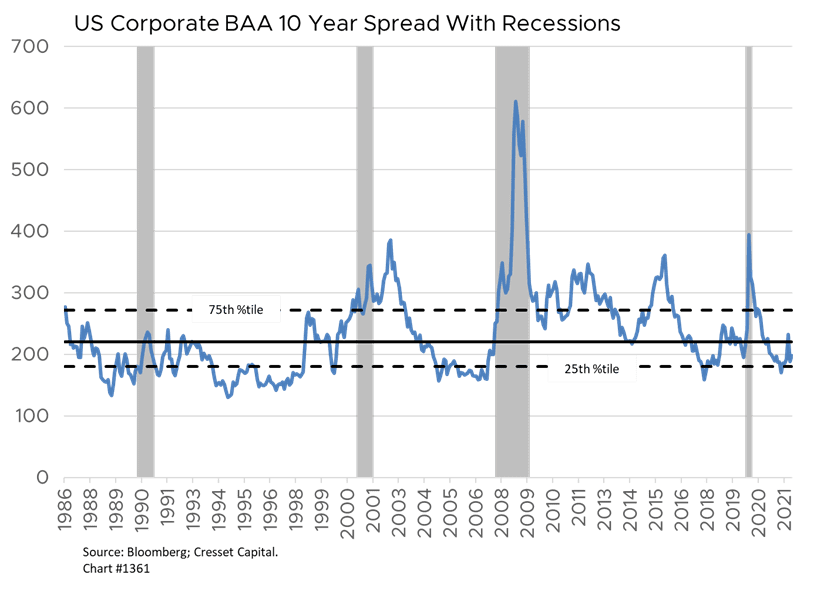

05.24.22: 2022 has been a remarkable year so far; not in a good way. The equity market is suffering its worst five month start of the year since the 1970, while bond investors are living through their worst start since 1842, according to the Wall Street Journal. Despite the equity and bond market damage, credit conditions, the willingness of lenders to extend credit to lower quality borrowers, remain intact, suggesting lenders aren’t currently forecasting much credit deterioration. At just under 2%, the yield premium lenders require to extend credit to BBB-quality borrowers for 10 years, remains at the skimpiest third of its historical range dating back to 1986.

One possibility for their optimism could be inflation itself. From a lender’s perspective, inflation is a double-edged sword. While price acceleration erodes the value of fixed income, inflation, thanks to top line growth, makes it easier for weaker borrowers to service their debt.

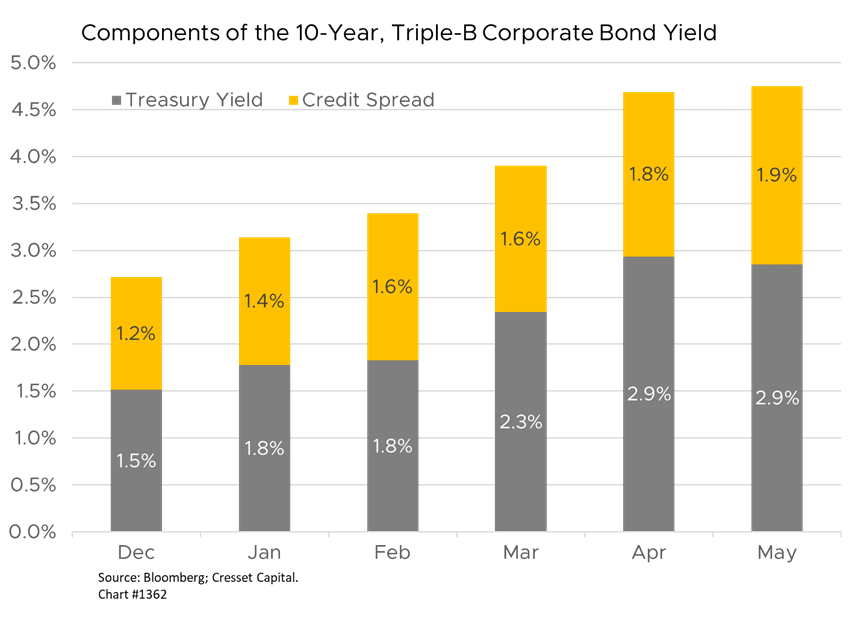

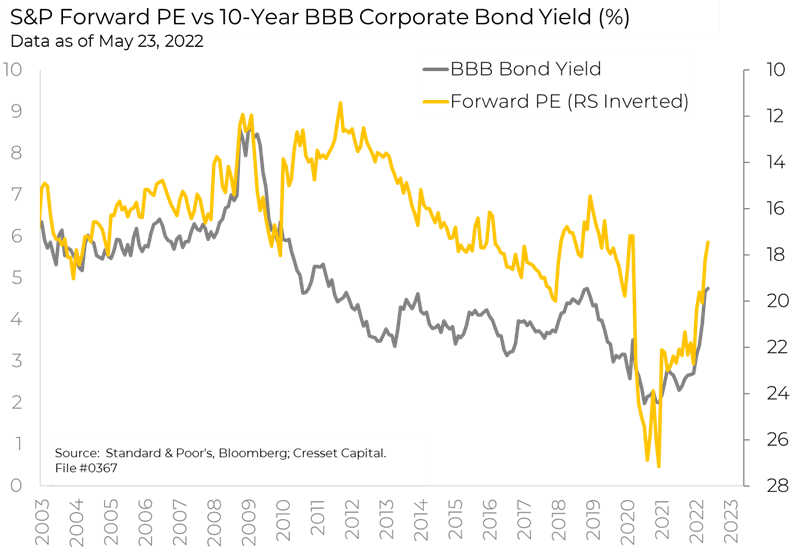

Not only do credit spreads dominate the corporate bond space, but they also matter to equity investors. That’s because equity market valuations hinge on the 10-year, triple-B corporate bond yield, a cost of capital proxy for most US large caps. For years, the S&P 500’s forward earnings yield, the reciprocal of its price-earnings ratio, tracked the triple-B corporate bond yield. The corporate bond yield comprises two elements, the underlying Treasury yield that compensates all lenders for inflation risks and a credit yield component the compensates lenders for credit default risk. Lenders will demand higher credit spreads for weaker borrowers. Triple-B, the lowest “investment grade” quality category, is the most common ranking in today’s credit environment.

So far this year, the 10-year, triple-B corporate bond yield has spiked more than two percentage points, from 2.71% to 4.75%. However, most of the move, 1.35 percentage points, was related to an increase in the 10-year Treasury yield and only 0.31 percentage points was attributable to a higher credit risk premium. What’s the likelihood that lenders could require a higher risk premium in the coming quarters? Possibly, if lenders expect a recession. Based on current levels, they do not. Higher yields, either due to a Treasury yield hike or wider credit spreads, would compress equity market multiples.

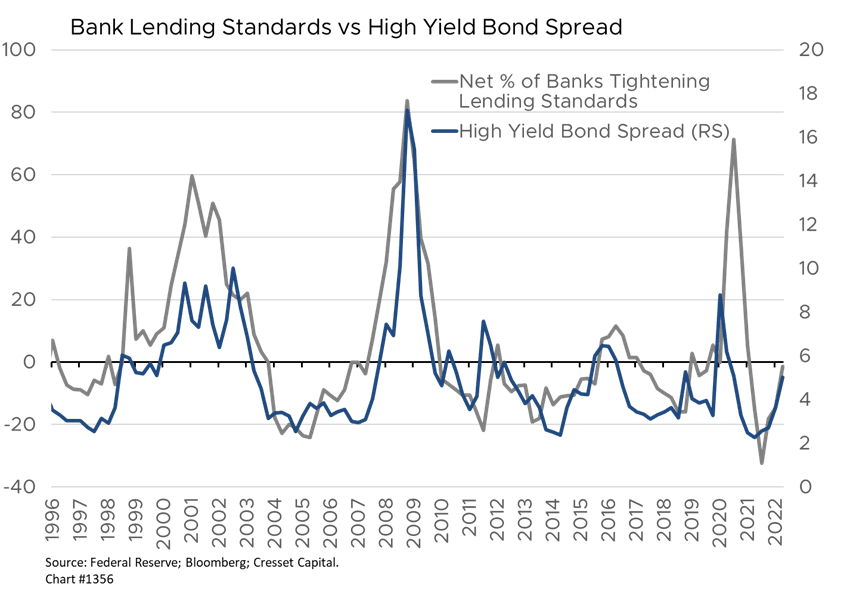

More expensive borrowing costs and the prospect of a slowing economy have already prompted banks to rein in lending. History has shown that lending standards tend to lead credit risk premiums. As of the first quarter, an equal number of banks have tightened and loosened their lending standards. That’s a stark reversal from last year when banks were tripping over themselves to get money out the door. We expect more banks to tighten by the end of the Q2.

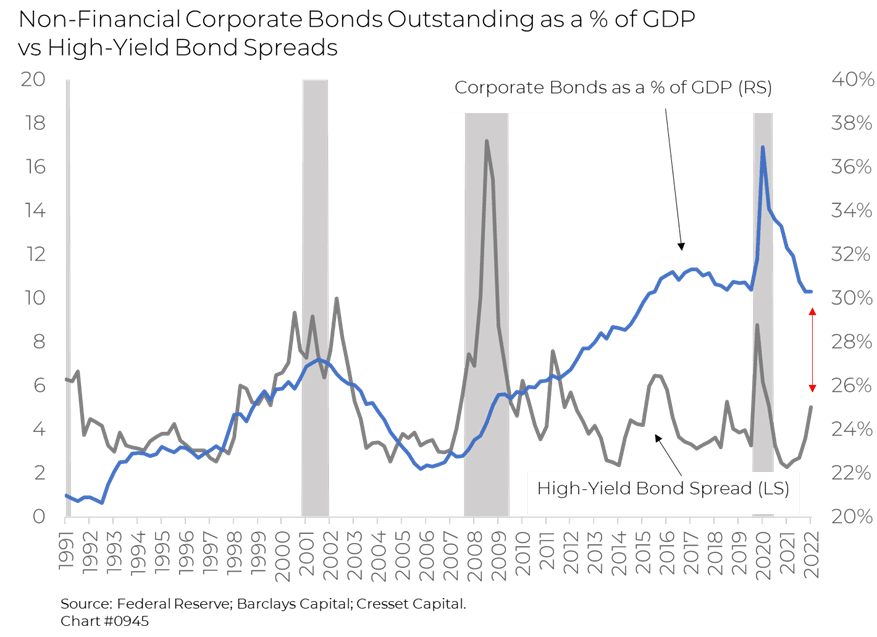

Credit spreads also respond to supply and demand. As more corporate borrowers come to market, lenders will require a higher yield premium all other things being equal. Over the last decade or more, all other things have not been equal. That’s because global central banks have flooded the bond markets with rivers of capital, keeping yields and spreads below “fair” value. Now that the central banks have ended buying bonds, yields are quickly moving back toward fair value. Higher corporate credit spreads, we worry, may not be far behind.

Valuation math suggests a one percent rise in interest rates, whether a result of higher Treasury yields or wider corporate credit spreads, equates to roughly two turns in today’s equity market price-earnings ratio, or about 15% in equity market value. We’re on the lookout for further credit deterioration that could impair equities.