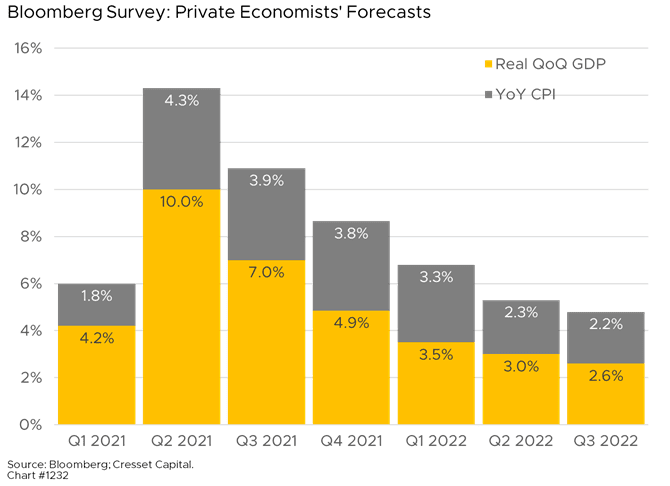

6/16/21: The Federal Open Market Committee (FOMC), the rate-setting arm of the Fed, is meeting Tuesday and Wednesday to discuss where interest rate policy is headed. Economists anticipate the FOMC will ratchet rates higher in 2023, with quantitative tapering perhaps beginning as a result of the Fed’s August 26-28 policy retreat in Jackson Hole, Wyoming. So far, the Fed has clearly been reluctant to indicate any desire to tighten policy even though the economy is expected to expand 6.6 per cent this year, with inflation running at 2.7 per cent. Private economists surveyed by Bloomberg expect growth and inflation to revert to their longer-term trend rates by mid-2022.

Powell & Company’s reluctance to tighten is twofold. First, the FOMC would like to wait for herd immunity in the US, which equates to roughly 75 per cent of adults being fully vaccinated. Original trend lines suggested that figure would have been reached by mid-June, but the vaccination rate has slowed as demand has diminished; August is the current target date. Second, the FOMC hopes to err on the side of stimulus knowing that the central bank has a long, successful history of keeping a lid on inflation, while having a spotty record of elevating tepid inflation. We expect the Fed will let the economy and inflation run hot for a while before intervening. That strategy could spook bond investors, who demanded higher yields earlier this year.

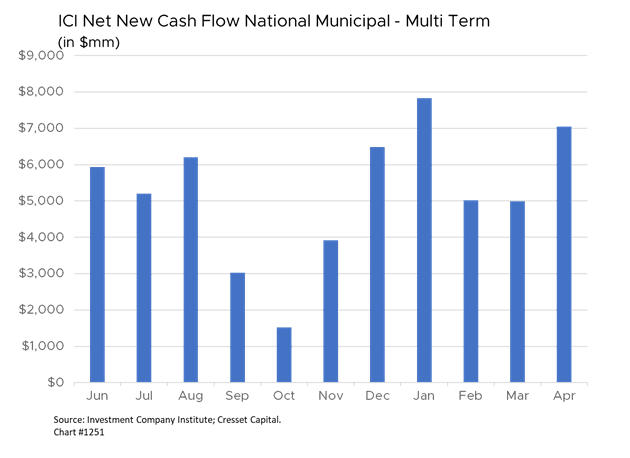

The 10-year Treasury yield kicked off 2021 below 1 per cent, but it quickly spiked higher. Bondholders worried that the confluence of reopening and public and private spending would conspire to sustainably boost growth and raise inflation. By the end of Q1, the benchmark yield breached 1.7 per cent before retreating. The move battered most fixed-income assets. Intermediate-term Treasury notes lost nearly 6 per cent of their value, representing their worst quarterly showing since Q4/16. Corporate bonds fell 5.5 per cent for the quarter. Municipal bonds, meanwhile, held up remarkably well as demand for tax-exempt securities swelled earlier this year. That’s because retail investors have piled into munis, adding nearly $25 billion of net new funds to national municipal mutual funds through April, according to the Investment Company Institute, a trade group of mutual fund companies. Meanwhile, new municipal bond supply has run consistently below average for most of the year. The reinvestment of income from maturities, calls and coupons outstripped municipal bond new issuance by nearly $16 billion in January alone, according to a Wall Street Journal report.

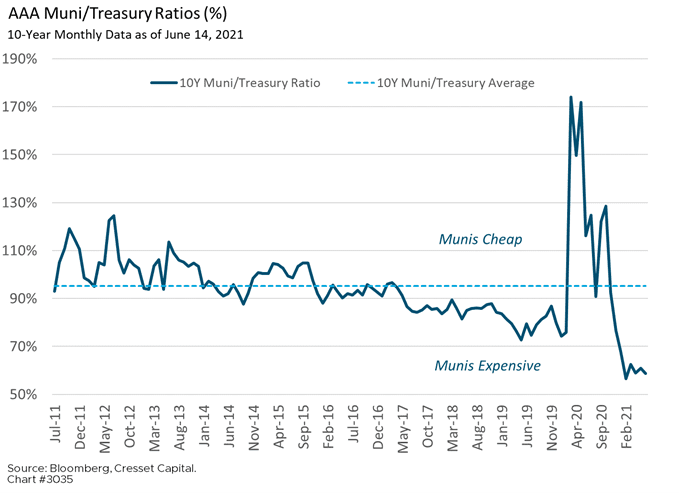

Favorable supply-demand dynamics have helped drive high-quality municipal bonds to become the best-performing investment-grade bond market this year – munis outpaced emerging markets, corporate bonds and Treasuries through May. It is the only investment-grade asset class that delivered a positive, albeit small, return for the year against a backdrop of higher yields. Unfortunately, munis could become a victim of their own success. Massive buying has propelled AAA municipal bonds to their lowest yield relative to Treasuries in history, offering holders little protection in the event interest rates rise or personal income tax rates hold steady.

We recommend investors hold investment-grade munis for cash flow purposes only. We are not concerned about credit quality among our nation’s top municipalities, and we believe that holders deserve an incrementally higher yield for holding those issues. We expect quality municipals to underperform their taxable counterparts once supply comes back online this fall.