Key Observations:

- Economic uncertainty increasing the odds of recession

- Stock valuations above fair value despite market pullback

- More downside likely if recession materializes and earnings deteriorate

While ongoing stock market volatility and declines manifest investor concern, in our view it’s premature to say the market has definitively priced in a recession. The stock market’s sharp drop might reflect an increased likelihood of a global economic slowdown: historical relationships suggest equity investors currently place the probability of recession this year at slightly more than 50 per cent. The progress of tariff negotiations looms large in shaping the outlook.

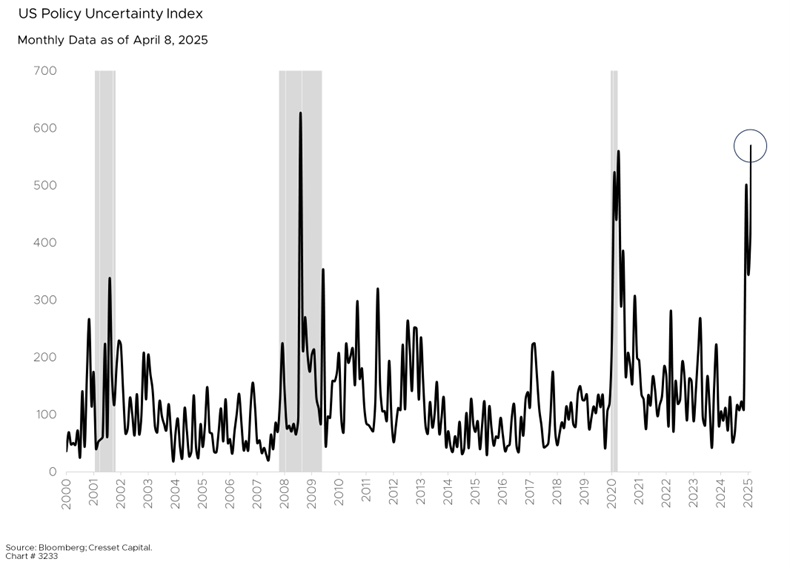

Economic Uncertainty Increasing the Odds of Recession

Economic uncertainty continues to envelop the investment landscape. The US Policy Uncertainty Index earlier this week reached levels in line with the peak of the pandemic and the financial crisis. Uncertain trade policy coupled with the possibility of an escalating global trade war prompted Cresset last week to raise our probability of recession this year to 40 per cent. That’s up from 10 per cent set at the beginning of the year.

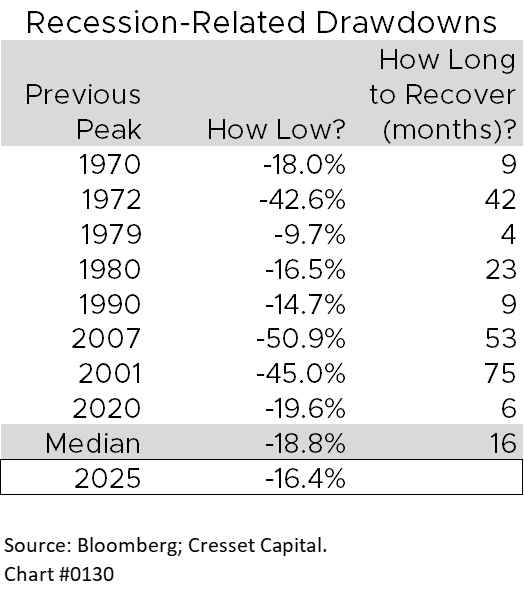

Stock Valuations Above Fair Value Despite Market Pullback

The S&P 500 is down about 16 per cent from its peak. Over two days last week tariff-related selling wiped $5 trillion from the value of US stocks, bringing the losses to as much as $9 trillion since the market peak in February, much of that in Big Tech. The pullback is in line with previous recession-related S&P drawdowns. Going back to 1970, the median market pullback was 18.8 per cent. However, valuations remain above fair value, considering interest rates and earnings expectations.

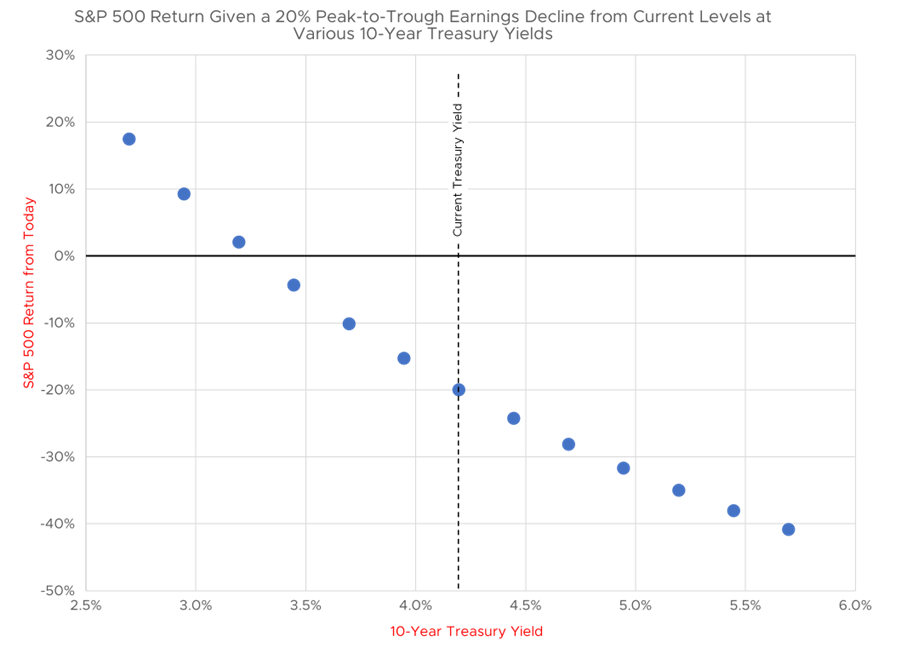

More Downside Likely if Recession Materializes and Earnings Deteriorate

While the market drawdown would suggest investors are bracing for recession, peak-to-trough earnings declines in past recessions suggest there could be more downside in the event we enter recession this year. We found that the median peak-to-trough earnings decline in recessions going back to 1945, is 21 per cent. All but three recessions were shallower than 30 per cent, with the last three recessions – 2001, 2007 and 2020 – down 32, 57, and 31 per cent, respectively.

Assuming we are entering a recession this year, coupled with an earnings decline of 20 per cent from current levels, implies more downside risk for the S&P 500. The floor for the S&P 500 depends on interest rates, since they determine the market multiple. At current interest rates, a 20 per cent earnings decline would imply a 20 per cent market decline. However, we believe interest rates would decline as the probability of recession rises, helping boost market multiples. A 3.5 per cent Treasury yield coupled with a 20 per cent earnings decline would imply less than 10 per cent additional downside from here.

Bottom Line:

While recession odds have risen as trading partners tussle over tariffs, the market – notwithstanding its mid-teen pullback to date – is currently only partially discounting a recession. Assuming the 10-year Treasury yield would decline to about 3.5 per cent in a recession, we infer investors are placing the odds of a recession at just over 55 per cent. We think that’s a reasonable assumption.