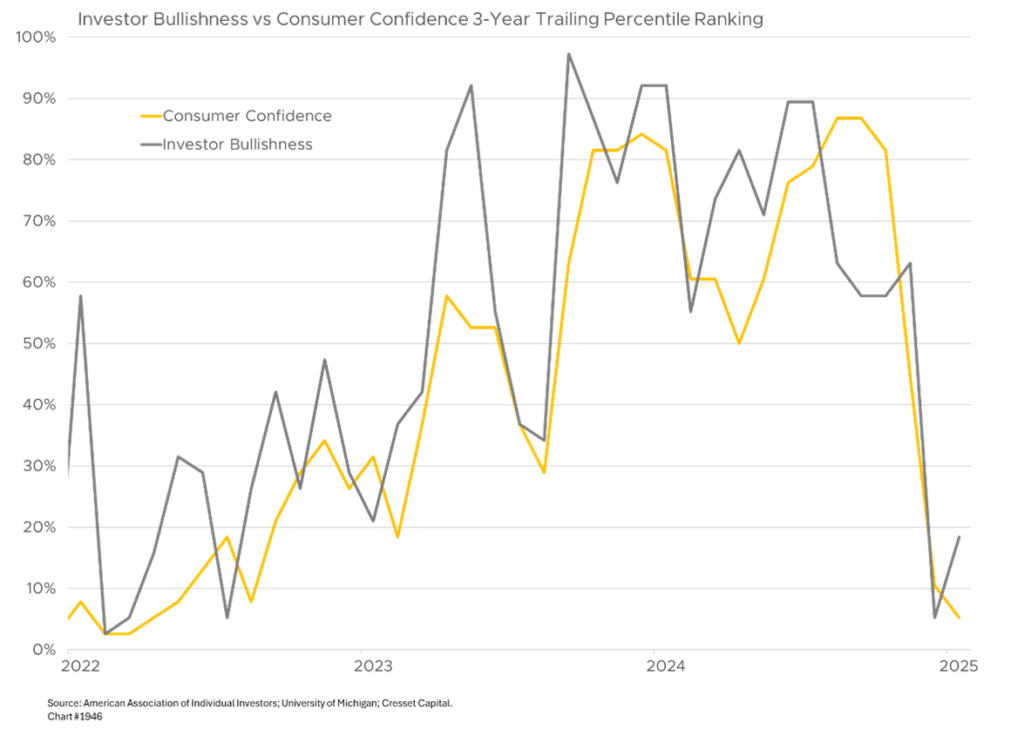

Treasurys appear to have recovered this week. But it is important to examine the reasons for the simultaneous US market selloffs. One explanation was reduced investor confidence and little appetite for US government debt due to policy uncertainty and inflation concerns related to tariffs. Consumer confidence and investor bullishness confirm that view, with readings on both situated in the bottom decile of their historical range.

Another plausible explanation was hedge fund selling, particularly holders of the “Treasury basis trade,” a strategy in which hedge funds buy Treasury bonds while selling futures contracts linked to them. As market volatility increased, margin lenders raised their collateral requirements, prompting the simultaneous unwinding of these highly leveraged positions, which amplified selling pressure.

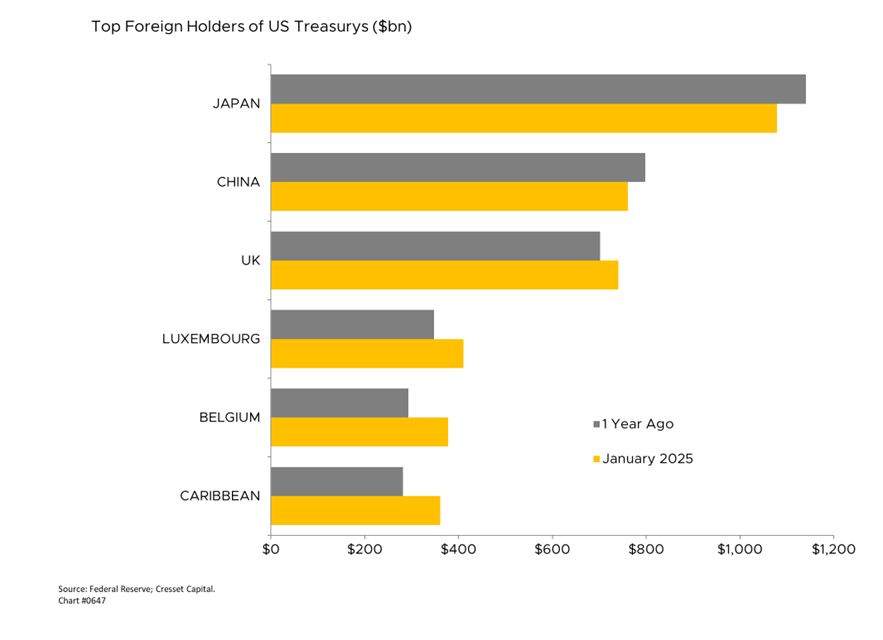

Were Japan and China Dumping Treasurys in Tariff Tantrums?

Speculation also emerged that foreign holders of US debt, particularly the world’s largest foreign holders of US Treasurys Japan and China, sold their holdings in response to trade tensions. While the notion got headlines, we believe this was an unlikely alteration of long-term strategy, particularly in the case of Japan. We won’t know for sure until the Treasury releases April holdings data in a few months. We should note that both China and Japan reduced their Treasury holdings incrementally over the last year through January.

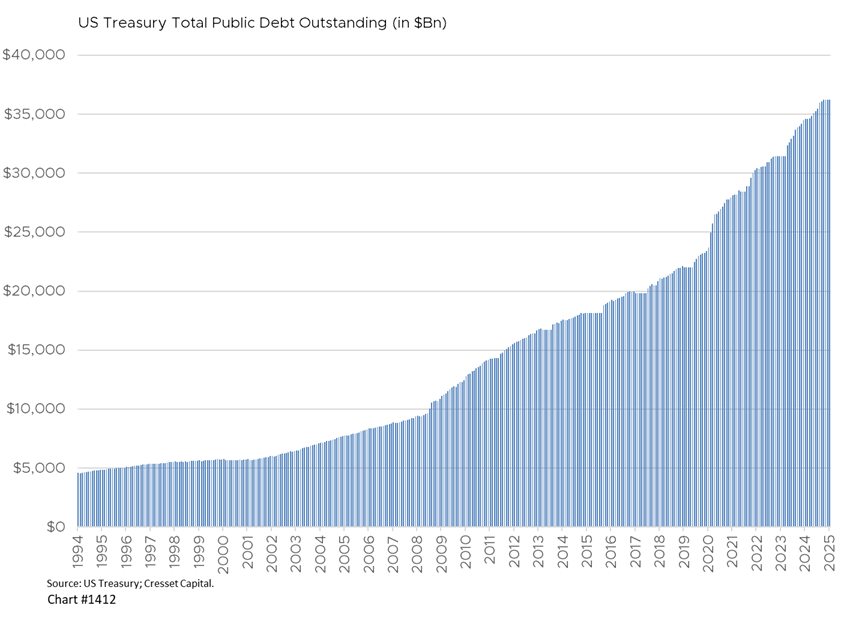

Some analysts have highlighted long-standing structural problems in the Treasury market as a source of the outsized move in yields. These include limited bank capacity to absorb selling pressure due to regulatory constraints, and difficulties in handling the growing $36 trillion US debt burden. While we don’t believe last week’s Treasury turbulence was caused by structural imbalances, it’s possible that concern raised by some administration insiders was behind President Trump’s move to extend the tariff deadline last week and exempt certain electronics products over the weekend.

Policymakers are always on the lookout for systemic risks. The health of the US Treasury market is paramount to Wall Street, Main Street and Washington DC, where higher Treasury yields mean more expensive borrowing costs for mortgages, car loans, corporate debt, and government debt, potentially slowing economic growth. At the same time, interest payments on US debt already account for 20 per cent of tax revenues, making higher yields particularly problematic for a government budget in which interest payments eclipsed defense spending last year.

US Dollar’s Reserve Currency Status Is Not Likely Threatened

The status of the US dollar as the world’s reserve currency is equally critical to all Americans. Some analysts raised the potential risk of a “regime change” in which the dollar no longer holds that status. Dollar weakness, lower purchasing power, and higher interest rates could arrive as a consequence of the greenback falling off its fiat pedestal. While countries like China, Brazil, India and Russia have openly discussed dollar alternatives, nothing concrete – with the exception of gold purchases by the central banks of India and China central banks – have threatened the dollar’s stature.

No Evidence That Stagflation Is on the Horizon

Economists are becoming increasingly concerned about the potential for stagflation – a combination of low growth and high inflation, similar to the 1973-1982 period – which would be particularly challenging for investors. Such an environment would put the Fed in an awkward position, torn between lowering rates to boost the economy and raising rates to quell price growth. We underscore that there is no evidence that stagflation is on the horizon.

Bottom Line:

Last week’s simultaneous selloff in equities, bonds and the dollar appear to be short lived and likely caused by hedge funds unwinding leveraged bets rather than fundamental reserve currency shifts by our trading partners. Investing in quality municipal bonds offering attractive pre-tax equivalent yields as well as high-quality dividend growth stocks is a defensive way to navigate today’s uncertainty.