Key Judgments:

- Voters Are influenced by Persistent Concerns About Their Cost of Living

- The Platforms of Both Candidates Skew Populist

- Ironically, History Shows Populist Policies Lead to Higher Inflation

The 2024 US presidential election is shaping up to be heavily focused on inflation and economic policies to combat high prices. Both candidates, former President Donald Trump and Vice President Kamala Harris, are making lowering costs for consumers a centerpiece of their campaigns. The Vice President and the former President are taking populist positions and betting that cost-of-living concerns remain top of mind for voters. They’re right – but these policies can have negative consequences for the very problem they seek to remedy.

Policy Can Do Little to Lower Costs in America’s Grocery Basket

Food and energy prices since the pandemic have been a growing concern among households, and now voters. Yet neither the Fed nor the president can do little to control these “non-core” categories – such as eggs – with interest rate policy or legislation. Nonetheless, prices of items in America’s grocery basket every week have ballooned between 20 and 50 per cent since the middle of 2020. Margarine is more than 50 per cent more expensive than it was in May 2020, according to Bureau of Labor Statistics data. Grocery bills will continue to be a source of annoyance, since branded food prices rarely decline.

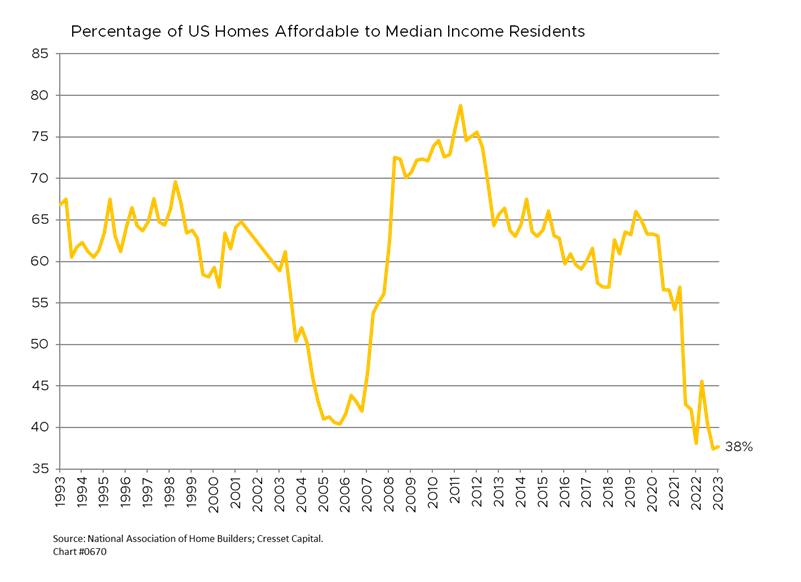

Housing Affordability at its Lowest Level in History

Lower inflation has been a welcome development this year: the inflation rate, which peaked at 9.1 per cent year over year in 2022, has fallen to 2.9 per cent as of last month. Pockets of price pressure that haven’t abated remain in the housing and services sectors. Housing affordability remains at its lowest level in history, as only 38 per cent of US homes for sale are within the financial reach of median-income households. That’s lower than during the housing bubble of 2005-2006.

The Platforms of Both Candidates Skew Populist

Tapping into voter frustration, Vice President Harris recently laid out her economic agenda, which includes: a ban on “price gouging” for food and groceries, something that’s hard to measure and enforce; a cap of $35 on insulin prices and $2,000 for out-of-pocket prescription drug costs; $25,000 in down payment assistance for one million homebuyers; restoring and expanding the child tax credit for young families; and no tax increases for households making under $400,000.

Trump’s economic proposals take a different tack. He pledges to: implement a “universal baseline tariff” of 10-20 per cent on most imports; implement a 60 per cent or higher tariff on Chinese imports; extend his 2017 tax cuts that lowered rates for corporations and high earners; eliminate federal income tax on Social Security benefits; restore the child tax credit; and cut electricity prices in half, although he didn’t say how.

Both candidates have strayed from traditional party orthodoxies to some degree with their populist pitches, and neither of them have pledged significant spending cuts. We recognize that a campaign promise is something of an oxymoron; however, if these policies were to be enacted they would lead to higher prices. Harris’ proposed ban on food price gouging sounds like it was ripped from the dusty pages of Nixon’s failed wage and price controls program of the 1970s. Her homebuyer assistance program prima facie inflates already expensive housing costs by increasing demand. Trump’s aggressive tariff proposals would not only raise the cost of imported goods and pave the way for domestic producers to raise their prices, but caustic trade confrontations could create significant supply chain disruptions, reduce GDP growth, and trigger persistently higher inflation. Economists estimate that Trump’s across-the-board 10 per cent tariff would add more than one percentage point to US inflation while crimping growth. Both candidates appear to be focused on spending while leaving dealing with the concomitant inflation to the Fed.

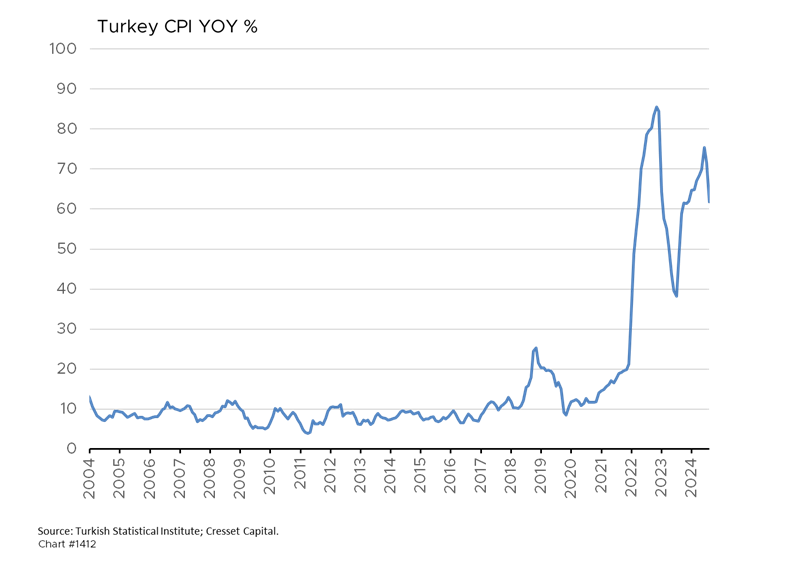

Ironically, History Shows Populist Policies Lead to Higher Inflation

Historically, populist measures – including profligate government spending, looser monetary policy, and price controls – have been a precursor of high inflation. An extreme example of this is Latin America in the 1980s and 1990s, in which economies under populist leaders like Alán Garcia in Peru imposed wage and price controls and Hugo Chavez in Venezuela nationalized oil production, and as a result suffered damaging inflation spirals. Tayyip Erdoğan’s populist measures in Turkey forced banks to roll back interest rates and led to persistently high inflation. Populists tend to blame inflation on external factors or elites, rather than acknowledging the role of their own policies. Ironically, studies have shown inflation affects voter preferences, helping fuel support for populist candidates who promise quick solutions to economic problems. We’re not suggesting these extreme policy measures, nor hyperinflation, would befall the US, although the cause and effect is clear.

Bottom Line

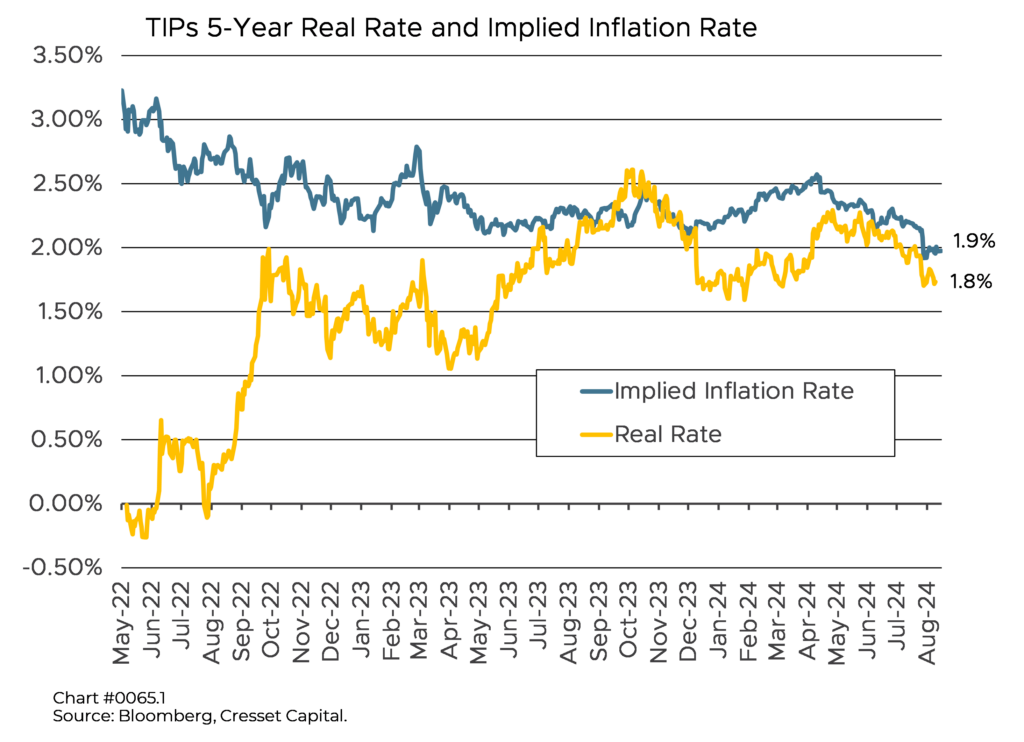

While the rate of inflation has moderated, its political salience remains high heading into the 2024 presidential election. Both leading candidates are making inflation central to their campaigns, reflecting its importance to voters still feeling the effects of recent price surges. However, history has shown that populist policies have led to higher inflation. Longer term, structural shifts in the global economy to address aging demographics and a transition away from fossil fuels could also put upward pressure on interest rates and inflation. Ironically, inflation risks are underpriced at current levels when viewed through the inflation-protected Treasury (TIP) market. Intermediate-maturity TIPs are reasonably priced, with relatively high real rates and relatively low inflation breakeven rates. It should also be noted that gold, another inflation hedge with a thousand-year history, is making new highs. Promises are not policy, but we will be on the lookout for legislation that could tip the scales toward TIPs investing.