Key Observations

- Impact of Federal Workforce Cuts Likely to Be Limited to Wage Growth

- States with High Proportion of Federal Jobs Are Vulnerable

- Federal Spending Reductions Could Have Noticeable Growth Impact if Services Are Affected

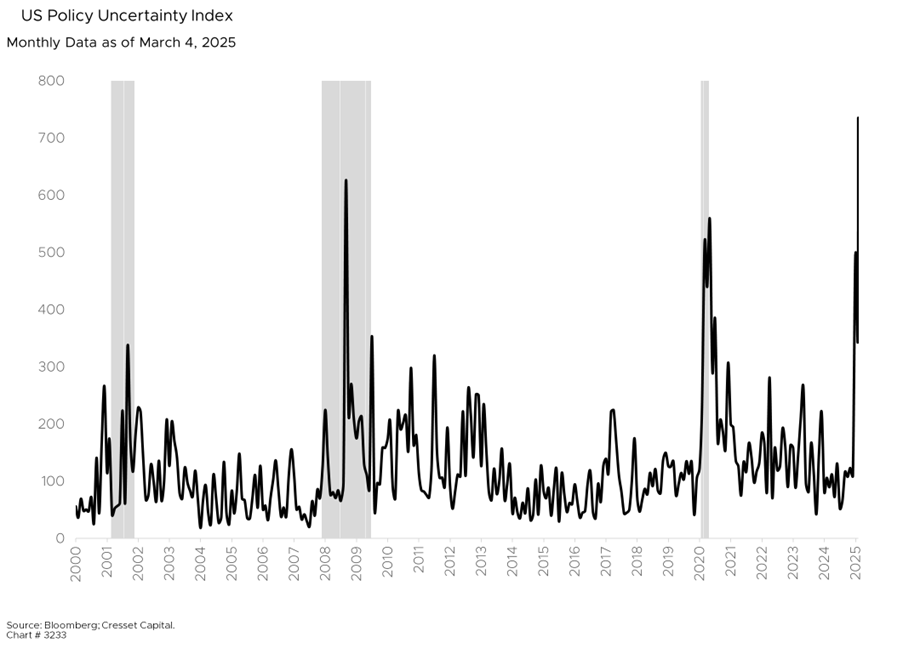

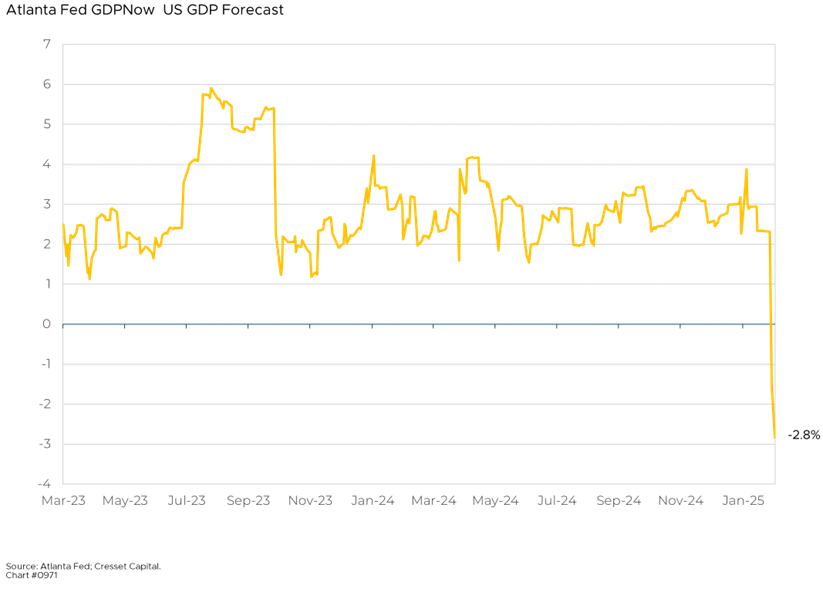

DOGE spending cuts are coming at a tenuous time in the US economy. Several economic indicators are softening. The Composite Index of Leading Economic Indicators slipped in February, falling short of economists’ expectations. Consumer confidence is also sinking on a surge in the US Policy Uncertainty Index. At the same time, the Atlanta Fed’s GDPNow model is predicting US gross domestic product will contract 2.8 per cent in the first quarter, marking a sharp reversal from last quarter’s 2.3 per cent expansion. The Atlanta Fed’s model anticipates that companies will accelerate imports ahead of anticipated tariffs, note that imports subtract from economic growth. What will be the ultimate economic impact of DOGE cuts?

The Trump Administration is poised to slash government spending. The Department of Government Efficiency (DOGE), led by presidential appointee Elon Musk, is implementing significant federal workforce reductions through layoffs, buyouts, and contract cancellations. Already, nearly 100,000 federal workers have been affected, with about 75,000 employees having accepted deferred buyout offers and will be paid through September, and around 25,000 workers have been laid off or placed on administrative leave. These cuts could have ripple effects on unemployment, wages, and the broader US economy.

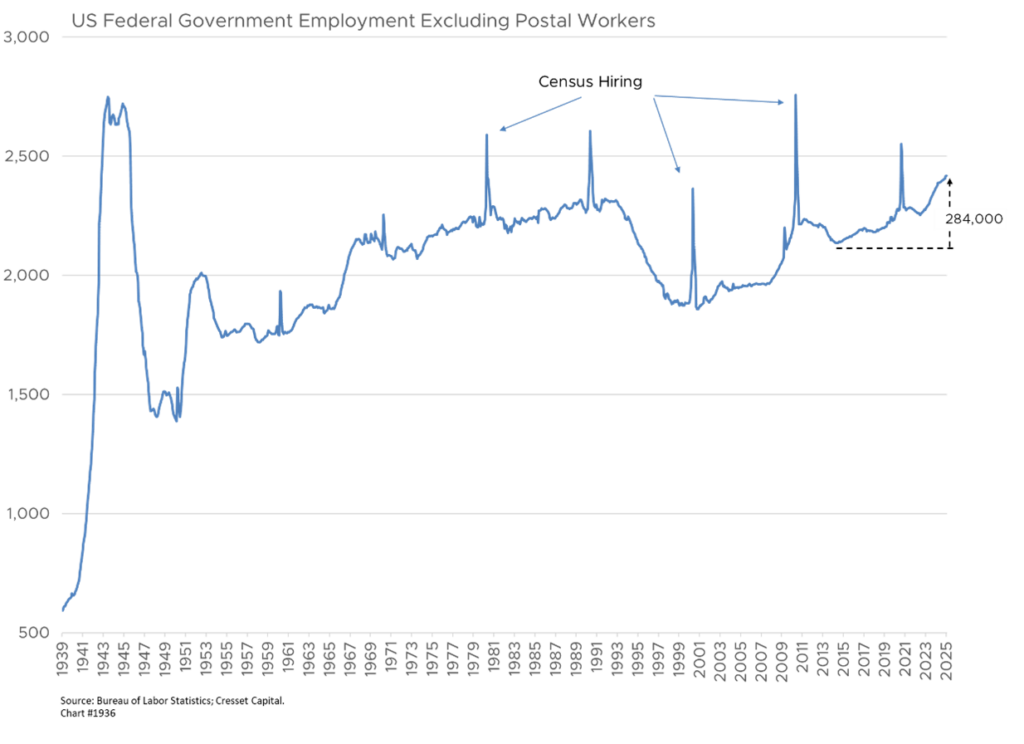

Current Federal Payroll Biggest Since 1945

The Federal government employs approximately 2.4 million civilian workers, excluding the US Postal Service. Over the last 12 months through January, the federal government added 47,000 net new jobs, representing between two and three percent of the two million jobs added in the economy overall. According to the Bureau of Labor Statistics, the government has added nearly 300,000 net new positions over the last decade. With the exception of the temporary hiring of census workers every 10 years, the federal government’s payroll is currently perched at its highest level since 1945. Analysts estimate that DOGE cuts could shrink the federal workforce by 300,000-400,000 throughout 2025, taking government employment below levels we haven’t seen since the Financial Crisis. Some economists suggest potential job losses of nearly one million when private contractors are included – because there are possibly two private government contractors for every federal employee.

Impact of Federal Workforce Reductions Likely to Be Limited to Wage Growth

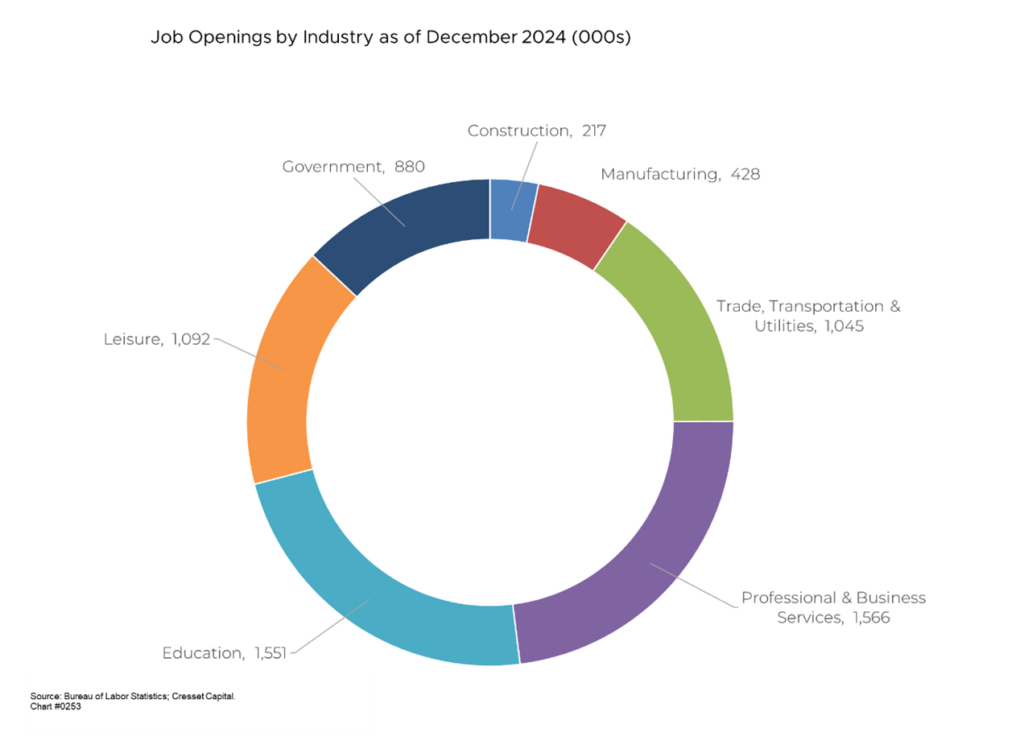

The share of the federal workforce, after declining consistently since the early 1950s, has remained steady since 2000, even though US productivity has been on the rise. According to the Bureau of Labor Statistics, while productivity among software publishers has surged more than 2,600 per cent since 1987, postal service productivity has been negative. Nonetheless, the economic impact of a 300,000- to 500,000-person reduction in government employment would be muted. Federal employees are relatively skilled and would likely be absorbed into the private sector workforce. As of December, there were nearly eight million job openings, with more than three million in professional and business services and education. Nonetheless, a sudden supply of 500,000 new private sector workers could help push wage growth lower.

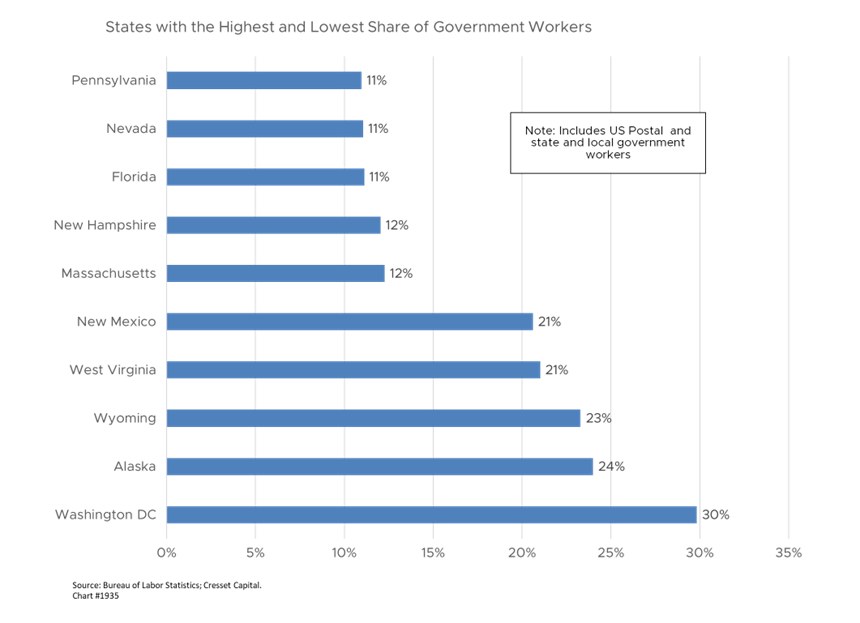

States with High Proportion of Federal Jobs Are Vulnerable

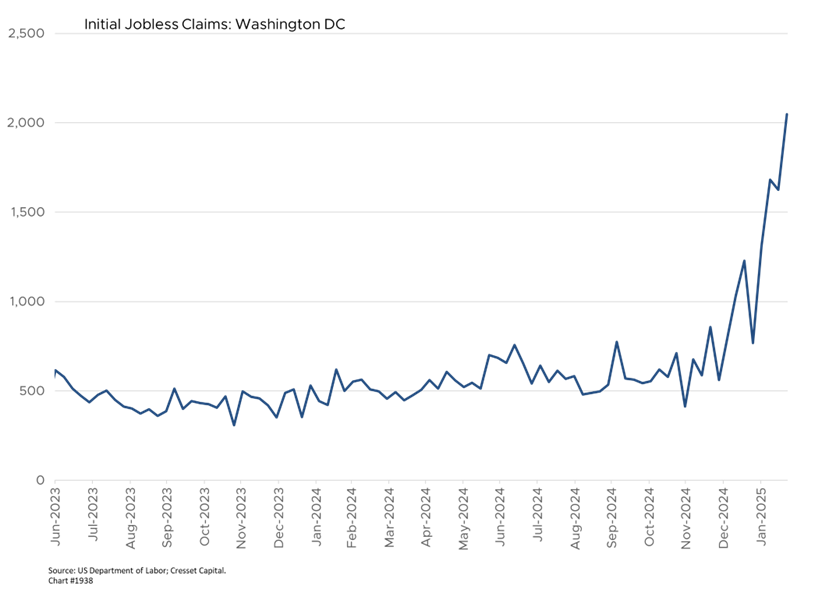

Parts of the country where government workers comprise a large share of the overall workforce would be disproportionately affected. The Washington DC metropolitan area, for example, would be most vulnerable to significant cuts. Federal jobs represent about 10 per cent of local employment and government jobs, local and federal, account for 30 per cent of the district’s workforce. Already, layoffs are showing up in DC’s data. Other states with a high proportion of government jobs are Alaska, Wyoming, West Virginia and New Mexico, all relatively unpopulated states. Meanwhile, Pennsylvania, Nevada, Florida, New Hampshire and Massachusetts are relatively insulated. Thirty-five states have at least one county in which federal employment exceeds five per cent, according to The Wall Street Journal.

Federal Spending Reduction Could Have Noticeable Growth Impact

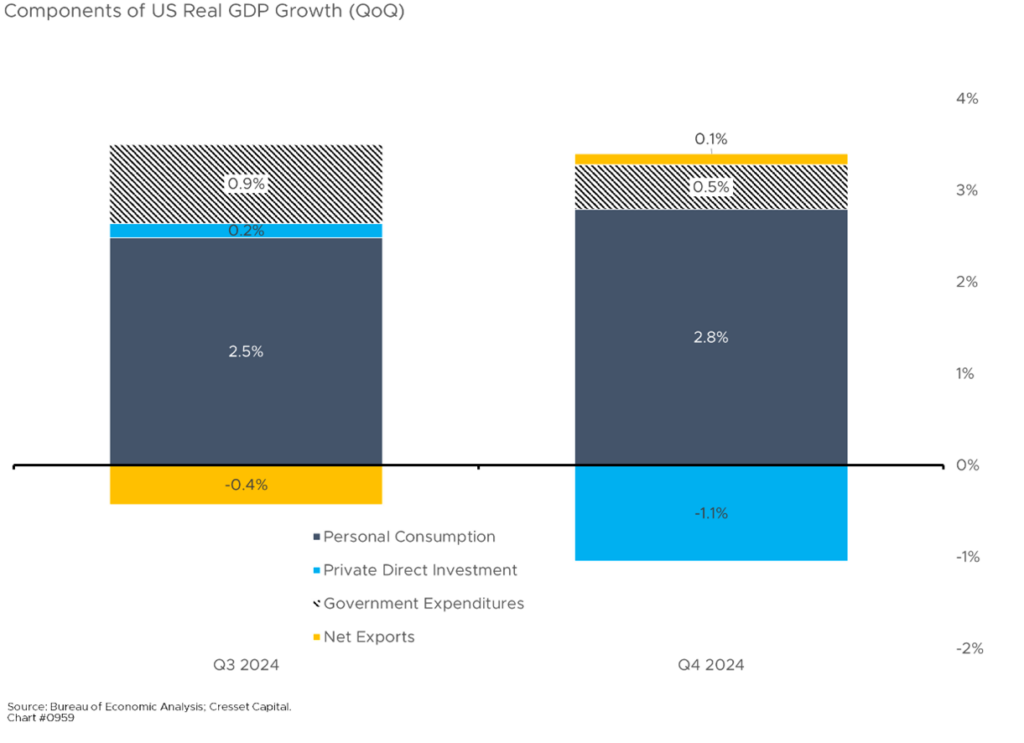

A reduction in government spending, however, could have a noticeable impact on growth. Over the last two quarters, government spending added 0.9% and 0.5% to overall US GDP growth respectively. Longer term, government spending’s median contribution to overall growth is 0.4%, suggesting that no spending increase could reduce economic growth by about half a percentage point. We estimate that US potential GDP is about two per cent; eliminating federal spending growth could knock potential GDP back to about 1.6 per cent.

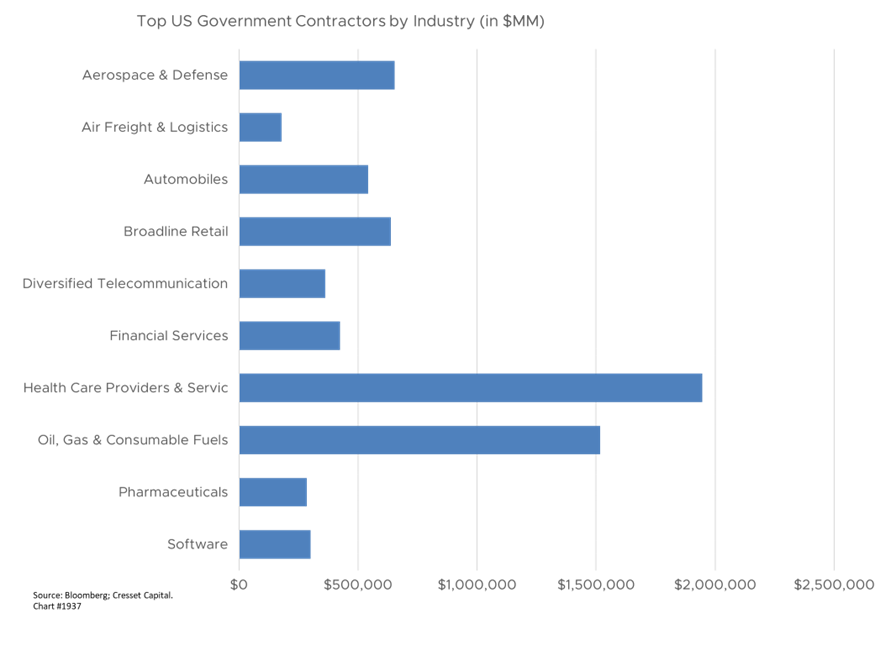

Government Spending Widely Distributed Across Industries

Most investors think of aerospace and defense as the industries raking in the largest amount of revenue from the US federal government. But this industry grouping ranks third at $653 billion, behind health care insurance companies with nearly $2 trillion in revenue and the oil and gas industry at $1.5 trillion. However, nearly 40 per cent of the defense and aerospace industry’s revenue is derived from government contracts. Government expenditures account for about 30 per cent of construction and engineering industry revenue. The top 10 industries account for nearly $7 trillion of US government expenditures.

Markets Concerned About Policy Uncertainty and Potential Slowdown

Markets are reacting to rising policy uncertainty and the prospect of economic slowing. The 10-year Treasury yield, a barometer of economic growth and inflation, slid 0.7 per cent in the past four weeks to 4.1 per cent, representing its lowest yield since October. US large- and small-cap stocks are under water for the year, while gold has surged more than 10 per cent. Traders now anticipate three rate cuts this year, up from one cut at the beginning of the year.

Bottom Line

The ultimate economic impact will depend on the final scale of workforce reductions, the ability of the private sector to absorb workers, and whether government service disruptions affect broader economic activity. US policy uncertainty, particularly around tariffs and government spending, is a wildcard that could undermine consumer and business confidence; we will be on the lookout for evidence of further slowing. We expect a higher level of market volatility as the impact of these policy changes plays out, reinforcing our conviction in maintaining a diversified portfolio and a long-term investment horizon.