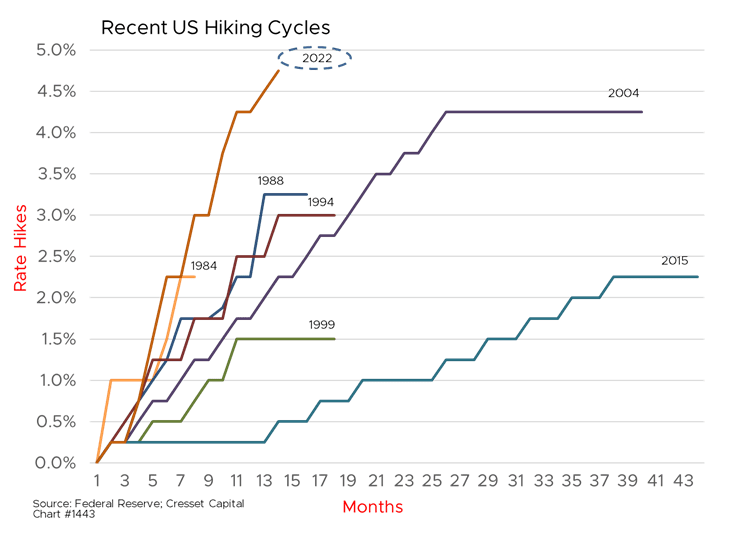

03.23.2023 Wednesday afternoon, Chairman Powell and the Federal Open Market Committee (FOMC) raised the overnight rate by 25bps, the latest in a string of rate hikes that started one year ago. Over the last 12 months the Fed has pushed up the overnight lending rate nine times, from 0.25 per cent to 5 per cent, representing the steepest rate rise since the Volcker years. Unless inflation spirals unexpectedly higher, we believe the next rate hike will be the Fed’s last.

The Federal Reserve carries a dual mandate, to achieve price stability with maximum employment. Last week’s banking turmoil argues for a third mandate: maintain a stable banking system. Powell’s aggressive tightening program was a catalyst behind the collapse of Silicon Valley bank, our nation’s second-largest bank failure. The primary contributors to the failure were SVB’s exponential growth, its concentration of large deposits, and long-dated assets whose value declined as rates shot up. However, the fact remains that the Fed, America’s lender of last resort, created an unstable environment for the industry it is tasked to protect.

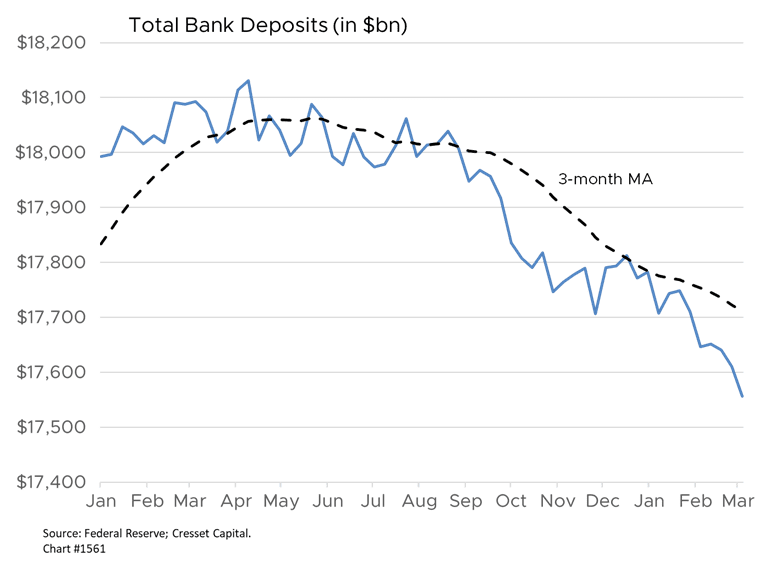

The height and pitch of the Powell’s rate hikes have left banks, most notably regional banks, scrambling for deposits. The yield differential between average deposit rates and the 3-month Treasury bill is several percentage points, inducing bank customers to flee. Depositors have collectively withdrawn more than $600 billion from banks since the Fed’s tightening program began.

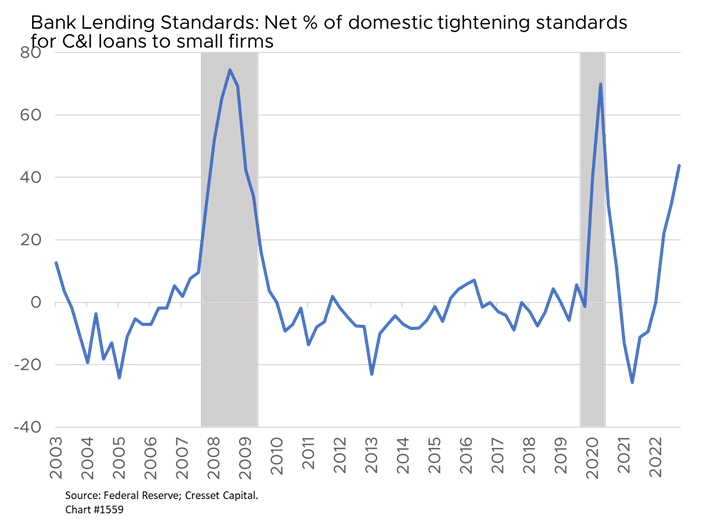

Smaller, regional banks are facing intense pressure because they are not considered “systemically important” by regulators. Silicon Valley Bank, with $200 billion in assets, didn’t even qualify as such. Since the cost of shifting their deposits to larger banks is negligible, customers of smaller banks are withdrawing their deposits at a faster clip than that of the overall banking sector. Fewer deposits mean fewer loans and stricter lending standards for the loans banks do originate.

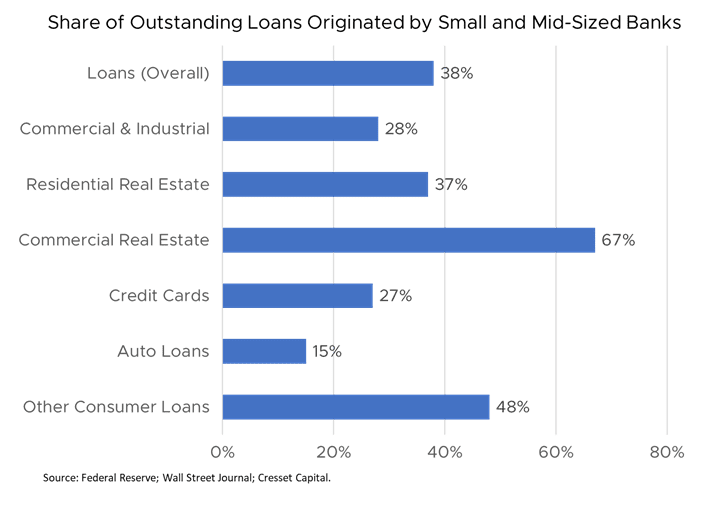

While smaller, regional banks don’t have the footprints enjoyed by their money center brethren, they nonetheless account for a sizable share of loan activity to individuals and businesses. The biggest banks, thanks to their size and scale, tend to fund capital market activity. Small and mid-sized banks originate two-thirds of commercial real estate loans and half of consumer loans. A continued pullback in lending will crimp business activity and economic growth.

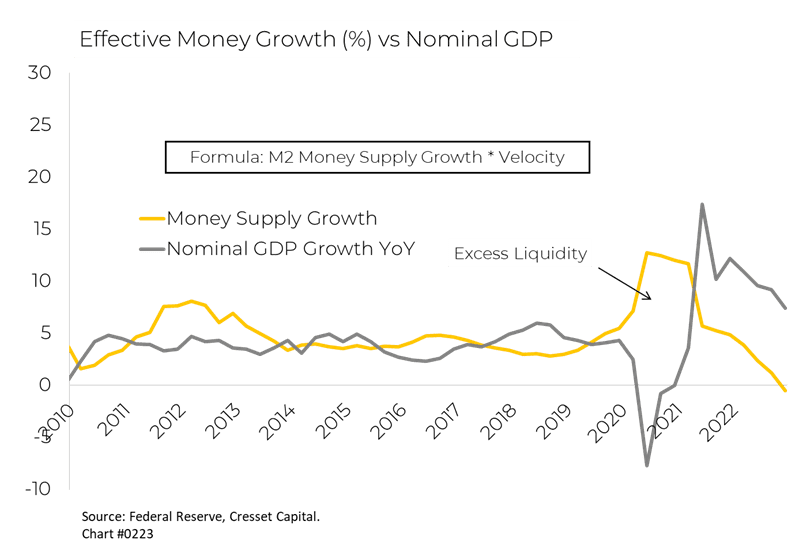

Fewer loans and tighter credit mean the supply of money – the pulse of the economy’s circulatory system – is slowing. In fact, for the first time in over a decade, effective money growth was negative last year.

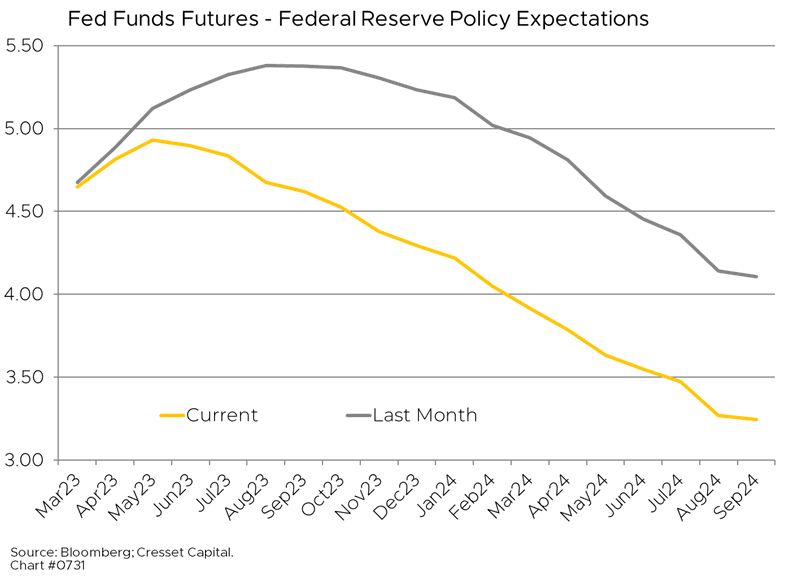

Bottom Line: We believe the Fed will raise rates just once more, at the next FOMC meeting on May 2-3, and then the hiking cycle will end. By raising rates, the Fed hopes tighter credit will slow growth and inflation – in other words, our nation’s banks would be doing the Fed’s work for it. We expect a meaningful withdrawal from lending will slow demand for investment and consumption and push the US economy into recession early next year. Today’s Treasury yield curve and Fed Fund futures suggest bond investors agree with our assessment.