Key Observations

- Donald Trump’s victory was decisive, with gains among all demographic groups

- Economy biggest issue motivating voters

- Perception gaps between incumbents and voters were deep

- The ’American Dream’ faces structural economic challenges

Analysis of last week’s election reveals a decisive victory for Donald Trump. Though the election results surprised most of us, in retrospect some trends were obvious.

Dissecting the Results

Trump gained ground across a swath of demographic groups. He was able to increase his share of the youth vote to 46 per cent, up from 36 per cent in 2020, while maintaining his support among older voters. He won 55 per cent of voters without college degrees while improving his standing among race and age categories. Trump also maintained strong support among white voters, while making inroads with Black and Hispanic voters, with 20 per cent of Black voters (particularly Black men) supporting him, up from 10 per cent in 2020. He also won about 50 per cent of Latino men under 45 while improving Hispanic support overall. Trump also delivered rural areas, his perennial stronghold, while also closing the gap in big cities and suburbs, helping him win key swing states, including Pennsylvania, Georgia, North Carolina, Wisconsin, and Michigan.

Economy Biggest Issue Motivating Voters, and Perception Gaps Were Deep

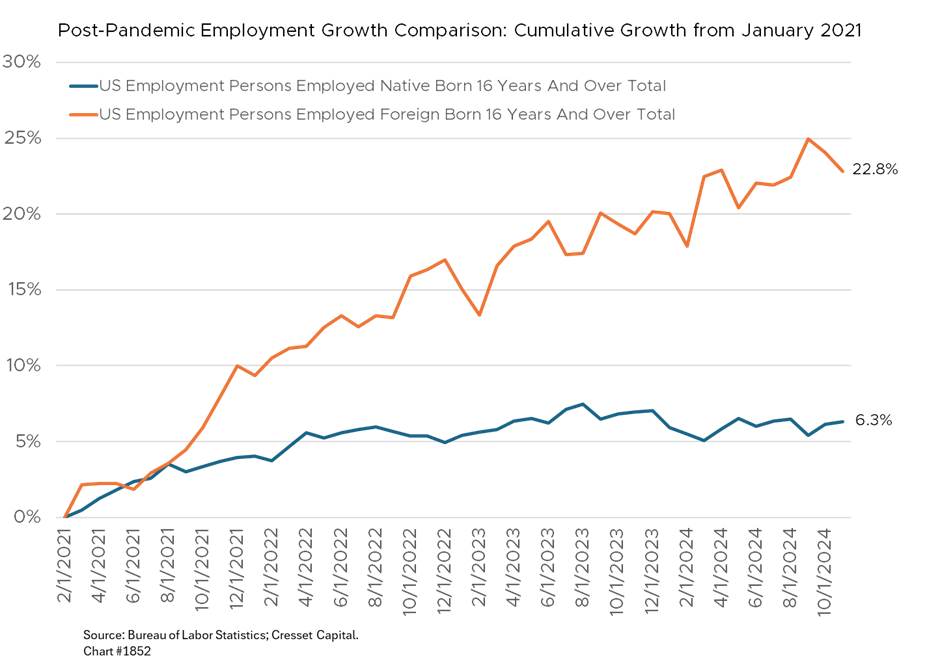

While Harris and Biden touted several macroeconomic indicators pointing toward prosperity – like an historically low unemployment rate, robust economic activity, and stock markets at all-time highs – perception gaps emerged highlighting the difference between what the incumbents viewed as successes and what the voters perceived as problems. Job growth, for example, was one of the biggest disconnects. The Biden administration proudly claimed they created 7.8 million jobs since taking office, one of the most prosperous jobs markets in modern history – yet most of the job growth gravitated toward foreign-born workers. Since January 2021, job growth among foreign-born workers grew more than 22 per cent while job growth among native-born workers expanded by just over six per cent.

The Inflation Rate Has Fallen, but Prices Remain High

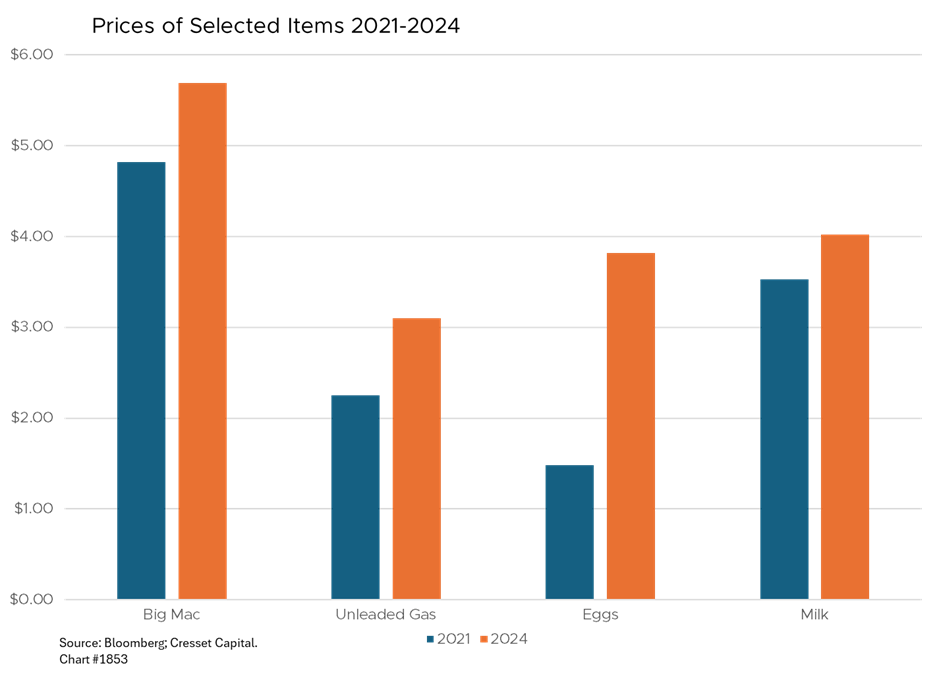

Democrats rightfully claimed they quelled inflation, bringing down year-over-year price growth to 2.4 per cent from the 9.1 per cent peak reached in June 2022. Even though the inflation rate has fallen, prices of everyday items remain high because inflation measures price growth, not the permanent price change. The prices of things Americans buy every day, like Big Macs, gasoline, milk and eggs, are substantially higher than they were at the beginning of President Biden’s term in office. The price of a dozen eggs, for example, has more than doubled in the past four years.

Real Income Growth Has Flatlined Since 2021

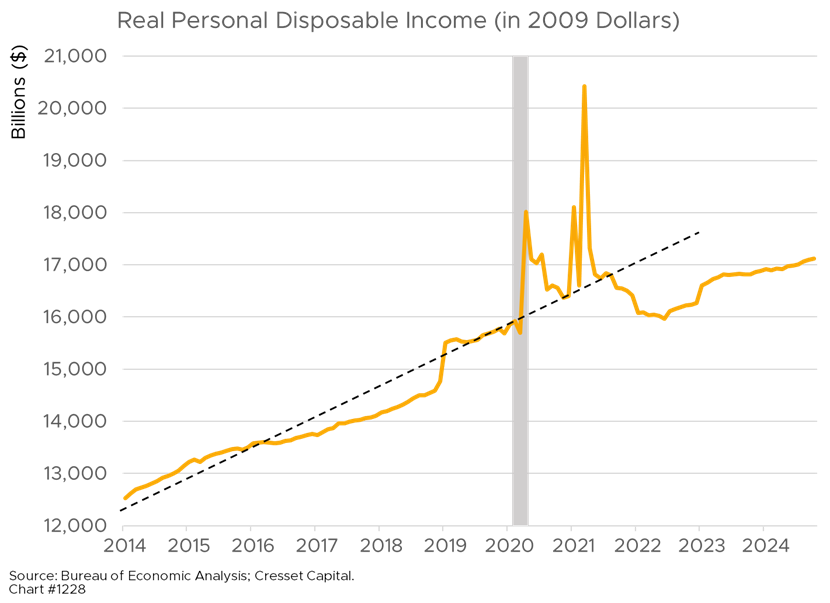

For most of the last decade, real income (wage growth relative to inflation) has risen steadily, enhancing Americans’ living standards. But since 2021, thanks to the post-pandemic inflation spike, wages have flatlined relative to inflation. This has left an increasing number of households feeling like they’re falling behind and motivating voters to blame immigration and the increased supply of workers for keeping a lid on wage growth.

The ’American Dream’ Faces Structural Economic Challenges

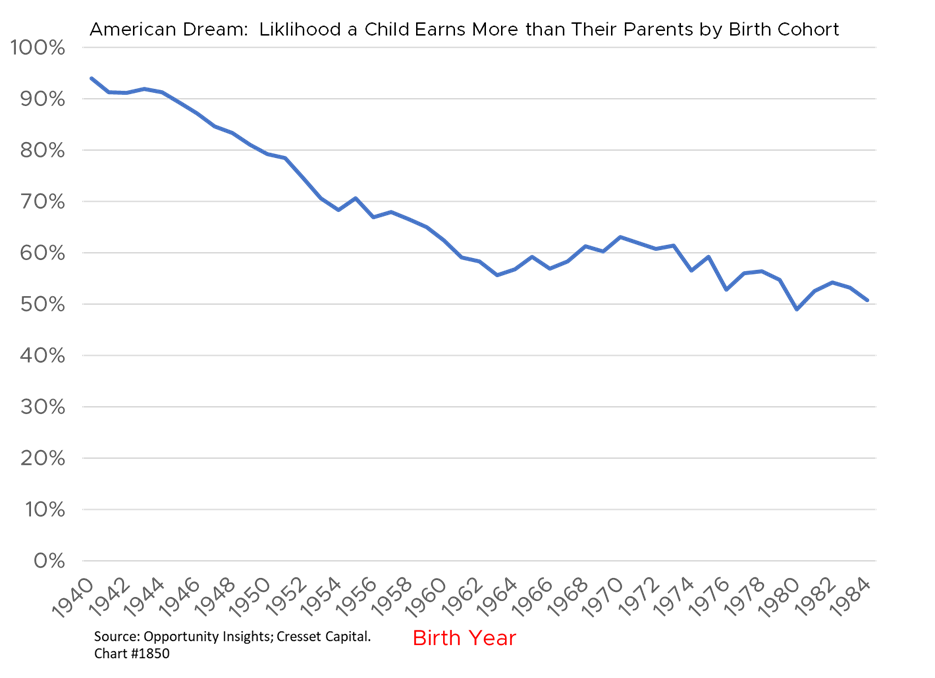

Perhaps most important, the American Dream is being undermined by structural economic challenges that cyclical policies fail to address. Since our nation’s founding, the American Dream has evolved to represent three principles: 1) each generation will do successively better than the previous generation; 2) homeownership is a pathway to prosperity and 3) access to higher education is available to aspiring young people, no matter their background.

Likelihood that children will out-earn parents has declined steadily for decades. Children born in 1940 had a 95 per cent likelihood of earning more than their parents. But for children born in 1984, the likelihood has fallen to about 50 per cent. Arguably, there were more children born to first-generation immigrants in 1940 than there were in 1984, but nonetheless the trend in successive improvement has flatlined.

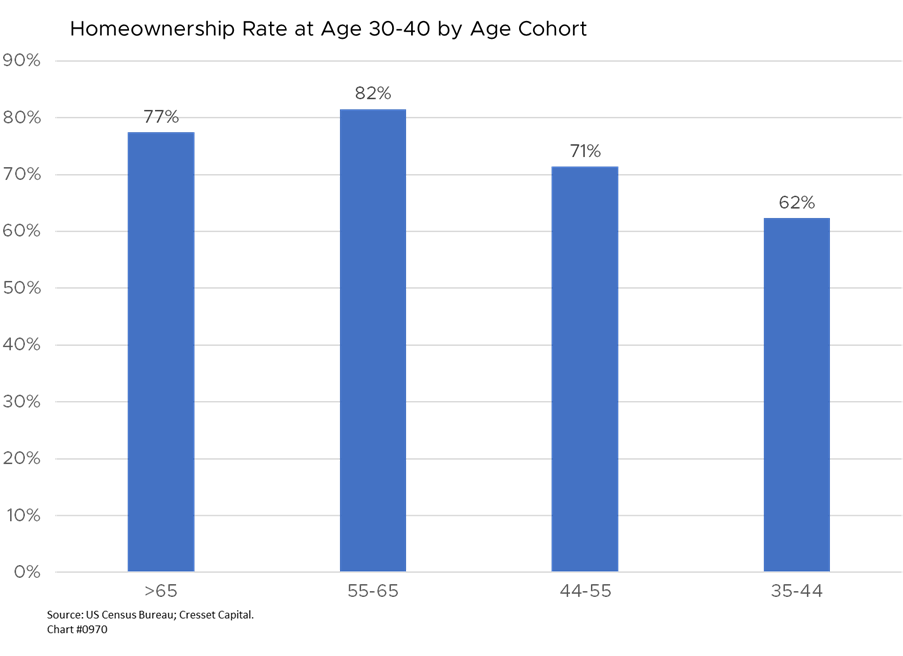

Homeownership among median-income families has declined to lowest level in history. Higher mortgage rates and skyrocketing home prices have conspired to crimp the accessibility homeownership. Only 38 per cent of America’s housing stock is within financial reach of families of median income, meaning that only 62 per cent of Americans aged 35-44 are homeowners. That’s substantially lower than that of other age groups when they were their age. Compare this to the rate of homeownership among today’s 55- to 65-year-old cohort when they were in their 30s and 40s, when more than 80 per cent of them owned their primary residence.

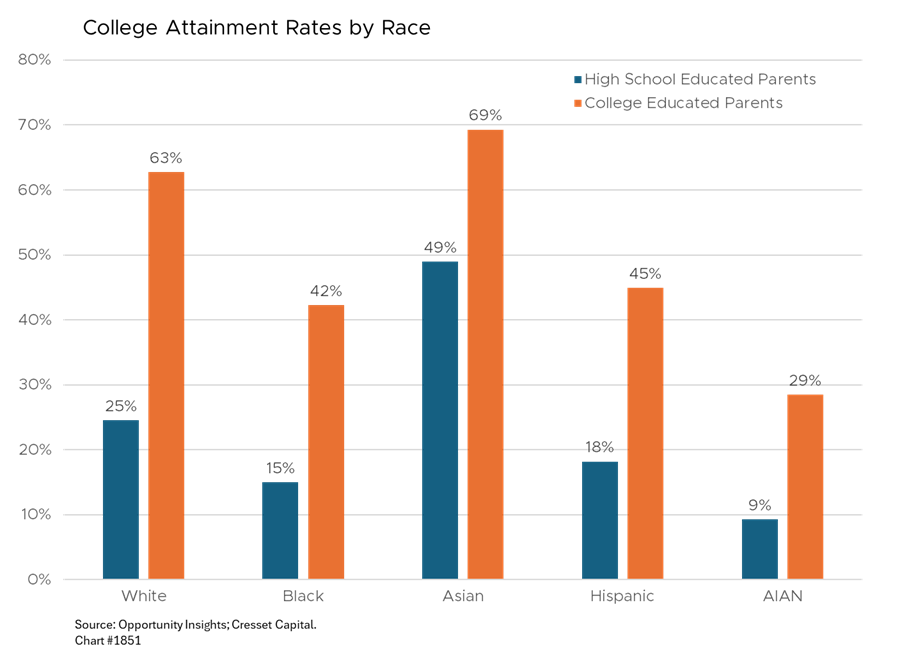

College diplomas are more likely to be held by children of college graduates. The opportunity to attain a college degree was expected to increase with each successive generation, helping pave the way for future success. Bright and ambitious kids should be able to find a pathway to college regardless of their economic upbringing but, unfortunately, today’s college attainment data presents a mixed picture. The likelihood of a child born to high school graduates getting a college diploma is less than 50 per cent among all demographic groups. Odds improve among children born to college-educated parents, in some cases nearly tripling – suggesting that a college education and the benefits it garners remain a domain of the affluent.

Bottom Line

Equity markets have rallied strongly since the election as investors anticipate the prospect of tax cuts and regulatory reform. Most expect higher profits and stronger growth, along with the possibility of higher inflation. Among the challenges confronting newly elected policymakers will be enabling more young Americans to achieve more than the previous generation, something we hope they will strive to achieve.