Key Observations:

- Dollar headwinds: trade policy, fiscal deficits, threats to Fed independence

- Foreign investors reducing dollar exposure at unprecedented pace

- The implications of losing dollar primacy would be significant

- Weakening trend likely to continue for now

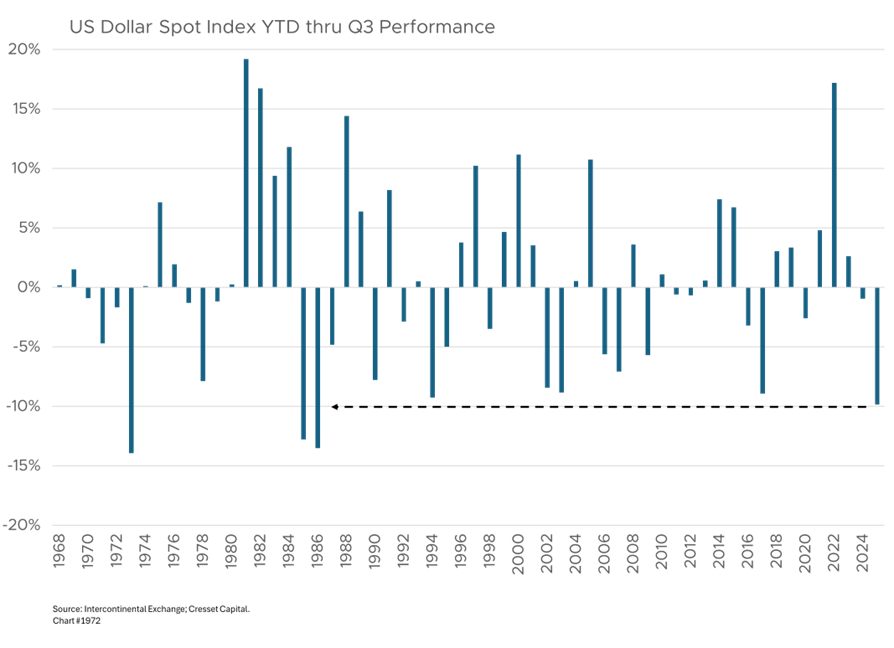

The U.S. dollar has experienced a historically significant decline in 2025 – the U.S. Dollar Index (USDX) has fallen about 10 per cent so far this year, its worst nine-month start since 1986. On a trade-weighted basis, the greenback is suffering its worst start to a year since 1973. Dollar weakness stands in stark contrast to the resilient performance of U.S. equity markets, creating an unusual divergence that reveals concern about American economic policy and institutional stability.

Dollar Headwinds: Trade Policy, Fiscal Deficits, Threats to Fed Independence

It’s interesting to note that during President Trump’s first term, the dollar actually appreciated significantly, but this time recovery appears more difficult due to a weakening real economy and:

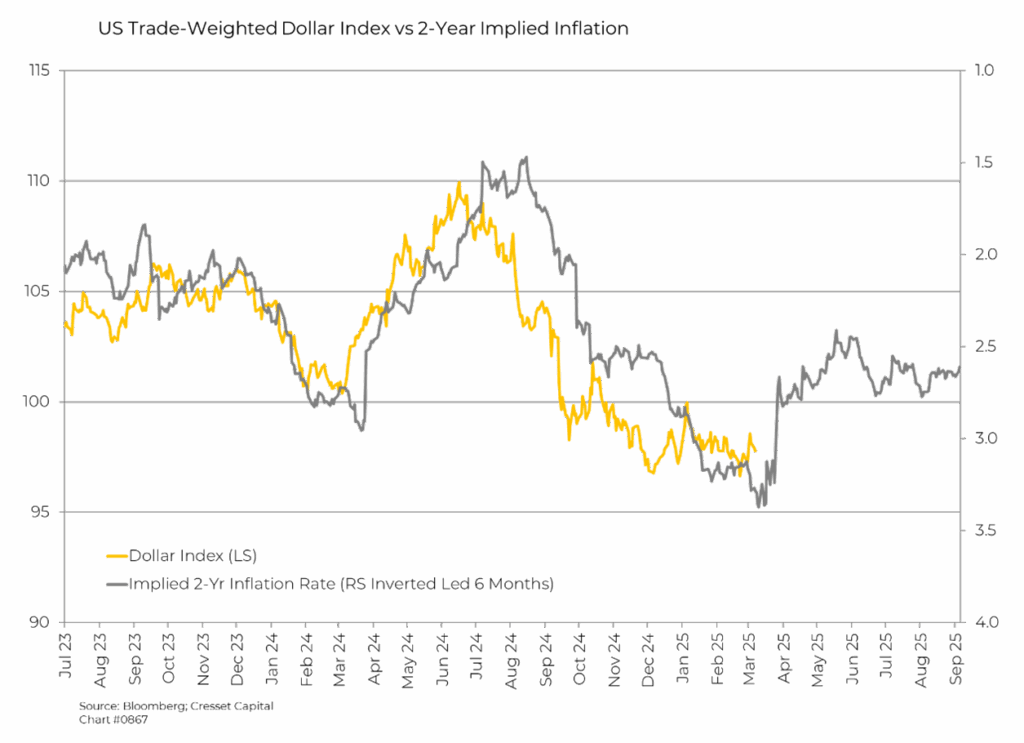

- Capricious trade policy. The trade war has caused the dollar to depreciate much more than interest rate differentials would suggest. Trump’s global tariff regime, while intended to boost domestic manufacturing, has undermined confidence in U.S. economic management. Meanwhile, dollar depreciation itself creates inflationary pressure. A 10 per cent decline in the dollar historically boosts inflation by approximately 0.3 per cent, creating a one-two punch of tariff-driven inflation combined with currency-driven inflation.

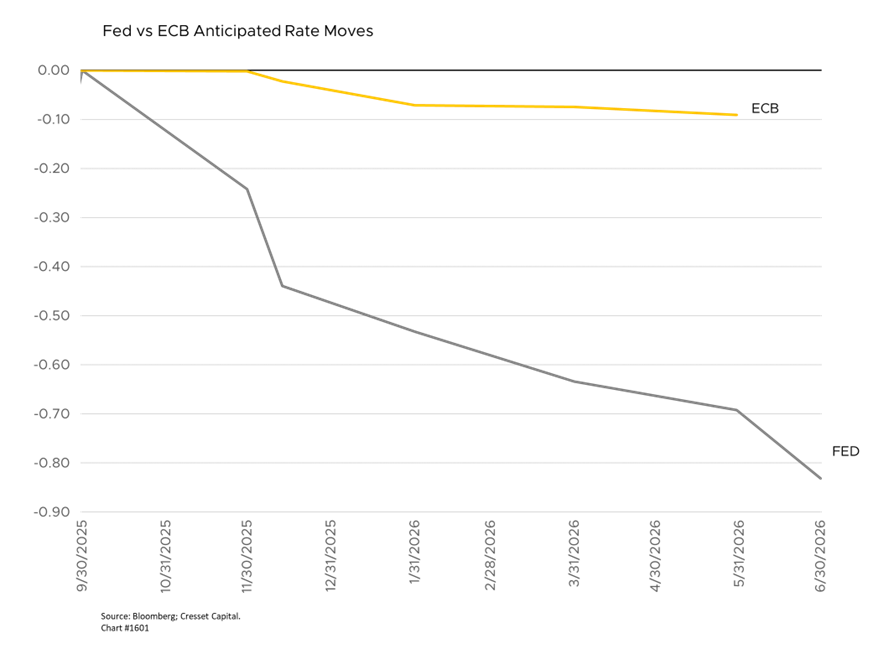

- Shift in relative monetary policy. The FOMC has resumed cutting interest rates while other major central banks are signaling that their cutting cycles might be ending. This reduces the dollar’s yield advantage, with one Fed appointee penciling in an additional 1.25 percentage points, nearly twice the rate cuts investors anticipate by year-end, implying a crisis-style policy. The convergence in interest rate differentials has removed a key pillar supporting the dollar.

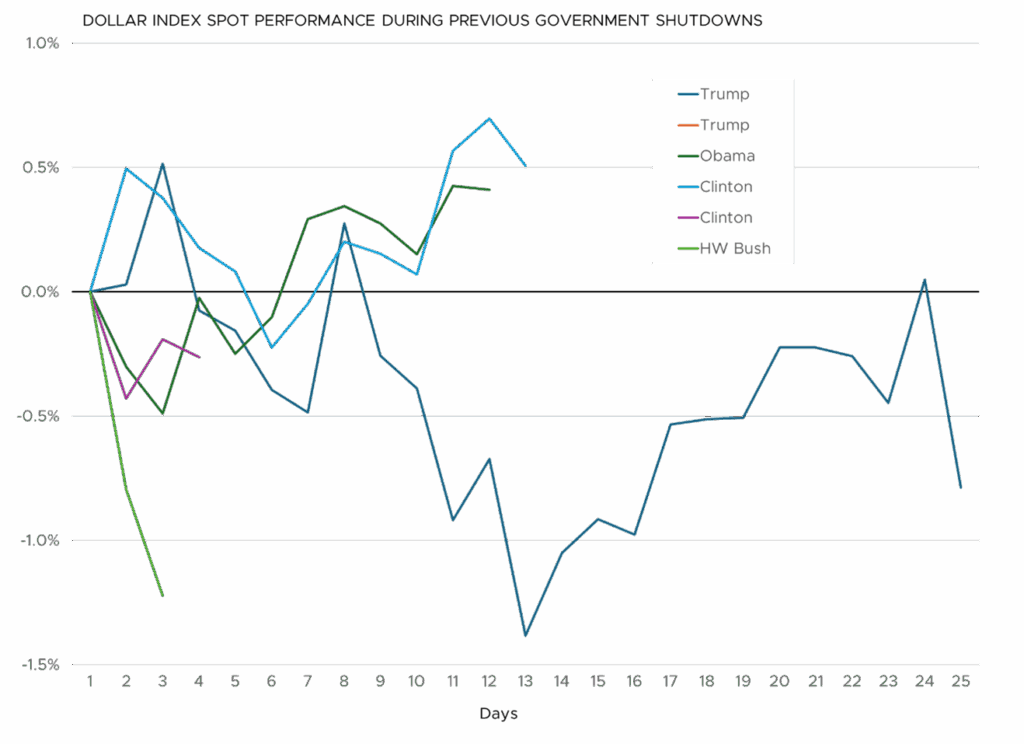

- Recurring risk of government shutdowns. The dollar typically weakens during these episodes. The 35-day shutdown in December 2018/January 2019 witnessed pronounced dollar weakness, with a roughly two per cent decline. The current shutdown threat is particularly concerning because the White House has threatened permanent dismissals of federal workers, which could push unemployment to 4.7 per cent and potentially trigger recession.

Foreign Investors Reducing Dollar Exposure at Unprecedented Pace

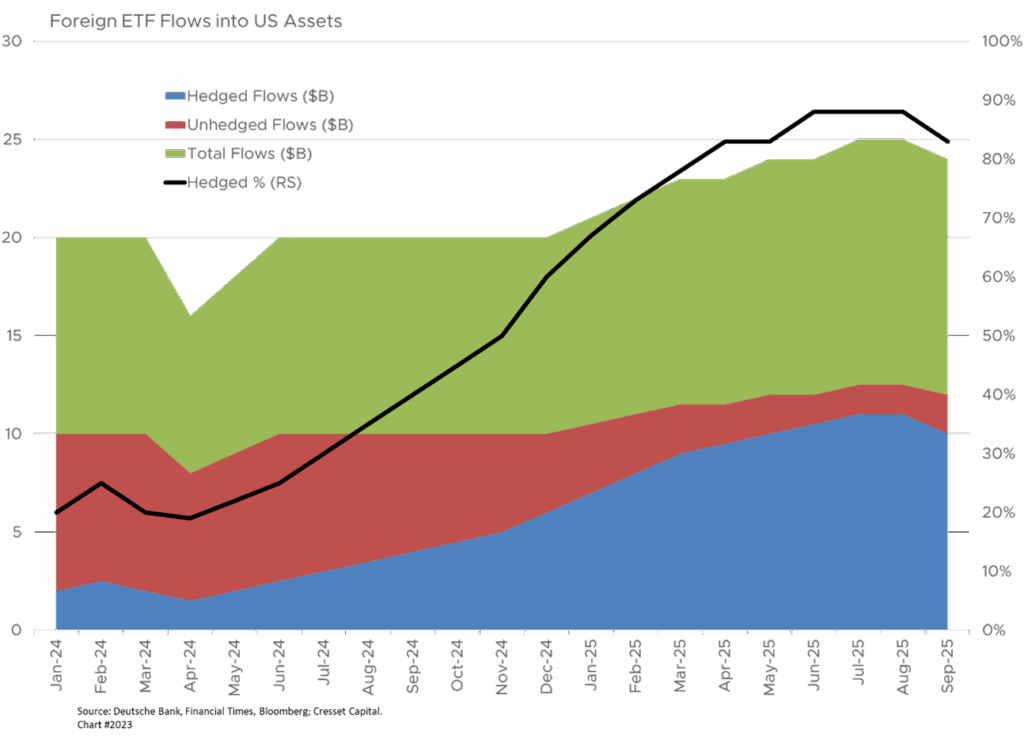

Foreign investors want access to American innovation and growth, particularly in technology and AI, but they’re unwilling to accept currency risk. This creates the unusual dynamic in which U.S. stocks rally while the dollar slides. Hedged flows into U.S. exchange-traded funds now outweigh unhedged flows for the first time this decade, with over 80 per cent of equity inflows now hedged, up from nearly zero at the start of the year. This represents an extraordinary vote of no confidence in the dollar itself, even as investors remain attracted to U.S. companies.

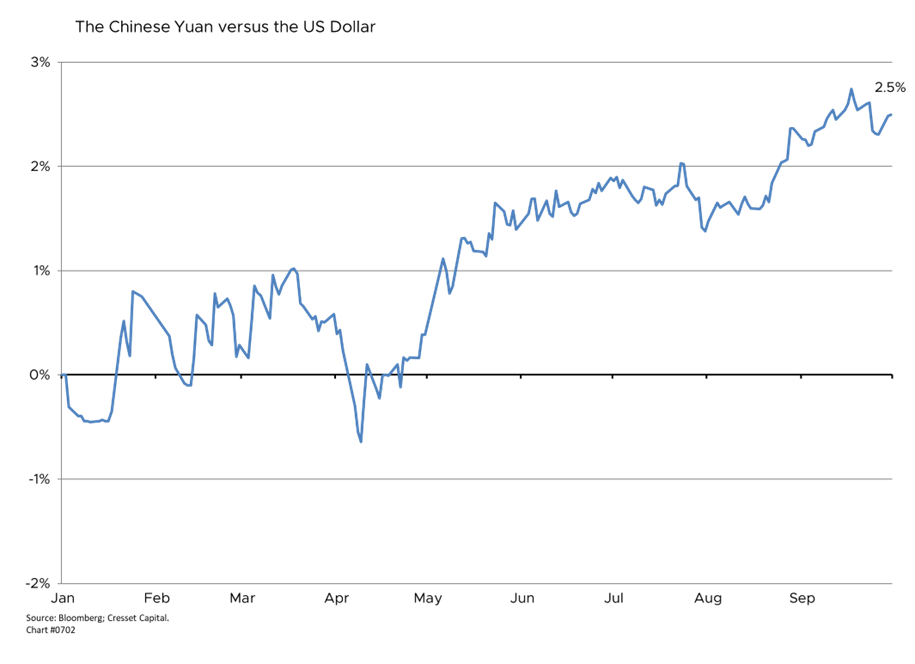

Dollar Uncertainty Has Created Opportunity for China

The yuan has reached its highest level since Trump’s re-election in November, with foreign investors and governments, particularly Brazil, Russia, India and China (BRICs), seeking alternatives to the dollar. China’s share of international payments has doubled since 2022, and over 30 per cent of China’s trade is now conducted in yuan, up from 14 per cent in 2019.

China has built alternative financial infrastructure including CIPS (similar to SWIFT) and mBridge, a digital currency network. More than 1,700 banks globally have joined CIPS, with transaction volumes rising 43 per cent in 2024 to 175 trillion yuan. While the yuan remains a distant challenger to dollar dominance – accounting for only four per cent of international payments versus 50 per cent for the dollar – the trajectory is concerning for U.S. interests.

The Implications of Losing Dollar Primacy Are Significant

Historical precedent is illustrative. The U.S. dollar lost its primacy once before: during the Great Depression, when policy mistakes and political interference undermined confidence. That experience taught that dollar dominance must be actively fostered and preserved through competent officials and sound policy. Politicians interfere at their peril.

The dollar’s role as the global reserve currency carries enormous benefits, like the ability to borrow cheaply, impose financial sanctions effectively, and export inflation abroad. Losing that “exorbitant privilege” (a term famously coined in the 1960’s by France’s then-Finance Minister Valéry Giscard d’Estaing) is a risk not just to the U.S. government, but to all Americans. For investors, the implications are significant. A weaker dollar provides a tailwind for U.S. multinationals, as roughly 40 per cent of S&P 500 revenue comes from abroad. Currency-hedged investing has become essential for foreign investors.

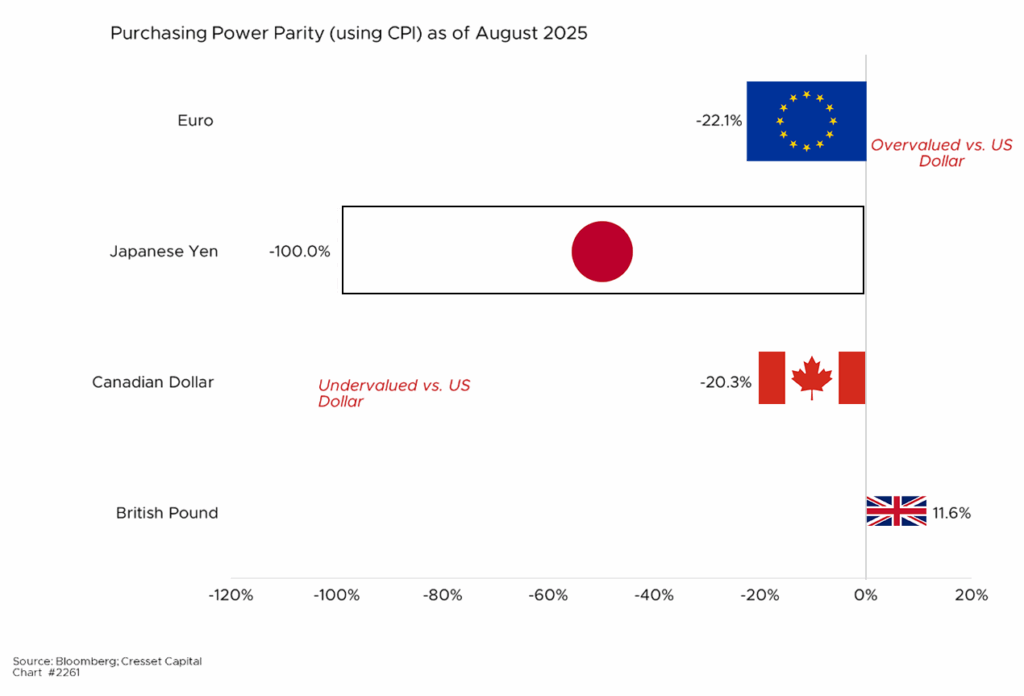

The dollar’s decline reflects more than cyclical factors or temporary policy missteps. It signals deep concern about American institutional stability, fiscal sustainability, and policy coherence. Fundamentally, the dollar remains overvalued against the Euro, yen and Canadian dollar. The UK pound is the only major trading partner currency that appears overvalued against the dollar on a purchasing power parity basis. That suggests the weakening trend will continue.

Bottom Line:

Confidence in the dollar, and by extension, U.S. economic governance, has deteriorated. Restoring that confidence will require consistent, competent policymaking, respect for institutional independence, and fiscal discipline. Without these elements, the dollar’s “exorbitant privilege” may continue to erode, with profound consequences for American power and prosperity.

Near term, the dollar’s outlook remains bearish. Structural headwinds include eroding institutional credibility, threats to Fed independence, persistent fiscal deficits, and trade policy chaos. Stripping away the negative sentiment, the U.S. private sector is strong. The economy grew at an eye-popping 3.8 per cent annualized rate last quarter and the promise of AI and associated technologies are the envy of the world. However, global focus is on the public sector, demanding policy course corrections, restoring Fed independence, fiscal discipline, and trade policy coherence could reverse sentiment.