12.6.2023 As investment legend Jack Bogle put it, “The stock market is a giant distraction to the business of investing.” Indeed, investor emotions play an outsized role, at least over the near term. And history suggests emotion-led investing leads to disappointment. While we at Cresset like markets that are both cheap and moving in the right direction, we also keep tabs on investor attitudes. In a world in which market movements are guided by the intersection of expectations and reality, we like to know whether expectations are high or low. Along the continuum of investor fear and greed, we find that extremes – either widespread optimism or enveloping pessimism – matter for the equity market’s direction over the near term.

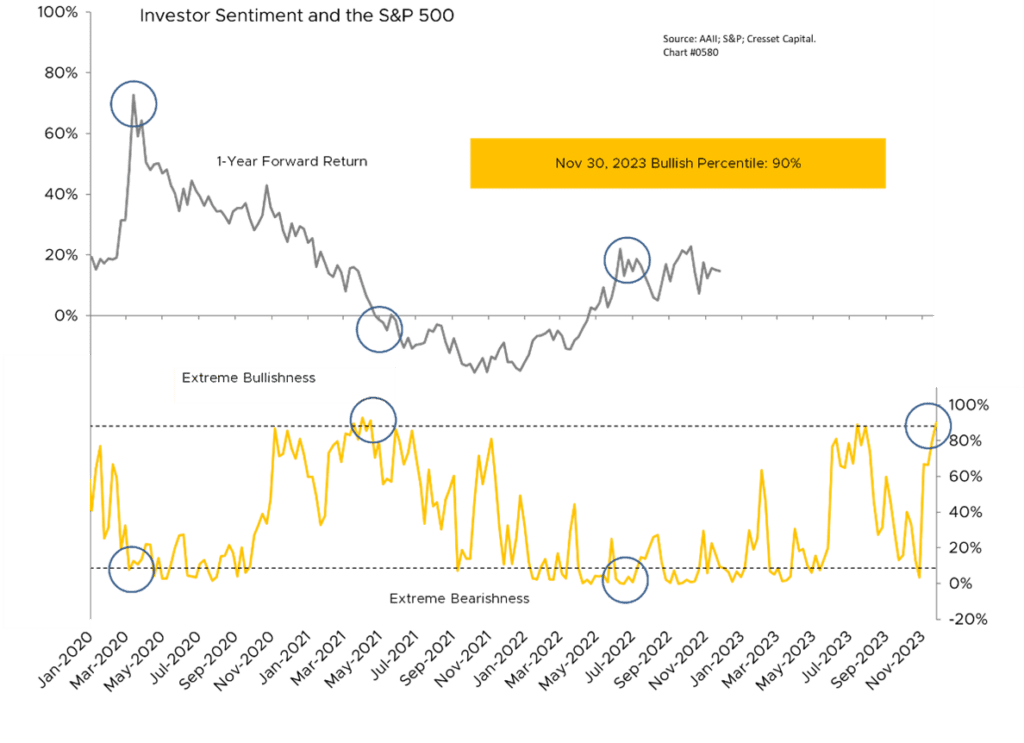

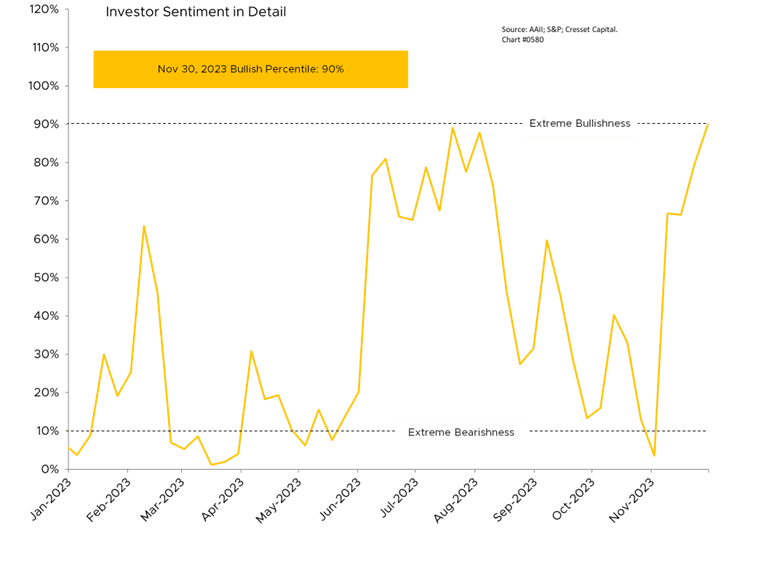

This year has proved to be a good example of an emotionally charged market. Investors were down in the dumps as 2023 kicked off. We had just closed the books on one of the worst years for both stocks and bonds in decades. Positive surprises on the inflation front helped usher in a bullish January, leaving the S&P more than six per cent higher for the month. Pessimism persisted as US large caps continued their climb. But optimism bloomed by the end of July, fueling a 20 per cent advance in the S&P 500 and thrusting bullishness into the top decile of its historical range. That was a market peak: US large caps fell 10 per cent from the end of July through October, coinciding with cascading confidence. By the end of October, bullishness was about as rare as a New England Patriots touchdown, setting the stage for nine per cent November. That move sparked another round of investor enthusiasm, leaving optimism in the top decile again.

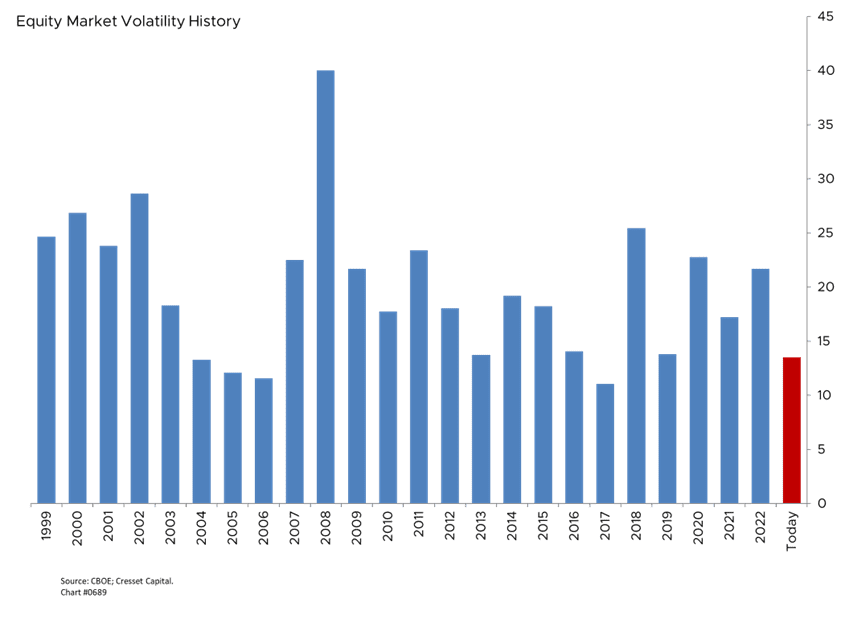

Other indicators, like stock market volatility (VIX), underscore investor complacency. The VIX is a real-time market fear gauge. Market volatility, which typically trades around 20 per cent, reached 80 per cent during the depths of the financial crisis in 2008 and the pandemic lockdown of 2020. Today’s market volatility, at 13.5 per cent, is in the bottom quintile of its historical range back to 1990.

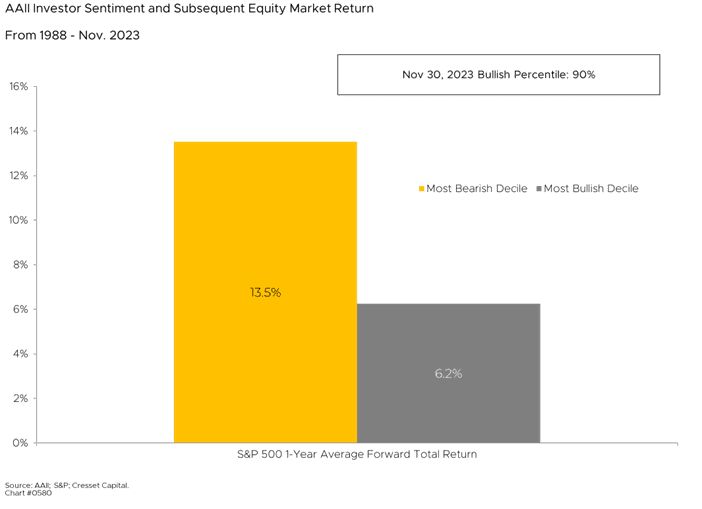

History suggests that investor sentiment, at its extremes, is an important ingredient in subsequent market performance. The difference between the extremes is that performance, when starting from an excessively bearish market position, is more than double the rate than when starting from an excessively bullish position.

Bottom Line: Investor sentiment acts more like a spice than a major ingredient when gauging markets over a one- to three-year period. That’s because sentiment is mercurial and only effective at the extremes. It should come as no surprise that bullishness surged along with the S&P 500 last month. November was the best-performing month this year and the strongest since July 2022. While we’re optimistic equities could advance next year on slowing growth and slowing inflation, history suggests equity markets could be vulnerable in the near term with such elevated expectations.