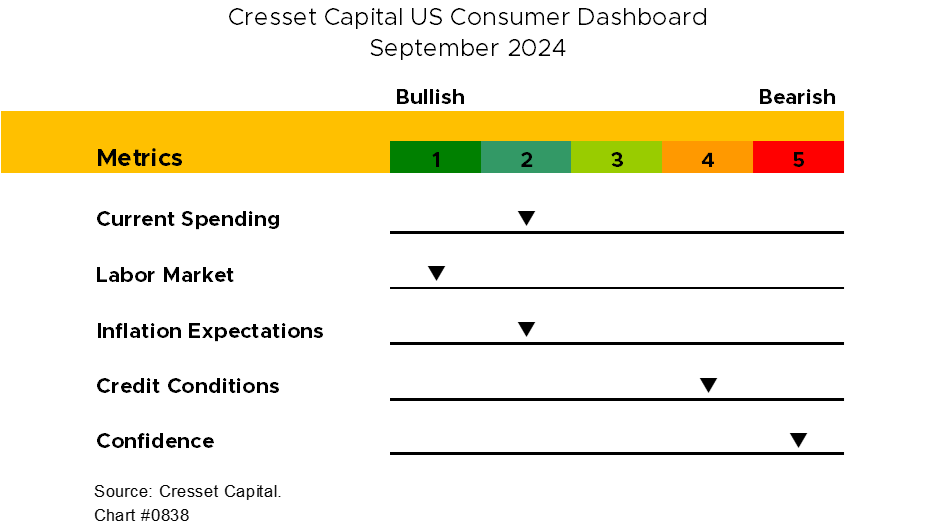

Key Judgments:

- Robust labor market and consumer spending create a virtuous cycle

- Consumer credit use evidencing financial stress; tepid confidence is concerning

- But we believe high-income consumers will offset spending pullback by lower-income groups

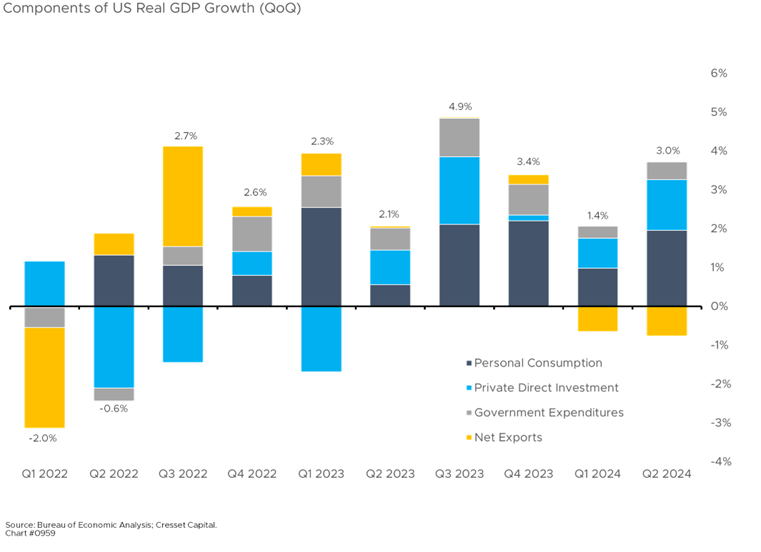

The US economy sits at a critical juncture as we prepare for the Fed’s long-awaited easing program to begin. History has shown that half of all rate-cutting cycles have coincided with recession, leading to disappointing near-term equity performance. Without the help of China and Germany – two of the world’s largest economies, which are struggling – US consumers are critical to achieving a soft landing here at home, since consumer spending accounts for roughly two-thirds of domestic growth. Their behavior, confidence and financial health are key factors in determining whether the economy can transition from high inflation to stable prices without falling into a recession. The good news is consumers have continued to spend despite being buffeted by high inflation and rising interest rates, and have supported economic growth in recent quarters. While a portion of consumer spending was fueled by fiscal largess throughout the pandemic this resilience has, nonetheless, been vital in preventing a sharp economic downturn as the Federal Reserve tightened monetary policy two years ago. We present here our US consumer health check-up.

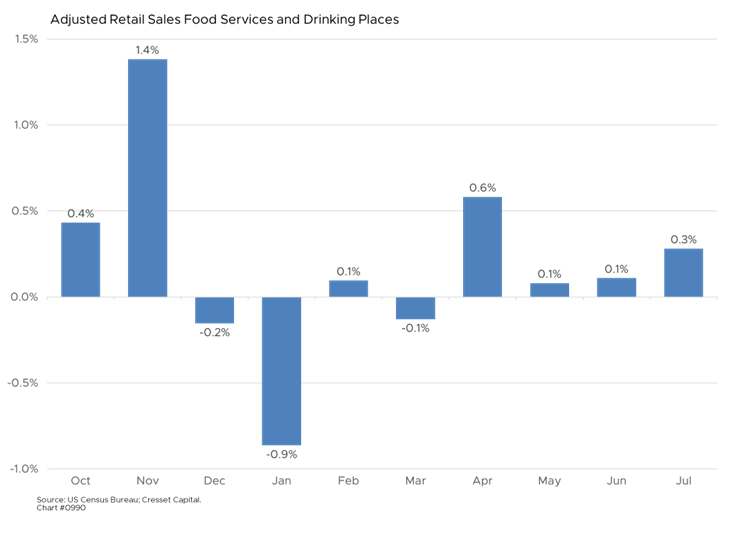

Discretionary Spending Remains Strong

Discretionary spending, a good indicator of consumer health, has been strong over the last 12 months. Households continue to dine out: consumer spending at bars and restaurants has advanced in five of the last six months, according to US Census data. It’s encouraging to note that over the last six months, some of the biggest increases in consumer spending were highly discretionary, like foreign automobiles, pleasure boats and motorcycles.

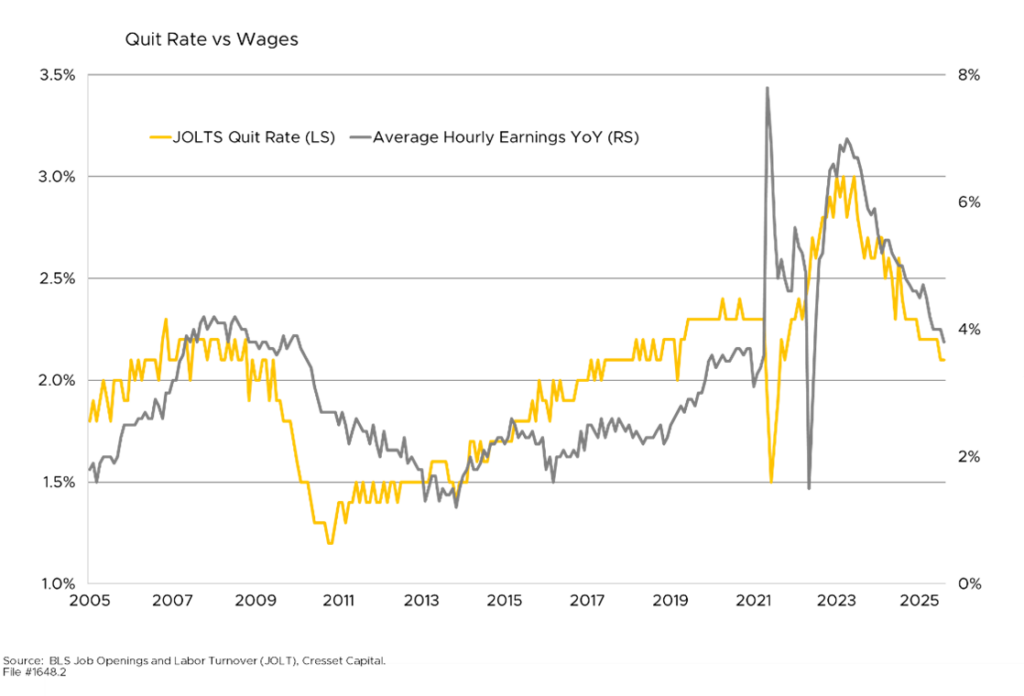

Robust Labor Market and Consumer Spending Create a Virtuous Cycle

The labor market has been powering America’s pocketbook, creating an economic flywheel. Consumer spending helps maintain demand for goods and services, which in turn supports employment levels. A strong job market has been essential in maintaining consumer confidence and spending power. The quit rate – the share of America’s workforce who voluntarily leave their jobs – is a useful confidence barometer. A high quit rate suggests workers are confident they will easily find another job. The quit rate hit three per cent last year, its highest level in over 20 years. While the rate has been declining since then, it’s currently situated at its historical median.

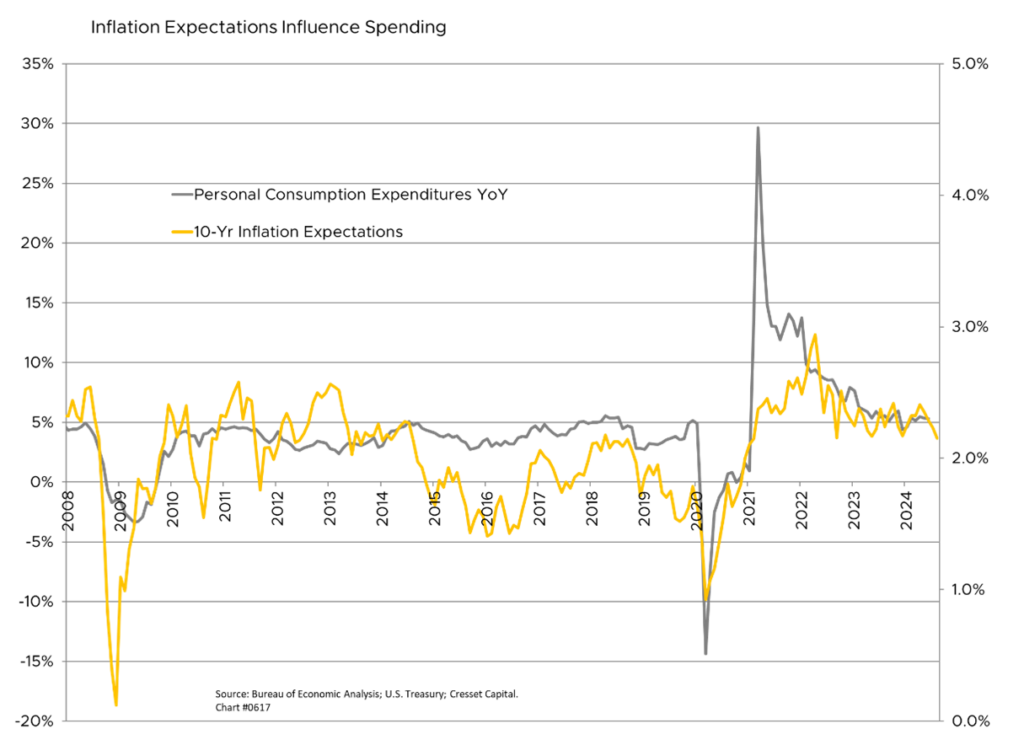

Inflation Expectations Influence Consumer Spending

Inflation expectations also play a significant role in consumer spending. If consumers believe inflation will persist, they might accelerate purchases, potentially fueling further price increases. Conversely, if they expect prices to stabilize, it can help anchor inflation. Ten-year inflation expectations have fallen toward two per cent, a realistic level that still supports spending, not hoarding.

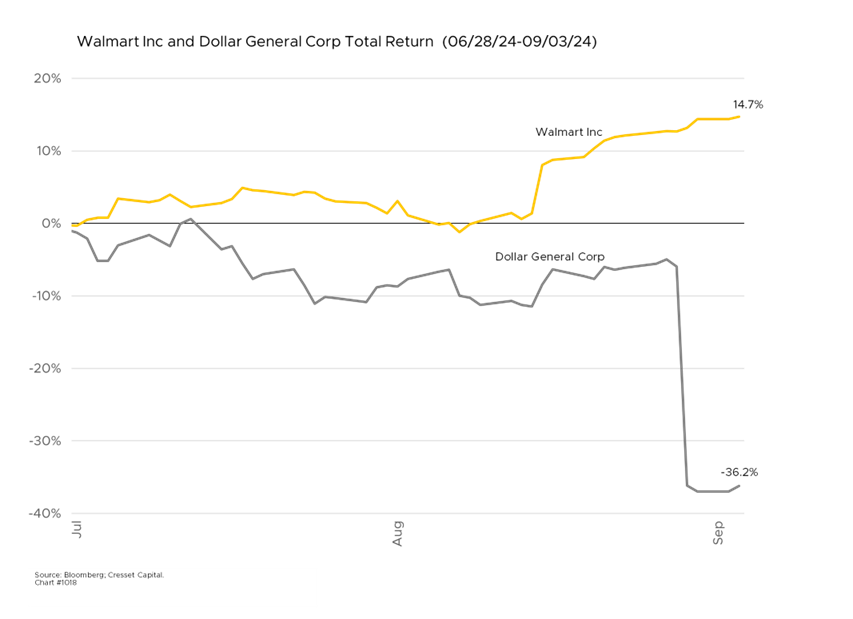

Consumer Push-back Against High Prices Helps Mitigate Inflation Pressure

Consumers’ ability to maintain spending while adjusting to higher prices and interest rates is crucial for a soft landing. Too sharp a pullback could trigger a recession, while overspending could reignite inflationary pressures. Consumers are pushing back against price increases, as lower-income households struggle with higher prices. Many are seeking out cheaper alternatives and discount retailers. For example, Walmart reported gaining market share “across income cohorts primarily driven by upper-income households” attracted by its “value-convenience proposition”. The company offered temporary price cuts on 7,200 items last quarter, including a 35 per cent expansion of food “rollbacks”. Dollar General, a rural variety store catering to lower-income customers, missed Q2 results expectations on both the top and bottom lines. Meanwhile, fast food giant McDonald’s launched a “$5 meal deal” to attract price-sensitive customers. Other quick-service restaurant chains followed suit. Consumer behaviors reflect more cautious and value-orientation, pushing companies to compete more aggressively on price and value propositions. While overall spending remains relatively strong, these trends suggest that consumers are becoming increasingly sensitive to price increases and are actively seeking ways to manage their budgets in the face of persistent inflationary pressures. This push-back from consumers is an important factor in achieving a “soft landing” for the economy, by helping moderate inflation without stalling economic growth.

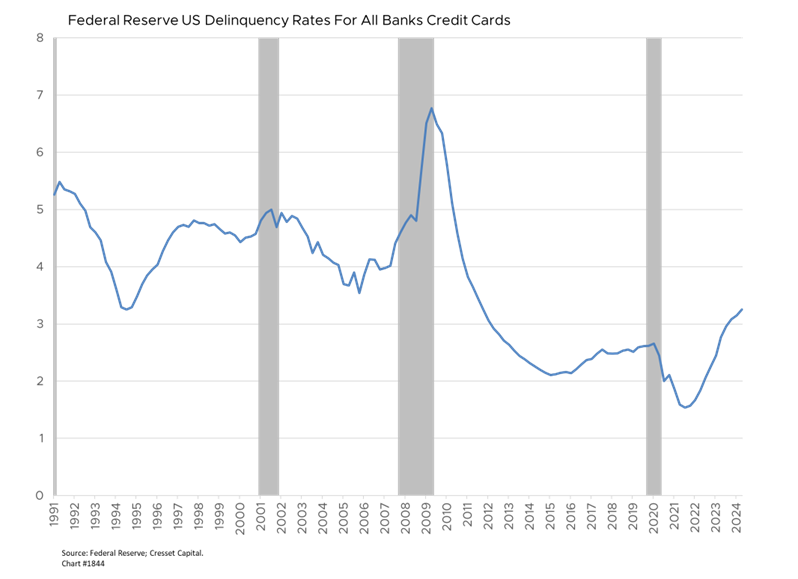

Consumer Credit Use Evidencing Financial Stress

Consumers’ use of credit can help smooth spending during transitions but must be sustainable to avoid future financial stress. The personal savings rate has fallen to 2.9 per cent, a nearly two-decade low. This indicates that because consumers have a dwindling financial cushion, they might be more likely to turn to credit cards to bridge gaps in their budgets. But credit card usage, which expanded dramatically through February, is now easing. That’s either because households are budget conscious, or because they’re maxing out their credit limits. Credit utilization in the April-June quarter declined in two of those months, according to Federal Reserve data. Meanwhile, evidence of financial stress is emerging. More Americans are now struggling to pay off their credit card debt and delinquencies are now pushing multi-year highs, according to data from the Philadelphia Fed. This suggests that as consumers rely more heavily on credit cards to maintain their spending levels, they are having difficulty keeping up with payments. As of June, 3.25 per cent of all bank credit card balances are delinquent, according to Fed data. That’s the highest such reading since 2011.

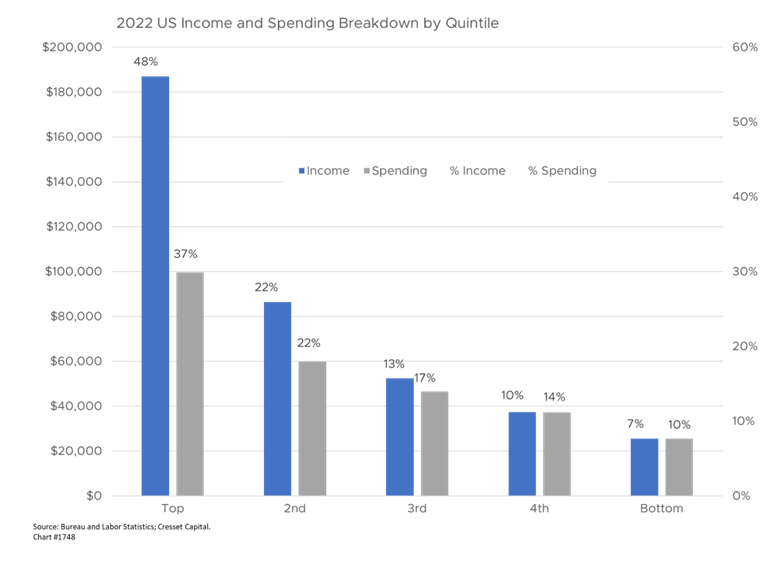

High-income Consumers Offset Pullback from Lower-income Groups

The spending patterns of different income groups can have different impacts on the economy. For instance, high-income consumers, who account for nearly half of all spending and most discretionary spending, continue to spend and have helped offset pullbacks from lower-income groups. Higher-end consumption is influenced by both income and wealth. Rising asset prices –such as equity markets at all-time highs and housing values on an extended run – supported spending even as interest rates rose, helping to cushion the economy. That’s part of the reason why Fed officials are sensitive to market sell-offs, since lower portfolio values could dampen higher-end spending.

Consumer Confidence Is Concerning

Tepid Consumer Confidence Is Concerning

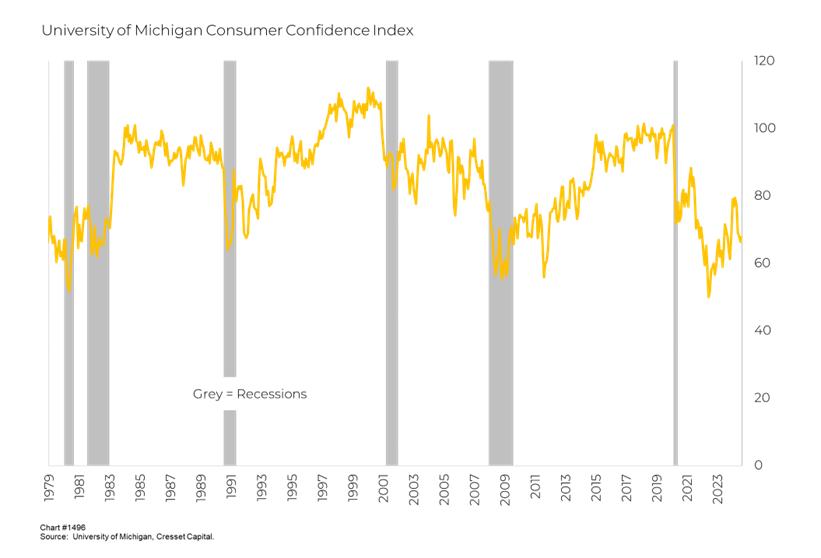

Consumer sentiment influences spending decisions. Maintaining confidence in the economy’s direction is crucial for continued spending and investment. Today’s tepid confidence is a concern: confidence is markedly lower across all income categories, with households earning between $15,000 and $25,000 suffering the biggest pullback. Overall, confidence has been stuck at middling levels overall, higher than mid-2022 when inflation spiked, but appreciably below pre-pandemic levels. Most consumers are too young to remember America’s last inflation struggle of the early 1980s, so this is their first experience with price hikes and likely explains their pessimism.

Fed Policymakers Closely Watch Consumer Behavior

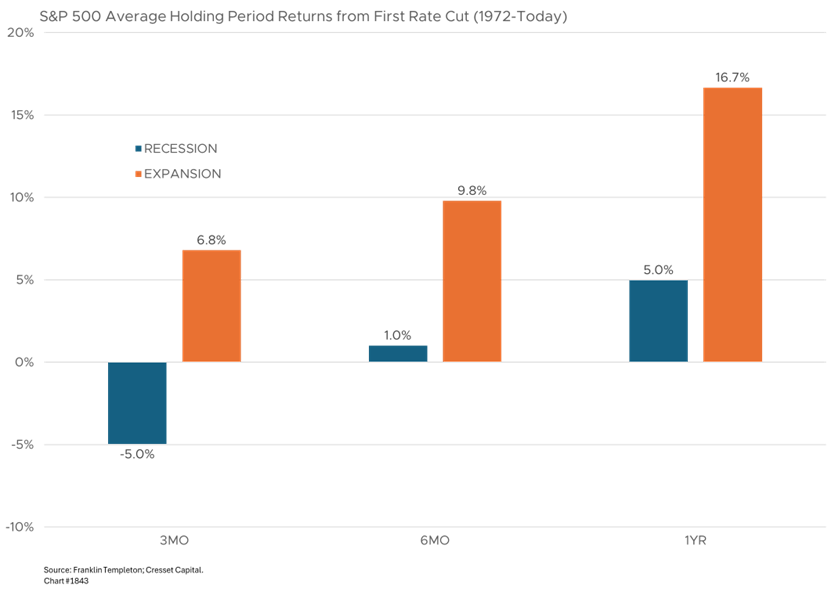

How consumers react to monetary and fiscal policy changes is crucial. Their responsiveness to interest rate changes affects the transmission of monetary policy. Fed policymakers are closely watching consumer behavior as they calibrate their approach. The ability of consumers to adapt to changing economic conditions without dramatically altering their spending patterns will be a key determinant of whether the economy can achieve the elusive soft landing. It’s a balancing act. Consumers need to continue spending at a pace that supports economic growth and employment, but not so aggressively as to reignite inflation. Investors are watching too. Consumer behavior sends important signals to businesses about demand, production, hiring and investment decisions. Any hint that the economy is headed toward recession will be felt by equity investors first. The difference in market returns between recessions and expansions after the initial rate cut is dramatic. The average S&P 500 return in the three months from the initial rate cut is 6.8 per cent in expansions and negative five per cent in recessions.

Bottom Line:

We’re optimistic household demand will support economic growth against a backdrop of easing interest rates and inflation. Housing, a segment that accounts for nearly 10 per cent of economic activity, has been sidelined by prohibitive borrowing costs but that could change with lower interest rates. In the meantime, current spending is positive and the labor market is strong. Though lower-income households are struggling, we believe consumer spending overall will help our economy avoid recession. History has shown that Fed easing in an expansionary economy is favorable for equity holders.