05.11.2023 Inflation is a current that businesses and individuals are continually swimming against. If you swim faster than the current, your profits and income exceed the inflation rate and your standard of living improves. Swim slower, and your living standard falls behind the cost of living. Between 2009 and 2019, the annual inflation rate averaged 1.6 per cent, making swimming against the current pretty easy and ushering in improved living standards across all income groups. Since the pandemic, however, inflation has been problematic. The average annual inflation rate between 2020 and today is 4.7 per cent, making improving one’s living standard harder to achieve. How can we boost our living standard in an environment that will be more inflationary than we have been used to for some time to come?

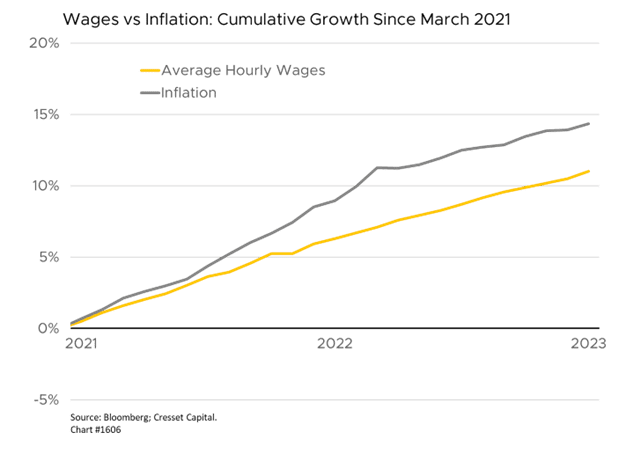

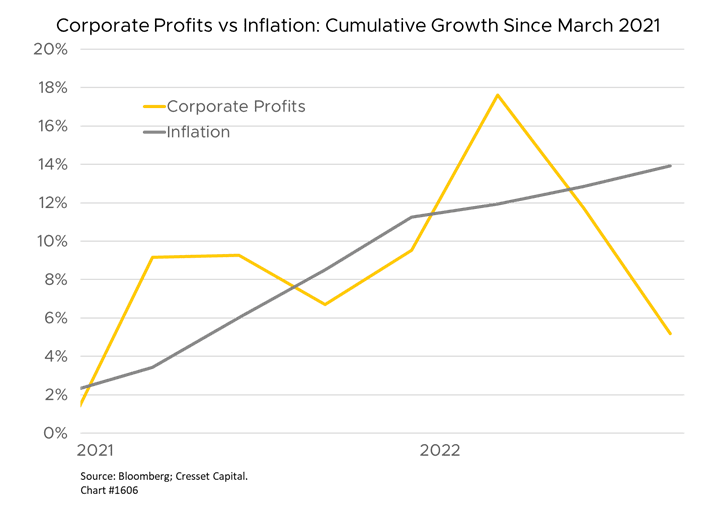

Real wage growth has been negative consistently since April 2021, implying that American households are falling behind as the cost of food, energy and other products and services are racing ahead of incomes. Corporate profits have had a similarly difficult time outpacing the inflation current. Since March 2021, cumulative profit growth has trailed inflation by nine percentage points.

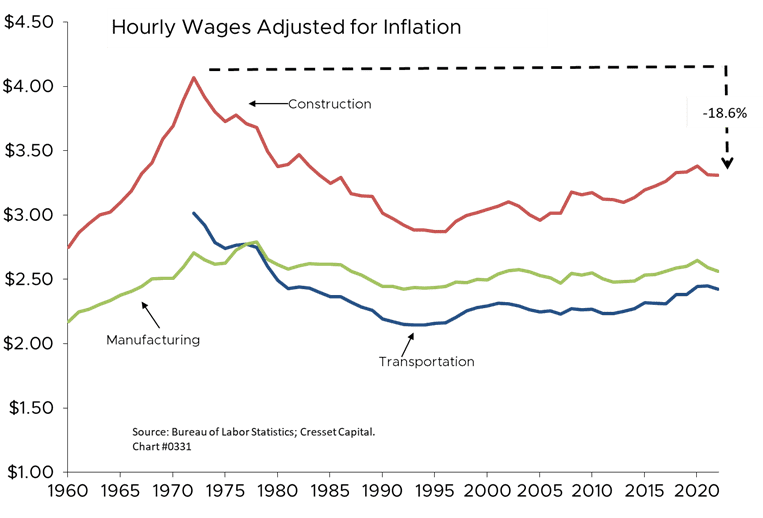

Hourly wages over long periods, particularly among less skilled workers, have failed to keep pace with inflation. Since 1972, the value of construction work has fallen more than 18 per cent against inflation. Similar trends also occurred in transportation and manufacturing work.

While the bar is raised when inflation accelerates, nominal growth (real growth + inflation) allows companies to keep more workers employed and allows more companies to remain in business. Nominal growth allows a greater share of them to collect income at a rate that trails the living standard benchmark than in an environment when inflation is zero. It’s part of the reason the Phillips Curve ‒ the inverse relationship between inflation and unemployment ‒ exists. Higher inflation allows more for more employees making less than the inflation rate. When the inflation rate is zero, earning a wage that trails inflation means job losses.

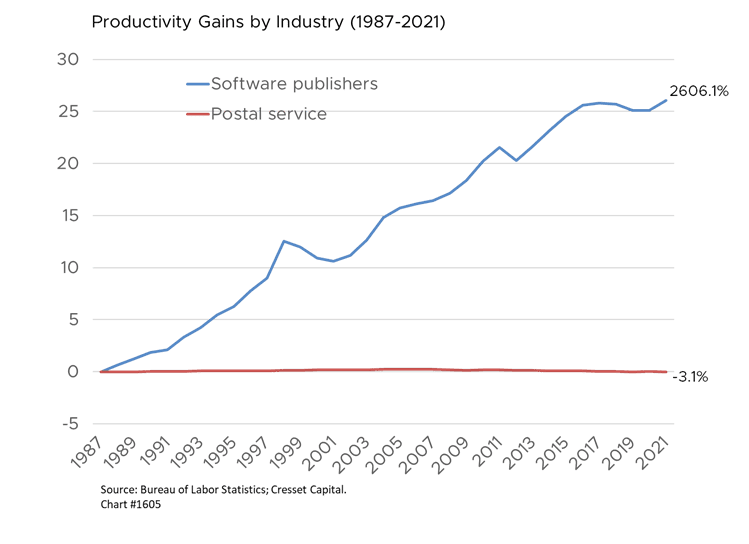

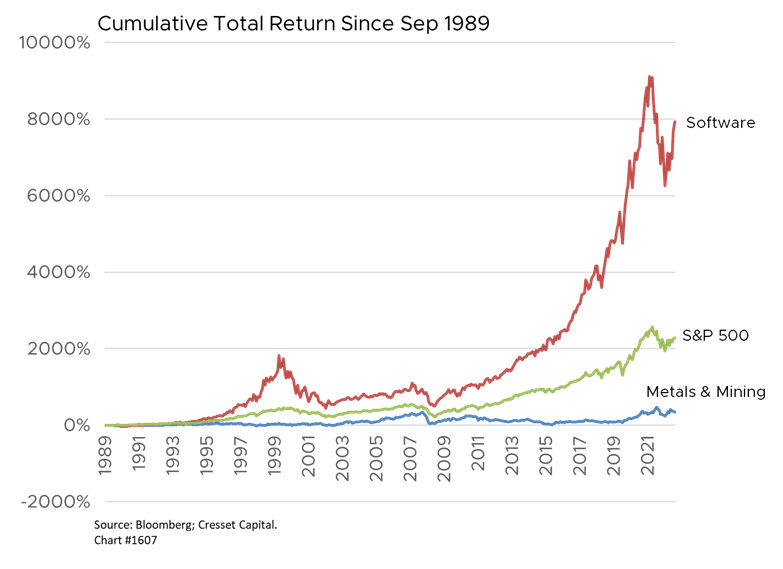

Productivity ‒ the ability to produce more goods or services per hour for an equal amount of effort ‒ represents the economic “silver bullet” that allows workers and the companies that employ them to grow their incomes higher than the living standard without generating inflation. Productivity, and innovation that spurs it, are the result of capital investment, risk taking and creativity. Innovation requires a favorable blend of access to capital, the availability of talented labor and little or no regulatory red tape. Indoor plumbing, electricity, the automobile, the telephone and air transportation are just a few examples of transformative innovations that dramatically altered the world’s living standards between 1870 and 1970. Given an adequate time horizon, productivity growth is an investor’s “free lunch,” as highly productive companies and industries outperform the averages.

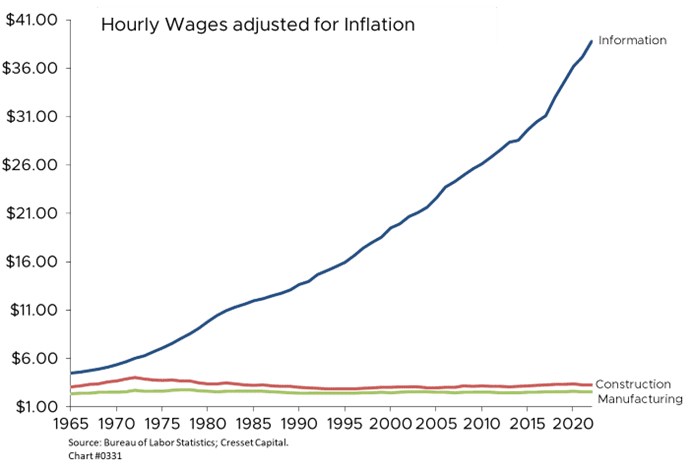

The Bureau of Labor Statistics (BLS) tracks productivity for hundreds of industries and, not surprisingly, information processing has boasted one of the best productivity rates since 1987, when BLS tracking began. That same productivity enabled wages for information workers to handily exceed the inflation rate over time. Moreover, superior productivity enabled software companies to meaningfully outpace market returns over time. Innovation, productivity and disruption are trends that can be tracked, followed and, with patience, leveraged. Time, however, is a critical ingredient. While valuation is a useful tool for gauging companies and industries over a market cycle, typically three to five years, productivity growth ‒ and its potential to positively disrupt a process ‒ requires more patience, since innovation and disruption play out a secular, 15-year-plus, timeframe.

We at Cresset continually look for the next secular disruptors, and invest accordingly. We do this not by betting on individual companies, but by embracing an entire sector and then continually rebalancing toward those companies most closely embodying the disruptive trend over time. The Cresset Investment Team has identified several themes that have the potential to change the way we live and work over the coming decades. Many of these trends, like artificial intelligence, are already changing the way we work. Some of these disruptive trends, and our thematic investment strategies to capture them, include:

Clean Energy – Our strategy seeks to benefit from the adoption of clean energy and sustainability technologies, such as software-driven home energy solutions, smart grid technology, and renewable energy generation, including solar, natural gas and battery technology.

Cloud Computing – The increasing centralization of computing power is being fueled by powerful and efficient server farms. Our strategy seeks to benefit from the growing trend of centralization, including the adoption of cloud computing technologies such as big data analytics and data center services.

Cybersecurity – As society becomes increasingly dependent on the Internet, our vulnerability to cyber threats increases as well. Our strategy seeks to benefit from the adoption of cybersecurity technologies such as autonomous cyber security detection, device security and network security.

Digital Entertainment – Broadcast television is in decline as the increased popularity of streaming entertainment rises. Last July, streaming captured 34.8 percent of viewers, according to Nielsen data, compared to 34.4 percent for cable and 21.6 percent for broadcast. Our strategy seeks to capture the growth in digital media, video on demand, online gaming and online gambling.

Fintech – Financial technology is rapidly evolving against the backdrop of a banking system struggling to keep pace. Our strategy seeks to benefit from the adoption of technologies such as electronic payment processing, digital banking solutions and blockchain solutions. In the near term we can expect greater use of blockchain, AI and the “Internet of things” in financial transactions, and automation and integration will grow more sophisticated.

Healthcare Innovation/Personalized Medicine – Innovations in how we treat illnesses are evolving quickly. Effective COVID-19 vaccines were produced in months thanks to mRNA technology. Personalized medicine is used for targeted therapy for many cancer treatments. Our strategy seeks to benefit from the adoption of healthcare innovations such as gene editing, precision medicine and genetic diagnostic testing.

AI & Robotics – Artificial intelligence has the potential to transform the knowledge business, while robotics is facilitating domestic manufacturing. Both trends are intertwined as advances in AI allow robots to perform increasingly more sophisticated activities, like “seeing.” Our strategy seeks to benefit from the adoption of robotics and artificial intelligence technologies, such as machine learning, 3D modeling and AI design automation software.

NextGen Transportation – The combustion engine has dominated transportation for over 100 years. Electric Vehicles (EV) require fewer parts and are cheaper to build and maintain. Germany, the world’s leading auto manufacturer, has mandated that the cars produced there all be electric by 2030, setting a target of at least 15 million electric cars on the roads by then. Our strategy seeks to benefit from the adoption of next-generation transportation, such as Electric Vehicles (EVs), Autonomous Driving, and input technologies that support these end products.

We are confident that advances in innovation and disruptive technologies will continue, harnessing the potential to lead the world forward. Cresset stands ready to identify and invest in this world-changing work. Feel free to reach out to us if you would like to learn more about our thematic strategies.