Investors were taken on a wild ride on a day when the February jobs report was set to take center stage. Instead, the collapse of Silicon Valley Bank, a leading financial institution for the venture capital community, dominated the headlines.

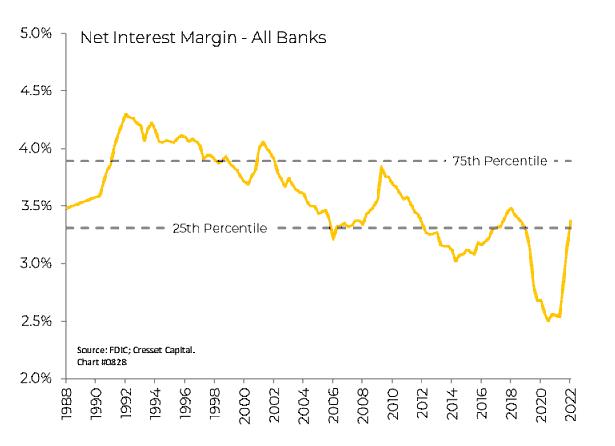

Blame the Federal Reserve’s aggressive monetary policy, but for the first time in over 15 years banks are having to pay more to attract deposits. At the same time, shorter longer term rates are making it more difficult to earn a spread between their loans and deposits.

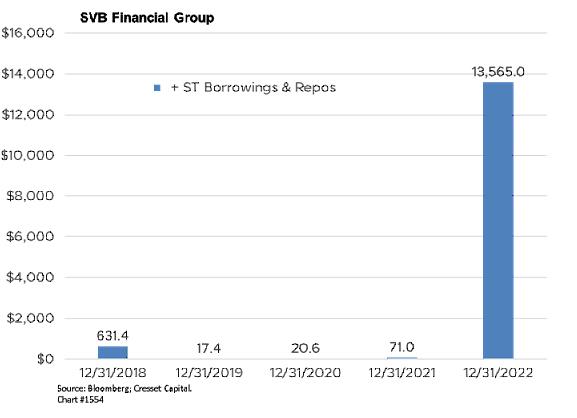

Silicon Valley Bank relied on short-term borrowing to make up for the shortfall in deposits. Total deposits fell 8.5% to $173 billion at the end of 2022, according to the bank’s financial statements. Meanwhile short-term debt spiked more than $13 billion to make up for the deposit shortfall.

An attempt by the bank to raise additional capital yesterday failed and federal regulators swooped in this morning and took control, representing the first bank failure this year. Investors, recounting the Bear Stearns failure in 2007, reduced their bank exposure. As of this writing the S&P banking index fell nearly one percent, with Signature Bank and First Republic Bank sliding about 20% in the session. JP Morgan, meanwhile, rallied nearly two percent on the prospect it would take over SIVB’s remains.

Banking failures are serious, and because of the interconnectedness of the banking system, problems can metastasize and turn up in other places, including money market funds and the swaps market. Given its relatively smaller size, we expect Silicon Valley Bank’s financial blowback to be contained. We expect regulators to announce the sale of the failed Silicon Valley Bank to a national bank, like JP Morgan, as early as next week.

We recommend clients shift their cash sweep balances to government money market funds, since prime funds could have regional bank exposure. Municipal money market funds are fine, although government funds could offer better pre-tax yields, given the constrained municipal supply. We also recommend affirming clients hold money market sweep, not deposit sweep since money market assets are not counted as bank assets while deposit assets are a bank liability.