03.17.2022: As expected, Chairman Powell’s Federal Open Market Committee raised rates by a quarter point on Wednesday afternoon. The move represented the Fed’s first interest rate hike since 2018, and equity investors initially sold on the news. But equity markets ended the day at session highs after participants took heart from Chairman Powell’s assertion that “the American economy is very strong and well positioned to handle tighter monetary policy.”

Fed officials anticipate raising the benchmark rate in seven quarter-point increments this year, bringing the overnight rate to 1.9% by the end of 2022, and to 2.8% next year. The announced trajectory was somewhat faster than investors previously expected.

Chairman Powell has clearly put fighting inflation front and center, believing the economy and labor market are strong enough to sustain nearly two years of metronomic tightening. For now, equity investors are willing to give the central bank the benefit of the doubt – but we see several factors that point toward economic slowing and higher unemployment.

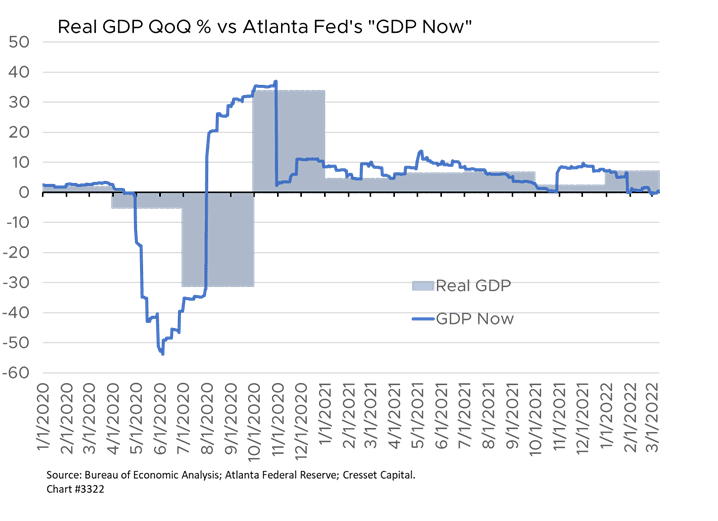

First is the Fed’s model itself. The Federal Reserve of Atlanta’s “GDP Now” model projects Q1/22 GDP to limp in at 1.2%, hardly robust growth. What we learned was an outsized portion of supply chain clogging Q4 demand was inventory hoarding, not final sales. We expect the inventory drawdown will weigh on Q1 growth, as does the Fed.

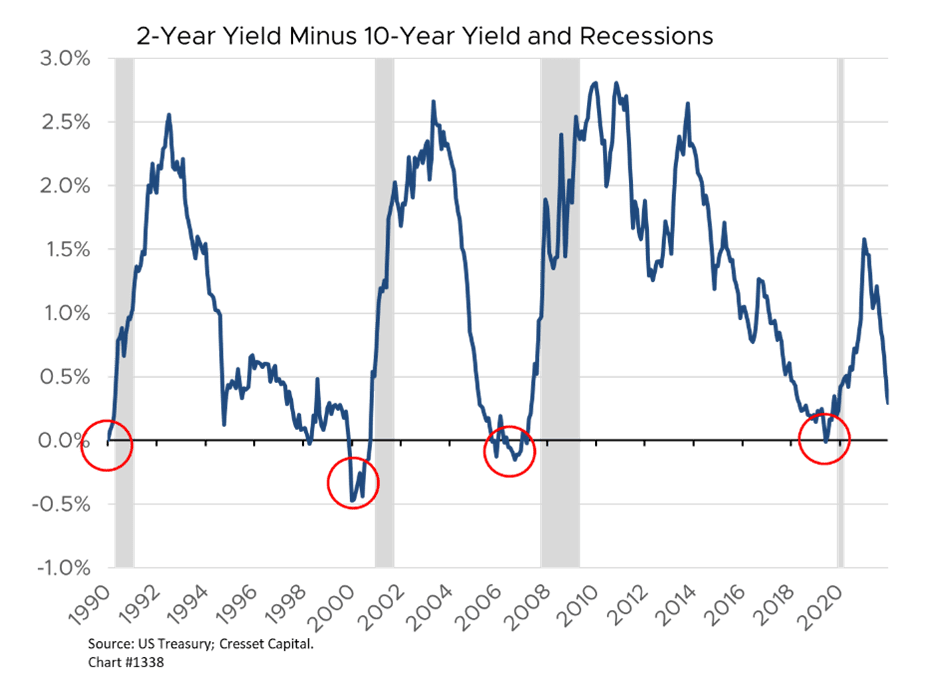

The bond market paints a similar picture. The yield differential between 2-year and 10-year Treasuries, which encapsulates investors’ collective growth outlook, also suggests slowing. Note that every recession in recent history was preceded by a yield-curve inversion, in which 2-year yields exceeded 10-year yields. While the curve isn’t currently inverted, it’s flattening quickly – not a ringing endorsement of Powell’s Panglossian view of the economy.

Perhaps equity investors are selling the rumor and buying the news. However, we at Cresset remain data dependent and prefer to navigate facts – not Chairman Powell’s opinion.