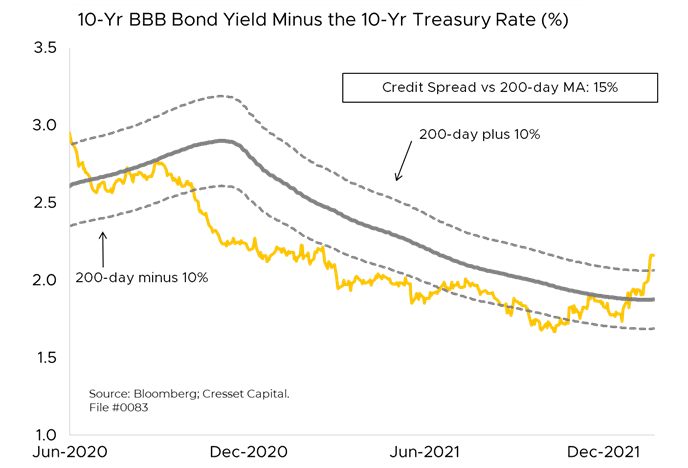

02.22.2022: The credit spread metric is our canary in a coal mine. Credit conditions – the availability of funds to borrow, spend and invest – reflect the favorability of the environment for risk taking. Easy credit conditions have lowered the bar on shouldering risk, whether in lower-quality borrowing or equity investing, since the global financial crisis of 2008. Well, the canary died last week, when the credit spread moved more than 10 per cent above its 200-day moving average and tightened enough to flip the switch on risk taking. The signal is now risk-off, something we haven’t seen since the height of the pandemic in 2020.

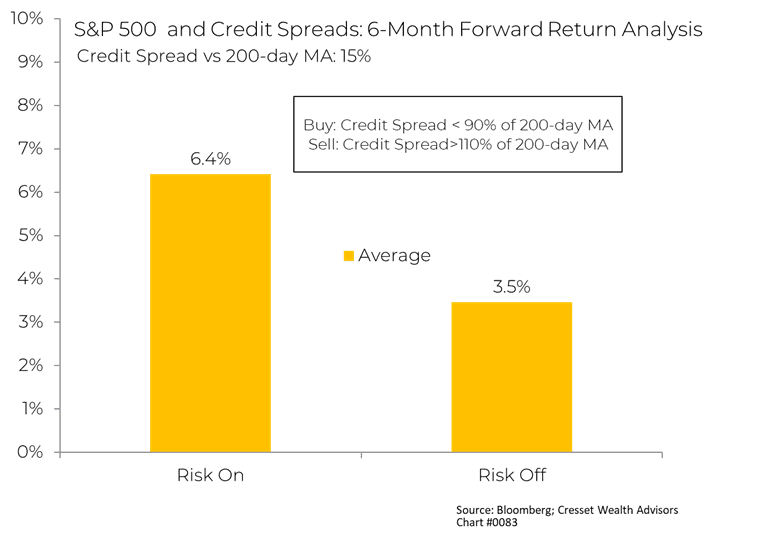

Our technical analysis tracks the 200-day moving average of the 10-year, BBB bond credit spread, which is the yield premium lenders require to extend credit to BBB-rated borrowers. History shows the S&P 500 returns 3.5 per cent over the subsequent six months, on average, after a credit breakdown (negative credit) vs 6.4 per cent after a credit breakout (positive credit). The tech wreck of 2001 and the financial crisis of 2008 were preceded by credit breakdowns. We are now seeing current credit conditions breaking down.

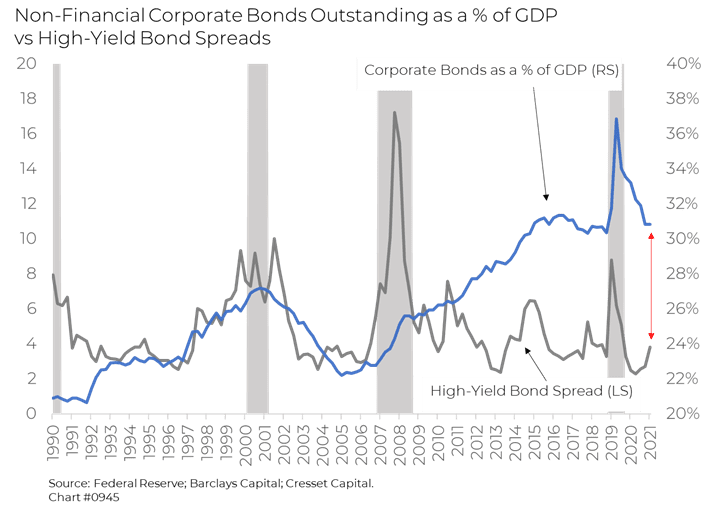

While we continue to expect today’s 7.5 per cent inflation rate to recede and economic growth to slow as we traverse 2022, credit conditions are hard to ignore. Perhaps lenders are beginning to embrace our view that inflation and growth will trend toward two to three per cent by year end, and are worrying that slowing growth combined with tighter financial conditions imposed by the Fed could conspire to weaken borrowers’ ability to repay their loans. Historically, credit spreads tended to track new issuance as a function of supply and demand, as lenders required higher yield premiums in response to new supply. That relationship broke down after 2008, the year the Federal Reserve embarked on quantitative easing. Since 2008, the Fed’s balance sheet expanded 10-fold, from $900 billion to $9 trillion, creating unprecedented demand for bonds. Fed officials revealed in their most recent minutes that, while they favor a faster pace of rate increases, they also support a “significant” reduction in the size of their balance sheet – something that could begin later this year.

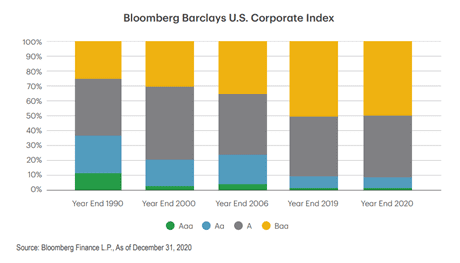

Not only has corporate bond issuance outpaced the growth in government debt, but the share of lower-quality bonds outstanding has increased over time. In 1990, BBB-rated bonds, the lowest quality “investment-grade” category, represented about one quarter of US corporate bonds outstanding. By the end of 2020, BBBs doubled to 50 per cent, while AAA-rated corporates virtually evaporated.

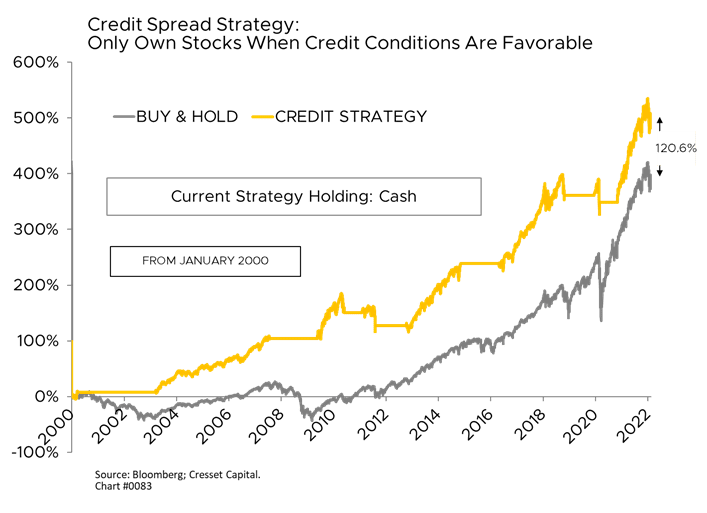

Notwithstanding our macro view, history suggests our credit risk metric is important. Going back to the beginning of 2000, if we had invested in the S&P 500 only when credit conditions were favorable and shifted to cash when conditions broke down, the strategy would have avoided an 11.9 per cent pullback in 2001 and a 22 per cent drawdown in 2002, as well as the 37 per cent plunge related to the 2008 financial crisis (preceded by a breakdown in credit conditions in late 2007). While the strategy outperformed in 2018, it trailed in 2019 and 2020, when the Fed embarked on massive bond buying in response to economic slowing. Over the last 22 years the strategy was able to add about 120 percentage points over the incremental return on a S&P 500 buy-and-hold strategy, with about one-third less risk. While we’re not recommending investors cash in all their equity holdings and bury greenbacks in their gardens, our credit metric deserves consideration given its rather interesting history.