4.10.2024 Earnings season, like the end of a scholastic semester, is when corporate report cards are issued. Investors, like parents, have expectations and earnings reports, like students’ report cards, approximate truth. Ensuing disappointment, or pride, often depends on expectations. This earnings season, investors’ expectations are running high. The S&P 500 delivered strong first quarter gains despite deteriorating prospects for rate cuts. The probability of a March rate cut was a virtual lock entering the year and evaporated early, in response to hot inflation and payroll reports. Bond yields and oil prices, meanwhile, rose in response, belying the enthusiastic equity view. The 10-year Treasury yield spiked more than 0.3 per cent over the quarter and spot crude spurted 20 per cent. Yet equity investors shrugged off rate cut disappointments and focused on the economy’s underlying strength. Perhaps optimistic equity investors are counting on both lower inflation and strong economic growth. Q1 earnings season should offer us clues.

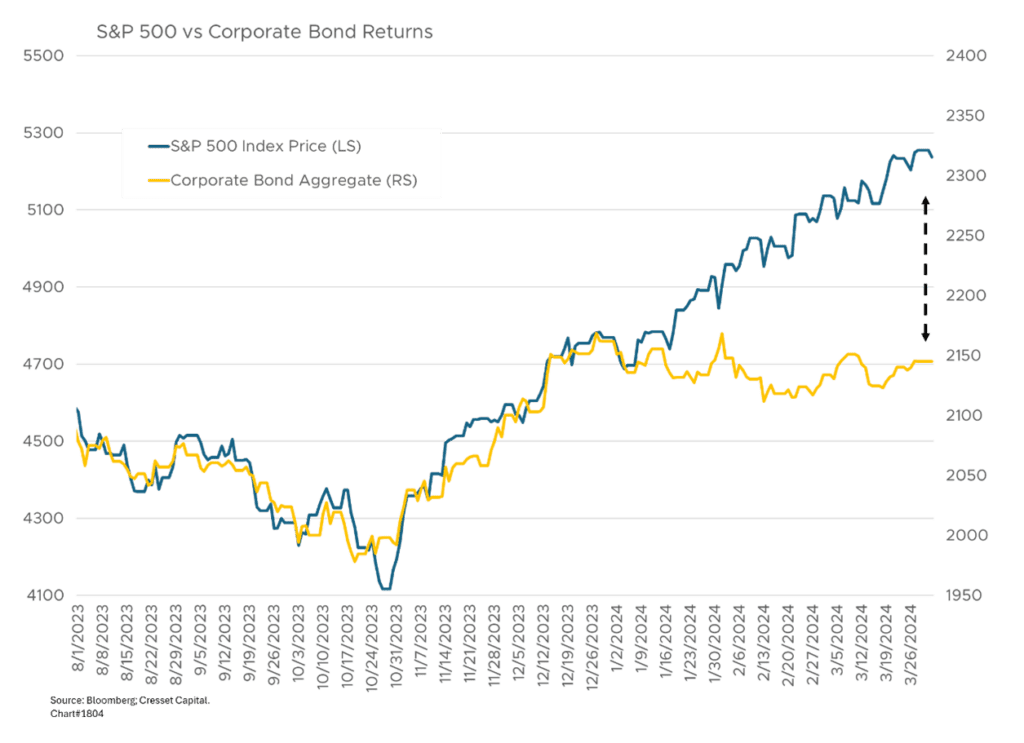

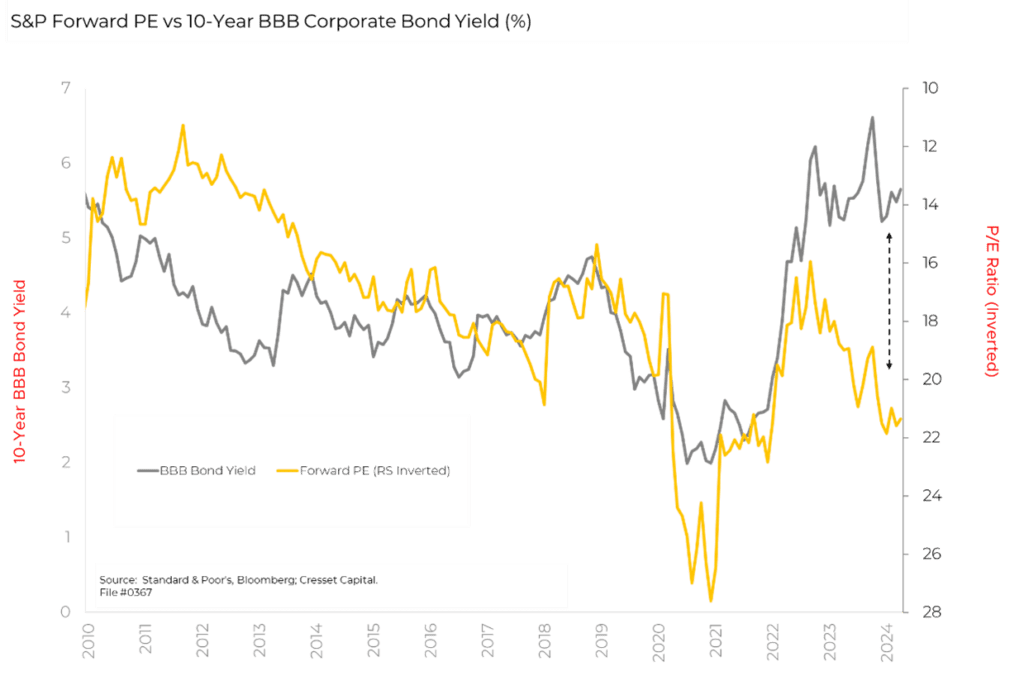

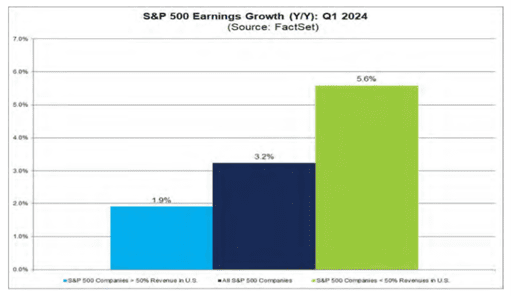

Q1 earnings profit growth forecasts of around three to four per cent year over year are rather modest, with revenue growth also in the three to four per cent range. However, it would mark the third straight quarter of positive earnings growth and the slowest quarterly earnings growth of 2024. Nonetheless, profit growth expectations have been falling, with consensus earnings growth for the quarter was nearly seven per cent as recently as January. Strong Q1 S&P performance against a backdrop of deteriorating profit growth has left valuations somewhat vulnerable. The S&P 500 trades at 20x expected earnings per share for the coming 12 months, high relative to current bond yields. The coming quarters will show whether corporate profits can back up investor enthusiasm. Either earnings growth will have to ramp up or interest rates will have to head lower to justify today’s stock-bond relationship.

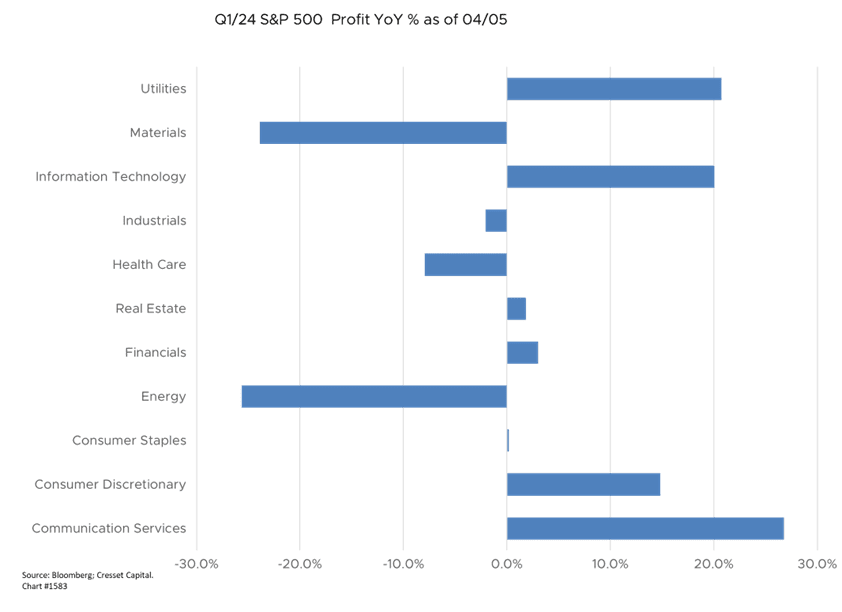

Meanwhile, most of the quarter’s earnings growth is expected to be concentrated in a small number of big tech companies like Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta and Tesla. Excluding these seven firms, the rest of the S&P 500 could see earnings growth decline in Q1. However, the trend is expected to reverse and improve by Q4, with the broader market seeing stronger earnings growth than the big tech firms. It’s interesting to note that most of Q1’s earnings growth will be concentrated among companies that generate less than half their revenue inside the US, like technology and communications companies.

Seven of the S&P’s 11 sector groups are expected to exhibit profit growth with utilities, communication services and technology leading the way higher. Commodity-oriented, energy and materials sectors will likely show the biggest profit growth declines. Analysts have been raising earnings estimates for previously lagging sectors like utilities, financials, and healthcare faster than they are lowering estimates, a positive sign. And corporate profit margins are expected to hold steady despite some uptick in inflation, helped by still-elevated pricing power and easing input costs.

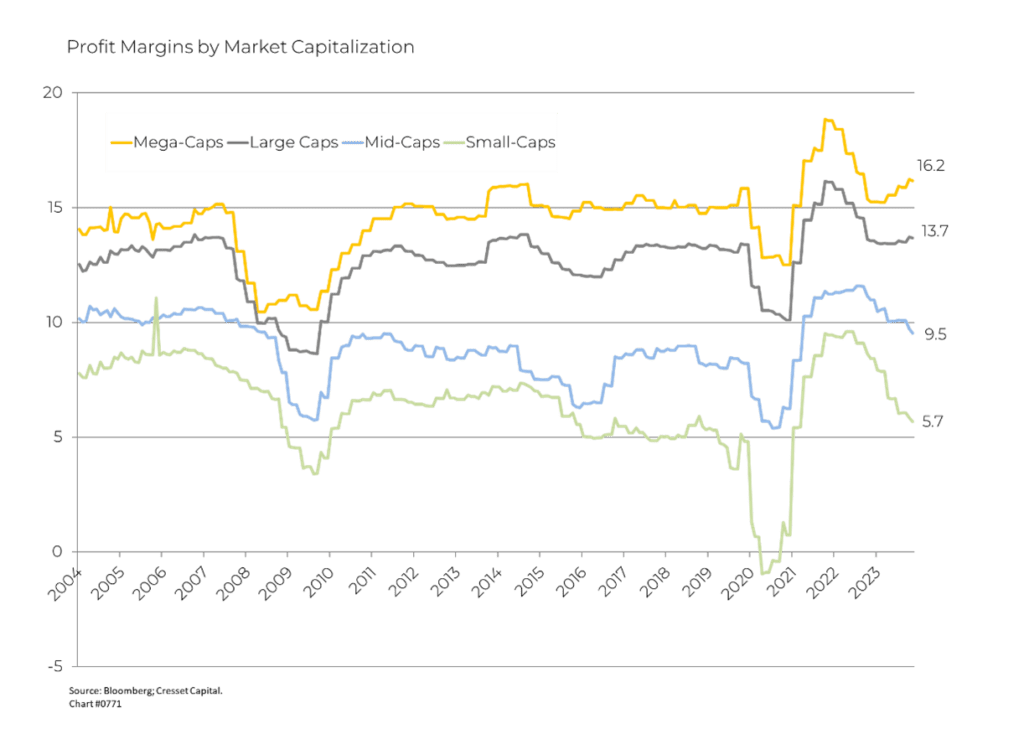

Despite the Q1 earnings optimism, we see signs that analysts and companies have recently started to turn more cautious in their outlooks again after being overly optimistic earlier this year. Several significant economic and market uncertainties could negatively affect results and guidance as the year unfolds. Meanwhile, operating profit margins are expected to remain robust, particularly for the largest companies which typically have unfettered access to capital. Margins among their smaller brethren are expected to contract due to higher financing costs and less ability to pass along price increases.

Bottom Line: Optimistic investors hope continued economic resilience and ambitious outlooks will propel earnings and validate the big year-to-date rally in stocks. While companies and households are adapting to higher interest rates, investors will be closely attuned to signs of rising inflation, weaker demand, and reduced corporate outlooks that could potentially undermine the bullish narrative. Q1 earnings season will be an important test for markets.