Key Judgments:

- Investors now expect four rate cuts by year end

- Economy decelerating but many growth indicators still healthy

- We aren’t at risk of an imminent recession

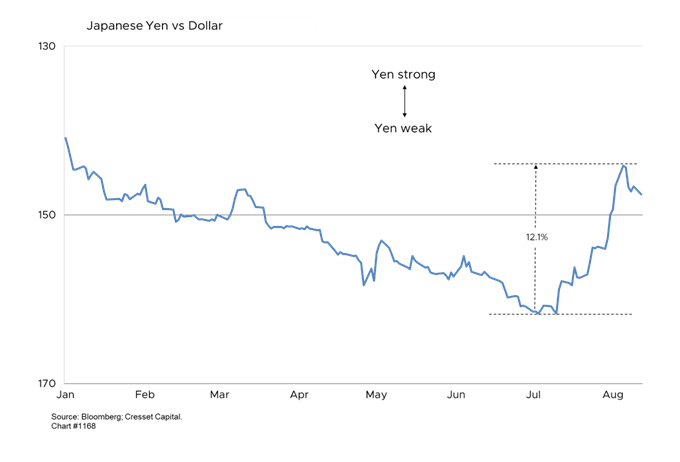

Last week, global financial markets suffered a significant spike in volatility and a sharp selloff, particularly in US and Japanese stocks. The three-day plunge was triggered by the combination of weaker-than-expected US jobs data that raised concerns about a potential recession, and an unexpected Bank of Japan rate hike that forced the unwinding of a $3 trillion carry trade by traders who bought mega-cap tech stocks financed with cheap Yen. The Japanese currency spiked more than 12 per cent in response to the BOJ action, catching highly leveraged traders flatfooted. The S&P 500 suffered its biggest one-day loss in almost two years, falling three per cent on August 7. Meanwhile, the VIX volatility index spiked to 65, a level only seen a few times this century during major crises. Is the Federal Reserve behind the eight ball?

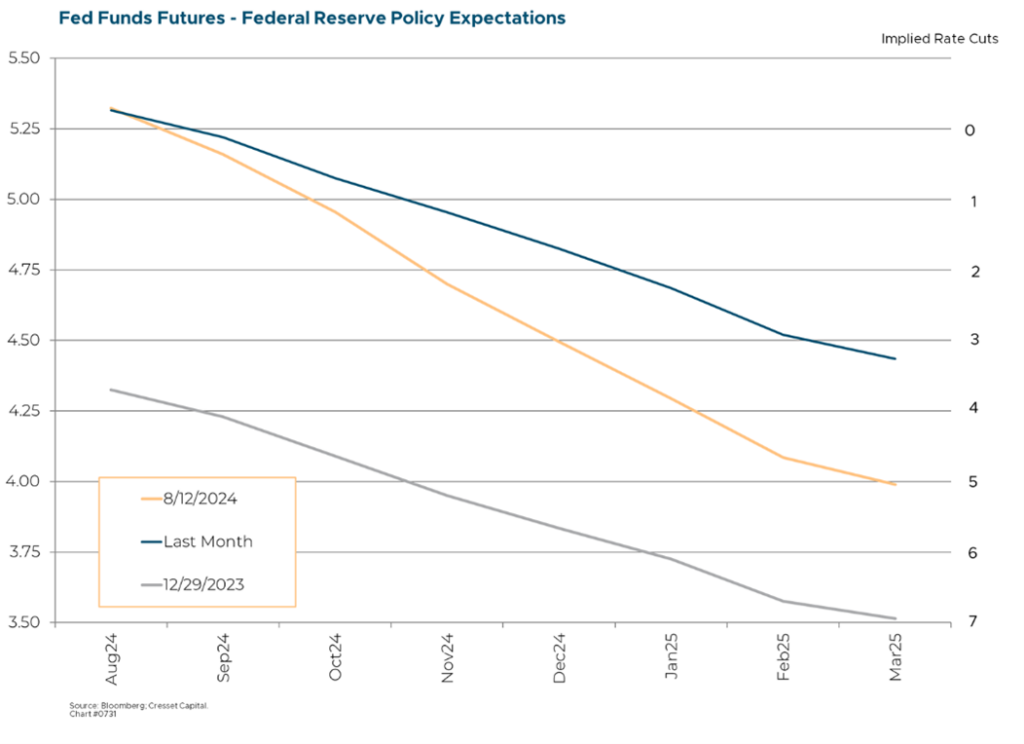

Investors Now Expect Four Rate Cuts by Year End

The weaker jobs data announced against a backdrop of panic-level market volatility prompted investors to demand emergency Federal Reserve rate cuts. Once the smoke cleared and sanity set in, calls for immediate Fed action died down. Nonetheless, investors have upped their expectations to four rate cuts this year, from just two cuts a few weeks ago. Many expect the Federal Open Market Committee to reduce its overnight rate by 50bps at its meeting next month, which would be a highly unusual move.

Let’s Not Overreact to the Slowing Economy

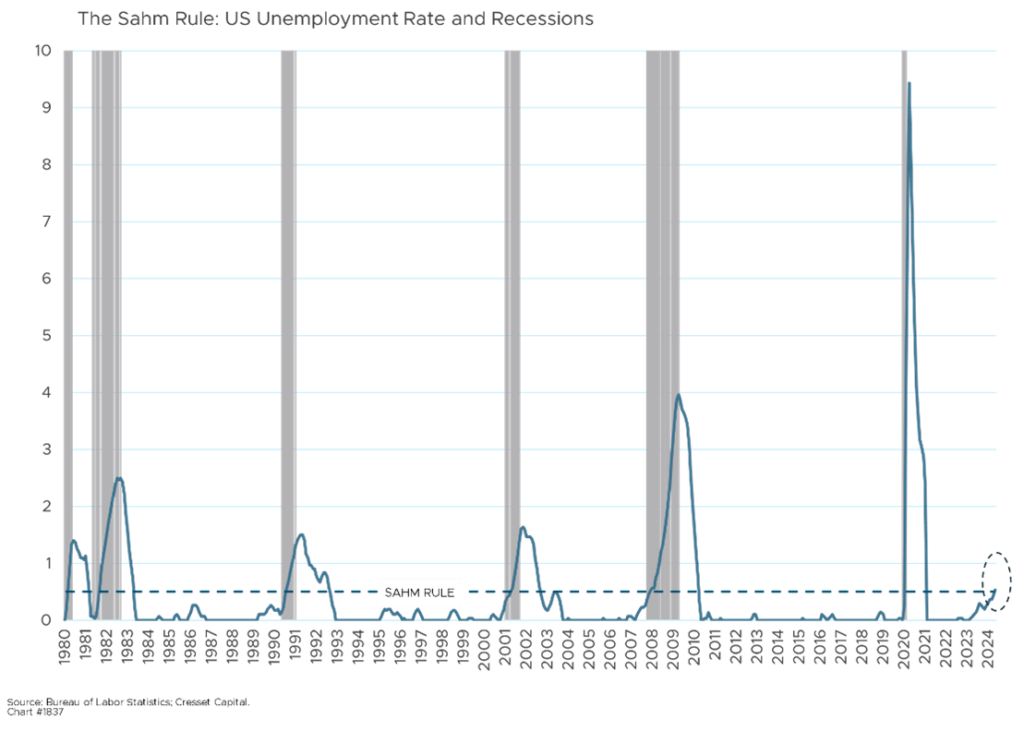

The economy is slowing, but does it require a one percentage point rate reduction by the end of the year? We don’t think so. Weakening job growth, manufacturing struggles, and households grappling with higher prices are problematic. The unemployment rate, at 4.3 per cent, is more than 0.5 per cent higher than its recent low, a condition that triggers the “Sahm Rule” and indicates a rising risk of recession. Yes, the number of permanent job losses is creeping higher – but they remain substantially below recession-like levels. Employers created 23,000 net new leisure and hospitality jobs in July, not a recipe for recession.

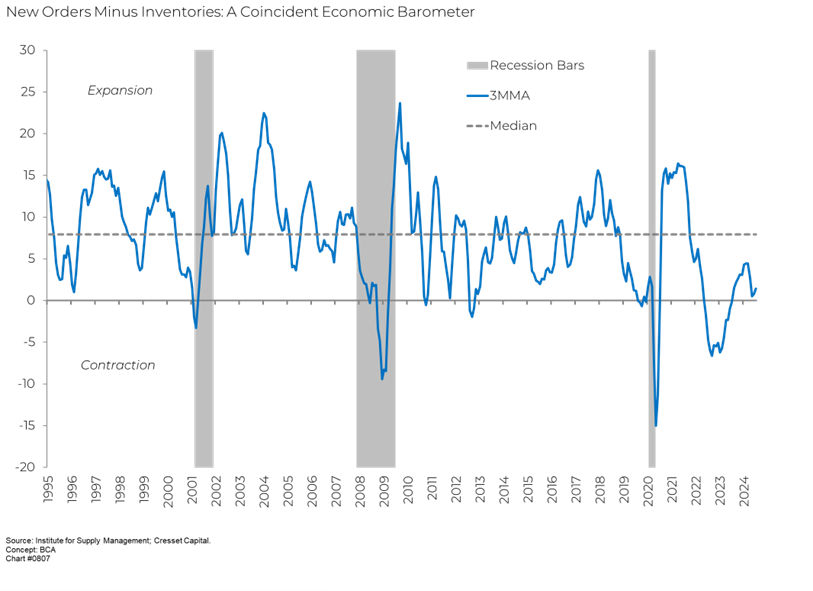

Manufacturing Sector Handling Inventory Management Well

The manufacturing sector is contracting, although companies have been doing a good job managing their inventories. Cyclical recessions often occur when manufacturing companies overproduce against declining demand and are stuck with excess inventory, leaving goods that must be worked off before production can resume. Nowadays, production is slowing in tandem with demand, so inventories remain relatively low. New orders minus inventories, a useful coincident growth indicator, remains bounded in neutral.

Economy Decelerating but Many Growth Indicators Still Healthy

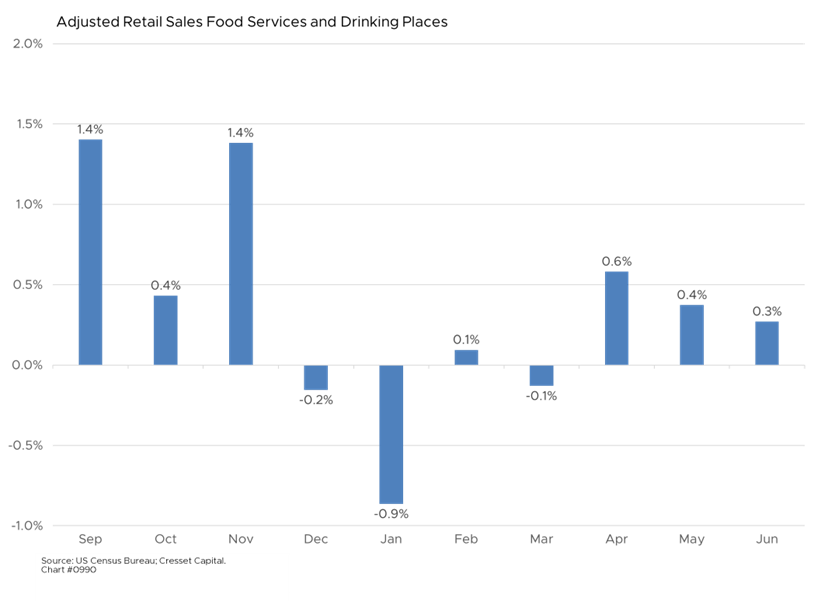

Consumer spending has been exhibiting signs of strain, especially among lower-income households. Consumer confidence among households earning $25,000 to $35,000 annually dipped to its lowest level since the pandemic. Nonetheless, retail sales edged higher in June as most categories expanded. The biggest declines were in gasoline, in response to lower pump prices, and autos. Dining out, a discretionary spending item, grew 0.3 per cent in June, although the segment has been slowing since April.

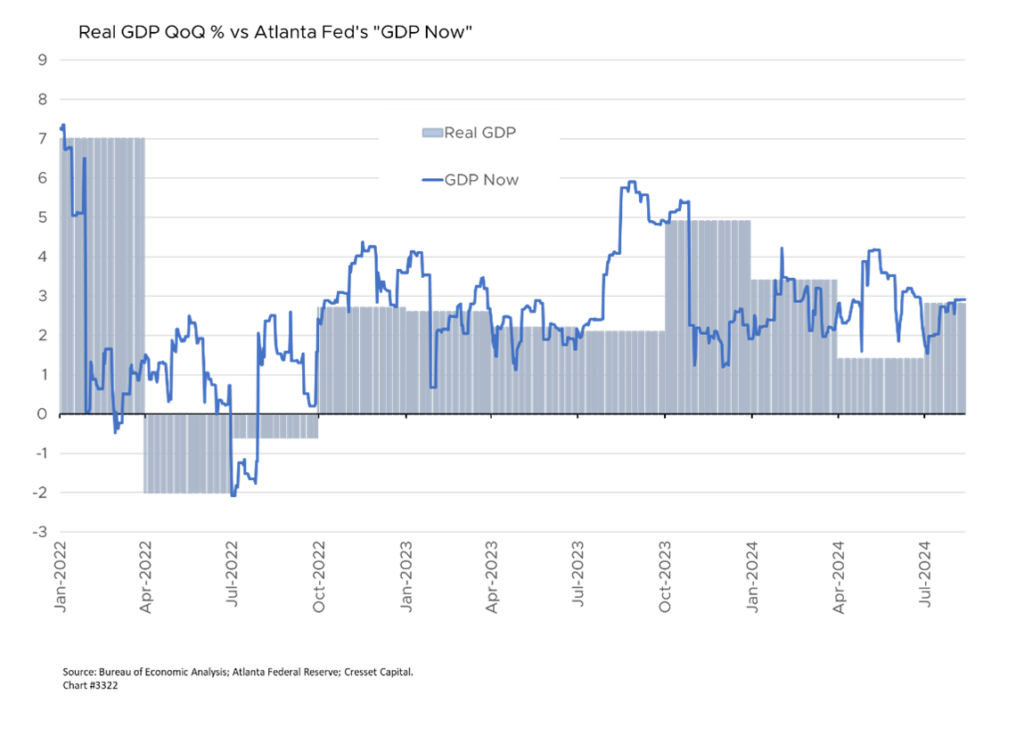

However, many indicators still point to continued growth. Q2 GDP grew 2.8 per cent and services sector data remains strong. The Atlanta Fed’s dynamic real GDP model predicts 2.9 per cent annualized growth this quarter – a far cry from recession.

Bottom Line

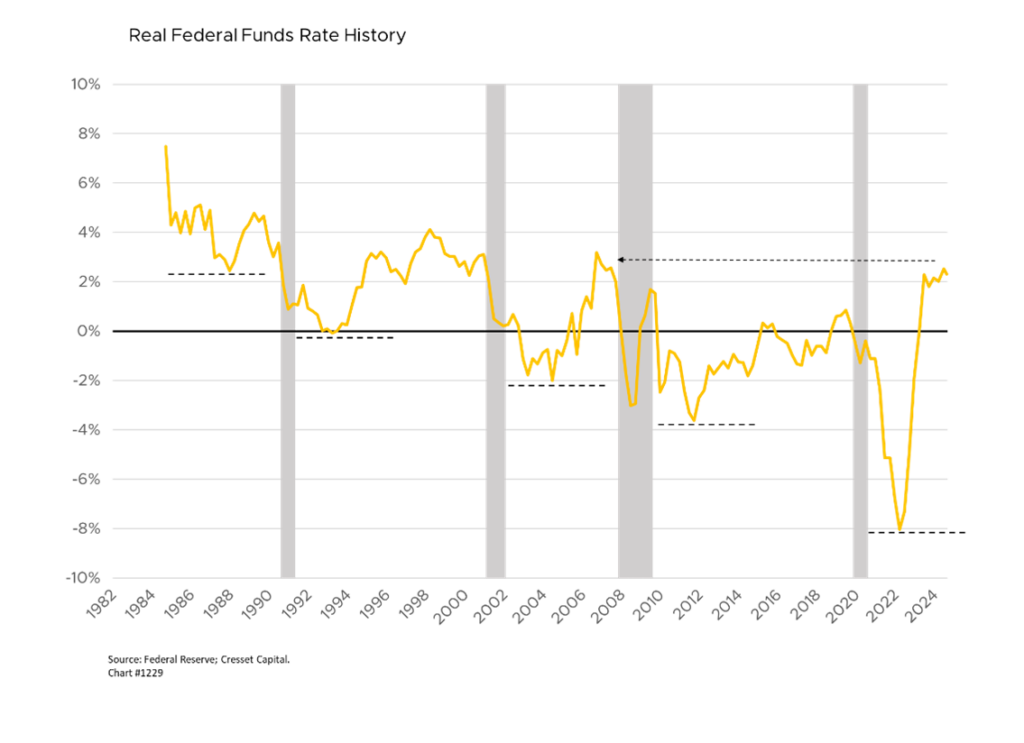

The economy has been slowing in recent months as manufacturing and consumer spending have pulled back, and economic data has come in below economists’ forecasts. The job market, while decelerating, is still creating thousands of jobs. We don’t see an imminent recession from our vantage point. We do want to point out, however, that overnight interest rates are unusually tight when viewed relative to inflation. At 2.3 per cent, the real Fed Funds rate is hovering at a level not seen since 2006. We welcome lower overnight rates, although we believe half-point cuts are unnecessary in light of current economic conditions.