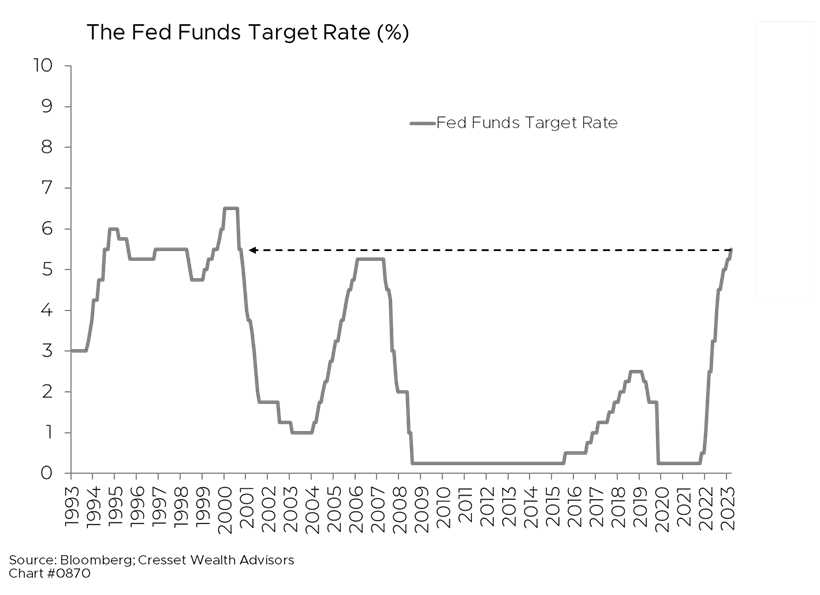

08.02.2023 In a span of 16 months, the Federal Reserve’s overnight rate has surged from zero to 5.5 per cent last week, when this critical monetary policy benchmark hit its highest level since 2001. Since the Fed began holding interest rates artificially below fair value, the benchmark rate in all but five years was held at zero. By the end of 2022, the 10-year Treasury offered investors nearly four per cent, its highest rate since 2009. After having spent 14 years at a policy-induced disadvantage, bonds are finally able to compete for capital against equities.

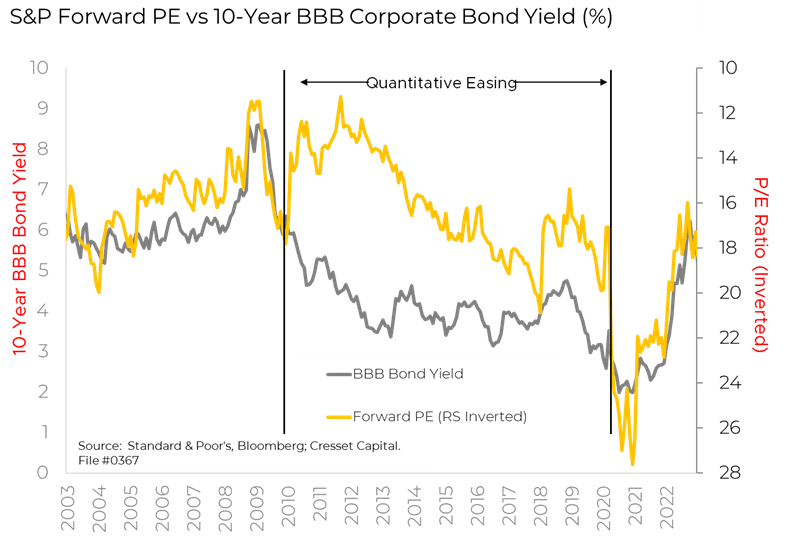

An interest rate reset was unleashed in 2022 as the Fed reversed course on unlimited easing. As the benchmark 10-year yield rose, the S&P 500 plunged 18 per cent while a broad basket of investment-grade bonds cascaded 13 per cent – the basket’s worst calendar-year decline on record. Though the violent selloff felt like a bear market at the time, 2022 markets represented a correction, as disparate markets repositioned to the new interest rate regime. By the end of the year, stocks and bonds were aligned, as represented by the relationship between the yield on BBB, 10-year corporate bonds (a good proxy for the cost of capital) and the S&P 500’s forward earnings yield (the reciprocal of its price/earnings [P/E] ratio).

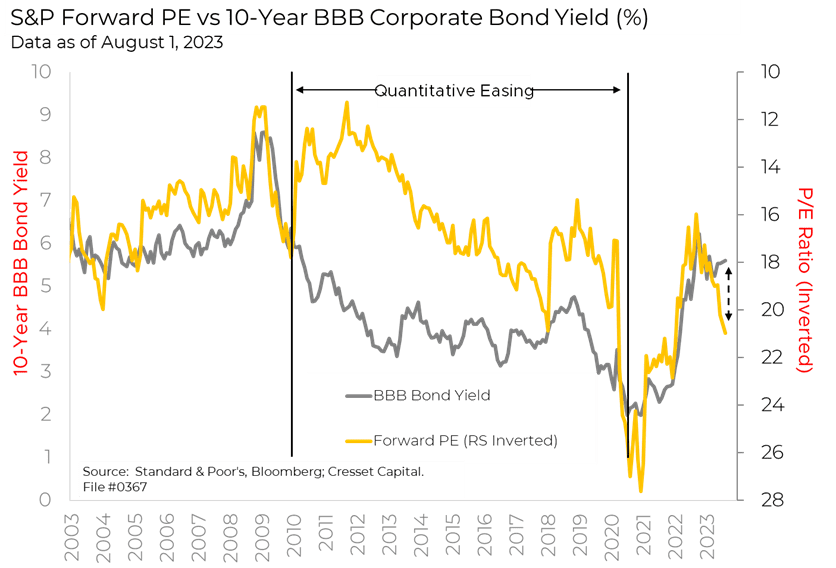

Beginning in 2023, however, stocks and bonds diverged, with bond prices trending lower on higher interest rates while the S&P 500, led by a handful of tech mega-caps, rose nearly 20 per cent. Against a backdrop of lower earnings yields, higher interest rates give investment-grade bonds an edge in the continual quest for capital. The 10-year BBB corporate bond yield suggests the S&P should trade at a forward P/E of 18x, not 21x where it is currently perched.

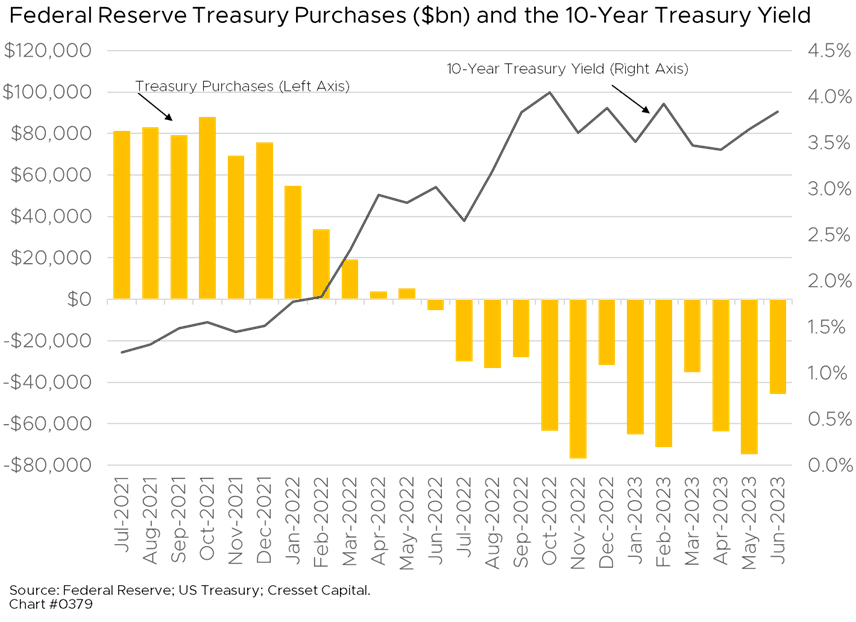

Stocks will need bonds’ help to move much higher from here. Yet the US Treasury is preparing to boost its quarterly refunding program to over $100 billion of longer-dated notes, necessitated by gaping deficits and high interest rates. At the same time, the Federal Reserve is reducing its Treasury holdings, prompting even greater public issuance. The Fed has been unloading between $40 and $80 billion of Treasurys per month over the last year. History suggests that higher Treasury issuance has not translated to higher rates, although it certainly won’t represent a catalyst for lower rates, either.

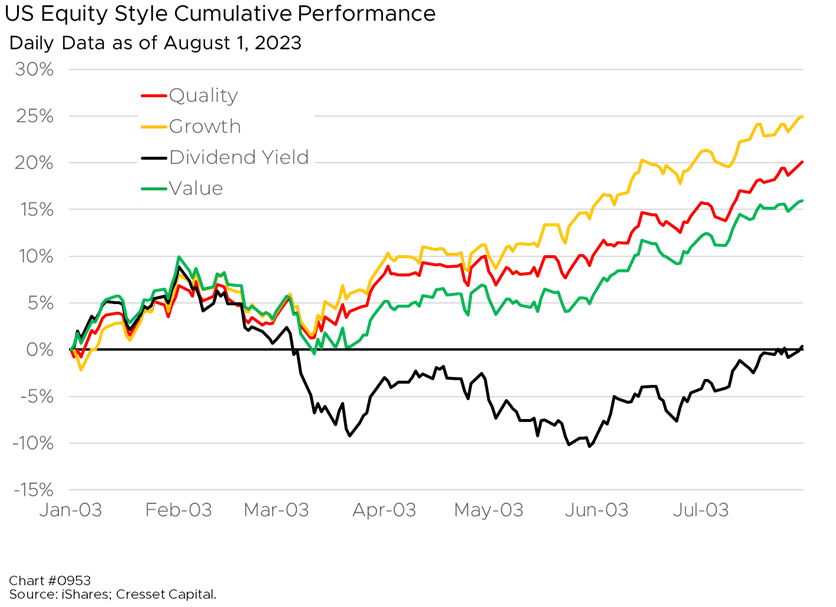

Bottom Line: While we’re not endorsing a wholesale shift from stocks into bonds, it should be noted that intermediate, investment-grade bonds offer, at long last, a compelling alternative to equities at current levels. While US large caps are garnering the attention, dividend-oriented stocks have not rallied to the same degree as their growthier counterparts, leaving them more favorably priced. For more than a decade, dividends served as useful bond substitutes while interest rates were held down by policymakers. The capital shift into bonds this year was largely at the expense of dividend equities. Quality companies with persistent and growing dividends offer a favorable blend of valuation with the potential to grow their yields in excess of future inflation.