Key Observations

- Interest rate cuts historically lead to a weaker dollar

- Dollar momentum trends can last for two years

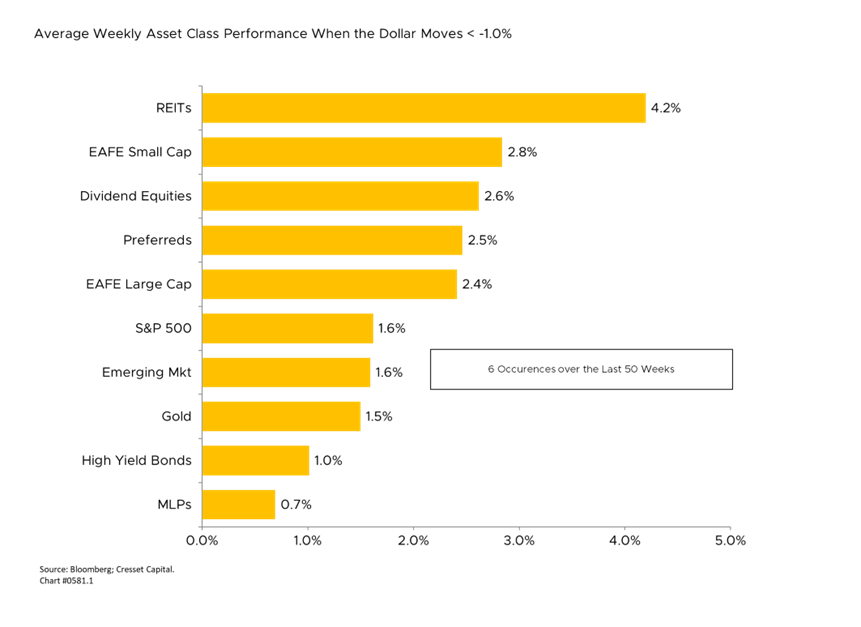

- Gold, REITs, and international developed equities beneficiaries of weak dollar

- Though technicals in Europe have improved, fundamental uncertainties remain

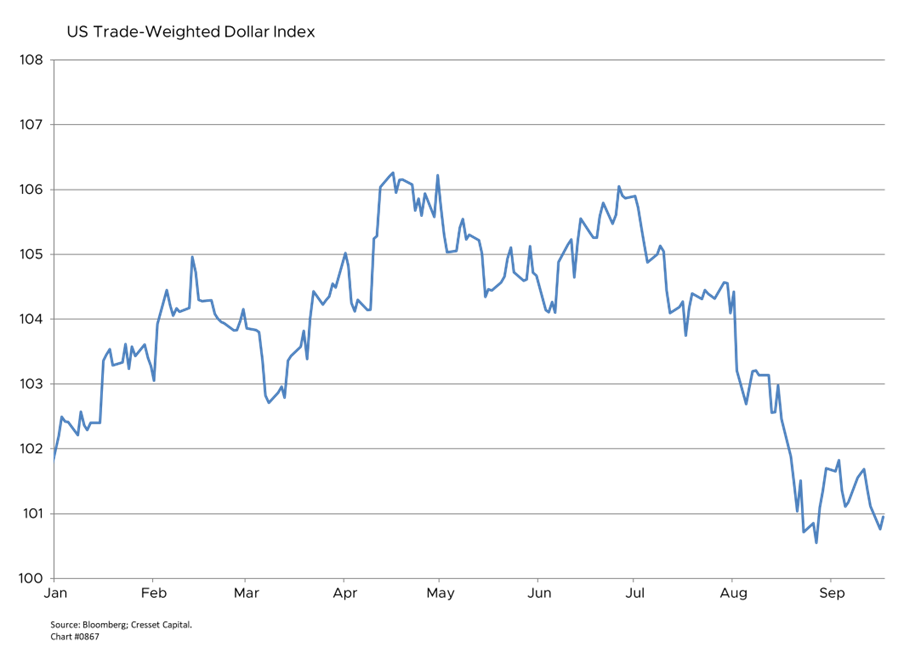

The US Dollar Index recently slumped to its lowest level in a year as investors anticipate that Jay Powell & Company’s long-awaited rate-cutting program will begin this week. The move unwinds one of the Fed’s most aggressive tightening cycles, which began in March 2022 and ratcheted up the overnight rate to 5.25 per cent from zero in the span of 18 months. What will this changing policy regime mean for investors?

Interest Rate Cuts Lead to a Weaker Dollar

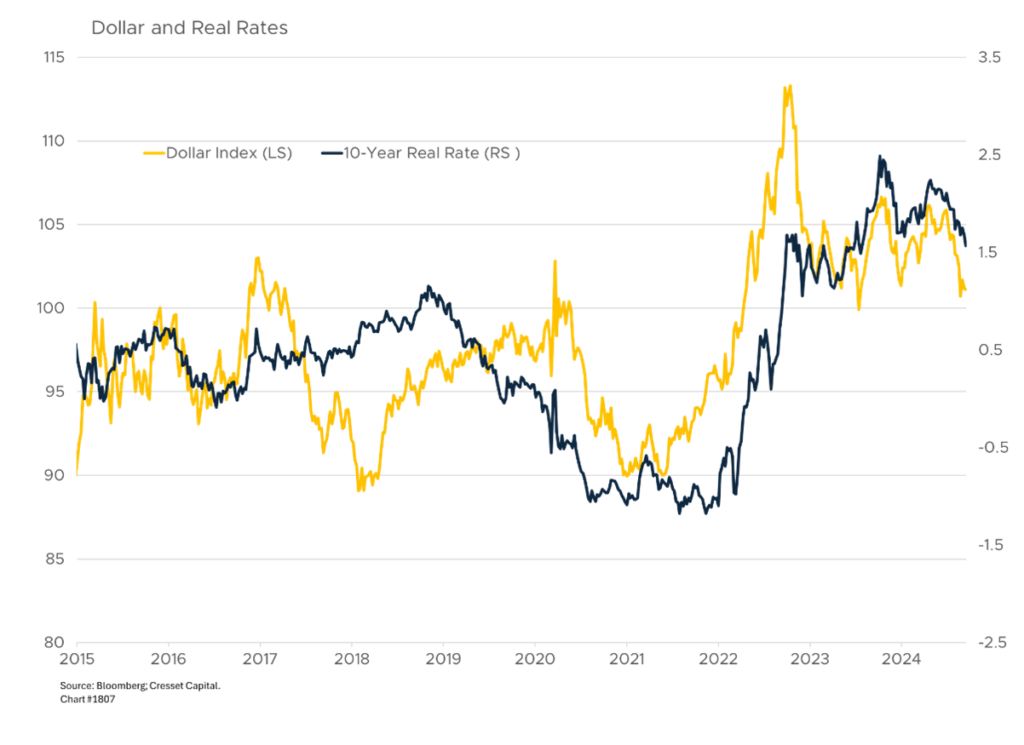

Historically, US rate cuts tend to weaken the dollar because the its value is largely influenced by real interest rates (US bond yields relative to inflation). At 2.8 per cent, the real overnight rate is at its highest level since 2006 as we head into this easing cycle. Investors are selling dollars in anticipation of lower real interest rates. Monetary conditions tightened over the last several months even though the Fed held rates steady, because inflation and inflation expectations declined. Investors have pushed the 10-year Treasury yield down about one percentage point since April due to lower inflation, leaving the Fed arguably behind the curve.

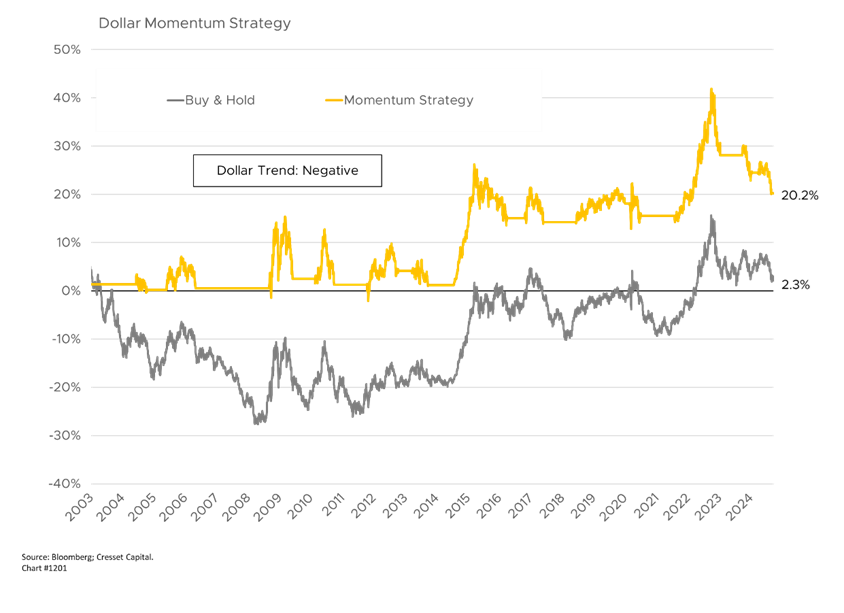

Dollar Momentum Trends Can Last for Two Years

Because dollar fundamentals are determined by deliberate government policy and not capricious investors, the currency’s momentum can trend for up to two years, with positive momentum when its 50-day moving average trades above its 200-day moving average, and vice versa. Recent dollar weakness has pushed its momentum trend negative last month, suggesting dollar weakness will continue.

Momentum trends have been predictive. Over the last 20 years the US dollar has gained 2.3 per cent cumulatively, after spending the financial crisis at secular lows. Meanwhile, Cresset’s simple momentum strategy – which holds the dollar when momentum is positive and shifts to cash when momentum breaks down – has gained more than 20 per cent in the interim by avoiding a falling dollar, underscores the significance of the dollar’s most recent breakdown.

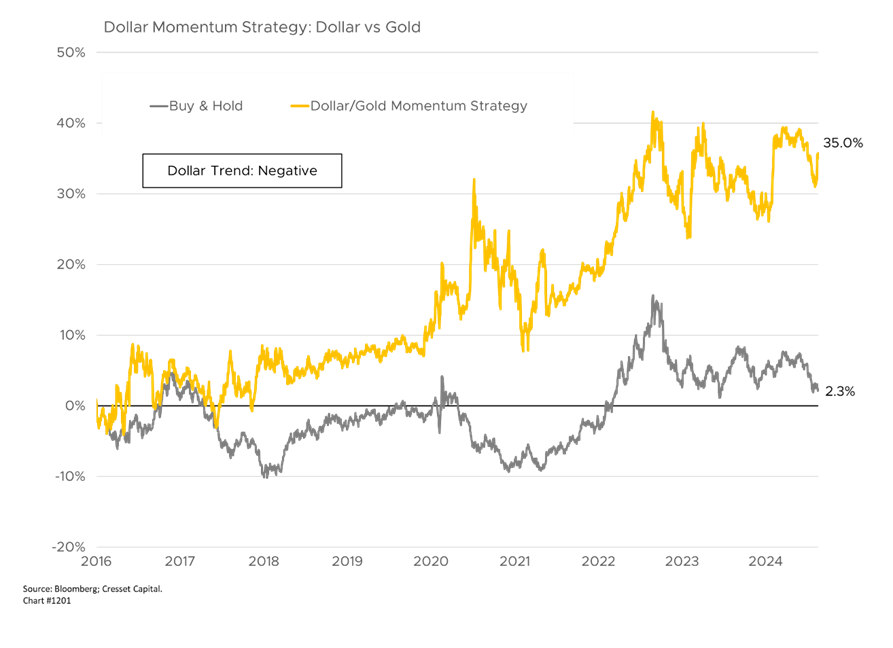

Gold, REITs, and International Developed Equities Beneficiaries of Weak Dollar

Gold, an alternative currency, tends to benefit in periods of dollar weakness. Since 2016, enhancing our switching strategy by shifting to gold instead of cash, grew 35 per cent, about 3.8 per cent annualized vs a 2.3 per cent cumulative dollar return. That’s impressive for an asset class that offers no yield.

A weaker dollar carries other implications for US investors. Over the last 50 weeks, the dollar has weakened by more than one per cent six times. REITs, dividend stocks and international developed equities have, on average, outpaced the S&P 500 in periods in which the dollar declined. REITs likely benefitted from a concomitant decline in interest rates, while international equities gained ground as their local currencies advanced.

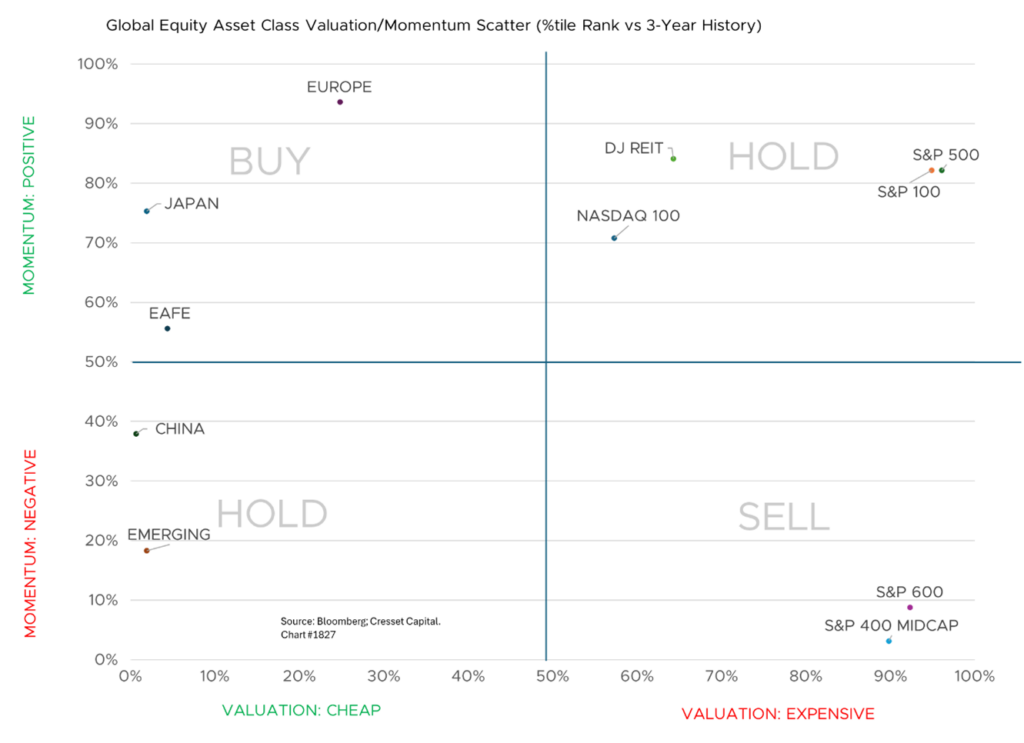

Technicals in Europe Have Improved, but Fundamental Uncertainties Remain

Continued dollar weakness represents a tailwind to foreign investment markets, most notably international developed equities like Europe and Japan. International developed markets are relatively cheap and are beginning to exert positive momentum relative to global equities. While currency trends are favorable for US investors with foreign market exposure, the UK and Europe have fundamental challenges. Elections in the UK, Germany and France are creating policy uncertainty. Meanwhile, Germany’s export economy, which relied on Chinese demand, is falling short of expectations. While technical conditions have improved, we need to confirm the region’s fundamentals are keeping pace.

Bottom Line

A monetary policy regime change is underway as the Federal Reserve is poised to embark on its first easing program since 2019. The US dollar, the beneficiary of generous real rates, has rolled over, setting the stage for broader market participation, particularly from markets denominated in foreign currencies. While the fundamentals in Europe and UK are cloudy as the region grapples with economic and political uncertainties, and China dominates the emerging markets, dollar weakness offers a technical tailwind for international markets. We recommend investors rebalance their foreign holdings back to their longer-term targets while we look for opportunities to increase our exposure abroad.