3.14.2024 Despite rising interest rates and geopolitical tensions, the US stock market has reached new all-time highs: the S&P 500 has risen 36 per cent in the past 12 months. This rally has been driven in part by a handful of giant technology companies, particularly those involved in artificial intelligence (AI), like Nvidia. However, the gains have broadened to include a wider range of companies, signaling investor optimism about US economy and recent productivity gains.

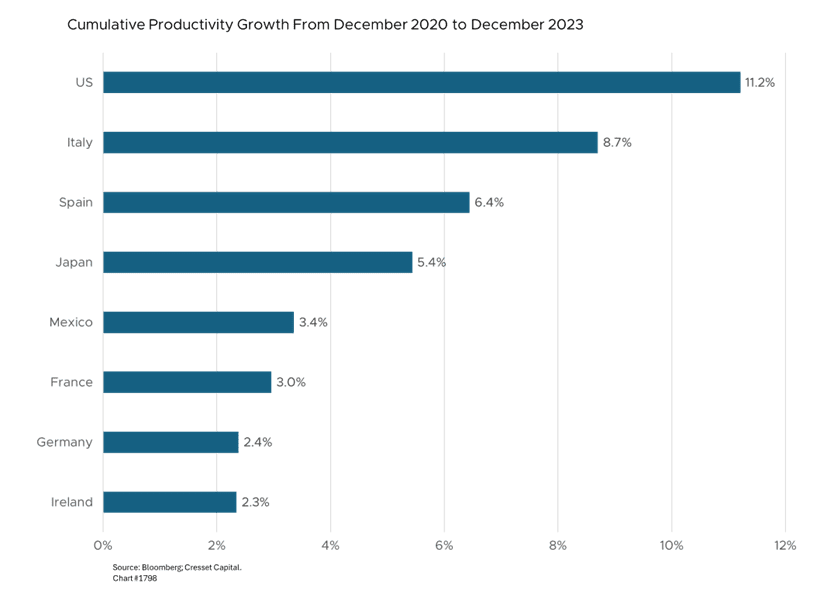

Productivity, measured as output per hour worked, is an economic silver bullet that enables an economy to expand and standards of living to improve without inflation. Productivity has improved significantly in the US since the pandemic, outpacing gains in the Eurozone and Japan. Several catalysts lie behind our nation’s productivity surge. Some economists point to the tight labor market incentivizing businesses to invest in automation and efficiency. Business investment has improved in recent quarters, although it’s been trending downward relative to GDP. Other factors like strong fiscal stimulus, the reopening boom, and a surge in new business formation could have fueled the productivity surge. Government expenditures between 2020 and 2023 totaled $144 trillion, according to Bureau of Economic Analysis data, helping power a spending and investment renaissance. Of course, AI is a factor, although we believe recent productivity growth has less to do with new technologies than with strong demand and labor shortages.

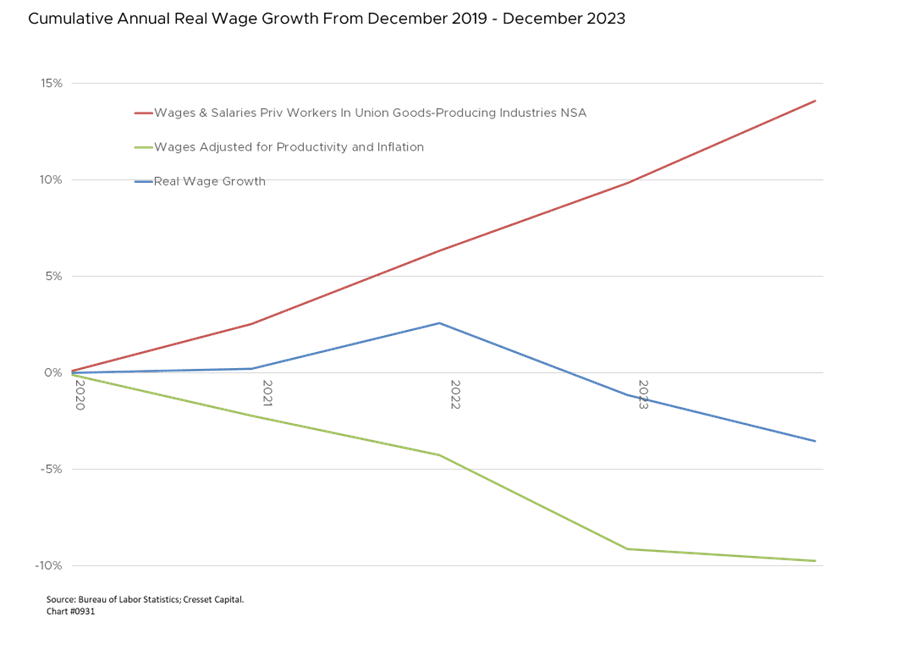

Productivity gains are expected to continue as AI becomes more accessible. There’s a debate, however, as to whether AI’s productivity benefits gravitate to labor or to capital. Some analysts worry that if productivity gains are attributed mainly to AI rather than to worker input, wage growth could suffer. History has shown that productivity gains have funneled to profits rather than paychecks. Between 2020 and 2023, goods-producing union wages rose nearly 15 per cent. However, adjusted for inflation and productivity, wages contracted nearly 10 per cent.

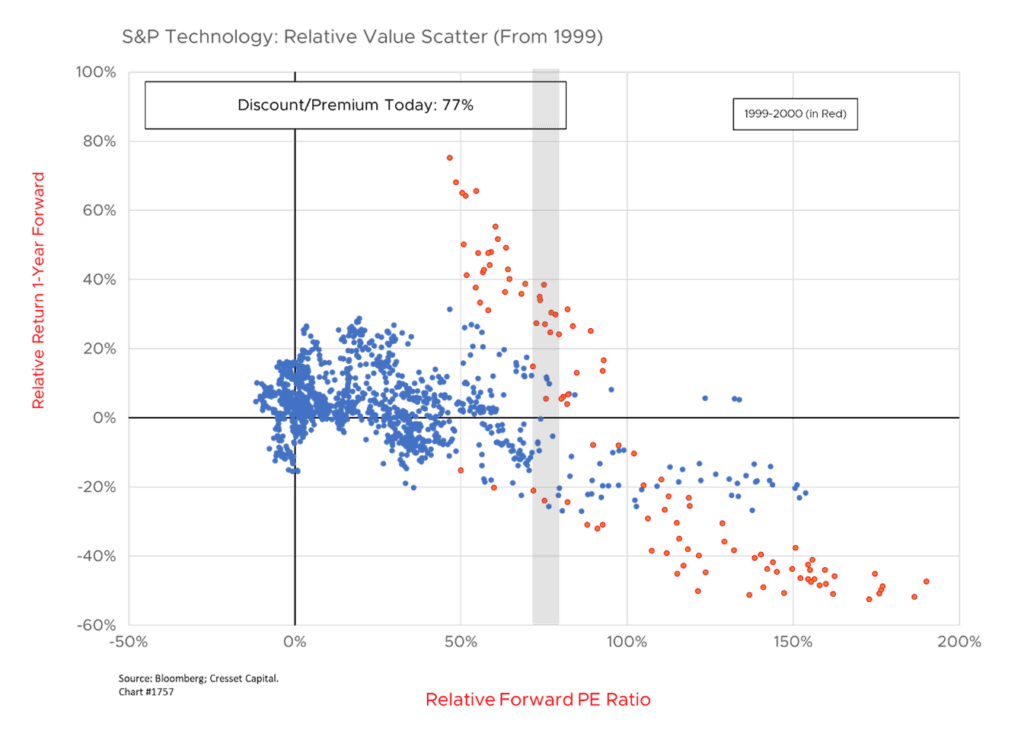

For now, a favorable combination of strong productivity growth and a robust economy is enabling a “soft landing” in the face of elevated interest rates. While there are risks that the equity rally becomes a bubble if valuations and investor exuberance around AI get too stretched, we take comfort that the average stock is “fairly” valued and lower short-term rates could usher in a broader market with the average name outperforming mega-cap tech. The tech sector is currently trading at a 77 per cent valuation premium to the rest of the market. History has shown that tech underperforms over the subsequent year compared to its “current” relative valuation. The red dots on the scatter show the relative valuation and subsequent performance of the tech sector in 1999 and 2000, a period that witnessed the tech bubble and bust. It should be noted that at its peak the tech sector traded at a nearly 200 per cent premium to the rest of the market.

Bottom Line: We believe continued productivity growth driven by automation, AI, and business investment will support higher economic growth and corporate profits while keeping inflation quiescent. In fact, a prolonged period of rising wages and tight labor markets could spur a virtuous cycle of investment, productivity growth, and higher living standards, although capital has tended to enjoy an outsized benefit from productivity. While history suggests economies face a tradeoff between employment and inflation, productivity could enable us to have our cake and eat it, too. Risks remain, however. A broader market could coincide with weaker market indices, if the prices of the largest names decline even as the average share price improves. And recent readings suggest that it’s too early for the Fed to declare victory over inflation just yet.