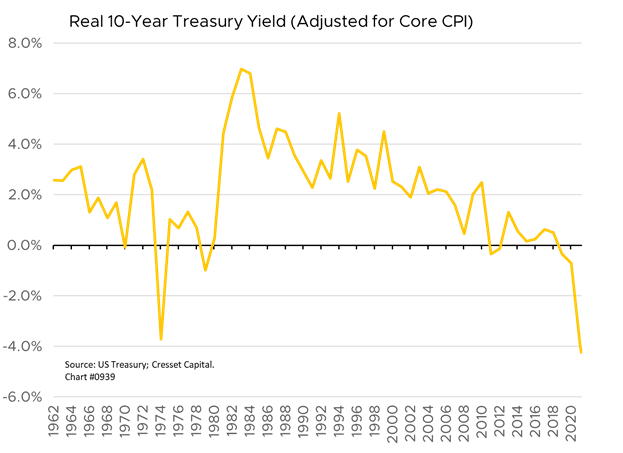

02.15.2022: Investors rode into 2022 on a wave of easy money and strong economic growth. Interest rates adjusted for inflation ended the year at their lowest level on record, while 2021’s 5.5 per cent GDP growth represented the best calendar year expansion since 1984 (when the overnight rate was 8.25 per cent and the 10-year Treasury yielded 11.5 per cent). Today’s 10-year US Treasury yield, adjusted for core CPI, is -4.3% – its lowest point since our records began in 1962. But with the economic backdrop now in a state of flux and geopolitical uncertainties on multiple fronts, where might markets go from here?

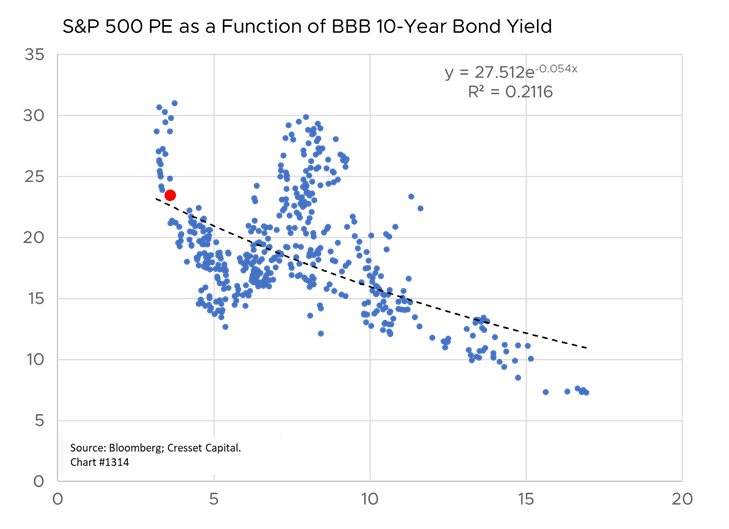

Historically low real interest rates, a key input to risk valuations, have enabled the market price-earnings ratio to expand. Over the last decade, the S&P 500 delivered a cumulative 362 per cent return to investors, 235 percentage points of which was attributed to valuation expansion – the willingness of investors to pay more for a dollar of earnings. For the same reason that valuations have benefitted from low interest rates, equity markets could be vulnerable to higher interest rates, especially in an environment in which the Federal Reserve is expected to raise overnight rates as many as seven times this year.

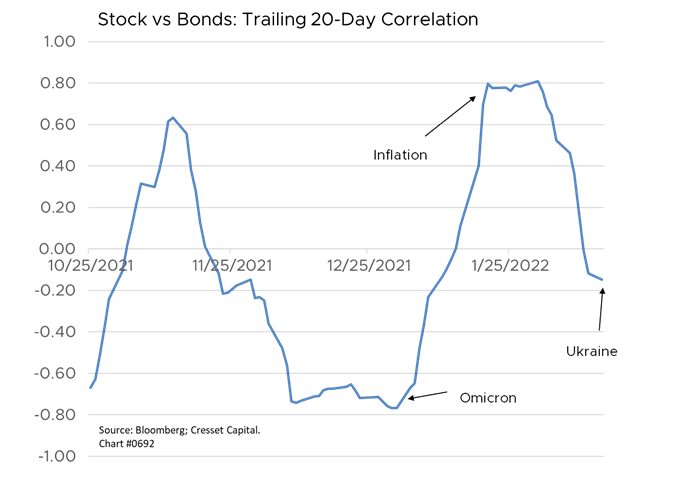

Bulls argue the equity market is correctly priced. While that may be the case, equities are leaning on bond yields that appear too low by historical standards. But, given the influence the 10-year Treasury rate wields in broad risk asset valuations, investors must focus on the belly of the yield curve. Inflation worries, prompted by the hottest CPI readings in 40 years, have pushed interest rates higher and equity markets lower. The 2-year Treasury yield, a Fed policy proxy, have surged from 0.2 per cent, as recently as October, to 1.6 per cent today. The correlation between stocks and bonds reached .80 by the end of January, underscoring the influence interest rates are imposing on equities.

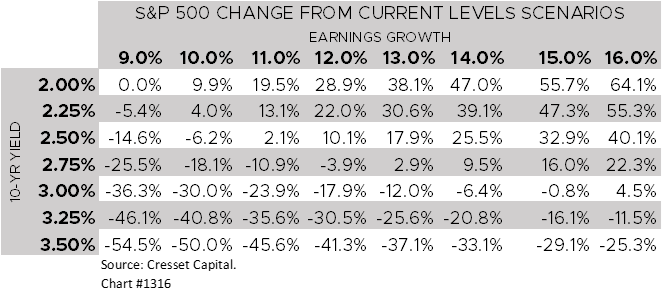

For now, the Treasury forward curve suggests the 10-year Treasury yield will peak at 2.25 per cent by 2031, not a far cry from today’s 2 per cent rate. But that could change, particularly in the face of tighter monetary policy and any cooling of geopolitical hostilities. Persistent inflation could force the Fed to unwind cheap financing, which in turn could prompt a bond market revaluation. Assuming equities are fairly valued based on 2 per cent 10-year Treasury yields and 9 per cent earnings growth, the table below estimates instantaneous S&P 500 price movements based on varying interest rates and earnings growth estimates. Stronger economic growth could push corporate earnings growth higher, but higher interest rates could undermine the optimism. We still believe inflation rates and economic growth will decline toward their longer-term trends by year end. In the meantime, we will be fixated on the 10-year Treasury yield, as it will likely be the most important determinant of equity prices this year.