Key Observations:

- Bank earnings will offer first evidence of economy’s health

- Healthy profit outlook, but risks abound

- AI-driven corporate divide evidenced in tech sector growth dominance

- Tariff-related cost pressure squeezing margins across multiple sectors

- We believe current multiples represent the market’s biggest headwind

Third-quarter earnings season kicks off this week with reports from major financial institutions, and what they reveal will take on heightened significance in the absence of government data amid the shutdown. The backdrop includes ongoing political negotiations, renewed tariff tensions with China, and questions about whether artificial intelligence investments will continue driving market gains.

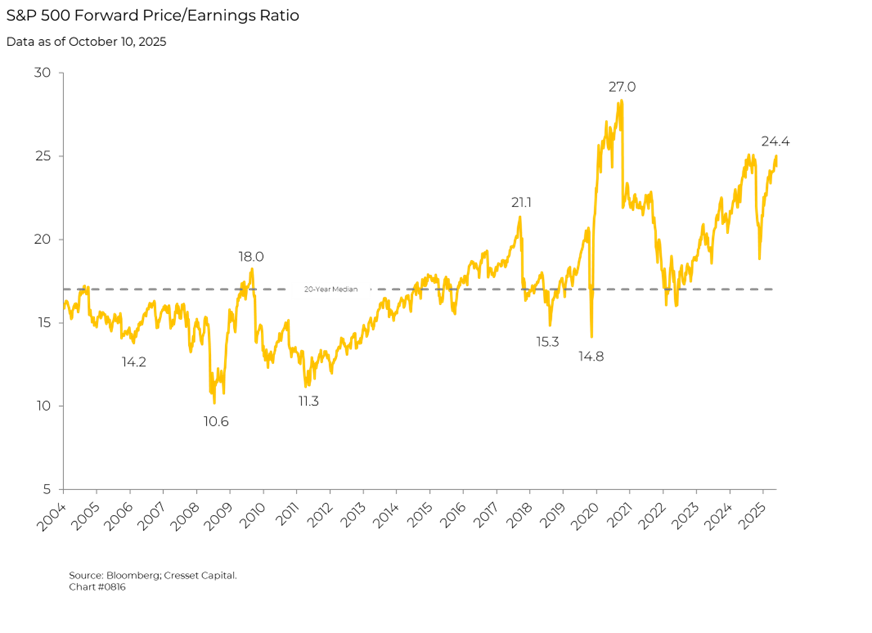

Rich Valuations Leave Little Room for Disappointment

The S&P 500 enters earnings season having hit a series of record closes. Yet the Index has been off-balance during the current government shutdown, declining since the beginning of October, its worst performance during a shutdown since 1990. The forward price-to-earnings ratio stands at 24.4x, well above the 20-year median of 17x, suggesting elevated valuations that leave little room for disappointment.

Analysts have raised their earnings estimates during the quarter, a rare occurrence that raises the bar for companies to clear. For Q3 2025, the S&P 500 is expected to report year-over-year earnings growth of eight per cent and revenue growth of 6.3 per cent, marking the ninth consecutive quarter of earnings growth. However, this represents a moderation from earlier expectations following the tariff turbulence that roiled markets in April.

AI-Driven Corporate Divide Evidenced in Tech Sector Growth Dominance

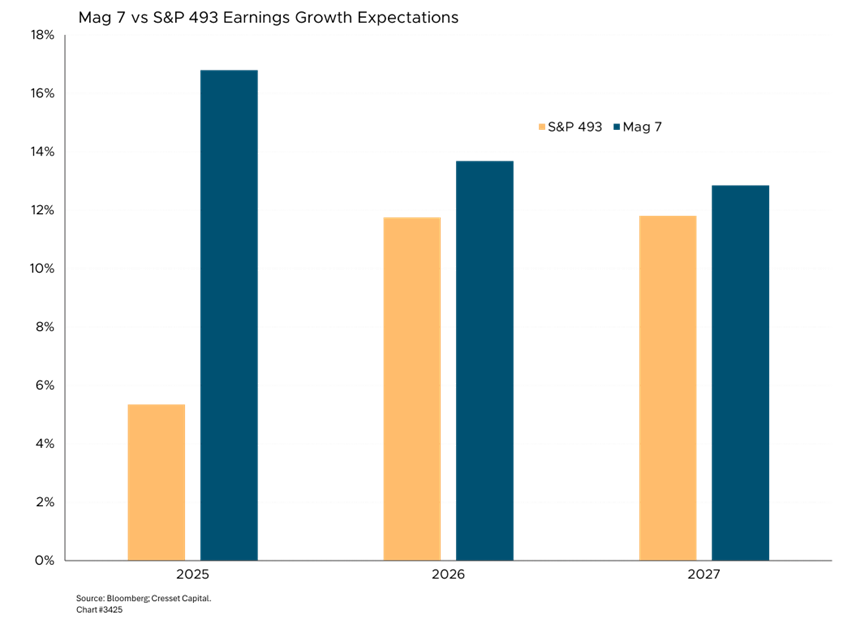

A fundamental split has emerged in corporate America between AI beneficiaries and traditional economy companies. The technology sector, even excluding the Magnificent Seven, is projected to deliver 21 per cent earnings growth in Q3, driven primarily by semiconductors and AI-related infrastructure spending. This stands in stark contrast to sectors like energy, down 4.2 per cent, and consumer staples, down 3.1 per cent, which face headwinds from lower commodity prices and margin pressure.

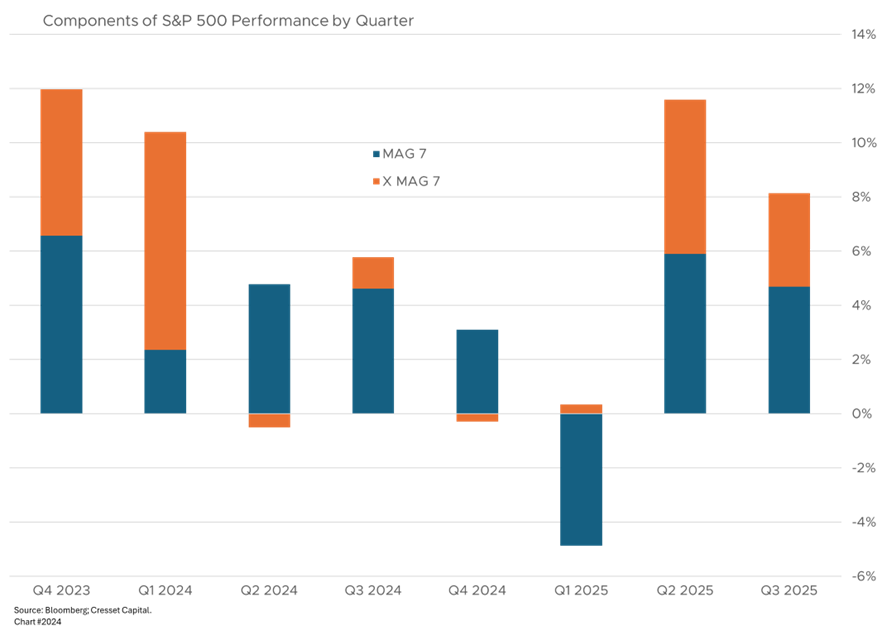

The Magnificent Seven continue to dominate, contributing roughly one-third of the Index’s overall earnings growth, in line with their relative market capitalization of the Index. Analysts expect robust results from companies like NVIDIA, Apple, and Microsoft, whose AI-related capital expenditure plans remain aggressive. The key question is whether this concentrated growth will broaden to the rest of the market, or whether the rally remains dependent on a narrow group of technology leaders.

Bank Earnings Will Offer First Evidence of Economy’s Health

Major banks including JPMorgan Chase, Goldman Sachs, Citigroup, Wells Fargo, Bank of America, and Morgan Stanley report this week, providing the first comprehensive view of economic conditions. The financial sector is expected to deliver 13.2 per cent earnings growth, benefiting from several tailwinds, including:

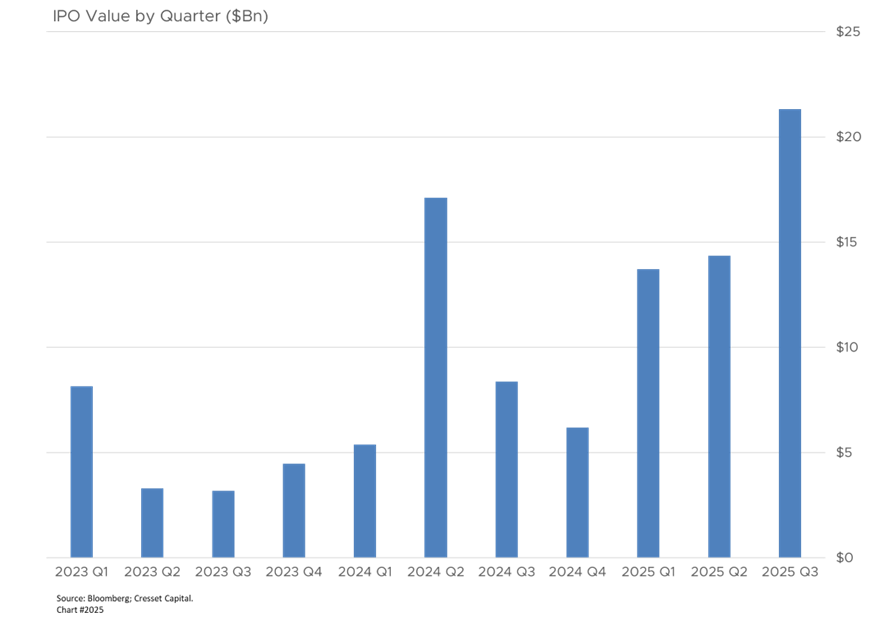

- Investment banking fees: Projected to reach $9.1 billion, representing the strongest quarter in over three years, driven by resurgent M&A activity of more than $1 trillion in Q3, including major transactions like the $55 billion Electronic Arts privatization. Equity underwriting will likely be particularly strong following the busiest IPO quarter since 2021.

- Trading revenues: Likely remained elevated due to continued market volatility from tariff announcements and policy uncertainty, with Goldman Sachs expected to lead in equities trading and JPMorgan in fixed income.

However, concerns linger about credit quality. The high-profile bankruptcies of First Brands Group and Tricolor Holdings have raised questions about stress in subprime consumer lending and the used car market. Banks’ exposure to commercial real estate and the health of their loan portfolios will face intense scrutiny, particularly given the absence of government economic data during the shutdown.

Tariff-Related Cost Pressure Squeezing Margins Across Multiple Sectors

A recent KPMG survey found that nearly 40 per cent of executives reported declining gross margins, with more than two-thirds planning price increases in the coming six months. About 62 per cent are restructuring supply chains to mitigate tariff impacts. The divergence in company performance reflects exposure to tariff pressures. Consumer-facing companies like McCormick and Constellation Brands have struggled with declining sales and margin compression, implementing surgical pricing strategies while seeking operational efficiencies. Companies serving affluent consumers, like Delta Air Lines, have maintained pricing power, with Delta noting its “exposure to the higher household income cohort has enhanced our relative position.”

This bifurcation extends beyond individual companies to entire sectors. Excluding the Magnificent Seven, earnings growth for the remaining S&P 493 companies is expected at just 5.3 per cent, significantly below the headline Index growth rate.

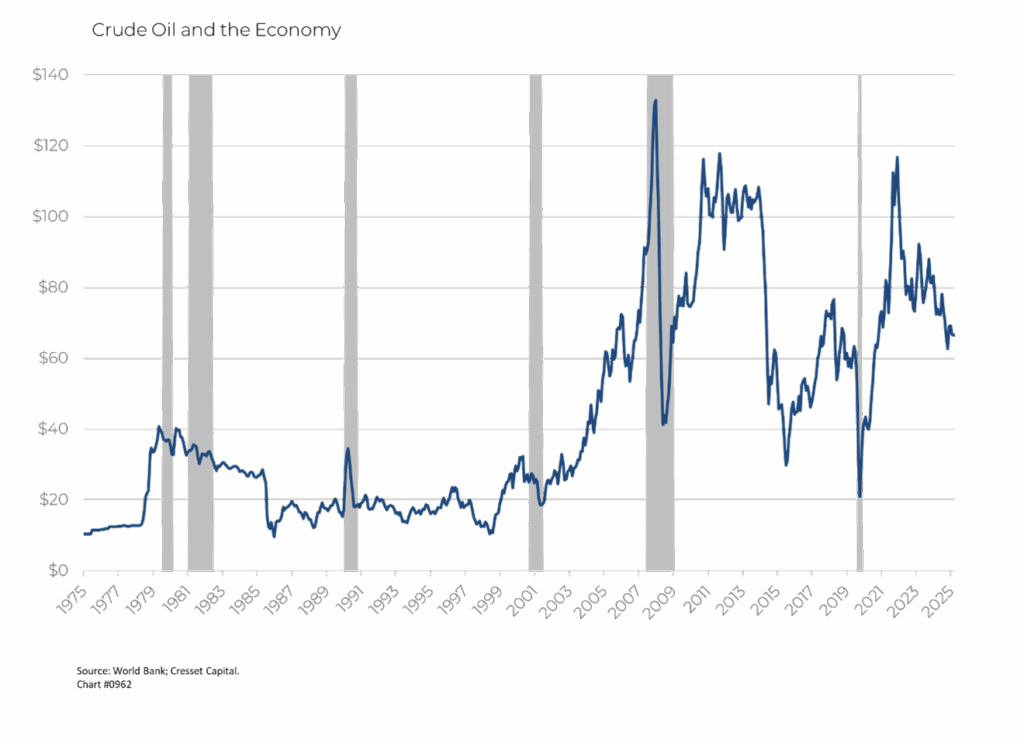

Lower Oil Prices Behind Energy Sector Weakness

The Energy sector faces its tenth consecutive quarterly earnings decline, projected at 4.2 per cent year over year. This weakness stems primarily from lower oil prices: West Texas Intermediate averaged $64.97/bbl in Q3 2025 compared to $76.06/bbl in Q3 2024, a 15 per cent decline. Within the sector, three of five sub-industries expect earnings declines: Oil & Gas Equipment & Services (20 per cent), Integrated Oil & Gas (13 per cent), and Oil & Gas Exploration & Production (four per cent).

Unexpected Strength in Power Generation

Utilities, meanwhile, are expected to report the second-highest earnings growth rate this quarter at 17.1 per cent, with significant contributions from power generation companies NRG Energy and Vistra Corp. This strength reflects growing electricity demand from data centers supporting AI infrastructure, particularly in regions like Virginia and Texas. However, without those two highflyers, sector earnings growth would decline to just 5.5%.

Healthy Profit Outlook, but Risks Abound

Looking ahead, analysts project full-year 2025 earnings growth at 10.9 per cent. Although that forecast is down from 14 per cent at the beginning of the year, it still depicts a healthy profit environment. However, several risks could derail this optimistic scenario:

- Narrow market leadership remains concerning, with market performance heavily dependent on a small number of mega-cap technology companies. The Magnificent Seven comprises nearly 30 per cent of the S&P 500’s market capitalization.

- Tariff escalation poses ongoing threats, particularly after President Trump’s recent announcement of potential additional 100 per cent tariffs on Chinese goods.

- Economic data vacuum created by the government shutdown makes assessing underlying economic health difficult, although we expect the government to reopen in the next week or two.

- Consumer weakness is emerging in lower-income cohorts, even as affluent consumers continue spending. Most discretionary spending has been supported by the top 20 per cent of income earners – those households that are emboldened by record stock market prices and housing values.

- Valuation compression risk exists if growth disappoints given elevated multiples. While valuation is not a timing tool, we believe current multiples represent the market’s biggest headwind.

Bottom Line:

The coming weeks will reveal whether AI-driven enthusiasm can offset traditional economy weakness, and whether the corporate sector can navigate the challenging environment of elevated costs, policy uncertainty, and selective consumer strength. This quarter’s earnings season, in light of the dearth of government data, will be an important milepost in gauging the future direction of the economy and markets.