11.02.2022 Clearly, 2022 has been a lousy year for investors. We can blame interest rates two to three percentage points higher across the maturity spectrum for large-cap equities giving up nearly 20 percent of their value this year. Adding insult to injury, many open-end mutual funds are forcing their holders to pay capital gains taxes. That’s because they’re structured in a way that makes mutual fundholders’ tax experience a function of what other shareholders do. Any capital gains realized during the year, often from fundholder liquidations, must be paid out to fundholders that same year with taxes due in that tax year. Paying capital gains taxes in a year in which paper profits are off 20 per cent stinks.

As many fund investors sold their positions this year, fund managers were forced to sell shares to meet redemptions, which triggered capital gains. Those capital gains are distributed to the remaining fundholders, triggering a tax liability. Take, for example, American Funds Fundamental Investors, one of the nation’s largest equity mutual funds. At $104 billion, this large-cap fund is off more than 19 per cent this year, yet fundholders received a capital gains distribution equal to two per cent of their holdings last June and should expect another one in December.

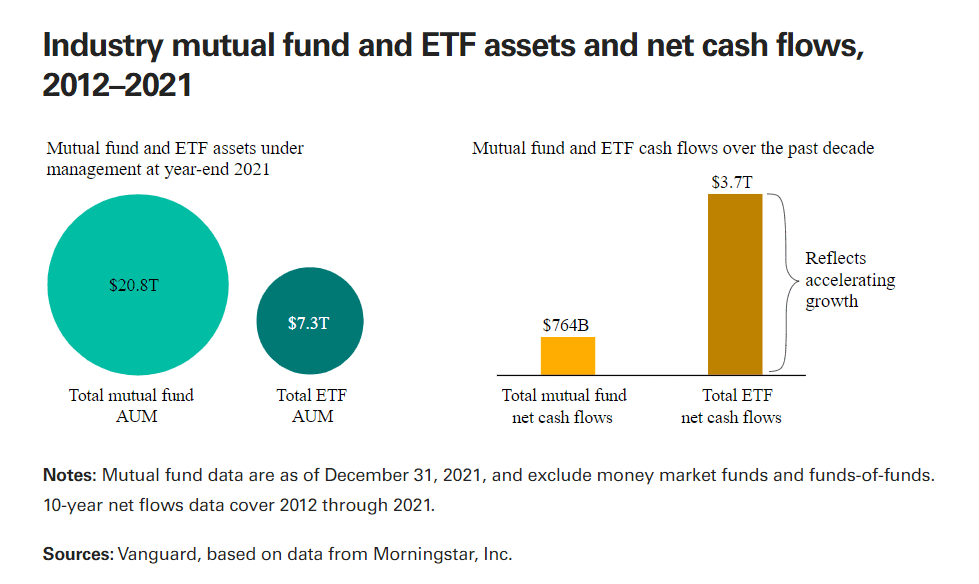

Capital gains distributions raise fundholders’ cost basis, offsetting their capital gains liability when they eventually sell their holding. But paying taxes on phantom capital gains is inefficient and antiquated. A better strategy would be to swap a mutual fund held with an unrealized loss into an exchange-traded fund (ETF) of similar strategy. Similar to owning an individual stock, capital gains are only realized when the position is sold, allowing gains to accumulate. Mutual fund managers argue that ETFs are generally passive strategies while many mutual funds are actively managed, implying that active management is the superior option. The problem: history has not been kind to active managers.

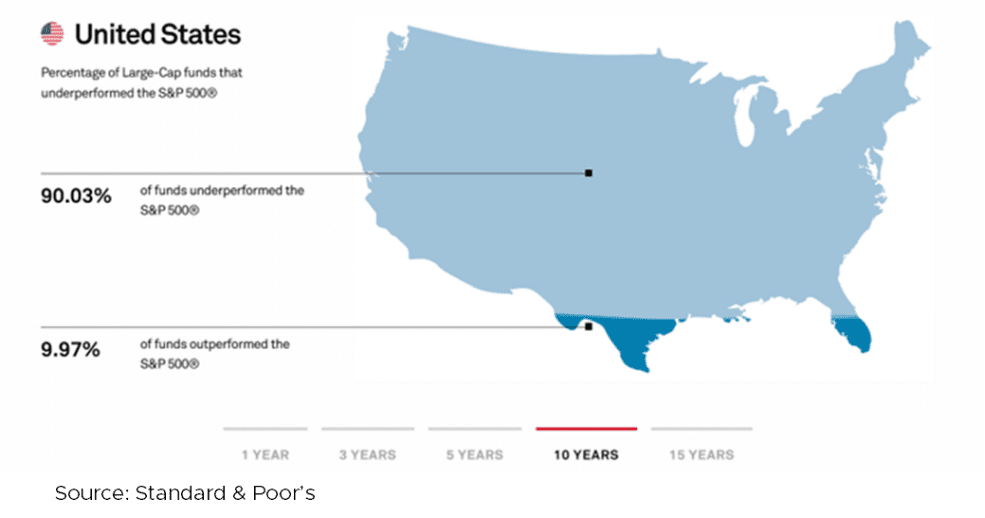

Standard & Poor’s has been tracking the record of active managers for more than 20 years. Its most recent report, issued in June, indicated that when adjusted for fees and for funds dropping out due to poor performance, 84 per cent of large-cap actively managed fund managers underperform their benchmark after five years, and 90 per cent underperform after 10 years, according to CNBC. As passive strategies, ETFs – particularly those tied to a widely respected benchmark – have an opportunity to outperform actively managed mutual funds.

The next step toward investment tax independence would be separate accounts, in other words holding your own portfolio of individual securities. With separate accounts, losses could be actively “harvested” to actively generate losses that could be used to offset capital gains. Please keep in mind that Cresset offers a suite of separately managed equity portfolios to clients for no additional management fee. Talk to your advisor to learn more about Cresset’s separate accounts.

Bottom line: Mutual fund investing is like riding the bus – your journey depends in large part on the comings and goings of fellow shareholders. Investing in ETFs is like taking an Uber. You may not have fellow passengers, but your journey sticks to a prescribed script. Separate accounts are like driving the car yourself, giving you the most control over your journey.