Key Judgments

- Highly leveraged companies have suffered under rising rates

- Interest rate outlook is increasingly dovish

- Easing borrowing costs will be catch-up catalyst for earnings and performance

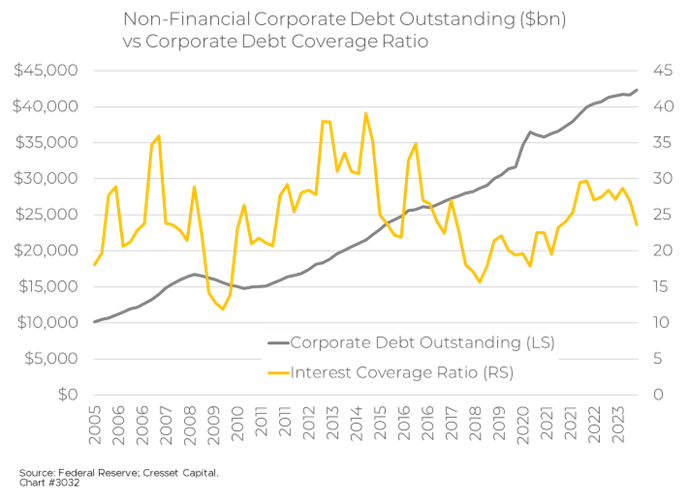

Confronted by spiraling price increases in early 2022, the Fed embarked on the most aggressive rate tightening program in 40 years, lifting overnight lending rates from, in essence, zero in mid-2022 to 5.5 per cent in a span of less than 18 months. The policy sent shockwaves through the financial markets, which had become accustomed to low borrowing costs. For more than a decade after the financial crisis, monetary policy authorities held overnight interest rates below the rate of inflation, prompting widespread, and often profligate, borrowing. Between 2010 and 2022, the dollar amount of corporate debt outstanding nearly tripled. Since 2022, interest coverage – the ratio of corporate profits to debt service payments, which expresses a company’s ability to service its debts – has fallen, reflecting higher rates on burgeoning debt. What are the implications for investors as the interest rate environment evolves in the second half of the year?

Highly Leveraged Companies Have Suffered Under Rising Rates

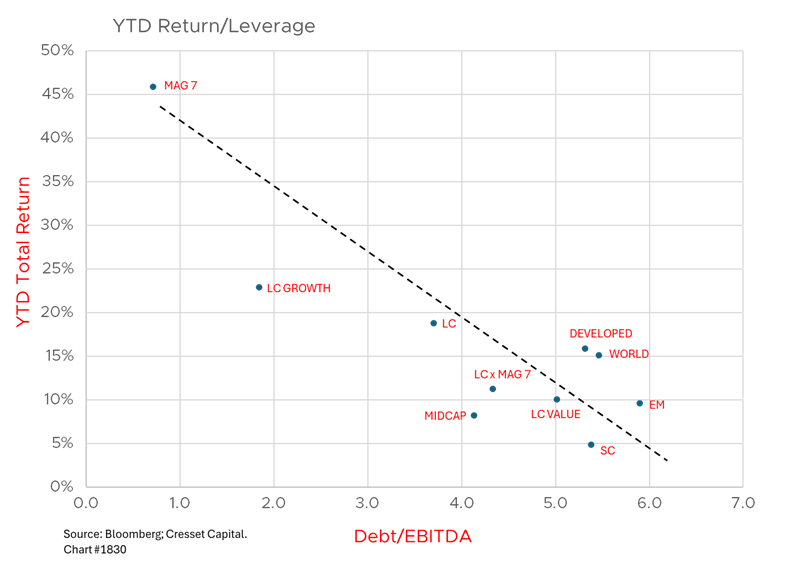

Rate hikes have been particularly unkind to the most leveraged companies, sectors and markets, as investors have gravitated to high-quality, mega-cap companies that don’t rely on debt. Leverage drove equity performance over the last two years, and companies with a high reliance on debt fared the worst. Equity investors rewarded companies with low debt levels and punished those that borrow. They piled into a handful of mega-cap tech companies that not only generate abundant cash, but also benefit from the artificial intelligence narrative.

Interest Rate Outlook Increasingly Dovish

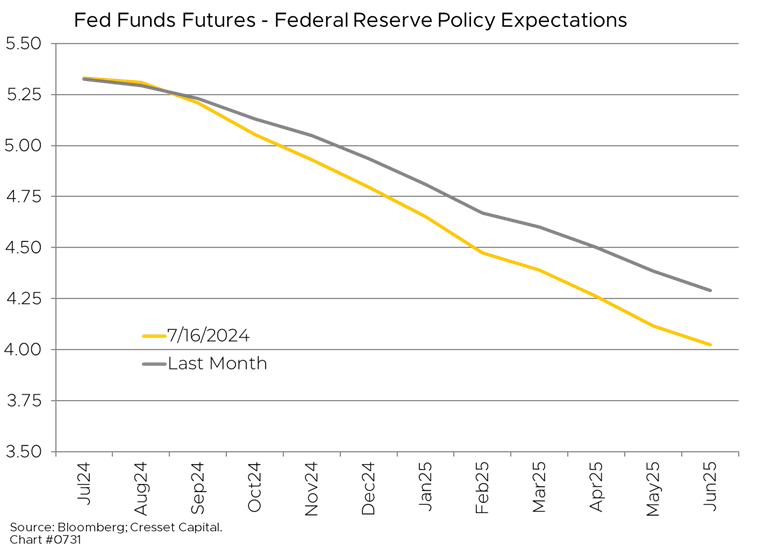

Despite a few false signals at the beginning of this year, investors are pricing in lower short-term rates thanks to weakening inflation and a slowing labor market. The probability of a September rate cut is now approaching 100 per cent. Just in the last month traders have penciled in an additional rate cut by March 2025. Meanwhile, candidate Trump, who’s leading in the polls, has suggested he would replace Fed Chairman Powell if he won the White House. Should he win, investors should expect a new, dovish Chairman to take Powell’s place early next year.

Easing Borrowing Costs Will Provide Catch-up Catalyst

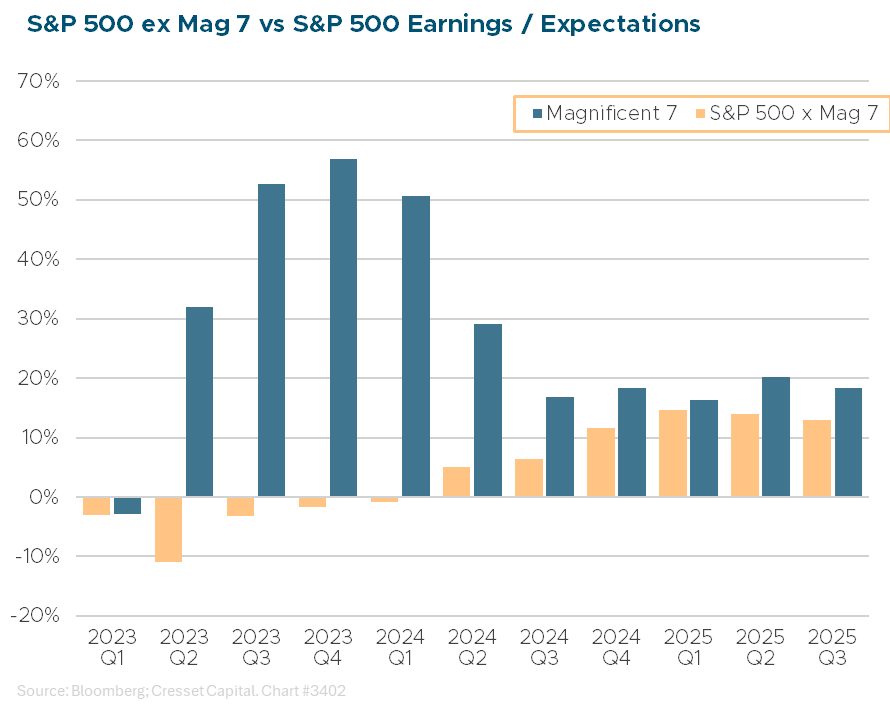

We expect equity leadership to reverse as Fed easing comes closer into view. That’s because lower short-term rates will ease borrowing conditions, and companies, sectors and markets with the highest debt to EBITDA will benefit the most. Moreover, fundamentals are beginning to favor the average stock in the S&P. Over the last 18 months, the Magnificent 7 (the largest companies in the S&P 500) have dominated earnings growth – more than 50 per cent growth for three consecutive quarters – while profit growth contracted for the rest of the S&P 500. Looking ahead, the earnings growth differential between the Mag 7 and the rest of the Index is expected to converge as borrowing costs ease, creating a catch-up catalyst.

Bottom Line

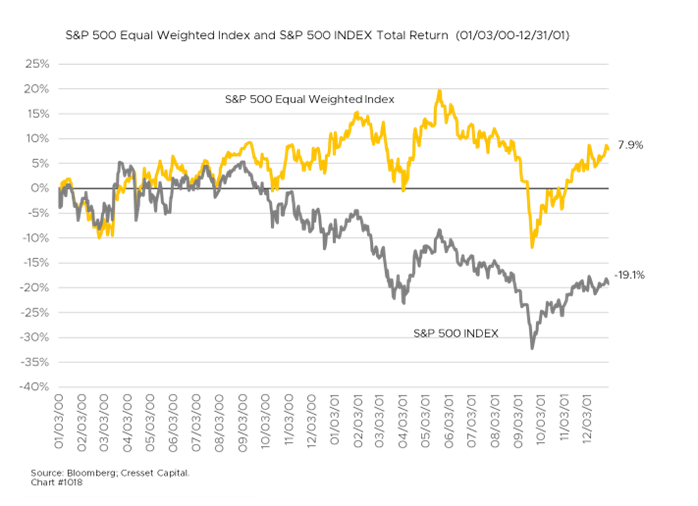

Debt levels and borrowing costs, which were key determinants of equity market performance since rates normalized last year, are set to reverse on the back of easier Federal Reserve financing rates. We expect lower rates will usher in a broader equity market, as those companies, sectors and market most disadvantaged over the last 18 months close the performance gap with the mega-cap market leaders. Given their outsized representation in the capitalization-weighted S&P 500 Index, it’s possible that the average stock could advance against a backdrop of an Index pullback, a situation that occurred between 2000 and 2001 when the S&P 500 declined nearly 20 per cent while the average stock gained nearly eight per cent.