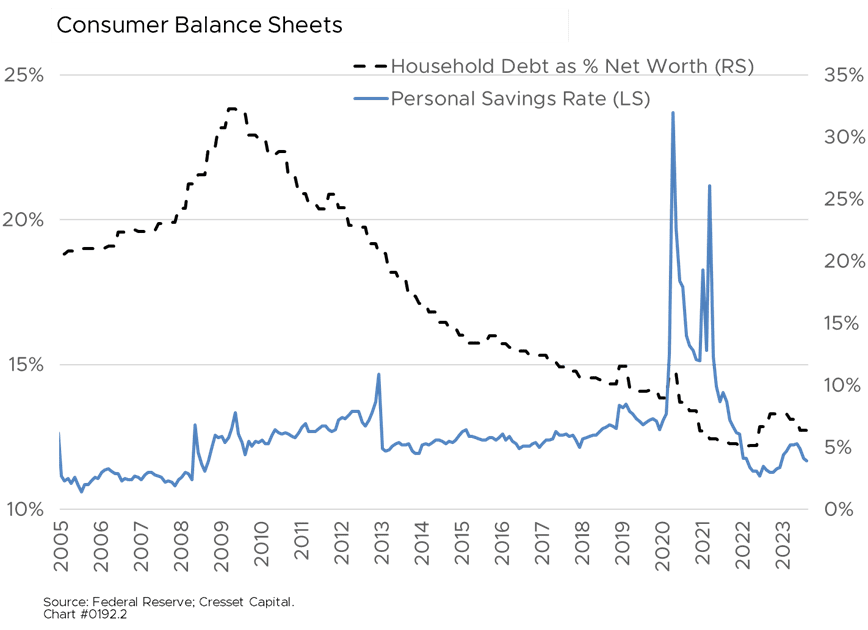

10.25.2023 Consumer spending continues to defy economists’ expectations against a backdrop of the highest interest rates we’ve endured since 2007. While a tight job market has contributed to buyers’ ebullience, one critical driver that’s been largely overlooked is the expanding net worth of American households. Between 2019 and 2022, household net worth grew by 37 per cent, fueled by expanding housing and equity portfolio values, according to the latest Survey of Consumer Finances. US household median net worth grew to $192,000 by the end of 2022, up from $141,000 three years earlier, according to the report. The Fed’s Survey of Consumer Finances, which is conducted every three years, showed the largest wealth increase in the history of the survey. Two factors contributed to the impressive growth: generous federal stimulus payments and a slowdown in spending during the pandemic lockdown, enabling households to accumulate savings and pay down debt. High cash balances have helped fuel steady spending and kept the labor market tight, forestalling the recession widely anticipated for this year. Demographic and wealth shifts that have contributed to the continuing buoyancy might make traditional economic cycle management more challenging.

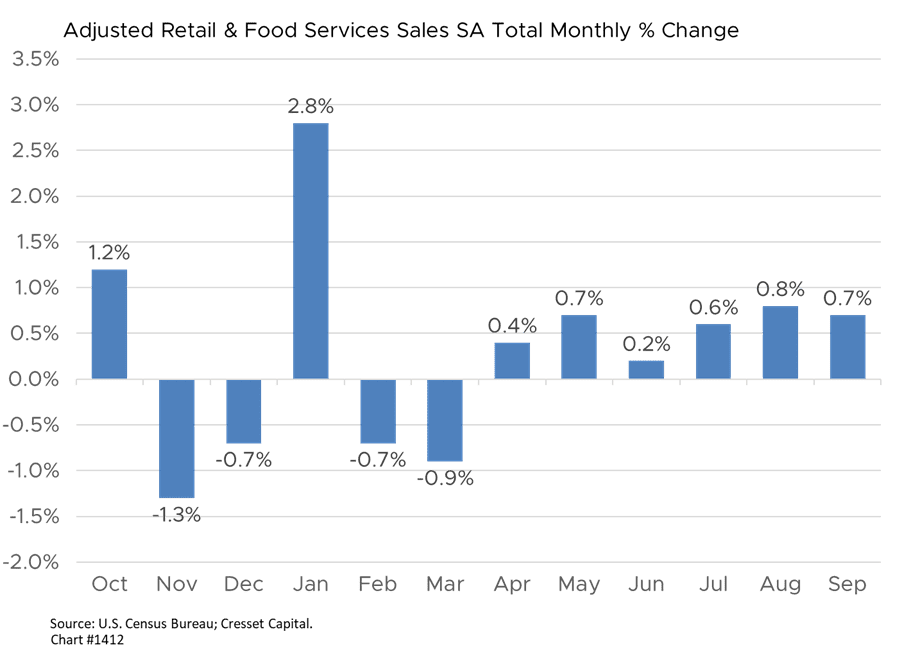

Notwithstanding evidence that household cash balances are dwindling, forcing an increasing number of consumers to switch to plastic, last month’s retail sales report shows remarkable consumer strength. Retail sales rose 0.7 per cent in September, topping estimates of 0.3 per cent, suggesting that the consumer remains resilient despite recent upticks in inflation data. Sales activity has increased every month since April. The US is a consumption-based economy – personal spending accounts for two-thirds of our nation’s economic growth.

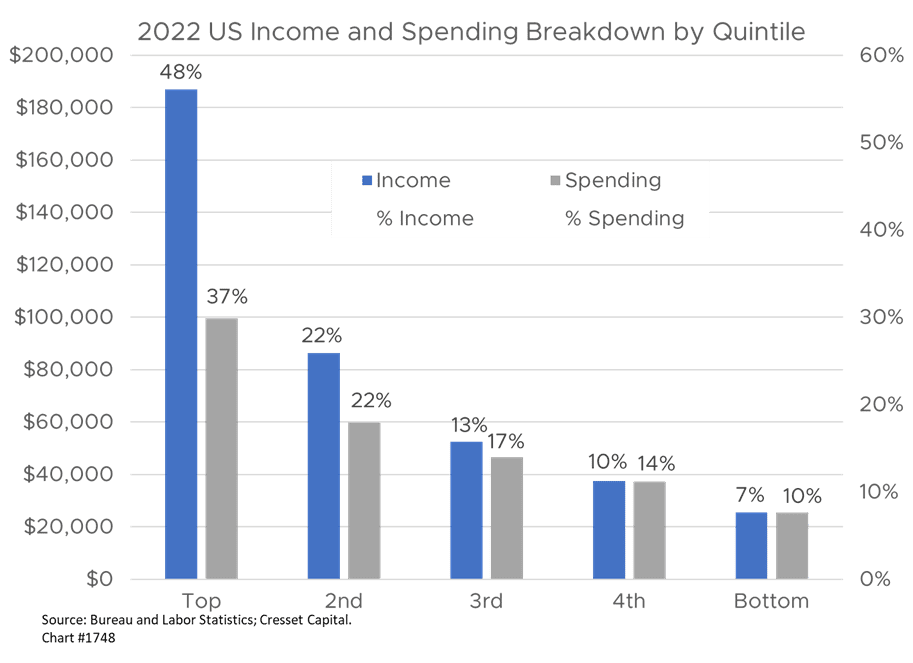

While Fed policymakers are aiming to quell inflation by orchestrating a cyclical slowdown catalyzed by substantially higher borrowing costs, spending among two segments of the population – high-income earners and seniors – are largely insulated from the vagaries of the economy. The highest quintile of income among American households brings in over $180,000 per year, accounting for nearly half of all income earned, according to the Bureau of Labor Statistics. In all, these households account for more than one-third of spending.

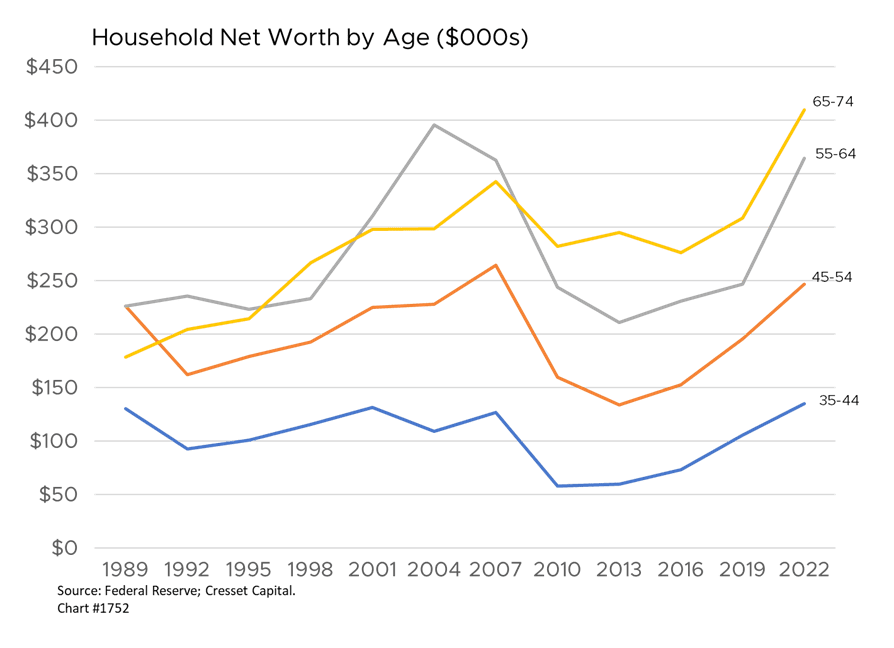

The senior set has become an important driver of consumer spending, given its numbers, financial health, and spending priorities. Now at its highest share on record, 17.7 per cent of the US population is aged 65+ and they are spending more than ever, accounting for an historic high of 22 per cent of our nation’s spending. The Baby Boomer cohort, currently aged 57-75 years old, benefitted from the central bank’s zero interest rate policy in recent years, which helped boost the values of their homes and stock portfolios. They now stand to benefit from interest rate normalization as they shift into income-earning assets.

Senior spending is less influenced by interest rates than other household segments since they generally carry little or no debt. Senior households also received an 8.7 per cent Social Security payout boost this year, helping to fatten their wallets. And they’re less affected by unemployment and the job market since they’re largely retired. That means that traditional monetary policy won’t be as effective in curtailing senior spending as it was in the 1990s and 2000s, when the Baby Boomers were in the workforce. Like their high-income counterparts, senior spending behavior is fueled by the wealth effect, the cumulative growth in housing and equity value, suggesting it would take a significant pullback in housing or the equity market to keep the senior set away from America’s cash registers.

Bottom Line: The Fed, relying on traditional economic cycle management, is betting that a growth slowdown coupled with higher unemployment stands to deliver a one-two punch to spending and inflation. We think it might be different this time. Seniors, along with certain high-income households, are insulated from economic cycles, interest rates and jobs, could likely keep right on spending, creating stronger-than-expected pressure on prices. Persistent inflation fueled by unwavering demand among seniors and other high-income households could prompt a more severe recession that dents housing prices and equity values to curtail demand. While we believe inflation is gradually trending toward the Fed’s two per cent target, we believe investors need to prepare for “higher-for-longer” interest rates.