4.3.2024 Strong performance permeated US financial markets in the first quarter of 2024, driven by resilient economic growth, optimism around artificial intelligence (AI), and expectations for future interest rate cuts by the Federal Reserve. Investors, who kicked off the year overwhelmingly bullish as measured by the American Association of Individual Investors, endured stronger-than-expected inflation readings, forestalled Fed rate cuts, and bought equities anyway.

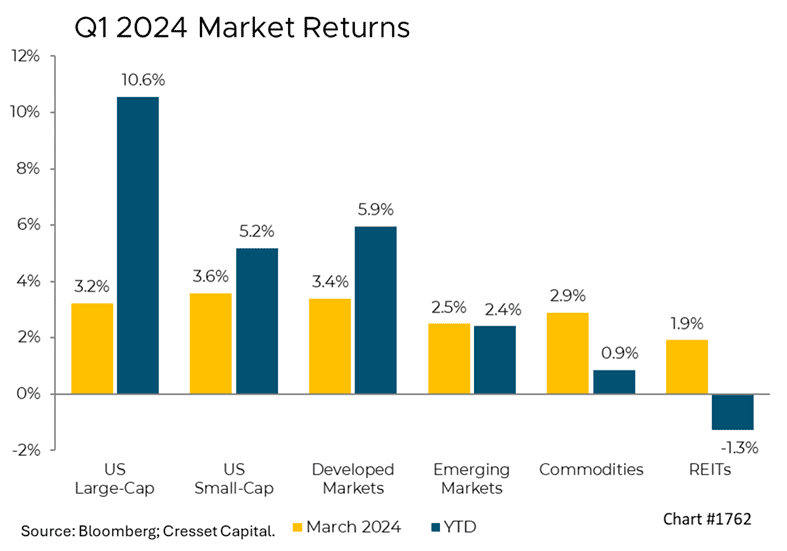

The S&P 500 Index gained 10 per cent in Q1/24, its best start to a year since 2019, hitting 22 record closing highs. The rally was broad-based, with 10 out of 11 sectors rising and more than half of the Index’s stocks reaching new 52-week highs. The strong performance was supported by robust corporate profits, enthusiasm around AI developments, and hopes that the Fed would begin cutting interest rates later in the year. Nearly 40 per cent of S&P 500 stocks are trading above where they were 12 months ago, according to The New York Times. Market leadership broadened. While the Magnificent Seven mega-cap stocks drove market performance last year, only four of the seven outpaced the S&P in the first quarter, with Apple losing nearly 11 per cent and Tesla almost 30 per cent lower. Dividends made a comeback this year, with dividend growers advancing seven per cent over Q1, with March contributing 4.6 per cent to the move. Higher ultra-safe government bond yields have distracted dividend buyers since 2022. Smaller companies, as represented by the Russell 2000, rose about half the amount of their large-cap counterparts, reflecting their relatively higher leverage and lower profit margins.

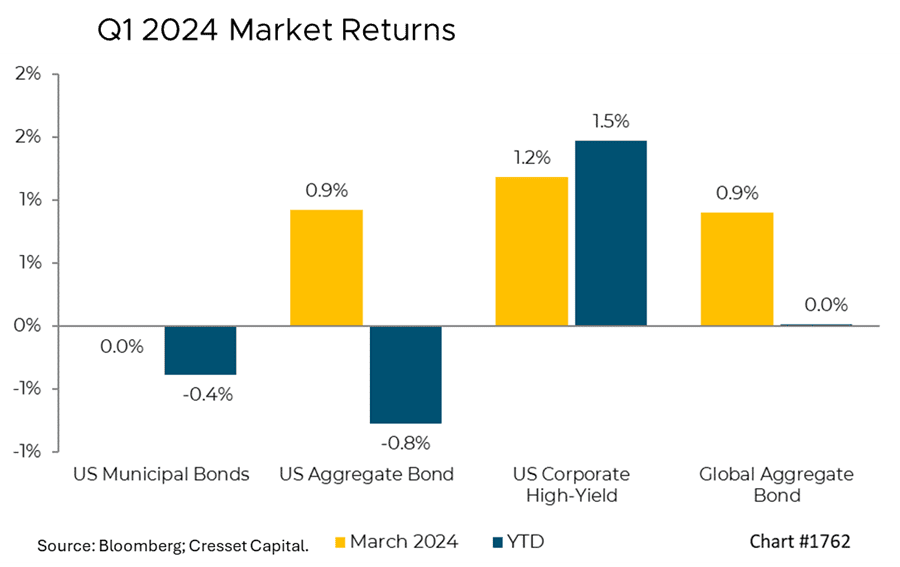

Bond investors were not as Panglossian as their equity brethren. Treasury yields rose since the start of the year, as the bond market took a different view of firmer-than-expected inflation readings and resilient economic growth. The yield on the 10-year Treasury note climbed from 3.86 per cent at the end of 2023 to 4.23 per cent by late March 2024, leading to higher mortgage rates and corporate borrowing costs. Corporate bonds and municipals slipped fractionally through March, with high-yield bonds gaining 1.5 per cent. Global fixed income was flat.

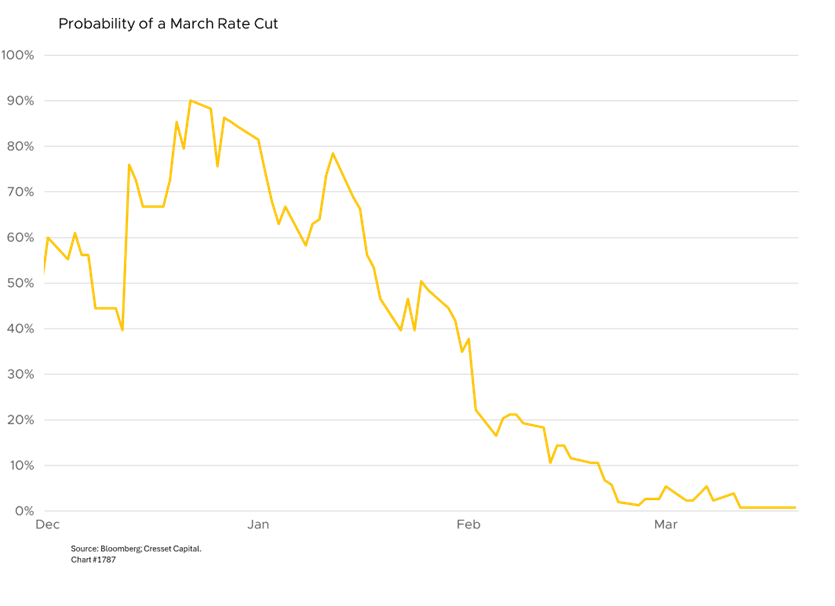

Notwithstanding investors’ optimistic rate cut expectations, the Fed’s messaging was consistent, with Chairman Jerome Powell emphasizing that strong economic growth allows the central bank to be patient before cutting rates. Powell’s Fed ratcheted rates to 5.3 per cent between early 2022 and mid-2023. The benchmark rate has been left unchanged since July 2023. While the Fed’s median forecast is for three rate cuts this year, current market yields reflect bets that the benchmark rate will drop roughly 2 percentage points over the next few years. Investor expectations ran far ahead of monetary reality last quarter. The odds of a March rate cut ran as high as 90 per cent coming into the new year, according to futures trading. Those odds were slashed to zero as investors’ hopes of an imminent easing program were dashed. That said, monetary policymakers are reluctant to keep rates too high for too long, risking a recession. But they also don’t want to ease too soon before inflation is under control. In fact, many analysts believe Treasury yields could rise further if investors continue to scale back their rate-cut expectations. That appears to be the case in the early days of April.

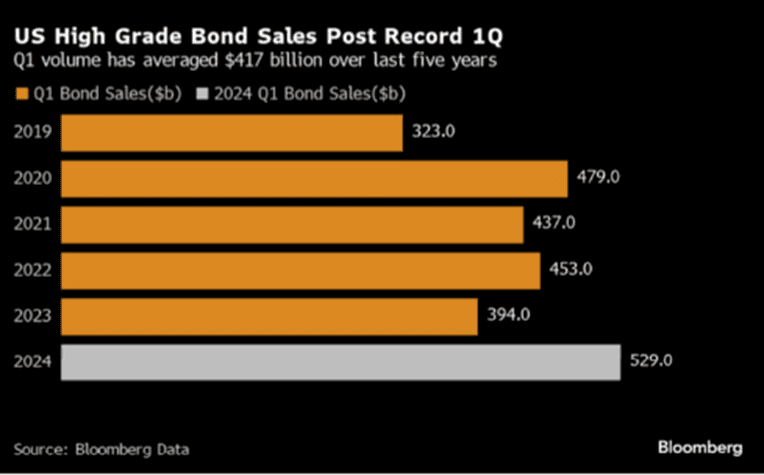

Corporate treasurers went on a borrowing binge last quarter, as blue-chip companies issued a record $529.5 billion in bonds, capitalizing on robust investor demand for high yields before the Fed starts cutting rates. The record pace of issuance is expected to slow in the months ahead. Meanwhile, corporate bond spreads – the yield premium lenders require to lend to corporate issuers – remain tight by historical standards, suggesting investors are more interested in nominal yield than the yield advantage over Treasury notes. At 1.4 per cent, the 10-year, BBB corporate bond spread is trading at its narrowest level in decades, reflecting lenders’ comfort with credit risk.

Speculation is on the rise. The cryptocurrency market also experienced significant gains, with Bitcoin surging above $70,000, a 60 per cent advance, spurred by the introduction of bitcoin ETFs in early January. The approval of these ETFs has led to increased mainstream adoption and a buying spree in cryptocurrencies, with most of the new bitcoin ETF purchases being fueled by institutional purchasers rather than individuals. Total assets among the 11 bitcoin ETFs have expanded to over $50 billion, representing nearly the half the assets held by gold ETFs. Even though gold has rallied to new highs, bitcoin’s current value is more than 30 times that of gold per unit and appears to be closing in on 35 times, a historical peak.

Overall, the US economy has shown remarkable resilience in the face of the Fed’s rate hikes, with strong consumer spending, low unemployment, and a continued downward trend in inflation. Cracks are beginning to emerge in the economy, as delinquencies on credit card debt are rising. The number of people behind on their auto loan has increased at its fastest pace in more than a decade, according to a New York Times report.

Bottom Line: While some investors caution that the stock market rally may be overextended, history is bullish. A strong first quarter often leads to further gains throughout the year, particularly in presidential election years like 2024. A recent Barron’s story pointed out that of the 16 times the S&P 500 rose more than eight per cent in the first quarter between 1950 and 2023, only once – in 1987, the year of the Black Monday crash – did the Index lose ground for the year. In other words, if the S&P 500 climbs more than eight per cent in the first quarter, there’s a nearly 94 per cent chance of more gains this year. Here’s to history repeating itself.