Key Observations

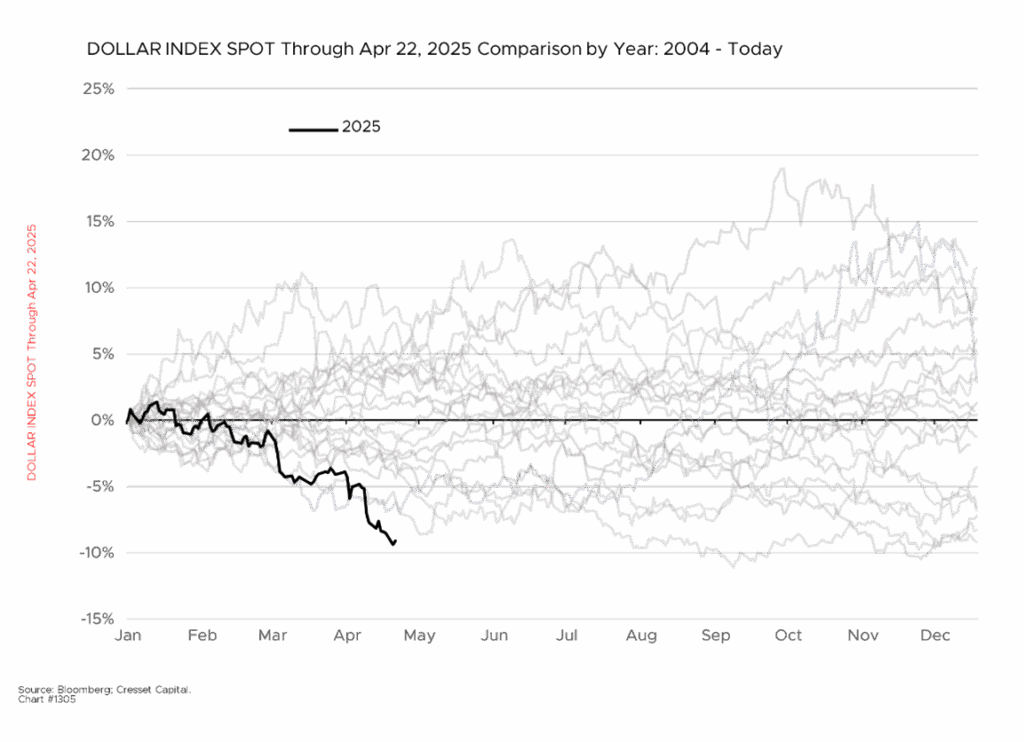

- Market pattern breaks: The dollar has dropped over 9%, its worst start since 1995, even as U.S. Treasury yields climb, signaling foreign investors are pulling out of American assets.

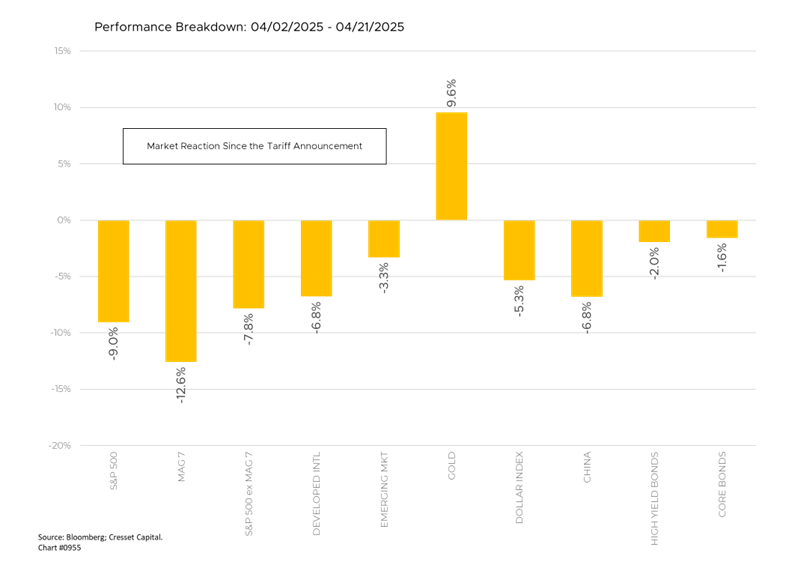

- Tariffs rattle confidence: The Trump administration’s sweeping tariffs, announced in April 2025 using a subjective formula, rattled markets and raised doubts about U.S. economic leadership.

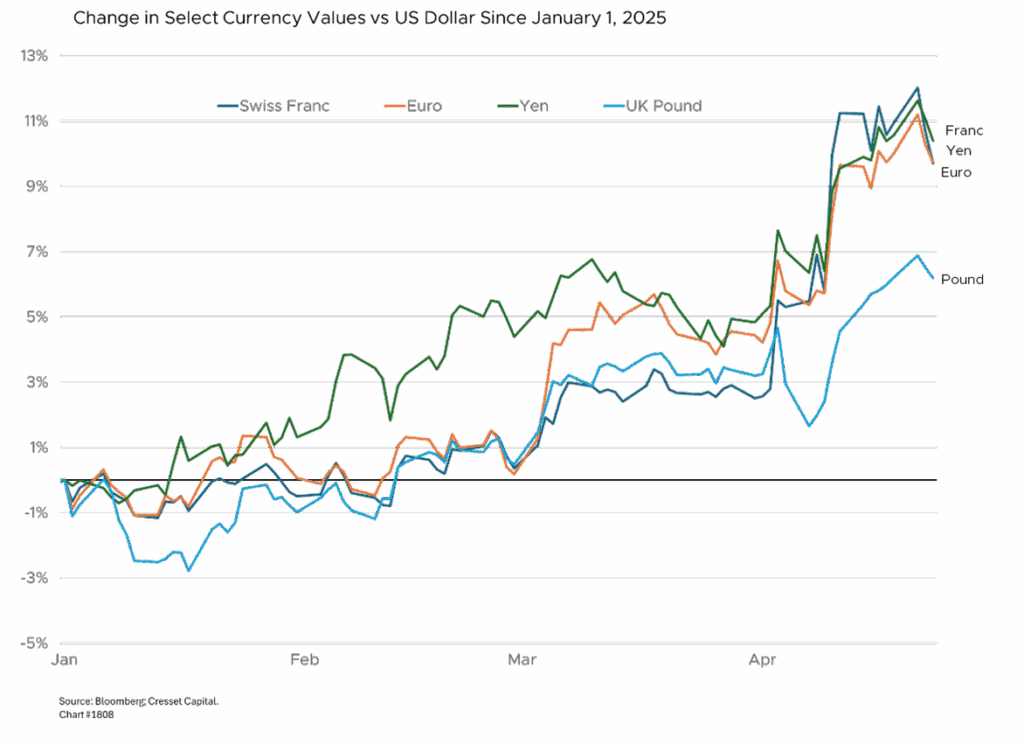

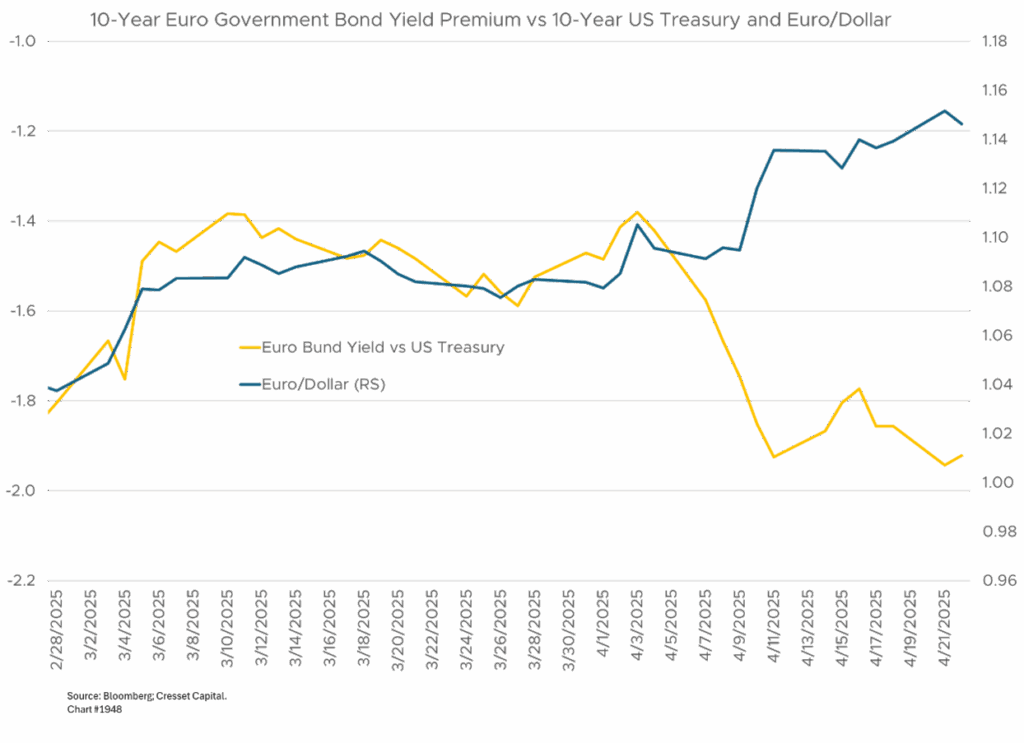

- Capital shifts abroad: European equities saw their strongest month of foreign inflows in a decade, the euro surged 5%, and German bunds are being treated as a new safe haven.

- Dollar dominance questioned: With deficits ballooning, interest costs rising, and central banks accelerating reserve diversification, the dollar’s “exorbitant privilege” is being seriously reexamined.

A once-reliable market relationship has broken down. Typically, during economic turmoil, the dollar strengthens as investors flee to the safety of US debt. However, in early 2025, the dollar has fallen over 9% against other major currencies while US Treasury yields have risen, indicating investors are selling American assets. The dollar is off to its worst start since 1995. This unprecedented pattern suggests foreign investors are reconsidering the dollar’s role as the world’s primary reserve currency.

Tariffs, Turmoil, and the Loss of Confidence

The Trump administration’s implementation of sweeping tariffs in early 2025 triggered the turn of events. When announced on April 2nd, Trump’s tariffs shocked global markets, causing the S&P 500 to drop nearly 5% in a single day and pushing stocks of import-dependent American companies even lower. The seemingly subjective methodology behind the administration’s tariff calculations, based on countries’ trade deficits divided by their exports to America, undermined confidence in US economic governance.

Mechanics of Dollar Demand – and What’s Changing

America’s trade deficits have, over the years, helped fuel global demand for US Treasurys, as US trade partners recycled their dollars from trade back into US Treasurys. Over the years, those purchases have kept US interest rates low and bolstered demand for the dollar. These transactions, along with America’s free market policies, have helped position the dollar as the fiat currency, allowing the Treasury and Fed to maintain economic stability by offering greater control over the dollar.

Europe’s Appeal Rises

Meanwhile, other markets have gained renewed appeal among global investors. European stocks experienced their strongest month of foreign inflows in a decade, while the euro jumped 5% against the dollar. German bonds have become an attractive safe haven asset despite traditionally being a much smaller market than US Treasurys. It’s remarkable that the euro is rallying while German bond yields fall versus US Treasurys.

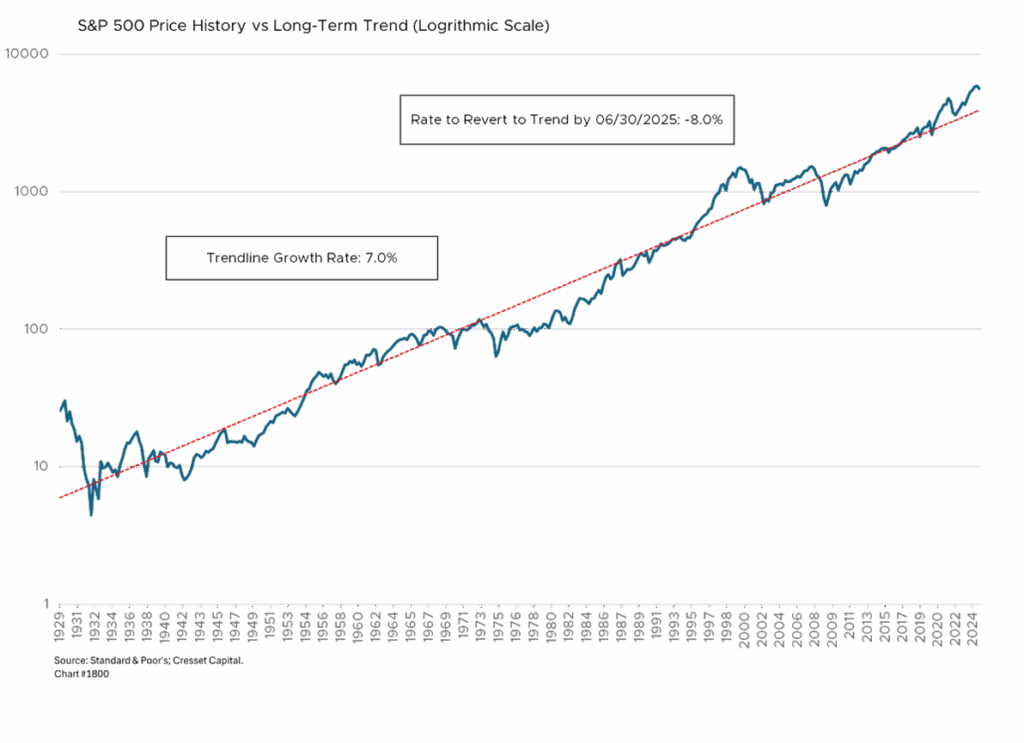

This shift threatens to end a remarkable period of American financial dominance. Between 2010-2024, US stocks rose over 400% cumulatively compared to just over 100% in the rest of the world. Foreign investors own approximately $19 trillion in US equities, $7 trillion in Treasurys, and $5 trillion in corporate bonds. Even after recent declines, the S&P 500 remains nearly 8% above its long-term trend, suggesting further corrections may lie ahead.

Is the Dollar’s Dominance at Risk?

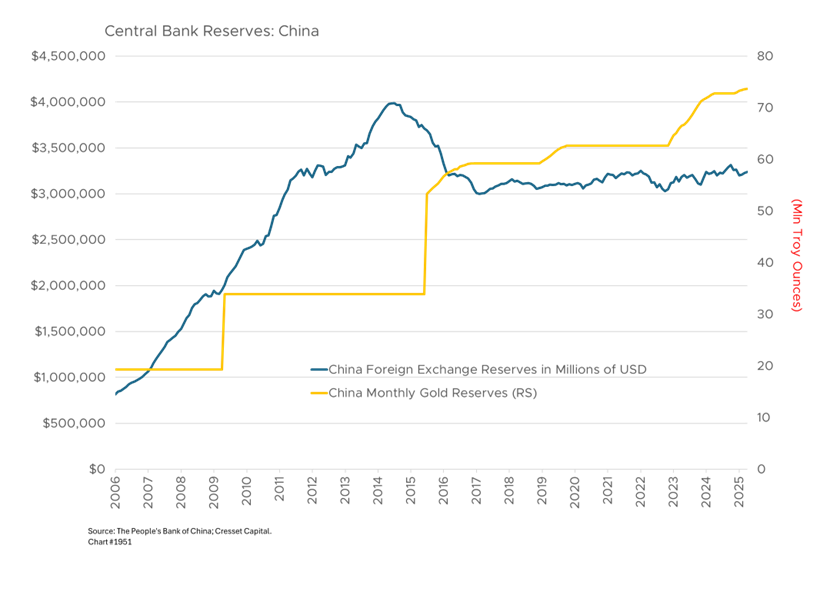

The broader implications of this shift are profound. America’s budget deficit stands at 7% of GDP with ballooning interest costs, making higher borrowing rates potentially catastrophic for US finances. Without foreign buyers helping keep rates low, the “exorbitant privilege” the dollar has long enjoyed, America’s fiscal position becomes more precarious. Meanwhile, central banks had already been gradually diversifying reserves away from dollars, from 73% in 2001 to 58% by 2025, while purchasing record amounts of gold. These trends will likely accelerate as institutions reassess their exposure to both US assets and dollar volatility.

Bottom Line:

While the recent trends are concerning, we believe the dollar will retain its dominance due to a lack of alternatives. The euro zone remains fragmented, China maintains strict capital controls; moreover, no Communist currency has ever held fiat status. Nonetheless, we concede that the era of unchallenged American financial supremacy may be ending. In a world where globalization is in retrograde and countries separate into trading blocks, expect higher interest rates, inflation pressure among import-oriented countries, and slower growth and disinflation among traditional exporters.