Key Observations:

- Bankruptcies, alleged fraud trigger concerns about private credit quality

- Recent outflows are a market correction, not a crisis, presenting long-term investment opportunities

- 2025 is fundamentally different from 2008

- Bank relationships with private credit firms are a stabilizing factor

- Proactive regulation is a maturation process that will strengthen sector

The private credit market, now valued at approximately $3 trillion globally, stands at a critical juncture. Recent high-profile bankruptcies and regulatory scrutiny have prompted a necessary recalibration of risk assessment and investment practices. While headlines have focused on concerns raised by Bank of England Governor Andrew Bailey about potential parallels to the 2008 financial crisis, a measured analysis reveals significant differences that support a more constructive outlook for the sector’s evolution.

Bankruptcies, Alleged Fraud Trigger Concerns About Private Credit Quality

Current private credit market volatility stems primarily from the bankruptcies of two US companies: subprime auto lender Tricolor Holdings and auto-parts supplier First Brands Group. These events, combined with alleged fraud cases involving regional banks Zions Bancorp and Western Alliance, have triggered investor concerns about broader credit quality issues. The situation prompted JPMorgan CEO Jamie Dimon’s widely quoted “cockroach” comment, suggesting these incidents might signal deeper systemic problems. However, we believe the recent headlines reflect idiosyncratic events rather than indicators of deeper systemic risk. This distinction is crucial for understanding the current landscape and future credit opportunities.

Proactive Regulation Is a Maturation Process that Will Strengthen Sector

The Bank of England’s planned stress tests for private credit firms represent a proactive regulatory approach aimed at ultimately strengthening the sector. Rather than view increased oversight as a constraint, investors should welcome the increased regulatory attention as a natural maturation process that will enhance transparency and risk management standards. The central bank’s examination will likely provide valuable insights into market resilience and help establish best practices across the industry.

Notably, the regulatory focus on “slicing and dicing” of loan structures, reminiscent of pre-2008 practices, demonstrates heightened vigilance that will likely prevent the accumulation of excessive systemic risk. This early intervention contrasts favorably with the delayed recognition of problems that characterized the subprime mortgage crisis.

2025 Is Fundamentally Different from 2008

Several key factors distinguish the current private credit environment from the conditions that precipitated the 2008 financial crisis:

- The scale and interconnectedness differ significantly. While private credit has grown rapidly, it operates within a more diversified financial ecosystem with stronger bank capital requirements and improved risk management frameworks established post-2008.

- The quality of underlying borrowers and loan structures today is generally stronger than in the subprime mortgage market of the mid-2000s. Private credit typically involves direct lending relationships with established businesses, allowing for more thorough due diligence and ongoing monitoring compared to the securitized mortgages that failed spectacularly in 2008.

- Regulatory oversight has been more proactive. The planned stress tests and ongoing monitoring by central banks worldwide represent a significant improvement over the hands-off approach that characterized financial regulation before the last crisis.

Bank Relationships with Private Credit Firms Are a Stabilizing Factor

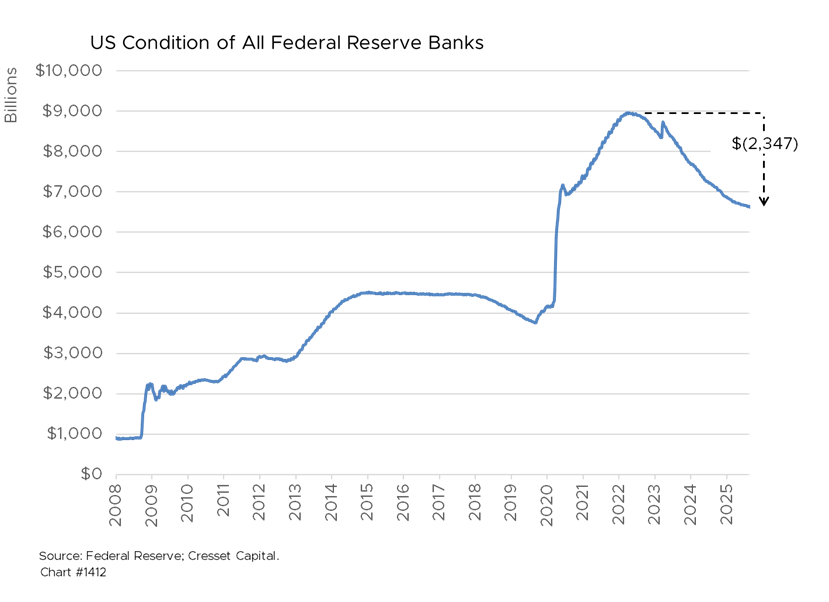

The relationship between traditional banks and private credit firms has evolved into a largely complementary dynamic. The recent surge in private credit can be directly attributable to a decline in bank assets, suggesting that most of the borrowers to whom private credit is lending were once bank borrowers. US banks have extended approximately $300 billion in loans to private credit providers, with Wells Fargo leading at around $60 billion in exposure. This financing model allows banks to participate in private credit growth while maintaining more conservative direct lending practices.

Wells Fargo CEO Charlie Scharf’s assessment that “worry is a strong word” regarding private credit risks reflects the careful underwriting standards major banks apply to their private credit partnerships. This selective approach to lending suggests that established banks are effectively screening private credit firms for quality and sustainability.

Recent Outflows Are a Market Correction, Not a Crisis

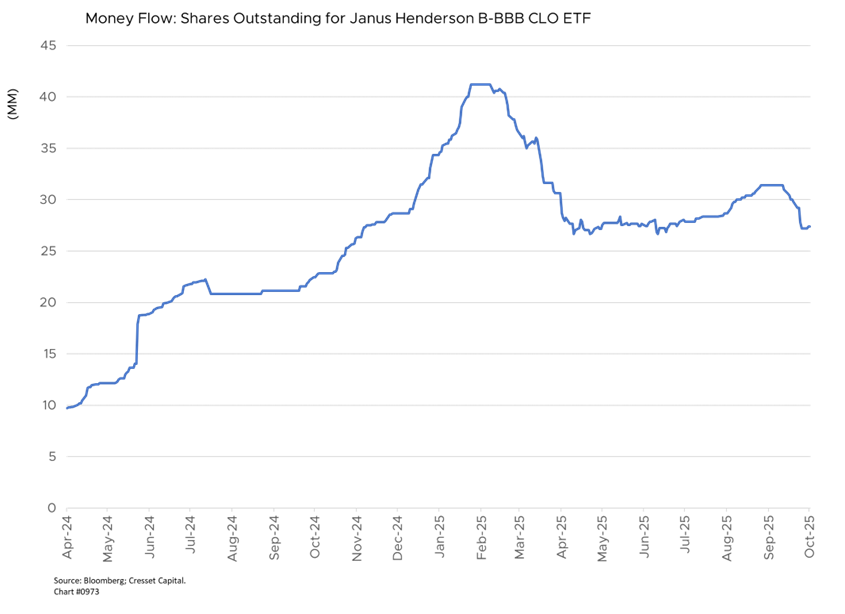

The recent outflows from collateralized loan obligation (CLO) ETFs, approximately $516 million in the largest weekly exodus since April, represent a healthy market correction rather than a crisis. The Cliffwater BDC Price Index is off 25% from its recent peak reflects investor fear, not fundamental realignment. Such adjustments typically create opportunities for discerning investors to acquire quality assets at more attractive valuations.

The spread widening in business development company (BDC) bonds, while a concern to some investors, remains within a reasonable range. This adjustment period allows for better risk pricing and should ultimately support more sustainable growth in the sector.

Correction Presents Strategic Long-term Investment Opportunities

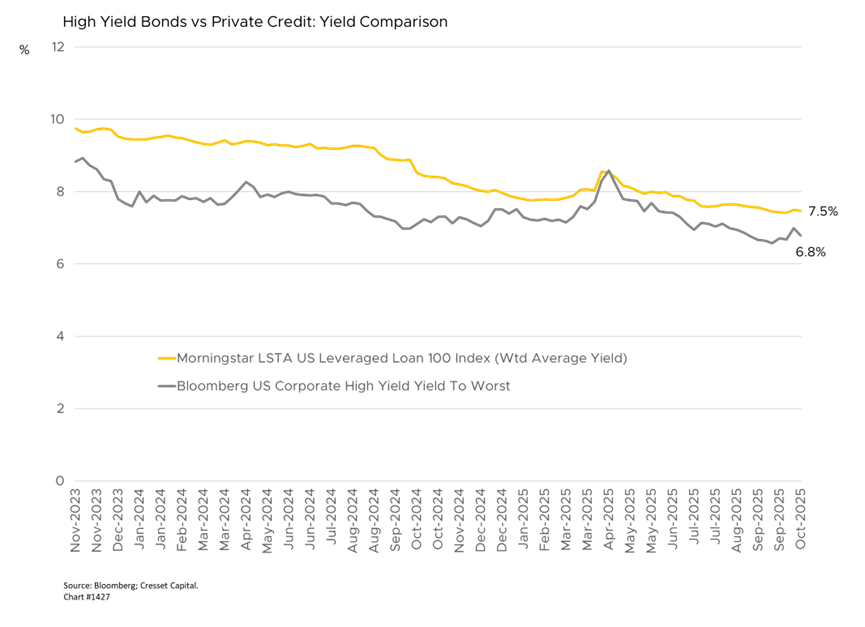

Heightened scrutiny is likely to eliminate weaker players and practices, strengthening the overall market structure. Furthermore, we expect improved risk pricing to lead to better risk-adjusted returns for investors who can identify quality managers and strategies. The integration of private credit into retail investment products, while requiring careful implementation, represents a significant opportunity for portfolio diversification. Private credit can provide uncorrelated returns that complement traditional bond and equity allocations. At current discounts, publicly traded BDCs offer attractive yields.

Meanwhile, the sector continues to benefit from technological advancements in due diligence, portfolio monitoring, and risk management. These improvements enhance the ability to identify and mitigate risks before they become systemic issues. We expect the transparency initiatives being implemented across the industry to further strengthen investor confidence.

Rather than viewing current challenges as existential threats, investors should recognize them as opportunities of a maturing asset class. The private credit market’s expansion from a niche alternative investment to a mainstream portfolio component requires the development of robust infrastructure, standardized practices, and appropriate regulatory frameworks. Many of those processes are taking shape. Structurally, private equity sponsors, whose portfolio companies are often private credit borrowers, own equity stakes that are junior to their loan obligations.

Bottom Line:

While recent events have understandably prompted concerns about private credit market stability, the fundamental drivers of growth remain intact. Corporate demand for flexible financing solutions continues to exceed traditional bank capacity, creating persistent opportunities for well-managed private credit strategies.

The key for investors lies in selectivity, focusing on established managers with proven track records, robust risk management systems, and transparent reporting practices. The current market adjustment period provides an opportunity to identify these quality players while avoiding the weaker participants likely to be eliminated by increased scrutiny.

Rather than retreating from private credit, we suggest that investors consider this an opportunity to lean in, emphasizing quality over quantity and ensuring appropriate portfolio allocation based on their risk tolerance and investment objectives. The sector’s continued evolution toward greater transparency and better risk management will ultimately benefit all stakeholders.