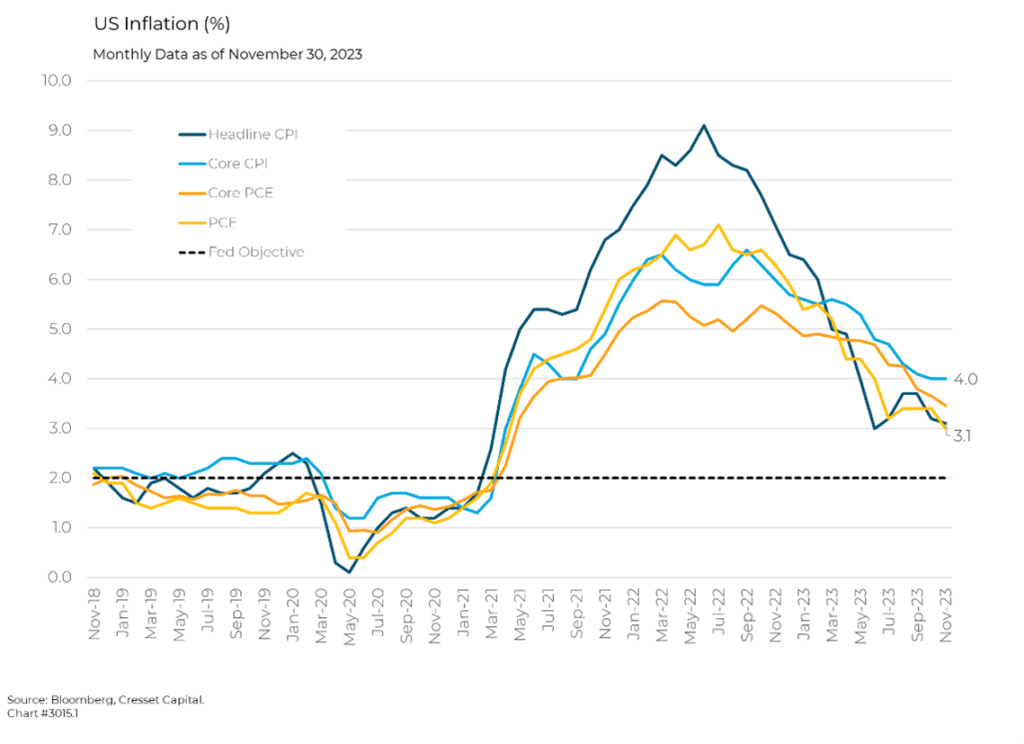

12.20.2023 If markets in 2022 were weighed down by a vertiginous rise in interest rates, markets in 2023 were pushed and pulled by emotion, as bearish investors braced for an impeding recession early in the year only to see inflation and growth expand. Persistent price growth this year kept markets, households and businesses at the mercy of the Fed’s tightening interest rate winch. As of the third quarter, GDP had expanded at a 5.2 per cent annualized rate, its best showing since 2021. By December, however, the growth and inflation tide appeared to crest. Readings from the job market, retail sales and inflation all suggested that activity is cooling, building a case for closing the books on the Federal Reserve’s 20-month interest rate-hiking program.

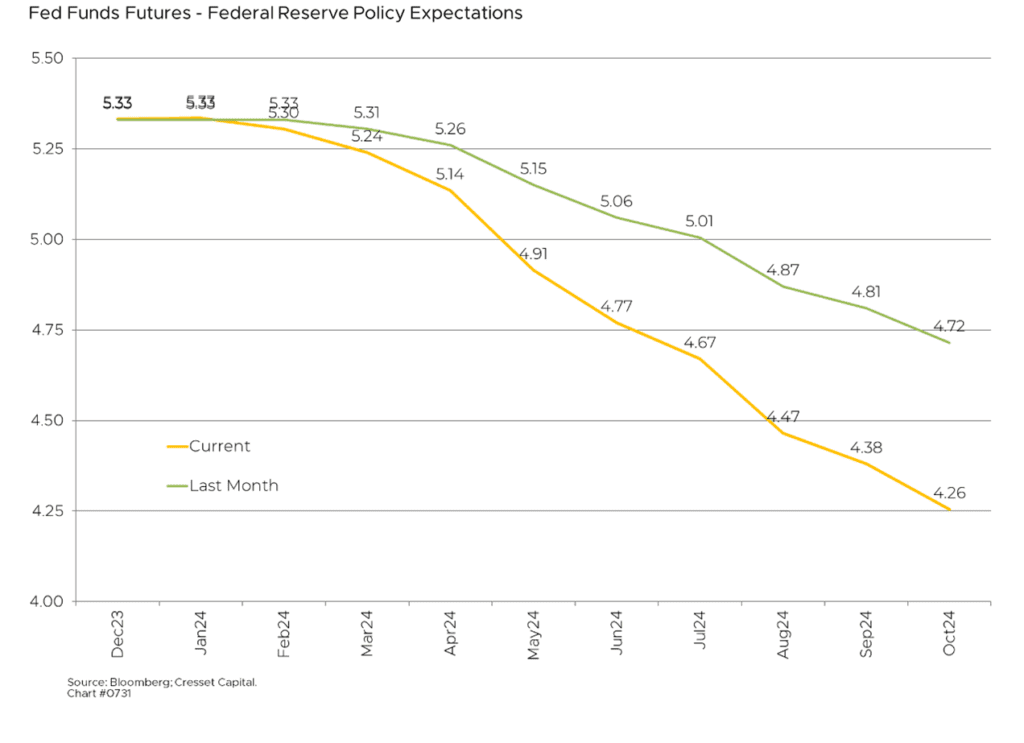

Not only has Jay Powell held rates steady since July, but the Fed Chairman in essence declared victory over inflation after the December FOMC meeting and set the stage for rate cuts next year. Bond investors, as suggested by futures trading, are penciling at least five cuts in 2024.

We believe the downshift in growth and inflation is real and this informs our view for the coming year. We have built three scenarios for 2024 with varying probabilities and outcomes.

Scenario I: 60% – Slowing Growth/Slowing Inflation

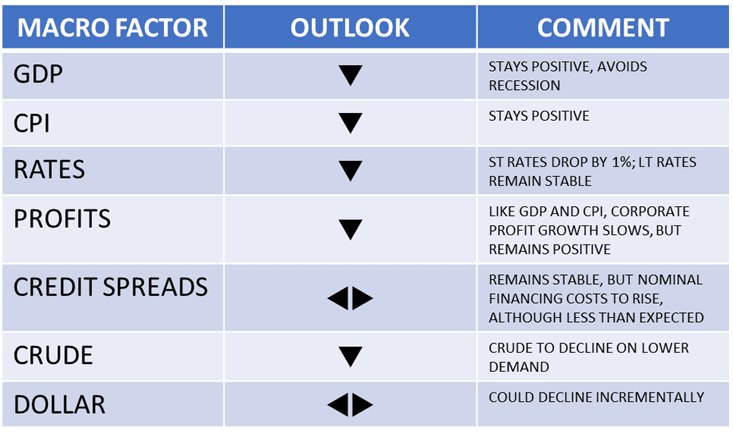

We expect economic growth and inflation to slow throughout next year, while both remain positive. Shorter-term interest rates will decline more than intermediate-term rates, creating a positively sloped yield curve for the first time since June 2022. S&P profit growth for 2024, which is currently estimated at 11 per cent, will slow, but remain positive as well. Credit spreads will remain stable. Commodities, most notably crude, will fall. We also expect the dollar to decline incrementally.

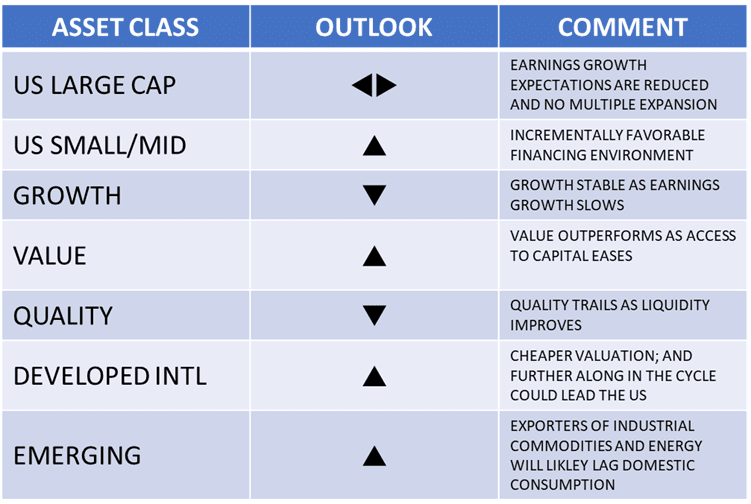

Lower rates and a steeper yield curve should be a tailwind for banks, which in 2023 saw more than $400 billion in deposits flee in response to rapidly rising short-term rates. Lending conditions, which tightened to recession levels, began to ease in the third quarter. We expect that trend to continue. That would be good news for relatively highly leveraged, smaller companies next year as access to capital improves. We also expect value stocks to catch up to their higher-quality growth counterparts next year under this scenario.

Scenario II: 30% – Hard Landing

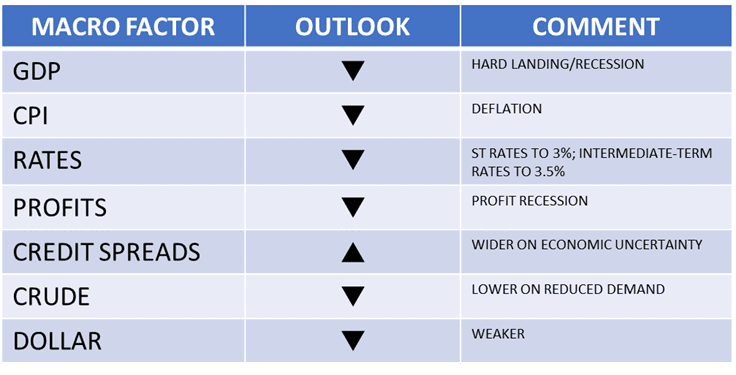

Under our hard-landing scenario, both inflation and growth slide into negative territory next year, resulting in a recession with deflation. Both short-term and intermediate-term interest rates fall more than one per cent in parallel. Profit growth, like that of the economy, turns negative and credit conditions tighten. Commodities, including crude, fall in tandem with the dollar.

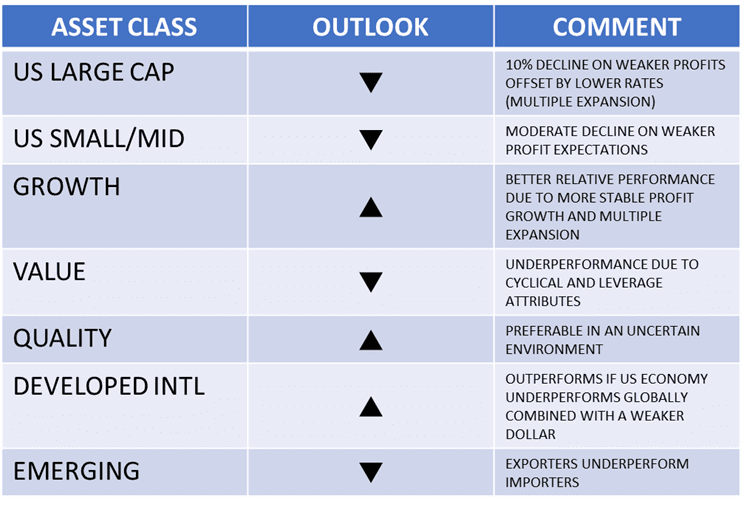

Recessionary conditions coupled with deflation would be a headwind for equities and commodities, offset by gains in high-quality bonds as rates decline. High-quality, growth stocks would outpace more highly leveraged value stocks, while large caps would outperform small caps. International equities could gain on the back of a weaker dollar, depending how foreign economies fare. Emerging equities would likely trail, with export-oriented countries falling behind importers.

Scenario III: 10% – Reacceleration

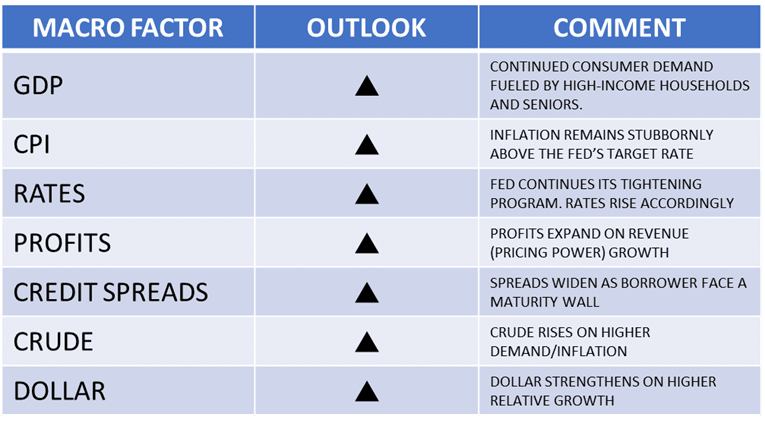

While a reacceleration scenario is unlikely in our view at a 10 per cent probability, it’s possible that continued demand, particularly from high-income households and older Americans, could fuel a reacceleration in inflation and force the Fed to reverse course and raise rates in 2024. It should be noted that high-income households and wealthy retirees are insulated from higher interest rates and a weaker job market, two tools the Fed employs to manage demand. In a reacceleration environment, short-term and intermediate-term rates rise in unison. Profit growth would be fueled by pricing power increases, but credit conditions would become more difficult for corporate and personal borrowers. High prices would be a tailwind for commodities and the dollar.

A reacceleration scenario would be deleterious for bonds and equities, as higher earnings growth would be more than offset by multiple compression due to higher interest rates. Similar to, but less severe than, the 2022 market, value would outpace growth and large caps would fall less than small caps. Quality would outperform highly leveraged companies and domestic equities would likely outperform foreign markets, on the back of a stronger dollar.

Bottom Line: We anticipate favorable market returns in 2024 from well-balanced portfolios of equities and fixed income. We estimate that the S&P 500 could advance between 6-12 per cent, fueled by lower interest rates and slowing, but stable, growth. Of course, a lot of things could go wrong next year; but from today’s vantage point, the investment markets look favorable.