03.02.2022: Russia’s invasion of Ukraine, representing Europe’s worst security crisis since World War II, has sparked global outrage. The court of public opinion clearly supports the Ukrainian people and their president, Volodymyr Zelenskyy. Even Switzerland, a steadfastly neutral country, has sided with Ukraine. The actions taken by NATO countries over the last week represent the largest sanctions campaign waged in the last 50 years, according to The Wall Street Journal. A broad range of crippling sanctions against the world’s 11th-largest economy are aimed at isolating Russia’s banks (including its central bank), Russia’s Direct Investment Fund as well as Putin and his close associates. The coordinated effort blocks Russia’s central bank from selling foreign currencies in its reserves to help stabilize the ruble.

In many respects, Russia needs Europe more than Europe needs Russia, although the pain will be felt on both sides. The European Union is Russia’s largest trading partner, representing more than one-third of the country’s global trade in 2020, according to The New York Times. Europe accounts for 70 per cent of Russian gas exports and half of its oil exports. At the same time, Russia represents only 5 per cent of Europe’s total trade.

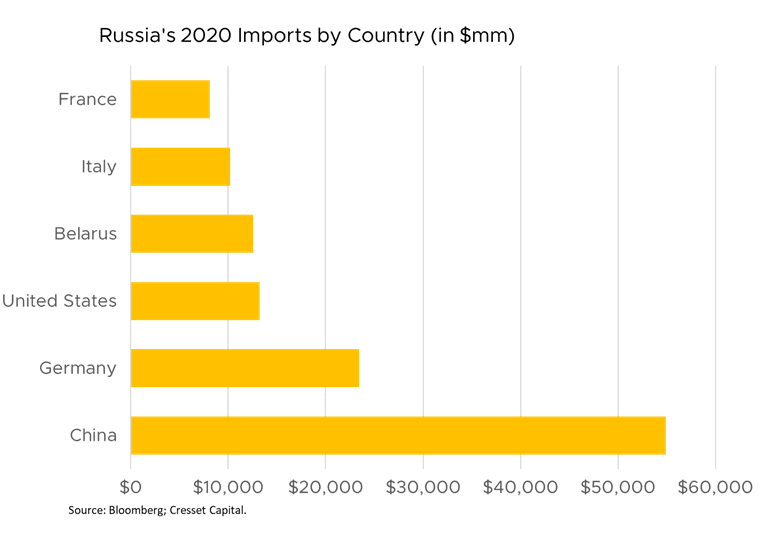

Worldwide sanctions will take a devastating toll on the Russian economy. Even though Russia is a net exporter, largely of energy and agricultural goods, relies on the rest of the world for many of its consumable goods, like food and household products. Even if a reduced quantity of goods continues to flow into Russia, consumers will no longer be able to afford imported goods with a depleted ruble.

Global economic impact

“Russia is a gas station masquerading as a country.” – John McCain

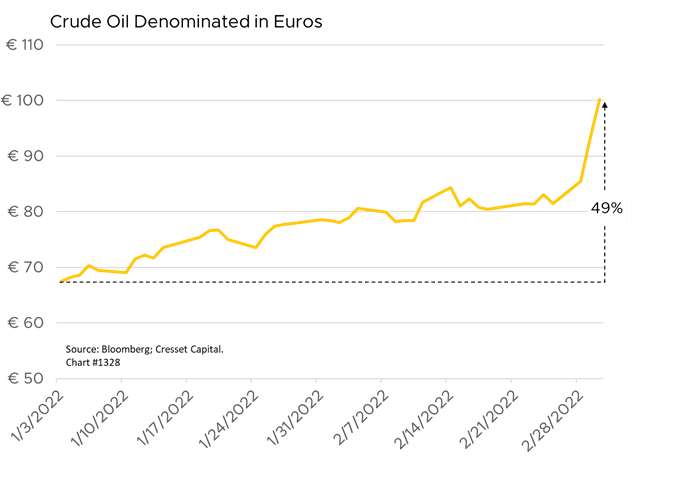

Russia is one of the world’s largest oil producers, pumping 10.7 million bbls/day, and is a dominant supplier of Europe’s natural gas. It is also a key miner of industrial metals, like nickel, aluminum and palladium. The immediate impact of a commodity shock will be higher inflation, lower growth and potential disruptions to financial markets. Supply shortages pushed crude prices above $100/bbl for the first time since 2014. Europe imports about 40 per cent of its gas, 35 per cent of its crude oil and more than 40 per cent of its coal from Russia. The EU is scrambling for other sources of energy, particularly natural gas used for residential heating. One bit of good news: spring is only three weeks away and warmer temperatures will ease some of the pressure felt by Northern European households.

The developed world will undoubtedly lean on Saudi Arabia to increase oil production. It should be noted that the US is the world’s largest oil producer at 11.6 million barrels/day and, according to The American Oil & Gas Reporter, possesses the world’s largest recoverable oil reserves at 264 billion barrels. President Biden could backtrack on his previous policies and encourage an increase in domestic fracking, although he didn’t mention it in his State of the Union address last night. The Biden administration will likely warm up to the idea of negotiating an updated Iran nuclear deal to facilitate Iranian oil flows. In the meantime, crude prices are on the rise as Europe seeks to cover for lost supply in the near term. A barrel of oil has surged nearly 50 per cent so far this year when denominated in euros. History suggests energy price spikes, while inflationary in the near term, ultimately lead to economic slowing as energy costs funnels discretionary spending away from other goods and services. In fact, every US recession in modern history was preceded by high energy prices.

Global financial market impact

The yield on Russia’s $7 billion dollar debt jumped to 8.3 per cent, doubling in one month. Longer-maturity bond yields topped 18 per cent, according to Bloomberg. Meanwhile, the ruble has plunged 30 per cent as the country and its banks become increasingly isolated. Adding to Russia’s misery, S&P Global Ratings downgraded Russian bonds to junk, as bond investors anticipate defaults. The cost of insuring $10 million of the country’s bonds due in five years costs $4 million up front and $100,000 annually, representing a 56 per cent likelihood of Russian bonds going kaput.

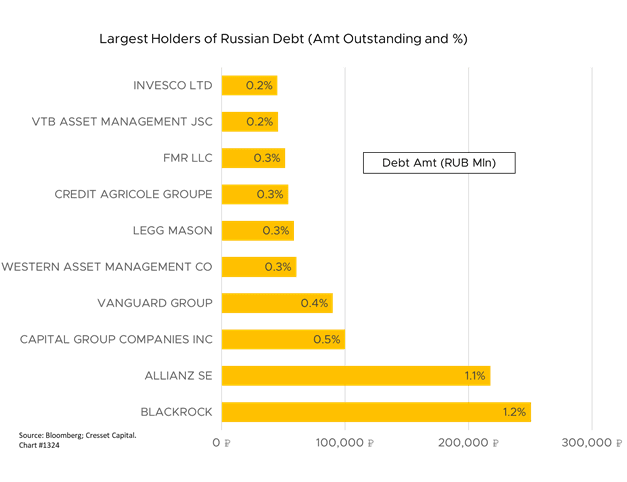

While the economic ripples will be felt worldwide, we expect possibly widespread Russian bond defaults will be successfully absorbed by the global financial system. That’s because Russian debt is widely held in small allocations, representing only about 3 per cent of the emerging bond world. Blackrock, the world’s largest money manager, is the largest holder, with about $1.5 billion of Russia’s $33 billion bonds outstanding. Those holdings are widely distributed among their dozens of emerging market bond funds. Western banks have little exposure there, but European companies are much more involved. Thirty-five of France’s largest public companies have Russian investments and 38 of Germany’s largest public companies have Russian exposure.

High energy prices put the Federal Reserve and other central banks in a bind. US inflation is currently running at a 40-year high. It is interesting to note that bond investors believe $100/bbl oil will do more to restrain growth than to fuel an inflation spiral. In the past week. Fed fund futures reduced to four the number of tightening moves this year, down from seven a week ago. The benchmark 10-year note yield slid nearly 0.3 per cent in the interim to 1.7 per cent, its lowest reading this year. Inflation and the Fed’s reaction to it is a 2022 wildcard, as the FOMC grapples with an overheating labor market coupled with persistent wage gains. We believe inflation will abate later this year; however, stubbornly high energy prices could force the Fed to raise rates more than the market currently expects – a bearish prospect.

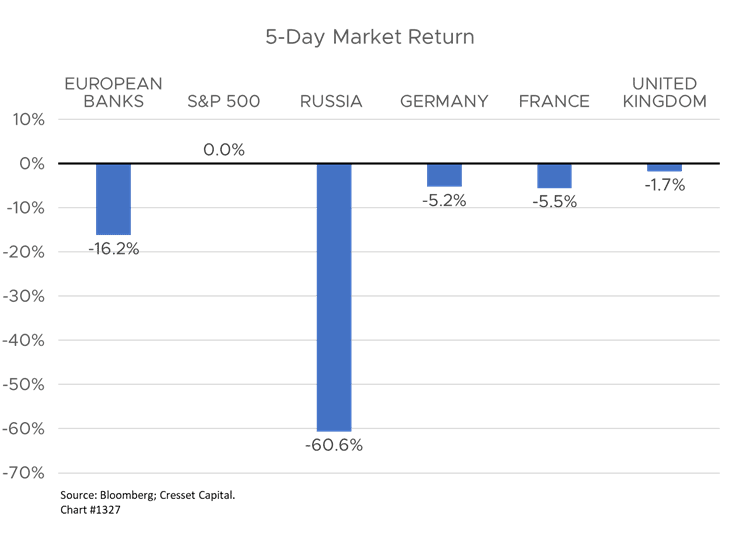

The equity markets’ reactions so far sum up investors’ views, as illustrated in the chart below. While sanctions are troubling for the global economy, what represents a speed bump for the developed world is a major roadblock for Russia.