Key Judgments

- Corporate debt level have been an important performance driver

- Rate cut hopes could flip the script on equity market performance

- Investors zeroing in on returns from Ai, cloud computing and digital advertising

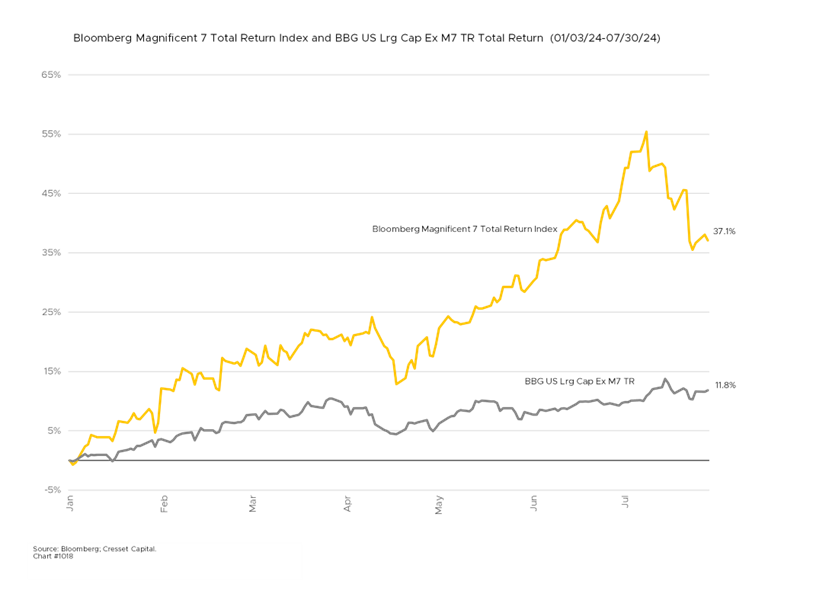

This week is set to be one of the busiest for corporate earnings reports, with major tech companies like Microsoft, Meta, Apple, and Amazon scheduled to release their quarterly results. This comes amid growing concerns about the sustainability of the AI-driven rally in tech stocks and questions about the continued strength of consumer spending. Fueled by a favorable blend of solid balance sheets and an indomitable AI narrative, mega-cap tech stocks have surged nearly 37 per cent so far this year, helping boost the S&P 500 by more than 15 per cent. The S&P 500 ex Magnificent 7 (the largest tech stocks) is about 12 per cent higher.

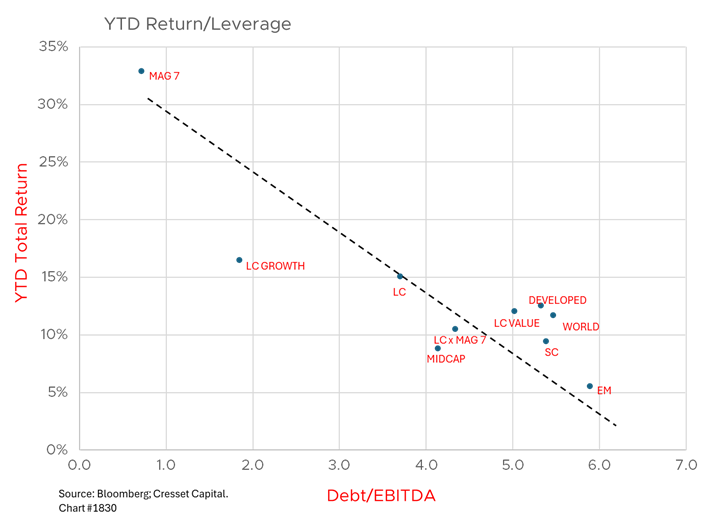

Corporate Debt Level Important Performance Driver

Onerous financing costs have made corporate debt level the most important influence of equity market performance so far this year. Most major equity markets carry debt levels 4-6x their annual cash flows. Meanwhile, the debt-to-EBITDA of the Magnificent 7 is less than one, meaning on average they generate more cash flow in a year than the amount of debt on their books.

Rate Cut Hopes Could Flip the Script on Equity Market Performance

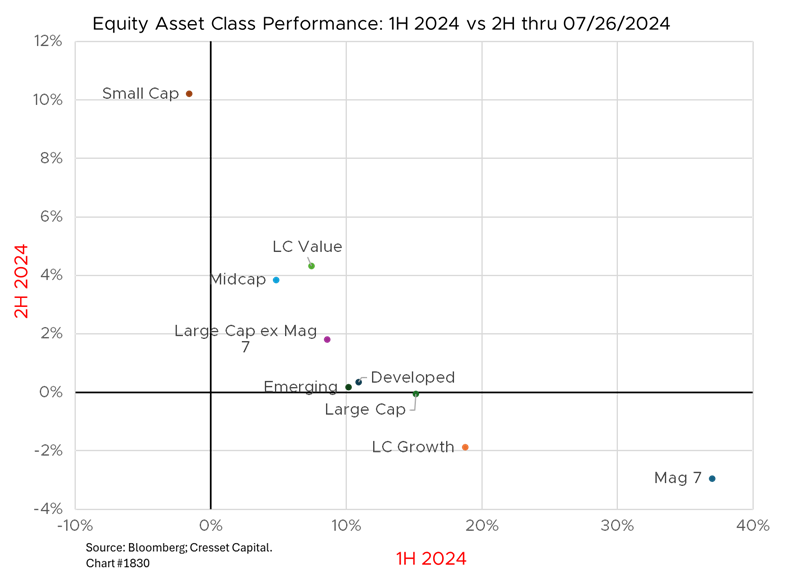

News of an impending rate cut has the potential to flip the script on equity market performance. Weaker-than-expected June inflation, coupled with a softening jobs report, has fueled speculation of a lower overnight rate as early as September. Fed funds futures trading implies a virtual lock on a September rate cut. Equity market performance broadened in July, with first-half losers blossoming into second-half (to date) winners. Small caps, which lost nearly two per cent through June, surged more than 10 per cent in July. The NASDAQ 100, a first-half winner, has fallen nearly eight per cent in just over two weeks.

Investor Focus on Returns from AI, Cloud Computing and Digital Advertising

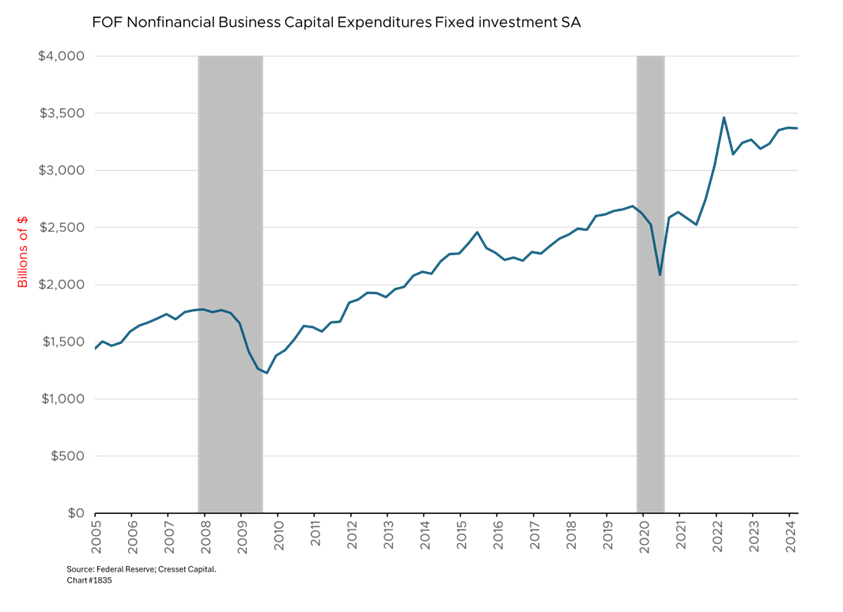

This week is an important one for earnings, with reports coming in from some of the largest tech names. Overall corporate earnings have been solid so far, with 78 per cent of S&P 500 companies beating expectations as of last week. Any surprises in tech giants’ earnings or guidance could have outsized impacts on broader market sentiment. Several themes are circulating this quarter among tech investors. Many will be looking for returns from investments in AI. Capital expenditures by corporate America hit nearly $3.5 trillion in the first quarter, according to the Federal Reserve, and a growing share is funneling into AI. With industry heavyweights shelling out hundreds of billions on AI development, investors want to be comforted that those seeds will bear fruit. Alphabet’s results last week raised concerns about heavy AI spending without clear near-term returns, so investors will be scrutinizing other tech giants’ AI strategies and spending plans this week.

Cloud computing is also an area of interest. Microsoft’s results will provide insights into the competitive landscape in cloud services as it battles Amazon and Google. Investors will focus on Microsoft’s AI investments, including its OpenAI partnership. Consumer spending trends have also been in view, particularly after disappointing top-line results from McDonald’s earlier in the week. Amazon’s e-commerce results will offer a window into consumer behavior and spending patterns. Lastly, digital advertising is capturing investors’ attention. Meta’s results will shed light on global advertising market trends. Investors will also pay attention to the company’s AI spending plans.

Tech Pullback Not the Start of a Broader Selloff

We view the recent pullback in tech stocks as a healthy rotation rather than the start of a broader selloff. It’s emblematic of a shift toward sectors more likely to benefit from an economic “soft landing” scenario and potential rate cuts. The risk of a greater-than-expected economic slowdown, prompting employer layoffs and spending cuts, could roil markets. Recent data, however, suggests a solid economy and easing inflationary pressures, bolstering hopes for a “soft landing” scenario. We will also be watching labor market data, since it could influence Fed policy decisions and market sentiment. The Federal Reserve is set to announce its latest interest rate decision this week. A rate cut is not expected, although investors will be looking for clues of a September easing.

Bottom Line:

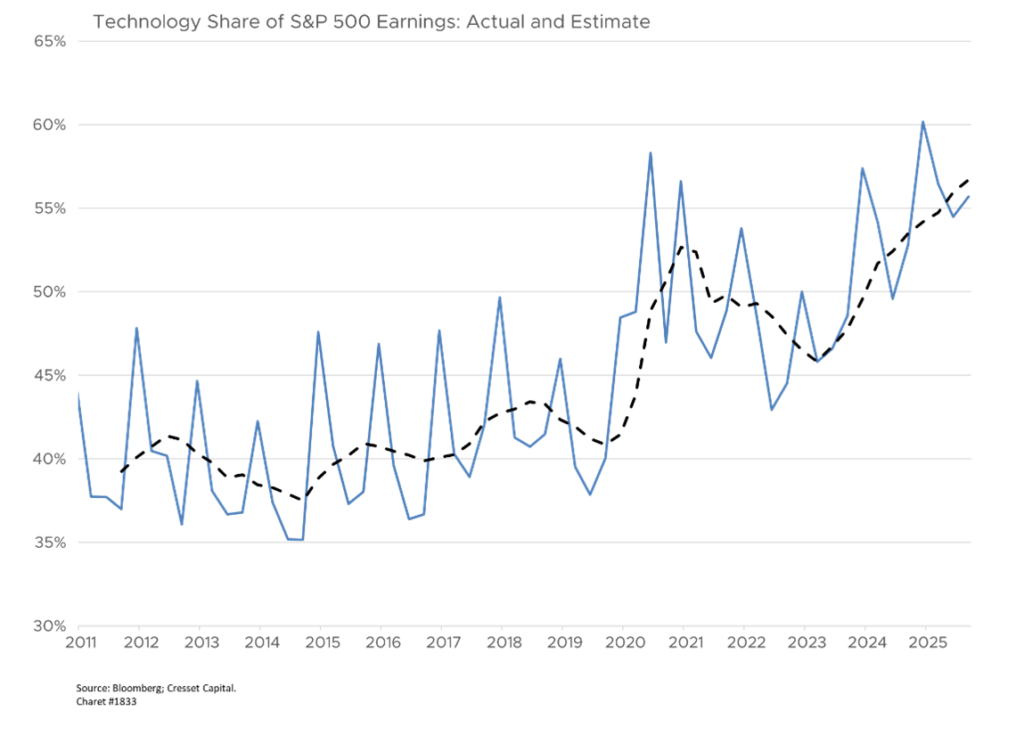

Mega-cap tech, which powered the market higher in the first half, is taking a back seat to other names as investors pencil in rate cuts later this year. We believe a broader market is healthy as more names, including small caps, participate in the market’s advance. That said, we can’t turn our backs on the tech sector. While it could be argued that the group ran too far, we must consider that the tech sector has become an important source of profits. The tech sector is expected to contribute half of the S&P’s earnings this quarter, a share of profits expected to rise over time.