Key Observations

- Longer-term bonds are signaling a soft landing

- Lower rates will have a lagged impact on the economy

- Future AI-driven productivity improvements imply Treasury yields are too low

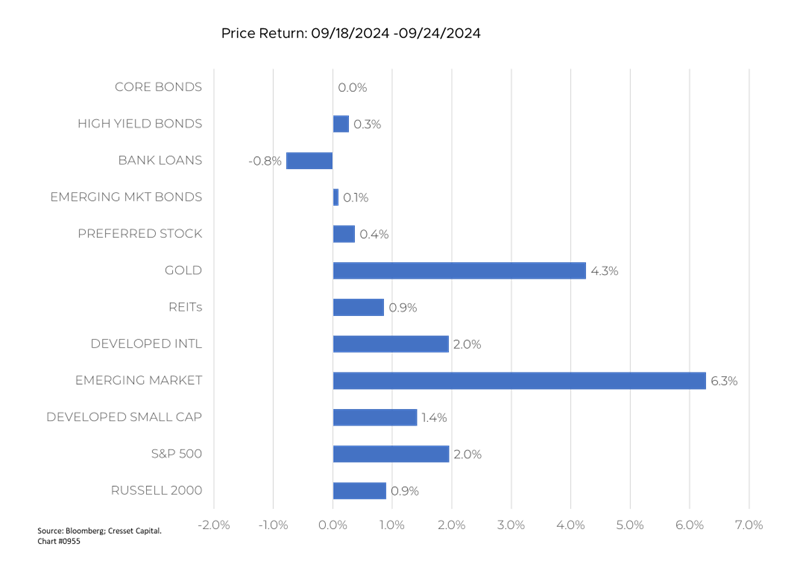

Chairman Powell and the Federal Reserve surprised investors last week by kicking off their easing program with a half-point rate cut, rather than the customary quarter-point move. Markets rallied in response and investors reduced their recession expectations. Gold, an alternative currency, led the way higher on a weaker dollar, with foreign equity markets not far behind. Bonds, meanwhile, pulled back on improved growth prospects. Let’s examine what the bond market implies for the economy going forward.

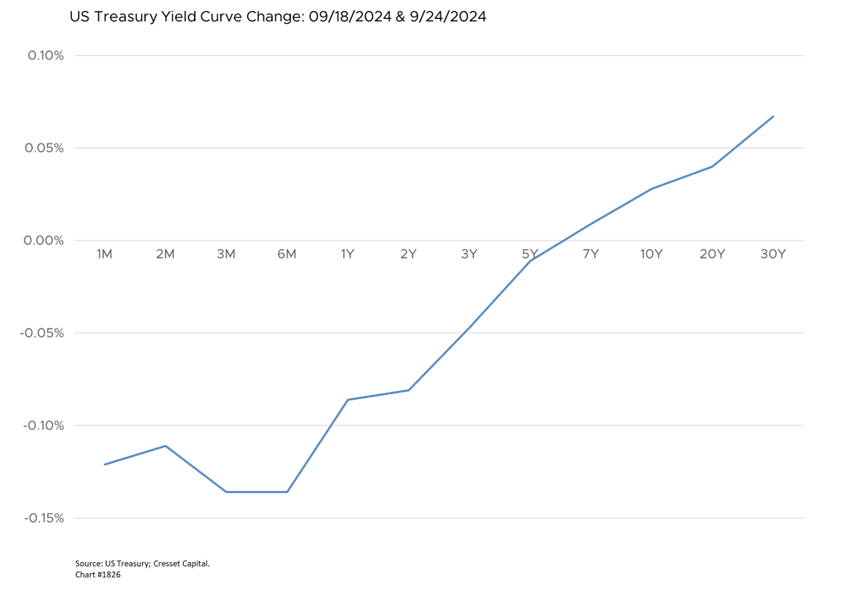

Longer-Term Bonds Are Signaling a Soft Landing

The bond market appears to be preparing for a soft landing. That’s good news for equities – particularly small caps and international, whose performance is sensitive to economic conditions. While short-term rates slid in response to the Fed’s recent rate cut, intermediate- and longer-term Treasury yields rose over the last week. The 30-year yield moved .06 per cent higher, suggesting bond investors are taking some of their recession chips off the table. Meanwhile, several Fed officials, when asked, left the door open for additional half-point cuts, noting that real rates remain restrictive.

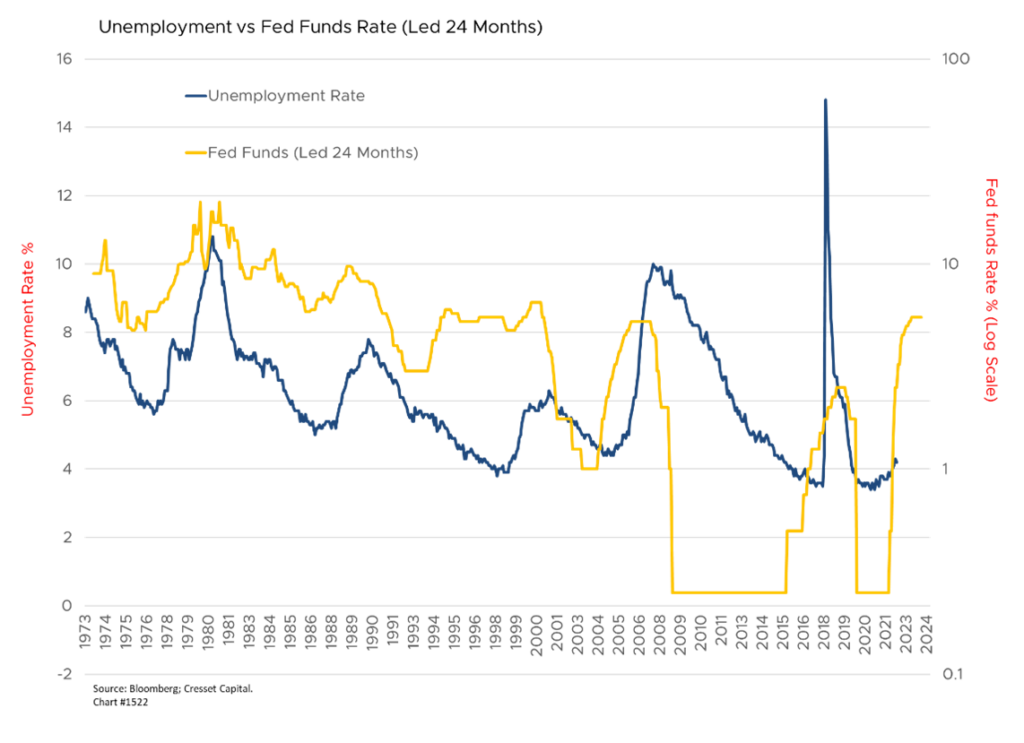

Lower Rates Will Have a Lagged Impact on Economy

While the markets celebrated the Fed’s initial rate cut, we recognize the sizable lag between lower benchmark rates and subsequent economic vitality. History has shown that changes in the Fed’s overnight rate have led the unemployment rate by about two years. We expect a similar lag in spending, investment and housing this time, too. That said, the current economy appears to have sufficient momentum to continue its growth trajectory until monetary stimulus kicks in.

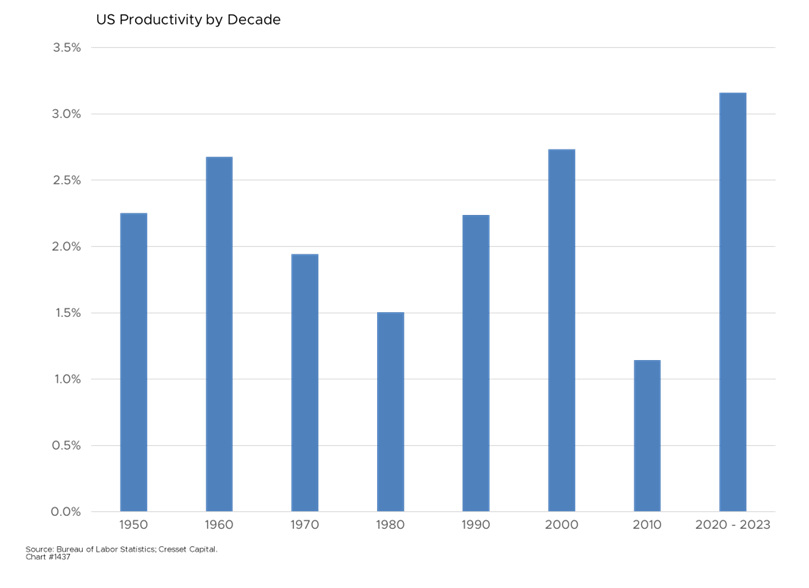

Future AI-Driven Productivity Improvements Imply Treasury Yields Too Low

Meanwhile, we believe intermediate Treasury yields are likely too low, considering their longstanding relationship with anticipated economic activity. Historically, the 10-year Treasury yield tracks nominal GDP (real growth plus inflation). The 10-year fixed rate is 3.7 per cent, while the 10-year TIP implies a 2.1 per cent inflation rate. That suggests the benchmark Treasury is anticipating 1.5 per cent annualized real growth over the next 10 years. Since real GDP growth is the sum of labor force growth and productivity, estimating future labor force growth at around 0.5 per cent suggests the Treasury market is forecasting one per cent annualized productivity gains over the next decade, its long-term average. That sounds too low based on the anticipated rollout of artificial intelligence (AI) tools and their expected impact on annualized productivity growth, which as a result could possibly reach 2.5 per cent over the next 10 years. A related example is widespread utilization of the internet, which resulted in annualized productivity growth of over 2.5 per cent during the 2000s. If the AI rollout gains traction over the coming years, even a 1.5-2 per cent annualized productivity gain suggests the 10-year note should yield 4.5-4.7 per cent, not 3.7 per cent.

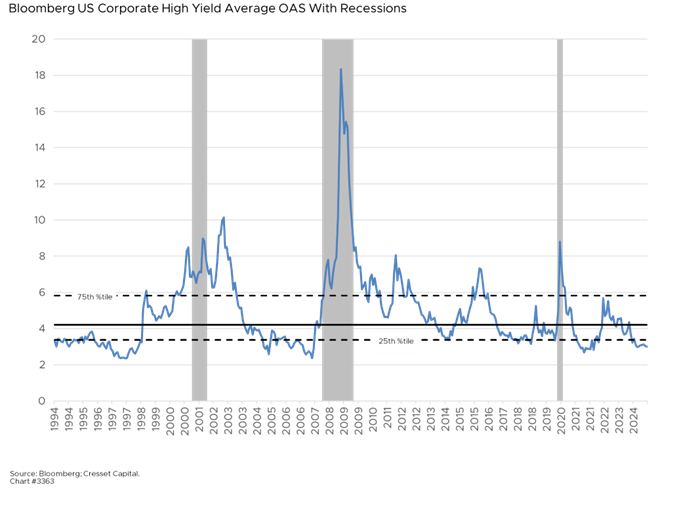

Credit Spreads Remain Low by Historical Standards

Meanwhile credit spreads – the yield premium lenders require to extend loans to lower-quality borrowers – remain low by historical standards. Worried lenders would require a higher loan premium, as they did ahead of the last three recessions. This time around the yield premium is comfortably situated below the 25th percentile of its historical range, suggesting that lenders are sanguine over current and future economic conditions.

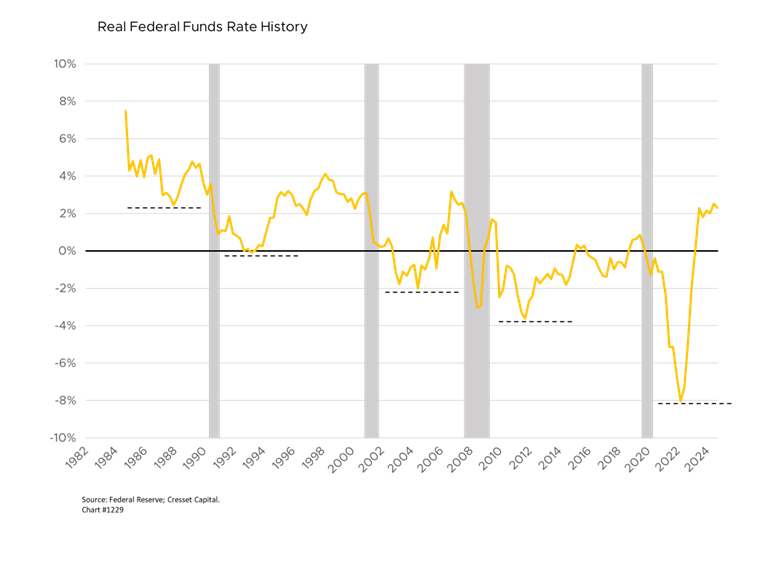

Some Pessimists Believe Recession Is Already Here

Nonetheless, some investors believe the economy is already in recession. Pessimists point out that the real fed funds rate, which is the overnight rate relative to inflation, at its highest level in nearly 20 years. They also assert that the Fed’s track record in engineering soft landings is spotty. Moreover, monetary policy must get increasingly easier with ever-lower rates relative to inflation to gin up growth. The problem is the Fed slashed rates to zero during their last easing cycle, with the overnight rate set at eight percentage points below inflation at its trough. That’s a troubling trend.

Bottom Line

We’re optimistic economic growth will stay positive throughout the Fed’s easing cycle, recognizing there is a lagged reaction between rate cuts and growth. If our expectations play out, an expanding economy against a backdrop of lower borrowing rates would usher in broader equity participation, particularly among smaller US equities and foreign markets. While the S&P 500 is arguably expensive due to the impressive rally in mega-cap tech names, other markets are more reasonably priced. A favorable blend of lower rates, a weaker dollar and economic momentum could represent the tide that lifts all boats.