5.1.2024 The US bond market is a great storyteller from a quantitative perspective. The bond market weighs in at over $50 trillion, a little larger than the combined market capitalization of all US equities. Because of the bond market’s size and liquidity, investors can easily infer market expectations for a host of indicators thanks to the interconnectedness of yields. Beginning in 2022, for the first time in nearly two decades, the bond market’s “voice” is no longer muzzled by repressive central bank policies, and bond yields reflect market forces. What are bonds telling us now that they can speak freely?

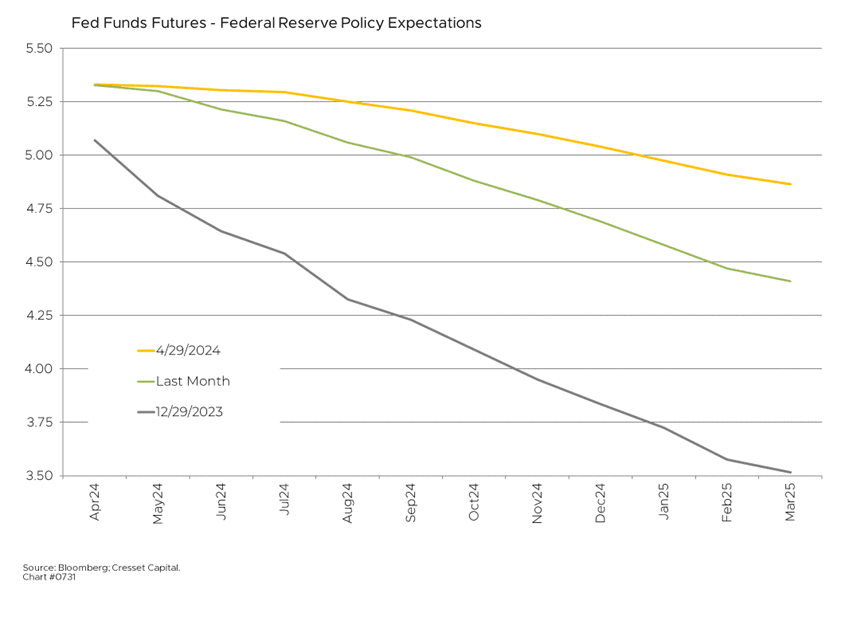

Expect a cut in rate cuts. Investors kicked off 2024 expecting Jay Powell & Company to deliver six rate cuts this year. Futures trading at the beginning of the year anticipated a 3.8 per cent Fed funds rate by December, implying six quarter-point cuts. Now, the December Fed funds rate is five per cent, implying just one cut this year. This week’s Fed meeting could quash the chance of any rate cuts this year. It was widely expected that lower overnight rates and easier financing would usher in a broader equity market, with small caps taking the performance baton from mega caps. But that hasn’t happened: year to date, the Russell 2000 is fractionally lower while the S&P is more than six per cent higher.

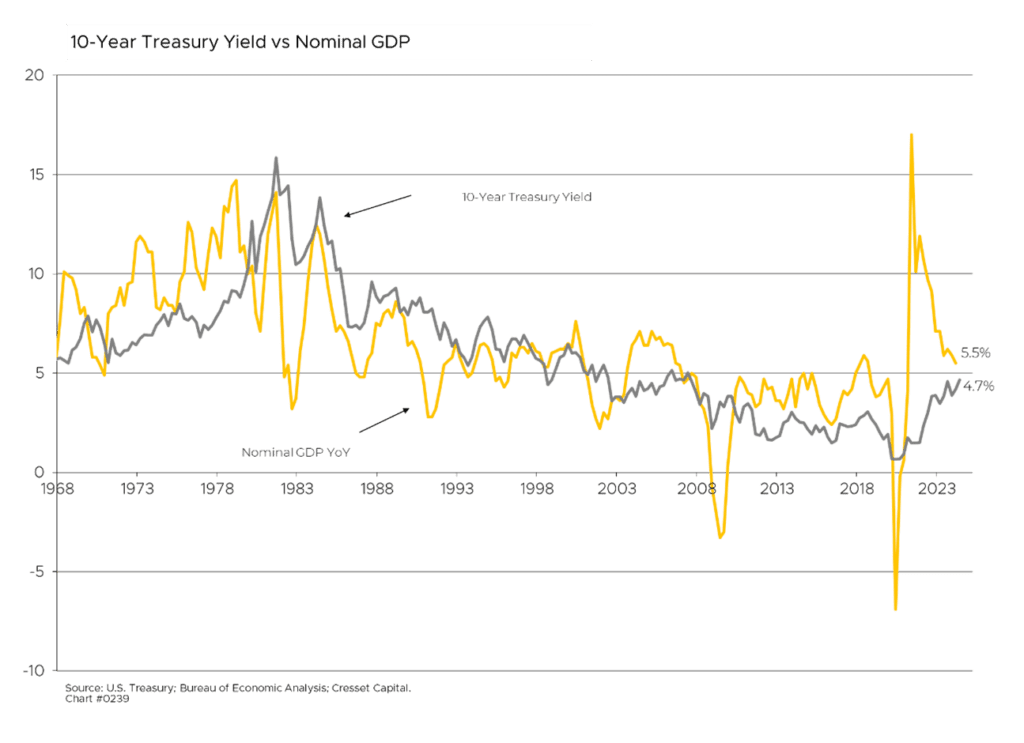

Nominal GDP is creeping higher. Over the long term, the 10-year Treasury yield reflects 10-year nominal GDP expectations (real economic growth plus inflation). So far this year the 10-year yield surged 0.7 per cent – from 3.9 per cent to 4.6 per cent – likely reflecting a higher estimate of all three nominal GDP components. These are higher labor force growth (due to increased immigration), an increase in forecast productivity (thanks to artificial intelligence), and hotter-than-expected inflation. At the beginning of January, the 3.9 per cent benchmark yield reflected expectations of 0.5 per cent annualized labor force growth, productivity gains at around one per cent (its long-term trend), and inflation at 2.5 per cent, totaling about four per cent nominal GDP growth. Now, the 4.6 per cent 10-year yield reflects a combination of immigration, productivity and inflation that’s nearly one percentage point higher annualized over the next 10 years.

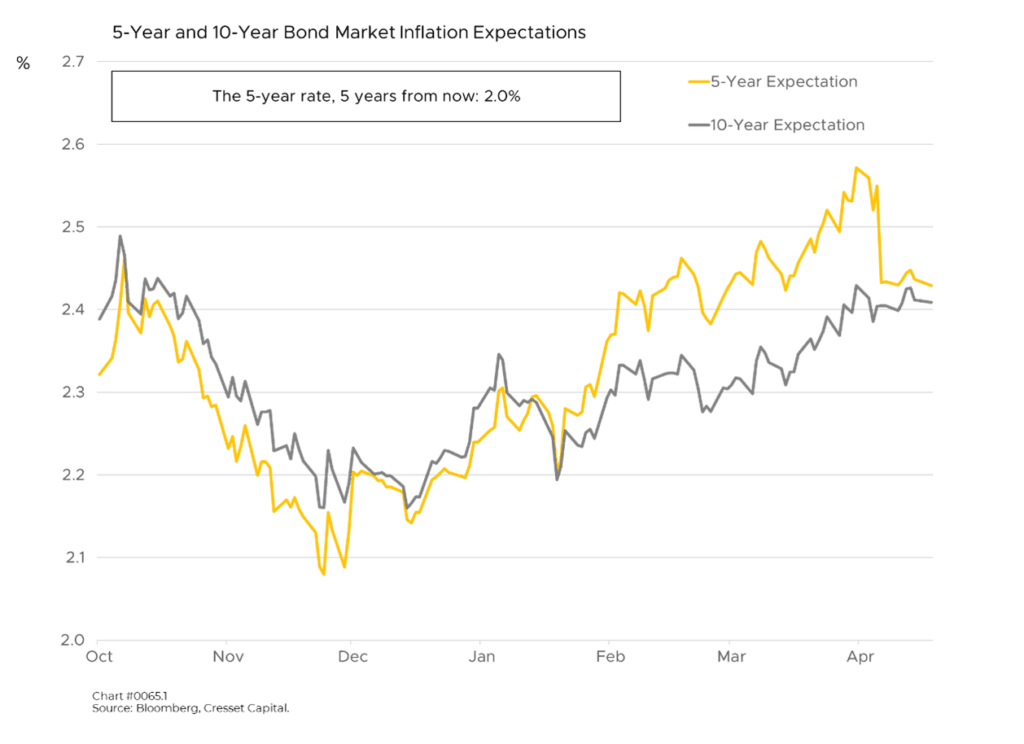

Inflation expectations are rising. Hotter-than-expected inflation reports have prompted investors to raise their inflation expectations, and not only for this year. At the outset of 2024 investors were anticipating the five- and 10-year annualized inflation rates to be 2.15 per cent and 2.17 per cent, respectively, in effect matching the Fed’s stated two per cent target. However, we can see based on inflation-protected Treasury yields that investors have since raised their five- and 10-year inflation expectations to 2.40 per cent and 2.42 per cent, respectively. It’s interesting to note that the five-year inflation rate, five years from now is eventually expected to reach the Fed’s two per cent target.

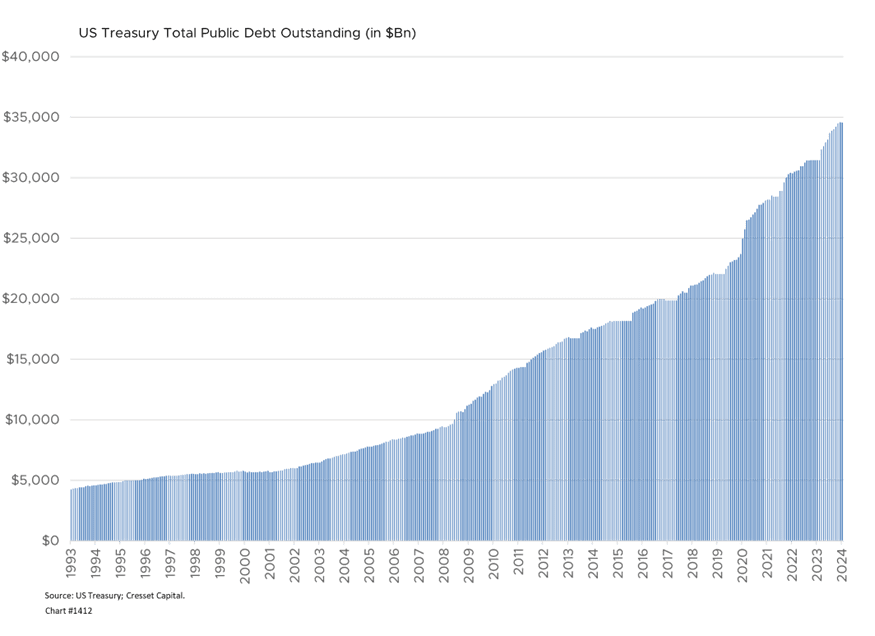

The US Government balance sheet is under pressure. Real yield – the yield differential the US Treasury pays over inflation – represents the risk premium bond holders require to extend credit to the US government. For nearly two decades that premium was negative, thanks to Fed intervention. That meant lenders were willing to lose some purchasing power when investing in US Treasury securities. Since the middle of 2022, the real yield has been in positive territory. Now, the 10-year Treasury yield is more than 2.2 per cent higher than the inflation rate, a level not seen in nearly 15 years. Perhaps investors, concerned about Washington’s fiscal morass, combined with the additional supply of new-issue Treasurys, are now requiring additional compensation to extend credit to the US government.

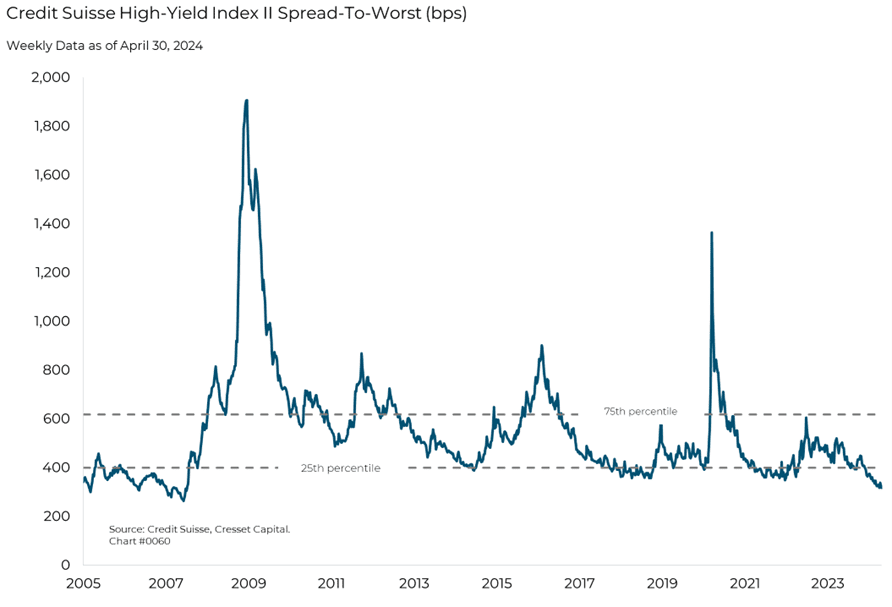

Lower-quality companies to benefit from inflation. While lenders are jacking up the yield premium they require to own US Treasurys, yield spreads on lower-quality corporate bonds remain tight. The yield differential between high-yield bonds and US Treasurys is the narrowest since 2007, according to Credit Suisse data. This suggests that lenders are more comfortable with lower-quality borrowers, believing that higher inflation makes debt repayment easier.

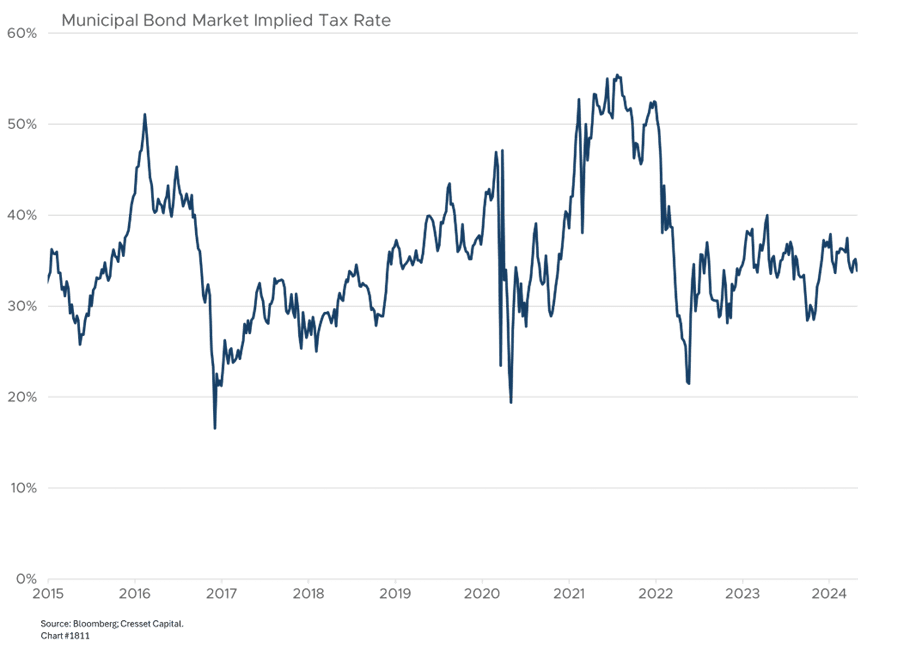

Personal income tax rates to maintain status quo, for now. The yield differential between high-quality corporate bonds and munis offers us clues to the direction of personal income tax rates. Tax-free municipal bond yields would decline relative to similarly rated taxable bonds if investors anticipate higher tax rates ahead. Investors seem not to be anticipating impending tax rate changes at present. In fact, the implied tax rate has been relatively steady for the last two years. This makes sense in an election year in which neither candidate would likely be willing to discuss tax rate hikes on the campaign trail. This could all change next year, depending on the outcome of the election.

Bottom Line: Given its size and liquidity, the bond market offers meaningful clues for the future. If current signals play out, we should expect continued growth, fueled by a favorable blend of labor supply and productivity gains. While bond investors are concerned about persistent inflation and fiscal imbalances in Washington, neither issue is currently ringing alarm bells. The municipal bond et is not predicting a personal income tax rate increase – although we expect taxes, either personal or corporate, or both, will need to rise to address our fiscal situation.