02.15.2023 To paraphrase Newton’s First Law of Motion, “A body in motion will remain in motion unless acted upon by an outside force.” What can be said for objects can also be applied to financial markets, particularly ones that are cheap or relatively cheap. Value buyers are too often early, entering a cheap market that, frustratingly, gets even cheaper: think value stocks in 2017. Notwithstanding the relative attractiveness of value stocks on a price/earnings and price-to-book basis, they ended up trailing their growth counterparts by nearly 50 percentage points over the subsequent five years. Momentum, when used in concert with valuation, helps identify a cheap market that investors have “discovered”. Momentum, elaborated upon by Sir Isaac in 1687, is the key that helps us identify opportunities for outperformance.

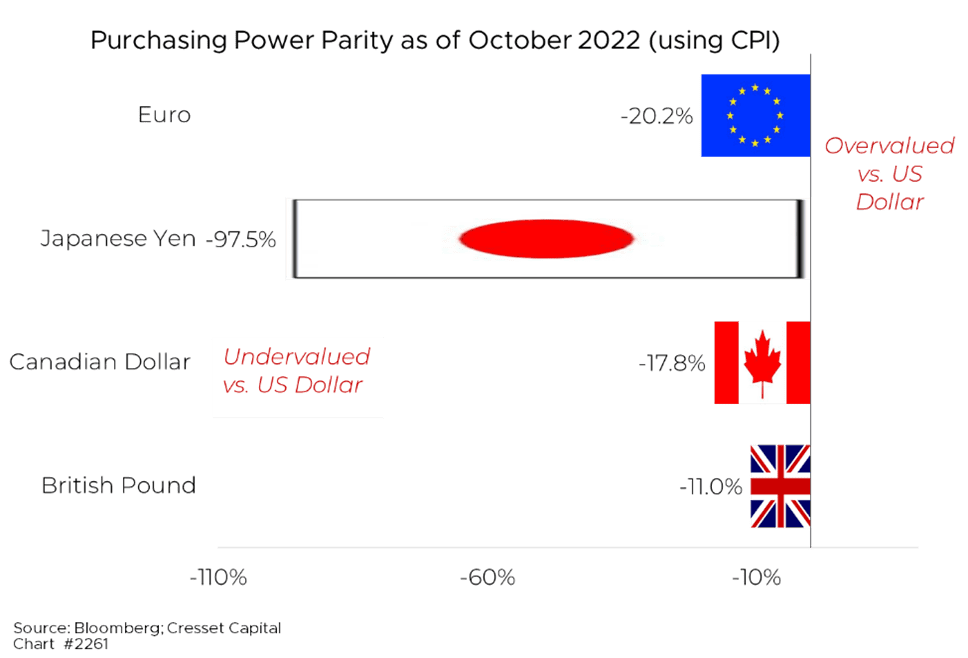

Similarly, an expensive market that loses momentum can be a great sell signal. The US dollar is the latest example. Aggressive Fed rates hikes led to a US dollar rally last year against most of the world’s currencies. Between January 2021 and October 2022, the dollar index surged more than 25 per cent, leaving the greenback fundamentally expensive relative to the currencies of our trading partners. Comparing the costs of a constant basket of goods in each currency, the dollar, at its peak, was 20 per cent overvalued vs the Euro and 10-20 per cent too expensive against the pound and Canadian dollar. By this measure, the US dollar was the most expensive vs the Japanese yen in history!

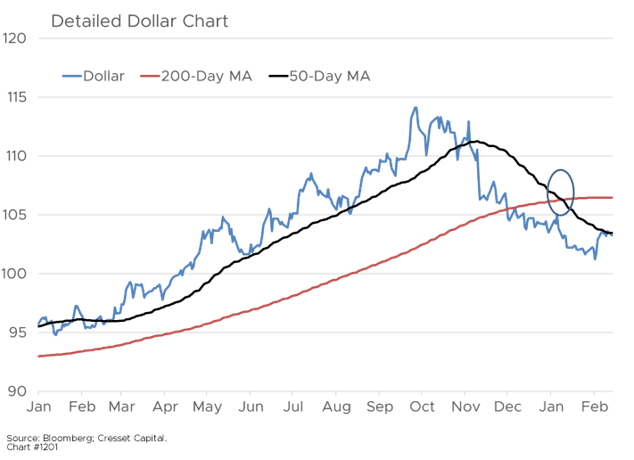

Cresset determines dollar momentum by comparing the currency’s 50-day moving average (MA) to its 200-day moving average. Positive momentum is defined as the 50-day MA being above the 200-day MA, and vice versa. On that score, momentum broke down on January 9, three months after the dollar’s trajectory reversed late last year.

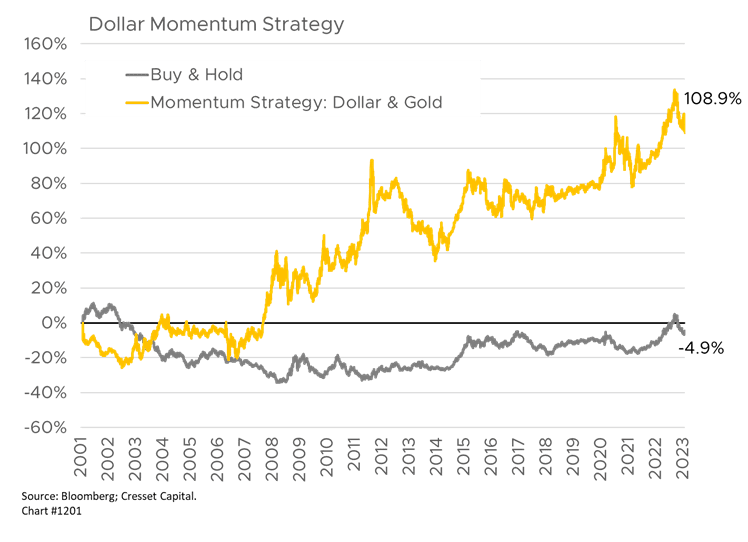

History has shown that the 50/200- and 200/50-day moving averages have been strong directional indicators for the US dollar, ushering in a trend that often lasts 12-18 months. Using dollar momentum as a buy-sell rule has delivered positive results over time. Swapping between the dollar, when its momentum was positive, and gold, when the dollar’s momentum was negative, delivered a cumulative gain of 108.9 per cent since 2001. That result trounced the -4.9 per cent cumulative return of buying and holding the dollar the whole time.

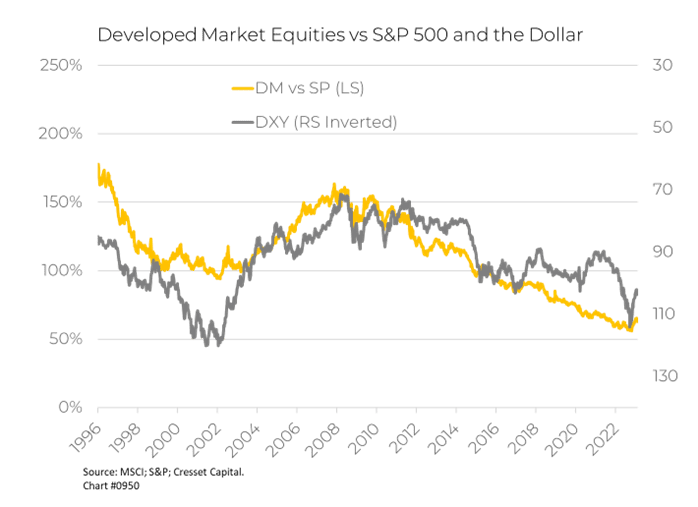

Dollar trends are also helpful in determining the allocation decision between US and foreign equity markets, with foreign markets tending to outpace their US counterparts when the dollar’s trend is negative. Between 2011 and 2022, the dollar advanced more than 50 per cent against a basket of currencies, which helped propel the S&P 500 to outpace developed market equities by nearly 60 per cent. Over the last half-century, the dollar’s direction corresponded with foreign underperformance or outperformance 39 of the last 50 years.

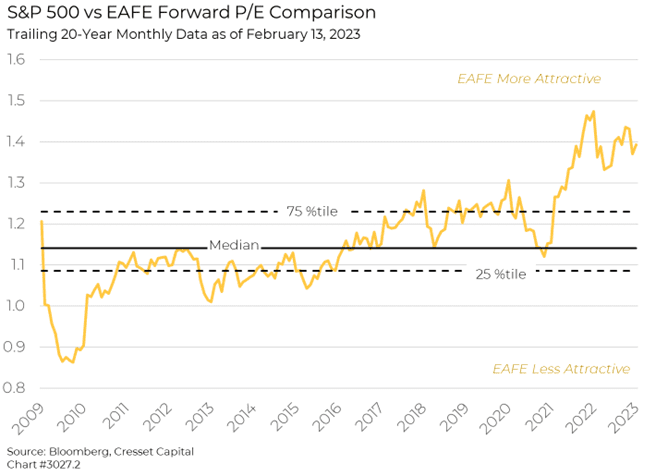

At the same time, developed market equities are relatively cheap when gauged against the S&P 500. Blame years of underperformance and the pall of war hanging over Europe, international equities’ relative forward price/earnings ratio is not far from being the cheapest it’s been over the last 15 years, according to our research.

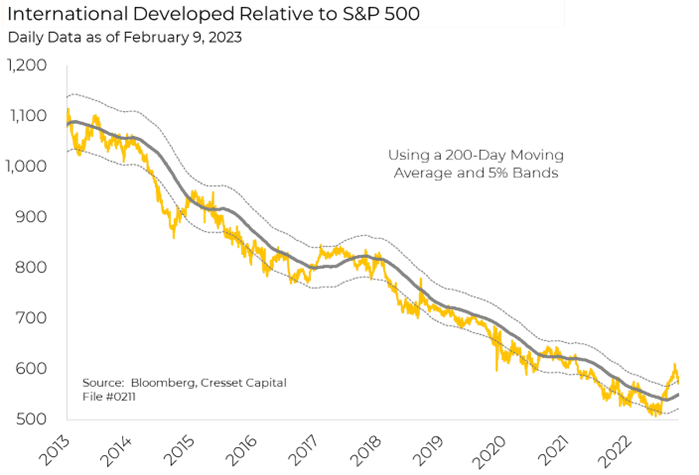

Not only are international equities more attractively priced, they’re beginning to break out relative to US equity markets. International equities recently broke more than five percent above their 200-day moving average of relative performance vs the S&P 500. This represents its first momentum breakout in over a decade, exemplifying investors’ recognition that foreign markets present a near-term opportunity.

Bottom Line: The combination of relatively cheap valuation and positive momentum, along with negative dollar momentum, suggests international equities offer an interesting opportunity to outpace their US counterparts. Thank you, Sir Isaac Newton. We’d give an apple to the teacher – but you already have one.