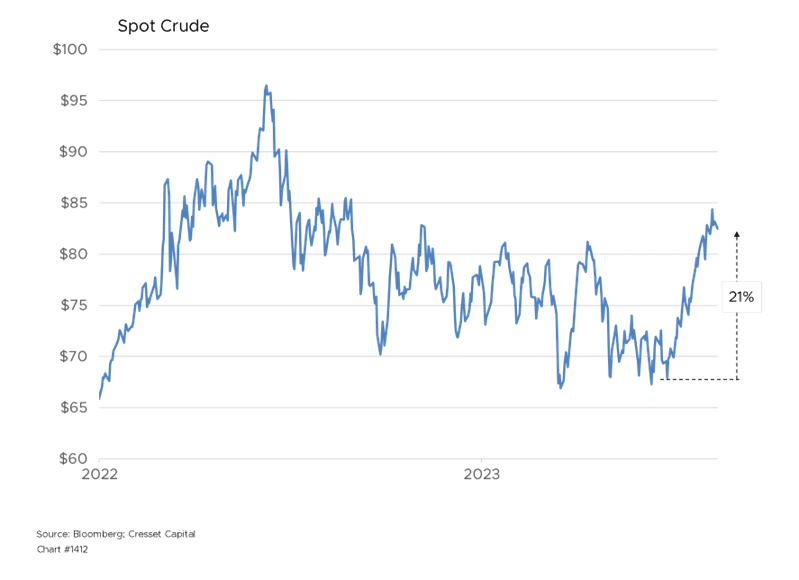

8.16.2023 The energy market represents the complex confluence of fundamentals, geopolitics and public policy, as the world grapples with autocracies, climate change and green energy solutions. Russia’s invasion of Ukraine last year sent oil prices surging, prompting President Biden to release nearly 200 million barrels of US crude oil reserves into the market, according to The Wall Street Journal. The Federal Reserve’s interest rate hikes helped curb industrial demand for energy. These two factors contributed to the nearly 25 per cent slide in the price of a barrel of oil between July 2022 and June 2023. Over the last three months, however, the price of oil has spurted more than 20 per cent from its June low to a nine-month high. In the interim, diesel fuel jumped 31 per cent, jet fuel climbed 33 per cent and the price of gas at the pump is 18 per cent more costly. Higher fuel prices raise the cost of everything from transportation to production. What will the next chapter of energy evolution bring?

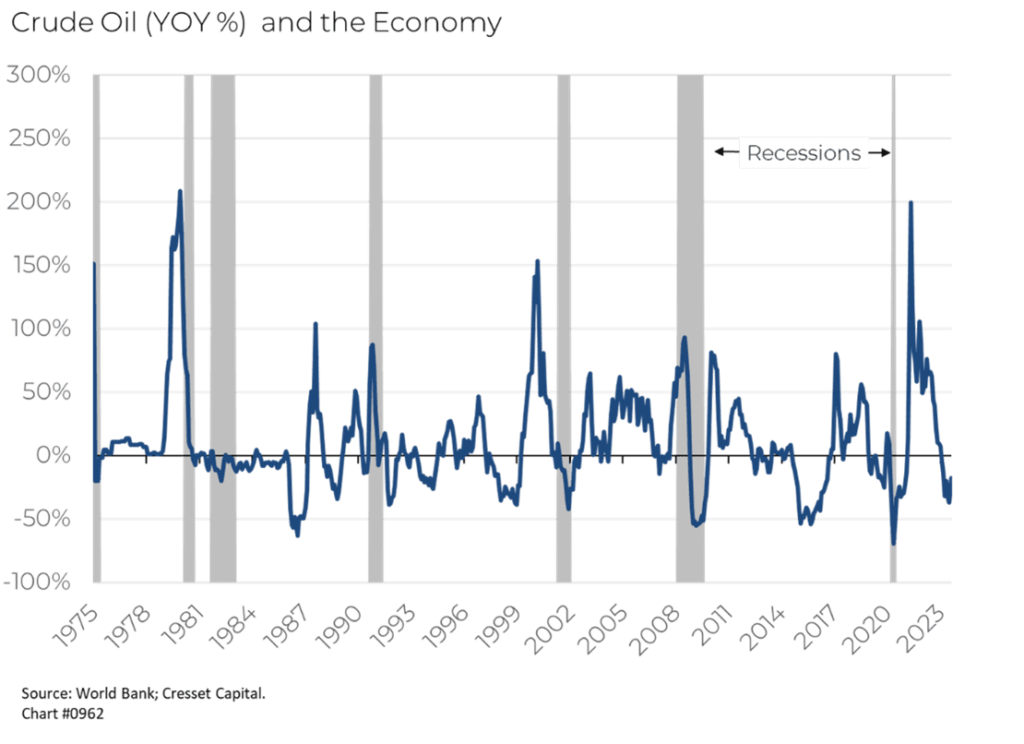

Notwithstanding America’s bustling energy sector, which produces about as much oil as the country consumes, energy prices act like a tax, sapping discretionary spending from other parts of the economy. Even though energy price fluctuations are removed from the “core” inflation calculation, energy inputs are so pervasive that elevated energy costs find their way into other prices, like manufactured goods and services such as travel. Energy spikes historically often prompted recessions. Understandably, the Biden camp worries that persistently high gas prices could threaten his reelection bid. The recent increase could be too steep for the Fed to ignore as it contemplates its interest rate policy. Even though energy prices declined more than 12 per cent over the 12 months ended July – the biggest detractor of inflation last month – it will undoubtedly spark higher inflation readings for August, which will be revealed when the report is released in September.

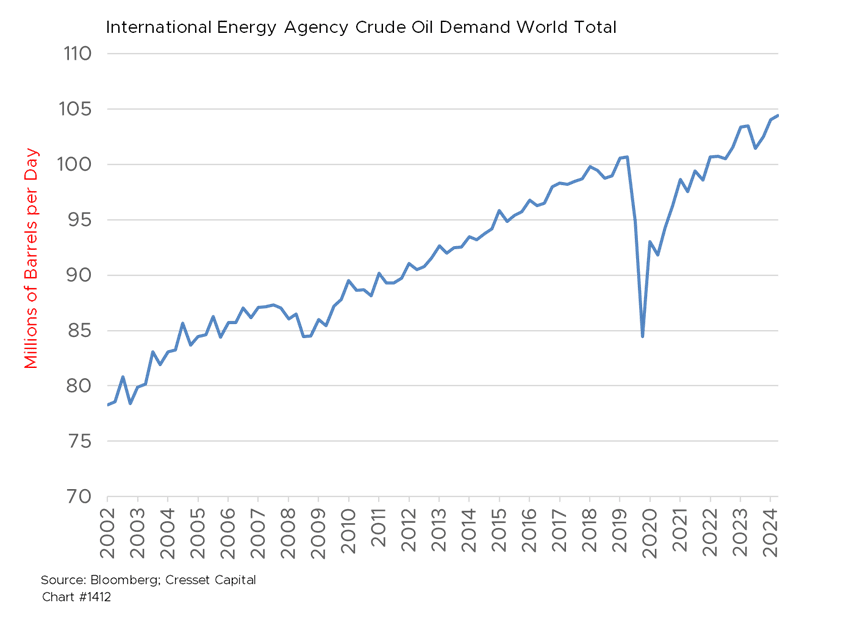

The recent rebound in oil prices is the result of the changing fundamentals of expanded demand and crimped supply. Global oil demand has hit a record high and might rise further in August, according to a recent report by the International Energy Agency (IEA). Demand reached an all-time high of 103 million barrels/day, fueled by better-than-expected economic growth and strong summer air travel. The IEA also noted that that 70 per cent of incremental energy demand is coming from China, the world’s largest energy consumer.

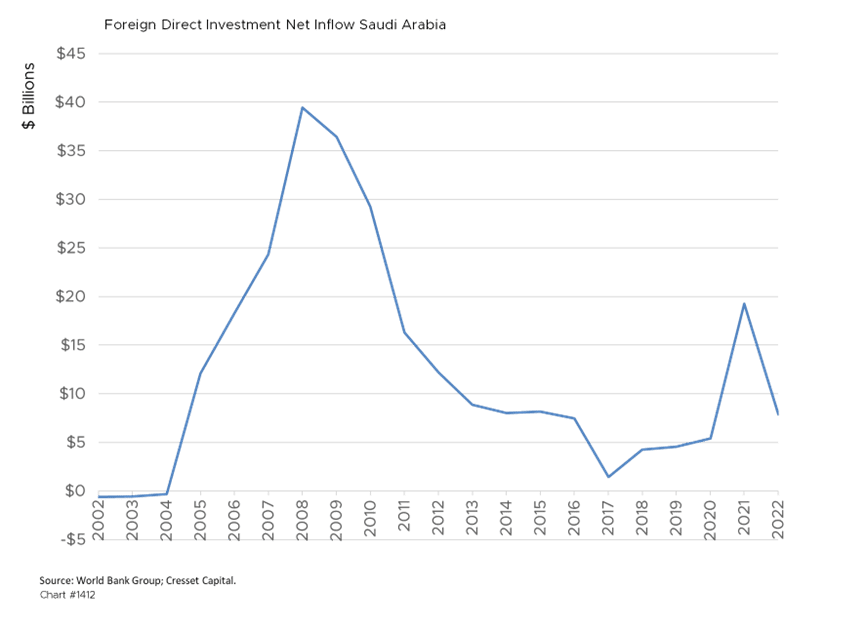

Unfortunately, higher demand collided with scarcer supply as Saudi Arabia and Russia cut production, pushing crude prices to their highest level in a year. Saudi Arabia, OPEC’s largest exporter, has a vital interest in persistently maintaining crude oil above $80/bbl as it scrambles to remain relevant as it attempts to overhaul its economy away from its reliance on fossil fuels. Saudi Arabia’s most recent production cut takes the country’s output to nine million barrels/day, its lowest level since June 2021. The value of Saudi exports in June fell more than 30 per cent (to about $19.2 billion) from May. The Kingdom’s urgency was created by its need to spend billions of dollars on economic diversification projects over the next five years, projects that have attracted little foreign investment, according to The Wall Street Journal.

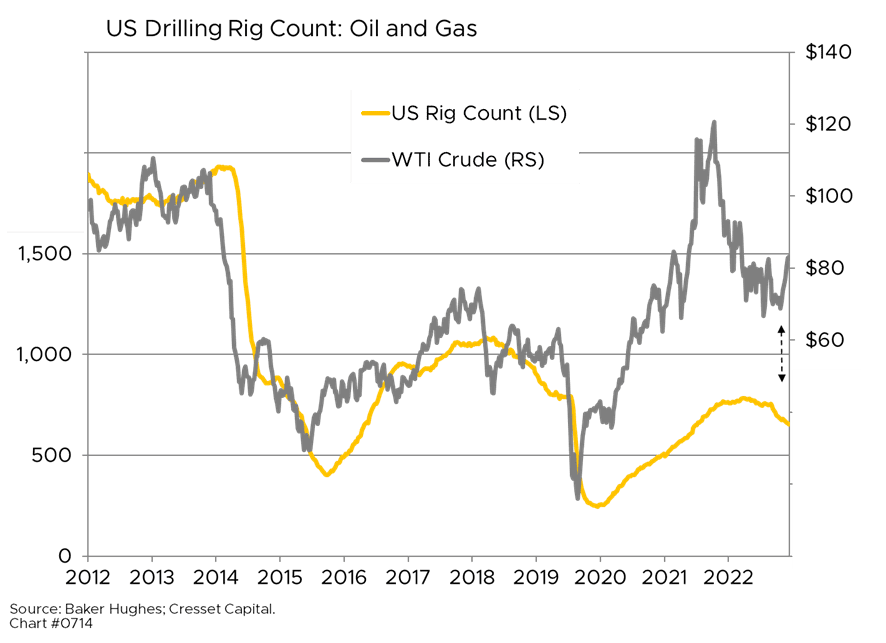

US production has grown by about one million barrels/day to just over 12 million bbls/day over the last year. Yet the number of drilling rigs currently operating in the US is only about half of that implied by today’s oil price, suggesting that domestic producers are not confident $80/bbl will stick. In fact, today’s rig count is lower now than it was at the beginning of the year.

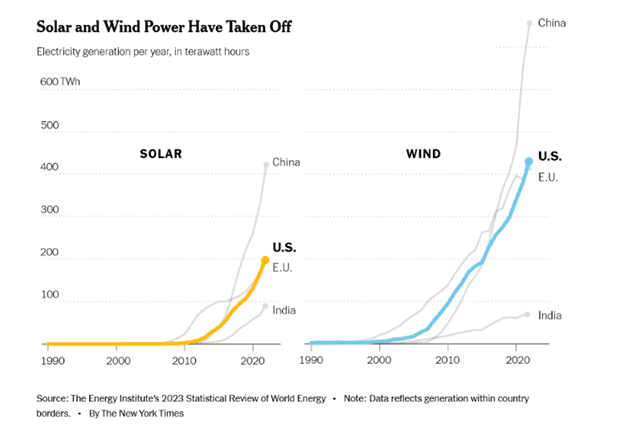

Nonetheless, the tectonic plates are shifting as policymakers throughout the developed world attempt to shift their countries’ reliance away from fossil fuels for economic, geopolitical and environmental reasons. Candidate Biden’s campaign pledge was to slash US greenhouse gas emissions by 50 per cent from 2005 levels by 2030. His Inflation Reduction Act represented a step in that direction. The legislation provides over $370 billion in direct support for renewable energy, electric vehicles and other low-emission technologies through tax credits. It also aims to launch the US toward becoming a major manufacturer of low-carbon energy products, while cutting its reliance on imports from China, currently the world leader in solar and wind power production. Wind, solar and other renewables are expected to overtake coal by 2025 as the world’s largest source of electricity.

Meanwhile, global liquified natural gas (LNG) exports are projected to reach 413 million metric tons this year, and grow 11 per cent over the next three years, helping loosen Russia’s grip on Europe’s natural gas supplies. The US is expected to become the world’s largest LNG exporter through the end of the decade, according to Bloomberg. It is estimated that global LNG capacity could rise 45 per cent from last year’s levels by 2027, with the US comprising nearly half of that growth. The European Union passed two key reforms aimed at reducing overall emissions by 62 per cent from 2005 levels by 2030 and lessen the trading bloc’s reliance on Russian fossil fuels.

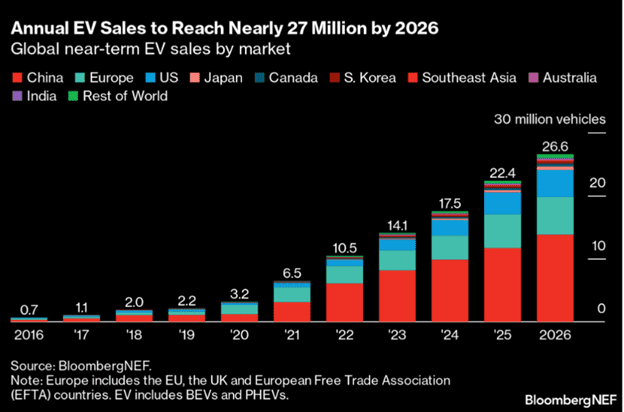

The shift toward electrification will create enormous economic opportunities. A recent Bloomberg report estimates that cumulative electric vehicle (EV) sales across all segments will hit $8.8 trillion by 2030 and $57 trillion by 2050, with EV sales reaching 44 per cent of global vehicle sales by 2030 and 75 per cent by 2040, as policymakers lay the groundwork for widespread public charging infrastructure. Meanwhile, oil demand from road transportation, representing two-thirds of US consumption, is peaking. Sales of new internal combustion vehicle (ICV) peaked in 2017 and are in long-term decline. It is estimated that by 2025, sales of new ICVs will have fallen over one third from their 2017 peak. Remarkably, EVs of all types are already displacing 1.5 million bbls/day of demand, according to Bloomberg. The report estimates that a current adoption rates, road fuel demand globally will peak in 2027. While demand in the US and Europe has already peaked, road fuel demand in China is expected to peak next year.

Wide-scale investments in alternative energy have helped drive down the cost of electricity generation. Since 2009, the cost of solar power has plunged by 83 per cent, while wind power costs have been cut in half, according to the New York Times. The price of lithium-ion battery cells fell 97 per cent over the last 30 years and solar and wind are currently the least expensive sources of energy in many markets, accounting for 12 per cent of global electricity. In fact, according to the New York Times report, this year, for the first time, global investors are expected to plough more capital into solar power production, an estimated $380 billion, than into oil drilling.

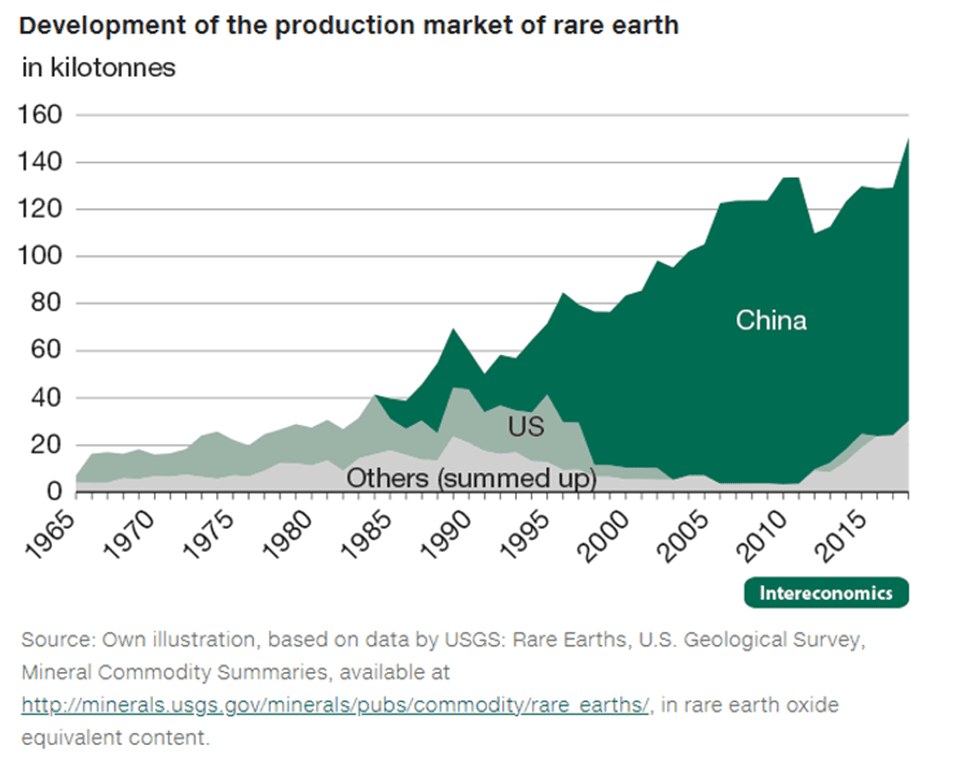

Challenges, and opportunities, remain. While public charging infrastructure is expanding globally, electrification of the last 10-20 per cent of the landscape will be difficult in many countries. Moreover, large investments in battery technology, while already taking place, will need to be ramped up to keep pace with EV production plans. China is the global leader in clean energy production and accounts for nearly two-thirds of the world’s rare earth mining and 85 of rare earth processing, key inputs in battery production.

While the US, through private sector innovations in horizontal drilling and fracking, has become energy independent, the next energy frontier is electrification and low-emission power generation. Capital investments and policy initiatives already in place are laying the groundwork for the next chapter of energy. Countries like Saudi Arabia and Russia will likely see their geopolitical influence wane while China could enjoy greater geopolitical leverage.