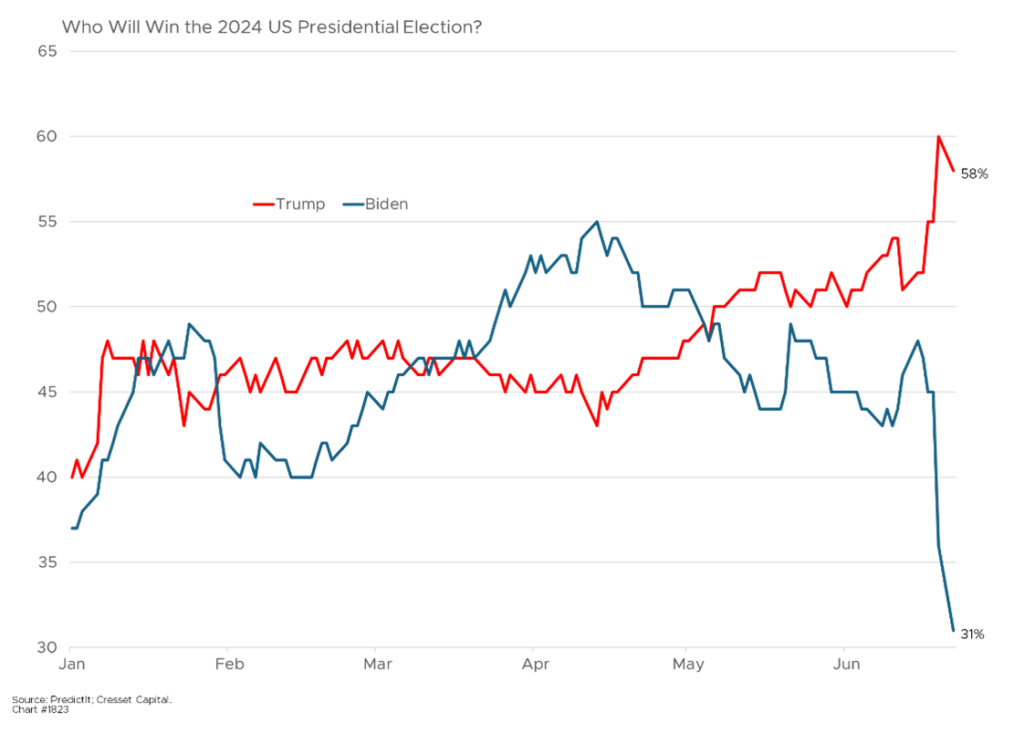

07.02.2024 President Joe Biden’s poor performance in the debate last week carries implications for both the Democratic Party and for financial markets. The debate was difficult to watch; Biden appeared weak and confused, he repeated anecdotes, and generally struggled for 90 minutes. While Donald Trump’s performance arguably might have warranted some fact-checking, Biden’s shambolic display overshadowed any criticism aimed at the former president. The negative reaction was swift: Biden’s presidential chances plunged from 45 percent prior to the debate to 31 per cent on PredictIt, a non-profit, political outcome futures market. Trump, meanwhile, surged to 60 per cent before settling at 58 per cent.

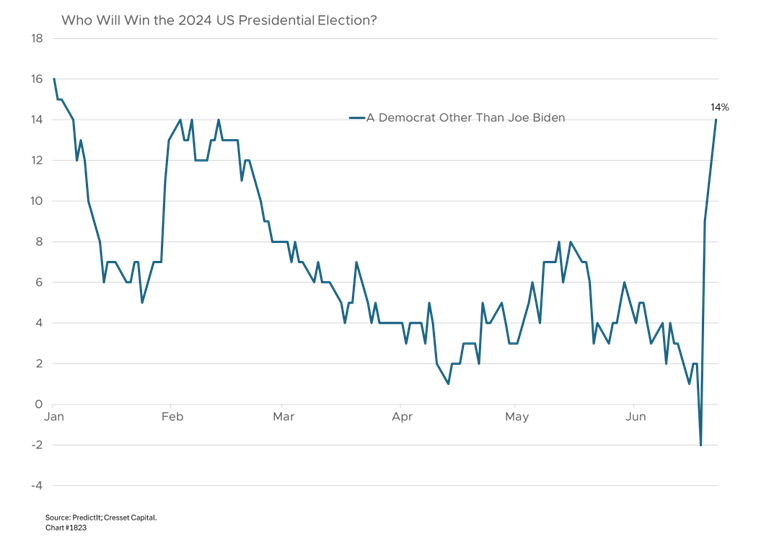

The odds of a Democrat other than Joe Biden occupying the White House jumped from a virtual impossibility to 14 per cent in the wake of the debate, offsetting the decline in Biden’s chances, as party insiders weigh their options.

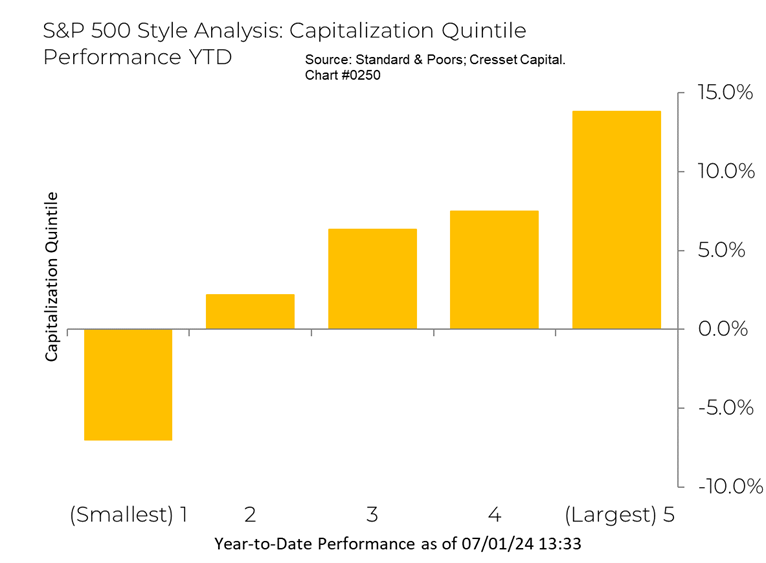

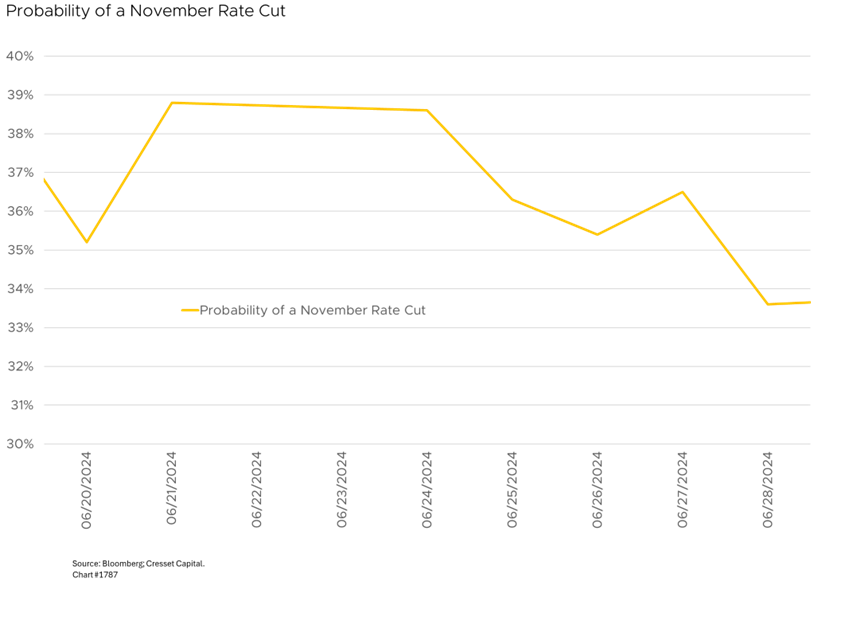

Investors appear to be positioning for a Trump victory. The investment implications of Trump being back in the White House include, most notably, a higher-for-longer Fed as the likelihood that the corporate tax cuts would be extended next year increases. Higher borrowing costs favor larger, high-quality companies with lower debt levels and unfettered access to capital. More highly leveraged, smaller companies that have trailed in equity trading this year would likely lose additional ground next year. The odds of a November rate cut slipped about three percentage points, to 33 per cent, in response to the debate.

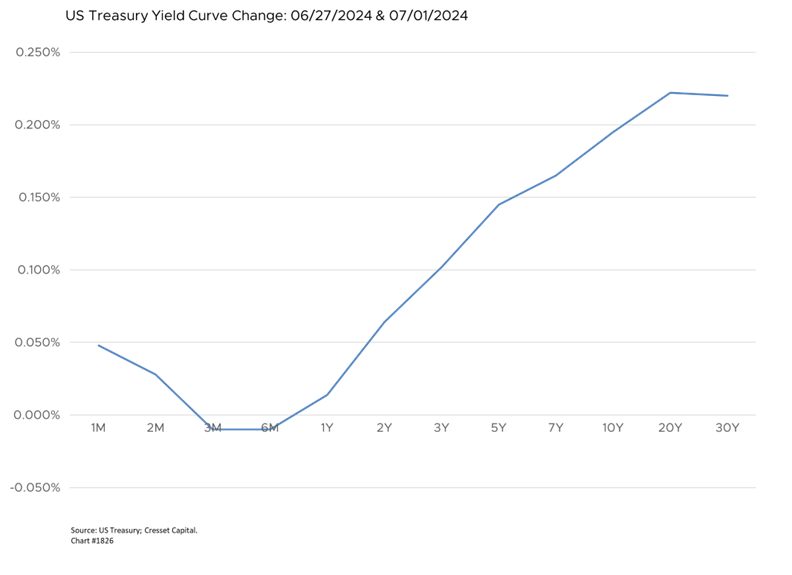

Moreover, investors are bracing for higher long-term inflation. The possibility of higher tariffs on imported goods would put upward pressure on prices by creating a price floor for domestic manufacturers. Chinese-made electric vehicles, for example, are currently priced well below US-made EVs. Protectionist policies would benefit US automakers and their workers at the expense of consumers, pushing prices higher and demand lower. Intermediate- and long-term yields rose more than 0.2 per cent in reaction to the debate. At the same time, immigration caps would put upward pressure on wages.

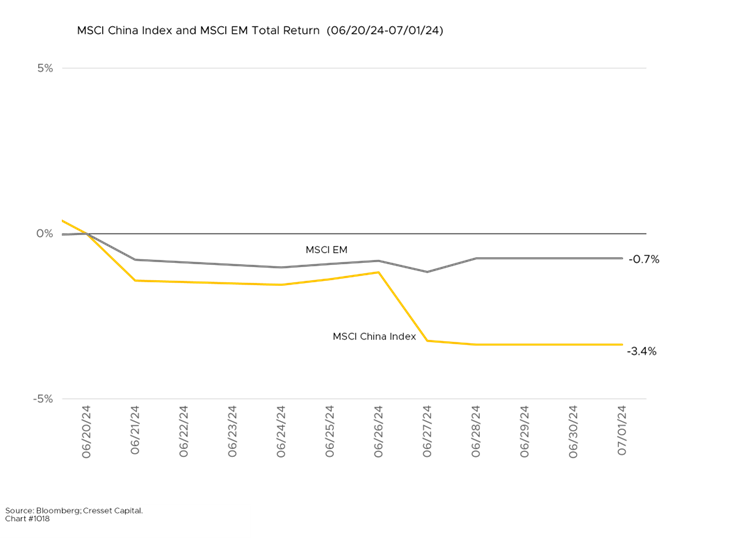

Similarly, investors reduced their exposure to Chinese equities, anticipating that Trump would take a tougher stance against our trading partner and rival. A country already struggling under the weight of its overextended property market could suffer as populist governments pop up not only in the US, but in France, Germany and the UK as well.

Bottom Line: While it’s still early in election season, the market appears to be pricing in higher chances of a Trump victory following the debate, with expectations of less accommodative monetary policy, faster inflation and a steeper yield curve. In an environment in which borrowing costs stay elevated, higher-quality, larger companies would outperform smaller, more highly leveraged names. Year to date, the 100 largest stocks in the S&P have on average outperformed the smallest 100 names by more than 20 percentage points. That trend will likely continue if borrowing costs remain elevated. Meanwhile, it’s important to note that recent market trends are based on initial reactions and market expectations could shift as the campaign progresses.