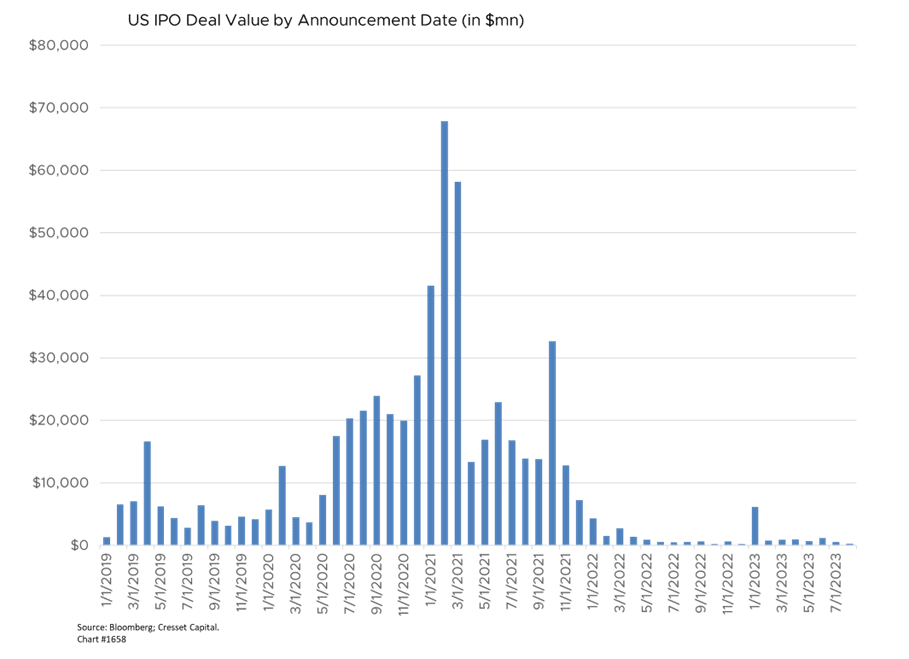

08.30.2023 The tightening program started by the Fed in 2022 not only pressured stock and bonds, but also private markets as higher interest rates raised funding costs. Deal activity dried up last year, as fundraising was the most challenging it had been at any time in the last 15 years. The number of private fund strategies launched since the start of 2023 is 53 per cent lower than at the same time last year, according to Preqin. Nowhere is the funding problem more visible than in IPO activity, a long-time exit strategy for venture capital funds. Total IPO volume in the US this year is just $13 billion, according to Dealogic. But two forthcoming IPOs could signal a turning point for fund raising.

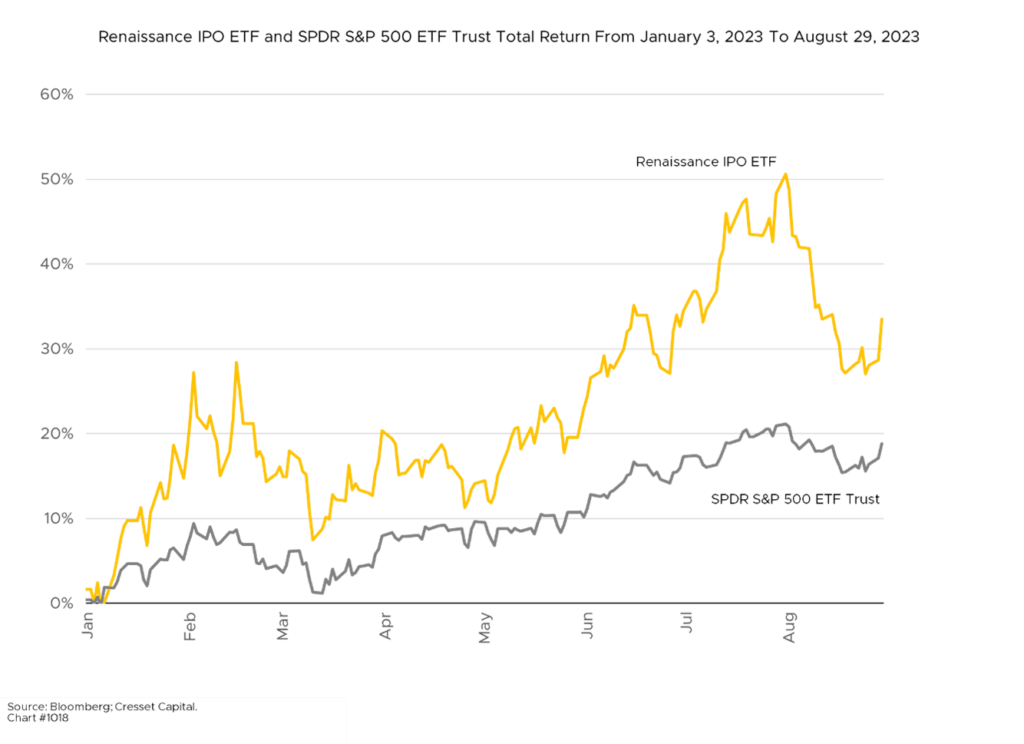

Shares of recent IPOs, as represented by the Renaissance IPO Index, slid more than 57 per cent in 2022. This year, the Index is rebounding, surging nearly 50 per cent through July before retreating to more than 30 per cent for the year so far. This suggests the investment community, after stronger-than-expected performance so far this year, might welcome renewed IPO activity.

A long line of private start-ups is hoping to tap the public equity market to replenish funding for impecunious venture capitalists. Buoyed by AI enthusiasm, Arm – a British chip designer backed by SoftBank – is hoping to launch the largest IPO this year. While pricing isn’t available, the company just bought back 25 per cent of its shares from SoftBank for $16.1 billion, implying a $64 billion valuation, according to The Wall Street Journal. At $64 billion, the company would sell at 24x revenue and 122x earnings. That might be a stretch. Nvidia, a known quantity in AI that just blew the doors off its last earnings estimates, is trading at 36x sales and 113x earnings.

Instacart, an online grocery delivery company, just filed for an IPO offering on the NASDAQ. It benefited from a surge in business during the pandemic, but the company warns potential investors not to draw a trend line. Instacart recently cut its internal valuation, used to value employee stock options, to $12 billion, according to The Wall Street Journal.

While neither deal is a lock based on estimated pricing, successful placements would signal good news to both public and private investors. A hot IPO market would enable private equity and venture funds to recycle capital into new start-ups and other private businesses. We will be paying close attention to both deals.