Key Observations:

- U.S. – China trade talks in Kuala Lumpur produced agreements spanning multiple contentious areas

- U.S. likely to remove or suspend 20% fentanyl-related tariff on Chinese goods

- China likely to delay expanded rare earth export controls for one year and resume “substantial” purchases of U.S. soybeans.

- Trump administration pursuing multi-pronged bilateral trade deals in many SE Asian countries to counter China.

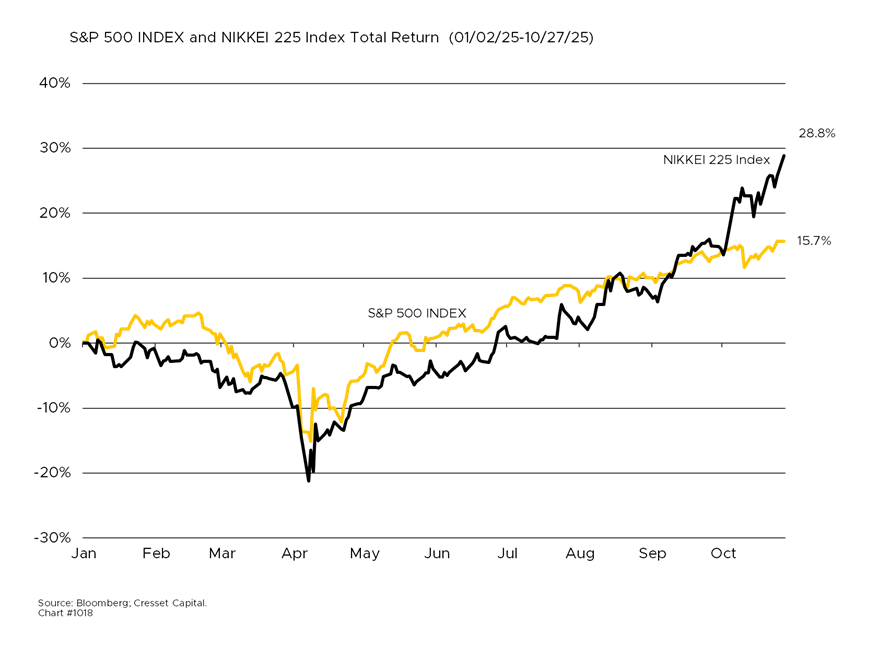

- The most prudent approach for investors: diversify geographic exposure; avoid over-concentration in sectors sensitive to U.S. – China trade; and build portfolio resilience to accommodate ongoing trade policy volatility.

Significant developments in U.S. – China trade relations were achieved in Kuala Lumpur over the weekend. Negotiators from both countries reached a preliminary framework agreement during talks in Malaysia ahead of a scheduled Trump-Xi summit. This represents the latest chapter in an escalating trade war that has seen U.S. tariffs on Chinese goods rise from two per cent to approximately 55 per cent, reaching levels not seen since the 1930s.

Agreements Span Multiple Contentious Areas Between U.S. and China

Most notably, the U.S. appears ready to remove or suspend the 20 per cent fentanyl-related tariff on Chinese goods, while China has agreed to delay implementation of expanded rare earth export controls for one year. The framework also addresses agricultural trade, with China expected to resume “substantial” soybean purchases from U.S. farmers. Rare earth material prices, which have served as a barometer of trade tension, have fallen precipitously in response.

Multi-pronged Approach to Trade with Concurrent Efforts Across SE Asia

New agreements with Malaysia, Cambodia, Thailand, and Vietnam maintain existing tariff levels but introduce reciprocal arrangements and stricter environmental and labor compliance requirements. This suggests the administration is pursuing bilateral deals rather than multilateral frameworks, consistent with Trump’s transactional approach to trade policy.

Asian markets responded positively, with the Hang Seng China Enterprises Index rising 1.3 per cent and the broader MSCI AC Asia Pacific Index advancing 1.5 per cent to new highs. Chinese government bond yields rose as demand for safe-haven assets declined following the positive trade developments.

Though Positive, U.S. – China Developments Are More Tactical Than Strategic

The agreement primarily addresses immediate flashpoints rather than fundamental structural issues. The U.S. maintains its broader export controls on semiconductors and advanced technology, while China’s core industrial policy approach remains unchanged. As Bloomberg Economics notes, this represents “frequent ruptures and short-term fixes” rather than a comprehensive resolution.

Bloomberg’s Scenario Modeling Provides Valuable Context

Under a détente scenario in which fentanyl tariffs are removed, China’s export losses to the U.S. could be limited to less than 10 per cent versus the current 70 per cent decline. However, the broader tariff structure remains intact, with Chinese goods still facing substantial duties. The U.S. economy shows resilience across scenarios, with GDP impacts limited to less than one per cent, reflecting America’s relative insulation from trade disruption.

Critical Limitations to the Trade Framework

- Geopolitical: The agreement occurs within broader strategic competition constraints. Secretary of State Marco Rubio’s statement that Taiwan policy remains non-negotiable illustrates the limits of economic accommodation. This suggests that while tactical trade issues may be resolved, fundamental strategic rivalry continues.

- Implementation: Multiple analysts emphasize that framework agreements are merely “first steps,” with execution representing the real test. Historical precedent supports this skepticism: previous U.S. – China trade agreements have struggled with implementation disputes and compliance verification.

- Conditionality: The one-year timeline for rare earth controls and Trump’s suggestion he might drop trade violation investigations “if talks go well” indicate the conditional nature of these arrangements. This creates ongoing uncertainty for businesses requiring longer-term planning horizons.

- Small Economy Vulnerabilities: The analysis of small open economies reveals how major power trade disputes create systemic vulnerabilities. Countries like Singapore, Switzerland, and Vietnam face significant economic disruption despite having limited influence over U.S. – China relations, highlighting the broader destabilizing effects of trade wars.

Investment Implications

Regional: Southeast Asian economies could face mixed impacts. While new bilateral agreements provide some certainty, the 19-20 per cent tariff levels remain economically significant. Vietnam and Thailand might benefit from continued trade diversion effects as companies seek alternatives to Chinese production.

Risk Management: Given the temporary and tactical nature of the agreement, we recommend that investors maintain defensive positioning. The Bloomberg analysis suggesting “frequent ruptures and short-term fixes” as the new normal implies elevated volatility and policy uncertainty will persist.

Currency and Bond Markets: The modest improvement in Chinese bond yields and regional currency strengthening likely reflects relief rather than fundamental optimism. The structural trade deficit and technology competition issues remain unresolved, limiting sustained currency appreciation.

Technology Sector: The maintenance of semiconductor export controls while addressing other trade issues suggests continued bifurcation in technology markets. Companies with significant China exposure in advanced technology sectors face ongoing regulatory uncertainty.

Sector-Specific Opportunities

- Chinese Exports: Removal of fentanyl tariffs could benefit broad-based Chinese exporters, particularly consumer goods manufacturers. However, technology and advanced manufacturing sectors remain constrained by ongoing export controls.

- Agricultural Commodities: U.S. soybean producers should benefit from resumed Chinese purchases, though the sustainability of these purchases depends on broader relationship stability.

- Rare Earth Supply Chains: The one-year delay in Chinese export controls provides temporary relief for technology manufacturers, but companies should be accelerating their supply chain diversification efforts.

Bottom Line

The U.S. – China trade framework currently under construction represents tactical damage control rather than strategic resolution. While markets may experience near-term relief, the underlying structural competition between the U.S. and China remains intact. The agreement’s one-year timeframes and conditional nature suggest investors should prepare for continued cycles of escalation and de-escalation rather than a return to stable, rules-based trade relations.

The most prudent investment approach involves maintaining diversified geographic exposure, avoiding over-concentration in U.S. – China trade sensitive sectors, like rare earths and agriculture, and building portfolio resilience to accommodate ongoing trade policy volatility. The new normal appears to be managed competition rather than comprehensive cooperation.