Key Judgments

- Q2 GDP report shows weakening discretionary spending

- Pressure on consumers also evident in Q2 corporate results

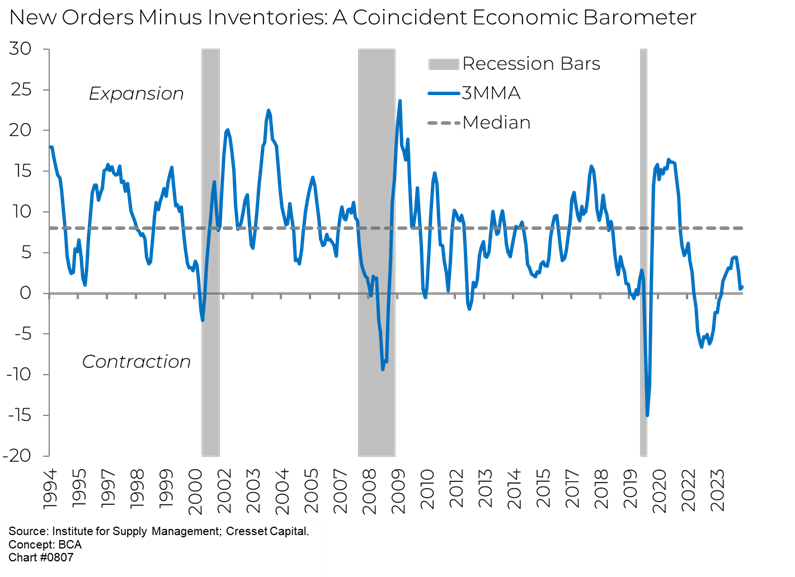

- Manufacturing activity treading water but above recession territory

- A soft-landing scenario is likely as the economy winds down further in H2

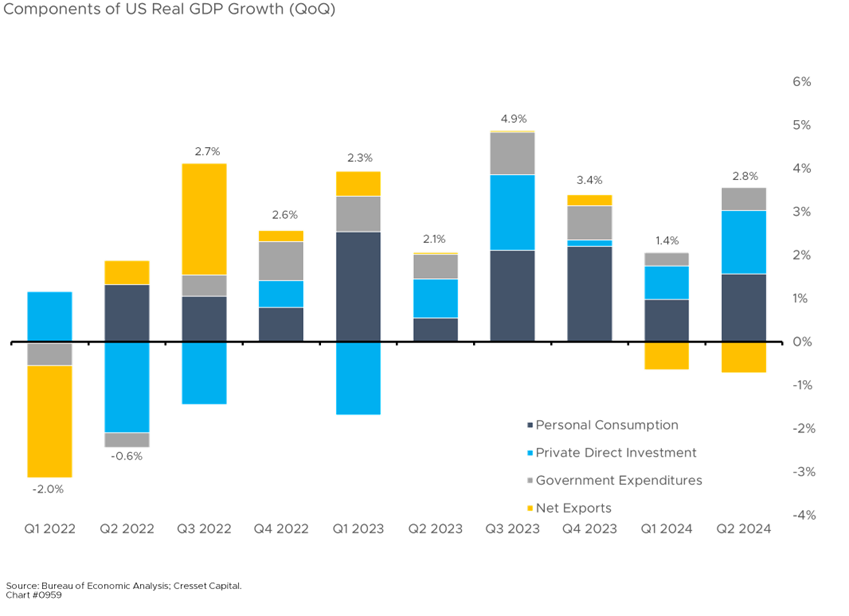

Just as Fed officials and investors were bracing for lower interest rates beginning in September, Q2/24 economic growth revealed surprising strength, catching economists and monetary policymakers off guard. Though price growth cooled to three per cent as of June, the US economy grew at a faster-than-expected annual rate of 2.8 per cent, twice the annualized 1.4 per cent pace in the first quarter. Economists had expected growth of around two per cent. With GDP figures suggesting continued economic resilience, do expectations for two to three interest rate cuts by December need to be tempered?

Discretionary Spending Showing Weakness

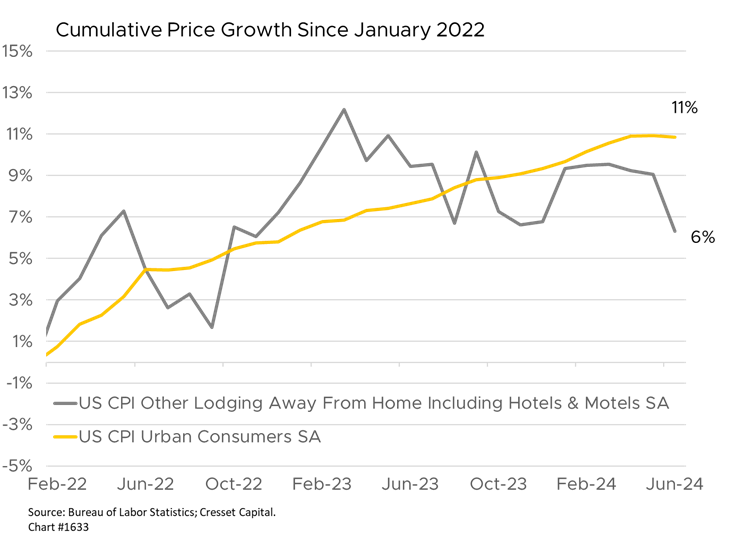

Household spending, a primary driver of US growth, strengthened last quarter. Consumer spending increased 2.3 per cent rate, up from 1.5 per cent in Q1. Spending on goods increased while, surprisingly, services spending moderated. Notwithstanding strong spending fueled by robust personal income, we’re beginning to see evidence of slowing. Hotel room rates, which ran ahead of inflation as COVID lockdowns ended, have fallen over the last 18 months on weaker demand. Luxury goods stocks like Prada, LMVH and Hermes are beginning to underperform low-end retailers like Walmart and Dollar General, underscoring the incipient decline in discretionary spending.

Growth Fueled by Business Spending on AI and Government Spending on Defense

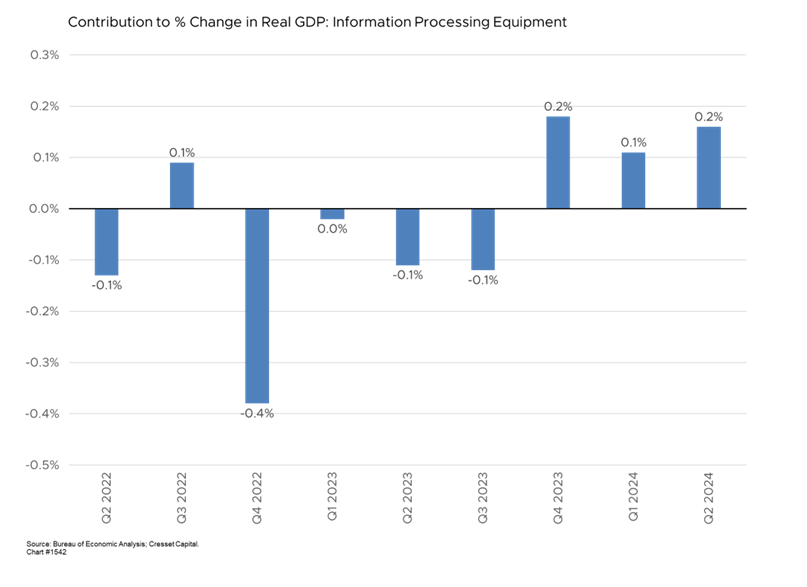

Business spending helped fuel the expansion last quarter, with non-residential fixed investment rising at a 5.2 per cent rate. Spending on equipment surged 11.6 per cent. Information-processing equipment expenditures, representing AI-related investments, has helped boost business spending over the last three quarters, a turnaround of sorts from last year.

Like it or not, government spending has been a reliable growth contributor over the last two years, fueled by a gaping budget deficit. Federal spending contributed 0.3 per cent to growth, up from flat last quarter, boosted by defense expenditures. Federal spending on defense was over $850 billion over the 12 months through June, with $210 billion over the last three months.

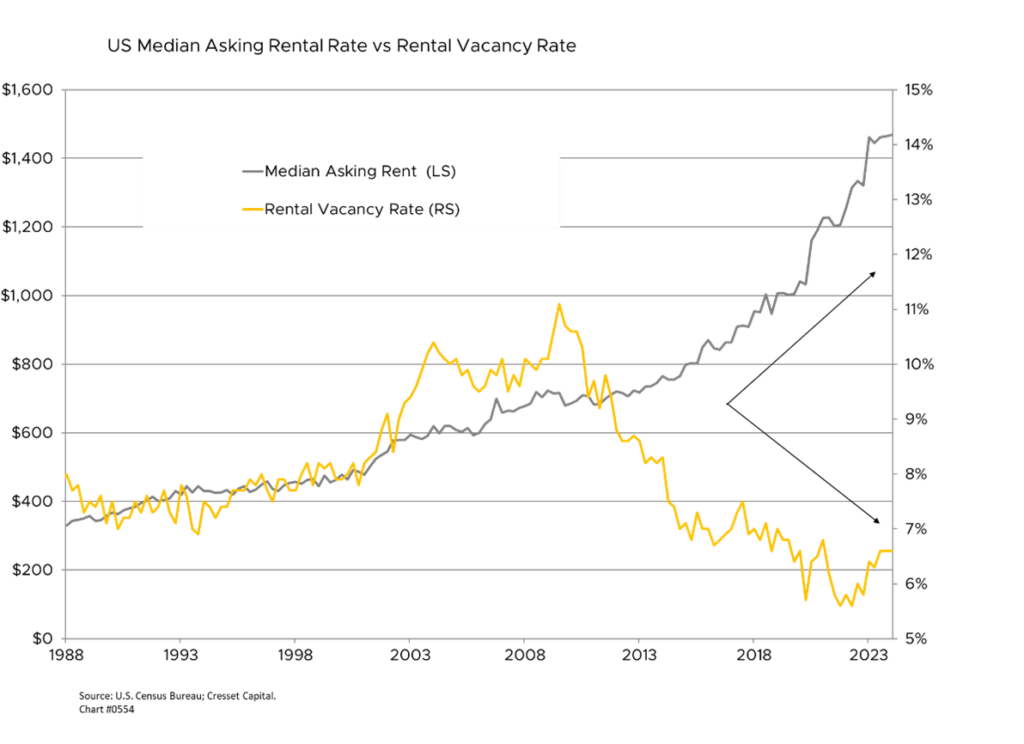

Lower Interest Rates Would Boost Home Sales and Dent Rents

The housing market has been a drag on growth as homeowners grapple with high mortgage rates. Residential investment declined, reflecting challenges in housing affordability. Sales of existing homes have dipped to their lowest level since 2010, as homeowners sitting on below-market rate mortgages are staying put. New home sales are also sagging: there’s an eight-month supply of new homes for sale, the highest level of unsold inventory since the financial crisis. Lower rates would help give this important segment a boost. In the meantime, housing unaffordability has pushed would-be homeowners into the rental market, driving rental vacancies down and rents skyward. Lower rates could potentially dent rent growth if the ownership option becomes more affordable.

Manufacturing Activity Treading Water, but not in Recession Territory

On the manufacturing front, inventories added to GDP for the first time since Q3/23, partly due to a jump in retail auto stockpiles. Overall, US manufacturing is treading water. New orders minus inventories, a useful coincident indicator, have trended slightly lower in recent months, although not in recession territory. US capacity utilization is currently situated just below its median level, confirming our neutral stance. Current capacity is consistent with an economy growing at slightly more than two percent.

Pressure on Consumers Evident in Q2 Results

Despite the positive picture we see some signs of potential challenges ahead, including a declining personal saving rate – which slipped from 3.8 per cent in Q1 to 3.5 per cent in Q2. Credit card usage, which spiked as pandemic savings drew down, is expanding at a slower pace in recent months. Delinquencies remain low, however. On the business side, companies including PepsiCo, Conagra Brands, and UPS have reported weaker results or lowered outlooks, citing pressure on consumers. Regional banks are saddled with troubled real estate loans, particularly in the office segment.

Bottom Line:

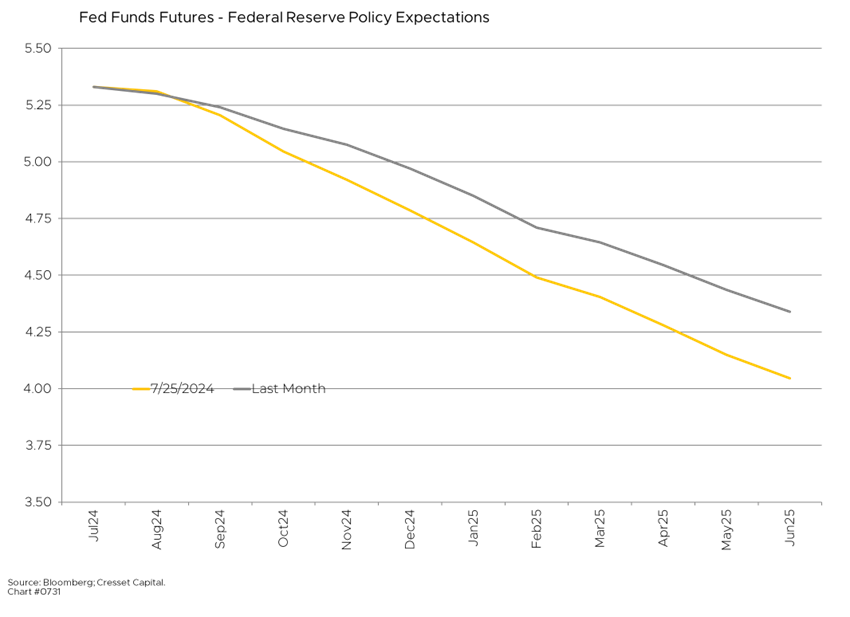

The Fed is poised to kick off its easing program this fall. The odds of a September rate cut are over 95 per cent, implied by the Fed funds futures market. The good news is inflation is clearly easing. Year-over-year CPI has been consistently in the threes this year, down from the sixes toward the beginning of 2023. Questions remain, however, about the advisability of cutting rates and easing financing conditions in a growing economy. The GDP report is supportive of a “soft landing” narrative, an ideal investing environment in which inflation glides back to an acceptable level without triggering a recession. We expect growth to moderate in the second half of the year as the lingering impact of higher interest rates works its way through the economy. We believe the Fed is justified in lowering rates, although due to the strength of the economy, they probably won’t need to execute a full easing cycle.