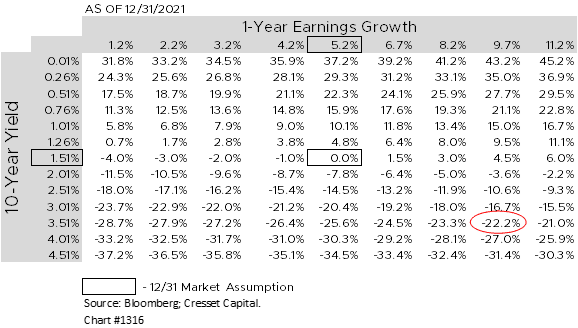

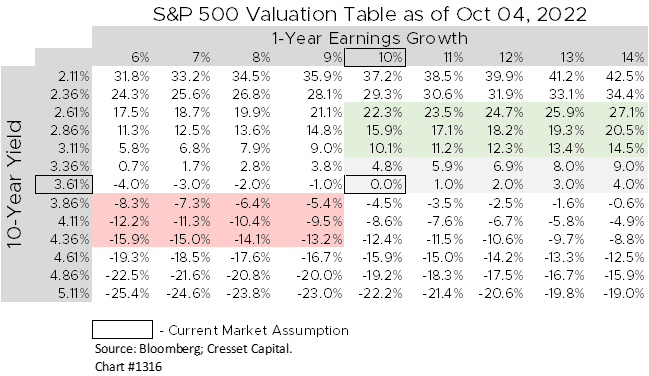

10.04.2022 The market downturn this year has been one of the most orderly declines in memory. The move was almost entirely explained by rising rates. For that reason, we believe the market’s direction depends on future rate trends. We published a table at the end of 2021 that depicted where we believed S&P 500 returns would be under various earnings growth and interest rate scenarios. Given what has played out this year, our table predicted the market move to the percentage point.

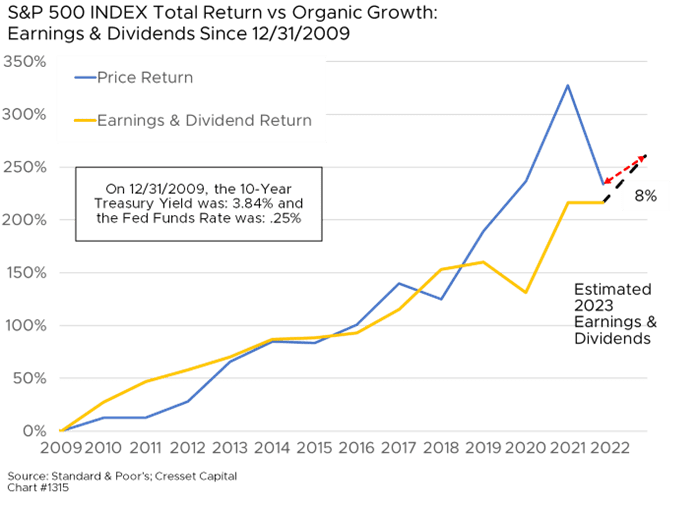

That suggests the S&P 500 is “fairly” priced based on current earnings and interest rates. Looking at the market from another perspective confirms that view. Equity holders are only entitled to earnings and dividends over their holding period. Valuations, or market multiples, are a function of interest rates. Since the end of 2009, the last time the 10-year Treasury yield was around current levels, the S&P 500 return has indeed tracked earnings and dividend growth. This model, using next year’s expected earnings growth, suggests the S&P 500 is eight per cent undervalued.

The prospects for global economic growth are dimming. However, from a valuation perspective, the benefit of lower interest rates has the potential to more than offset any earnings growth deterioration. A one percentage point decline in earnings growth would reduce equity values by about one percent. On the other hand, a one percentage point decline in the 10-year Treasury yield would boost prices by nearly 20 per cent, as the table below indicates.

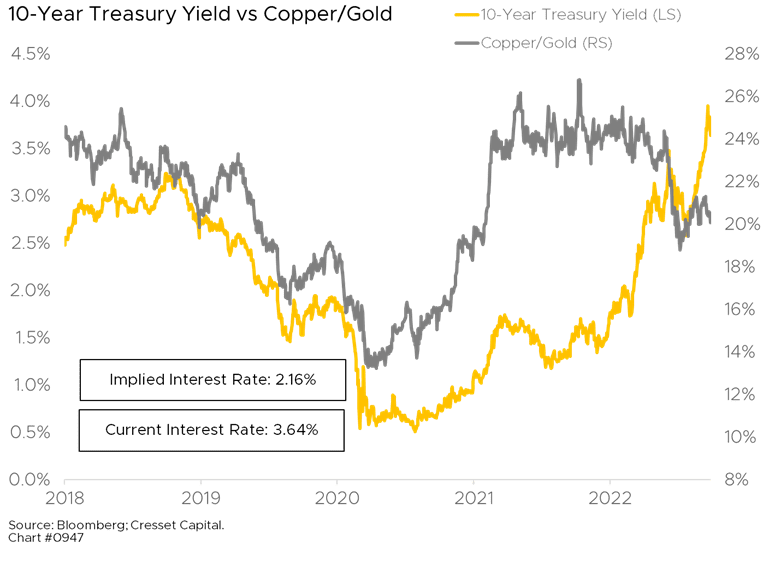

Cresset’s copper/gold model, which compares super-cyclical copper against store-of-value gold, suggests the 10-year Treasury yield should be substantially lower. This is the first time in three years our model is calling for lower interest rates. If the model is correct and the 10-year note yield declines to 2.2 per cent, that suggests the S&P 500 should trade 20-30 per cent higher, depending on earnings growth expectations.

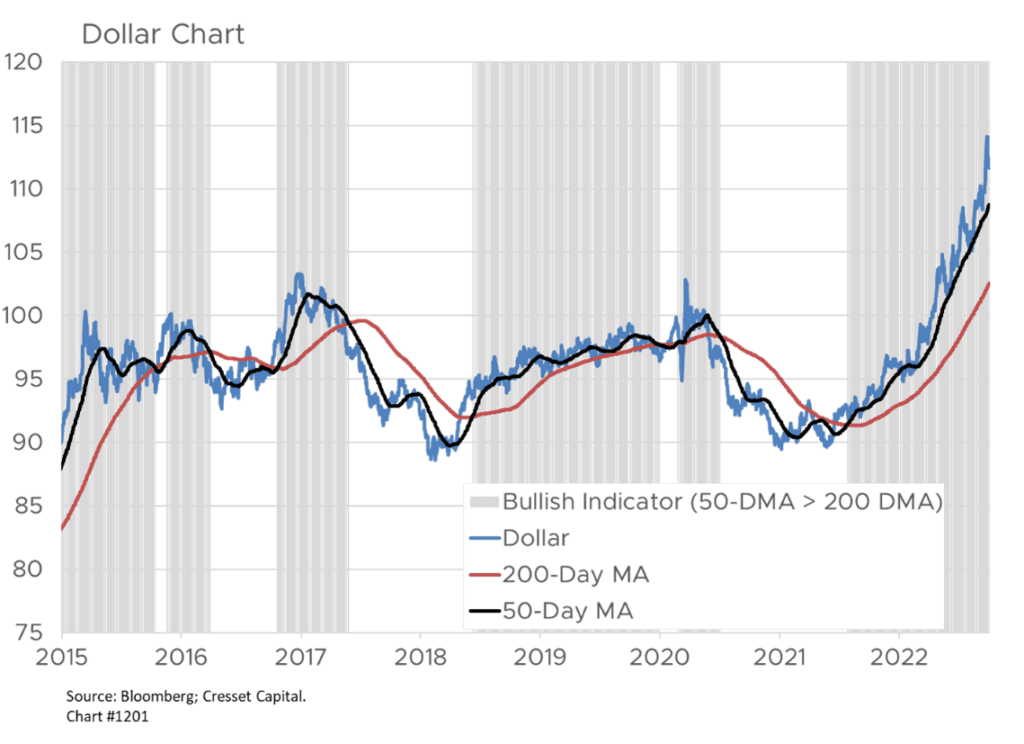

Our valuation view is not without risks, however. The biggest risk to our interest rate thesis is the Fed. Powell & Company could quash an equity bull market by simply dumping 10-year notes through quantitative tightening, if they believed a bull market’s wealth effect would impede their ability to ratchet down inflation. For that reason, we’re keeping an eye on the dollar. We believe the dollar will peak and roll over once investors see light at the end of the tightening tunnel. For now, dollar momentum is powerful, with the greenback’s 50-day moving average well above its 200-day moving average. Dollar weakness should be viewed as an open invitation to take on equity risk, particularly non-dollar equity risk. Until then, we expect equity prices to yo-yo based on perceived whims of the Fed.