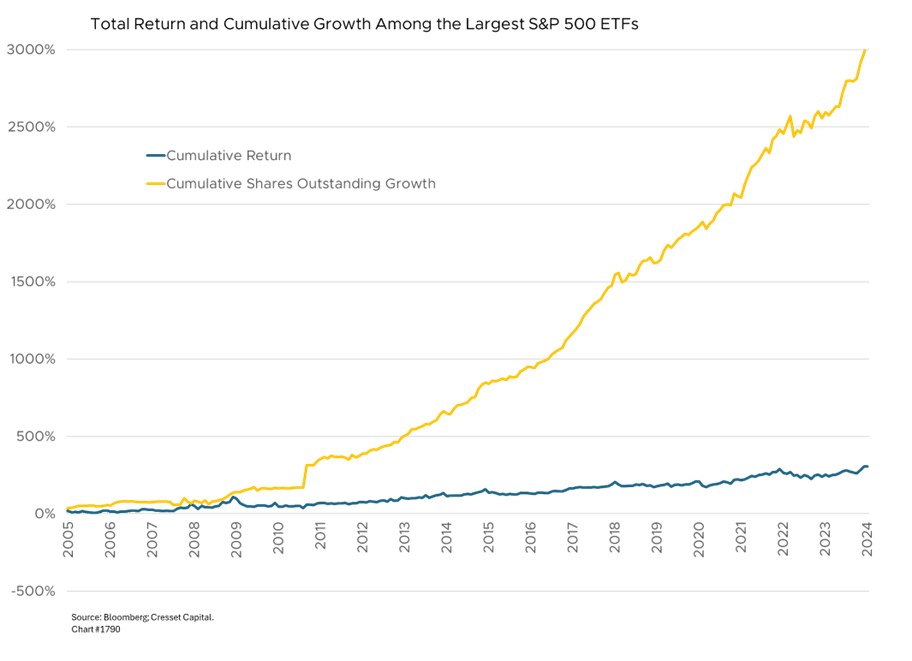

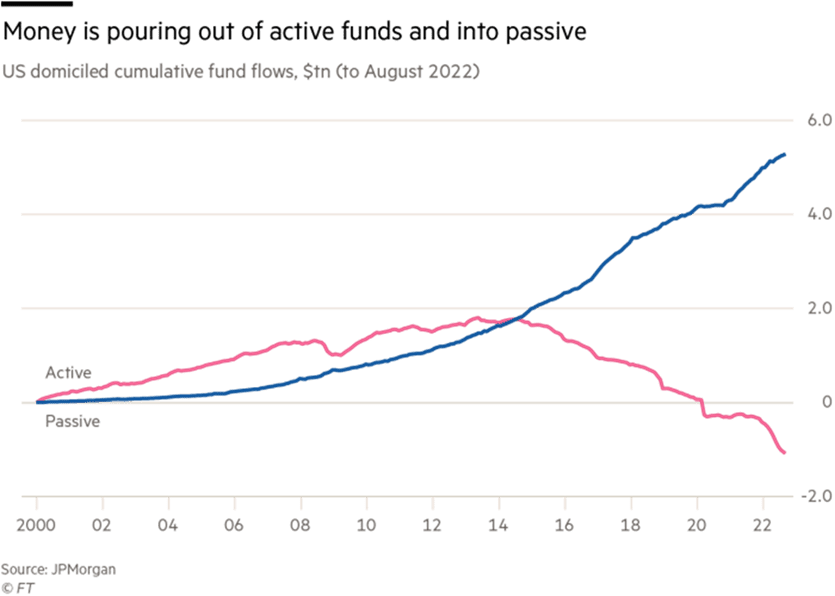

2.29.2024 – Assets in passively managed funds surpassed those in actively managed funds for the first time ever in January 2024, marking a milestone in the decades-long rise of index investing. The introduction in the early 1990s of exchange-traded funds (ETFs), which are low-cost and trade on exchanges like stocks, has driven strong inflows. Between 2019 and 2023, investors poured over $2.5 trillion into passive ETFs compared to $400 billion put into passive mutual funds, according to the Financial Times. The total in January was passive US mutual funds and ETFs $13.3 trillion vs active mutual funds $13.2 trillion. What are the implications of this passive fund tsunami?

Vanguard’s Jack Bogle launched the first index mutual fund in 1976 with mixed success. He argued that most active managers failed to outperform the market after accounting for their high fees. Actively managed mutual funds charged between 1-2% on average, while index funds charged nearly nothing. It took several years for passive strategies to gain traction, but investors have wholeheartedly embraced them.

Simply put, investors understood that they can achieve market returns for virtually no cost while active managers hadn’t proven their ability to add incremental return worth their higher fees. Over the 10 years ending in 2022, 98 per cent of large-cap core managers fell short of the S&P 500 on an after-tax basis. Meanwhile, active funds suffered over $450 billion in outflows last year as investors moved money into either index funds for their minimal fees, or alternative investments like private equity in search of higher returns. Only one in three dollars invested by institutional investors in US markets is actively managed, according to The Economist.

The ascent of passive strategies has raised some concerns about their impact on market efficiency, price discovery, and volatility. Recent research suggests passive investing has made stocks less sensitive to news and events, increased volatility, and led to less efficient markets overall. This could undermine the premise behind passive funds if indexing becomes so widespread that price signals get distorted. Critics argue that passive investors are getting a free ride on the backs of active managers who ensure equities are fairly valued. Think of active investors pushing a revolving door to keep the markets efficient while allowing index investors to pass through the door without pushing. Without enough active investors, critics assert, the revolving door of efficient pricing would eventually stop, distorting valuations by price-insensitive buyers.

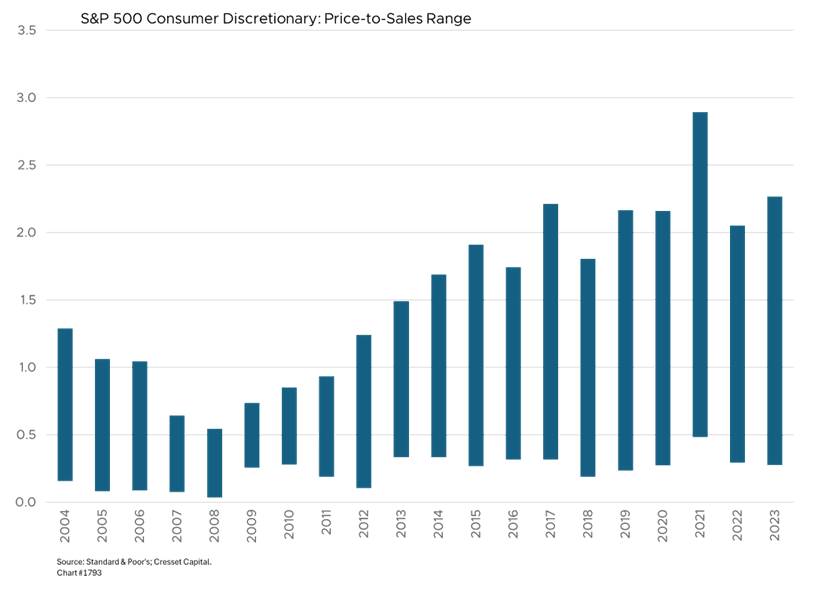

We’re already seeing a wider divergence among valuations in S&P 500 companies. Active managers and analysts have been leaving the market, tired of swimming against a tide of capital flowing into passive strategies. The average number of sell-side analysts covering S&P 500 companies has fallen 15 per cent since 1990, according to Barron’s. One byproduct is the widening range in price-to-sales ratios within the S&P 500’s consumer discretionary sector over the last 20 years, reflecting the inflow of passive capital and lack of price discovery.

Passive index fund managers are insouciant toward corporate governance unlike many of their active management counterparts. While passive fund managers vote shares, they spend less effort influencing individual companies compared to active managers. Collectively, Blackrock, State Street and Vanguard – the Big Three passive fund providers – own over 20 per cent of large, listed American companies. Nearly 25 per cent of tech giant IBM, which has a $170 billion market cap, is owned by the Big Three, as well as nearly three billion shares of Apple. There’s little evidence these investment firms, as proxy voters, require or demand excellence among management in companies they hold, leaving a potential governance gap. Inadequate oversight, particularly into small and mid-size companies, could potentially vitiate management, leading to inefficient capital allocation.

The continual cascade of cash into passive strategies has also dulled the impact that company-specific and geopolitical news has on stocks and markets, according to the National Bureau of Economic Research. It could be part of the reason why Russia’s invasion of Ukraine, for example, created little more than a ripple in the equity markets. There’s growing evidence that stocks are insulated against surprises and valuations are disconnected from fundamentals due to passive investment flows. This November, the choice for president will be stark given the divergent philosophies of the presumptive nominees. Market volatility, while expected, might not play out given the prevalence of passive investing.

Bottom Line: I was one of the earliest adopters of passive strategies and continue to favor them, particularly in large, liquid markets. While the rise of passive strategies warrants continued monitoring, their benefits for most investors still outweigh their challenges. Passive funds offer investors simple, diversified market exposure at virtually unbeatable costs. In fact, the ubiquity of passive investing creates unique opportunities in both public and private markets. Activist investors identify undervalued companies and create a catalyst, through operational or financial restructuring, to unlock value. While the heyday for traditional active stock-picking may be over, shifts caused by the rise of passive investing look likely to unlock new opportunities for us in public and private investments. Public-market beta and private-market alpha has been the cornerstone of Cresset’s investing philosophy since our inception.