Key Observations:

- Questionable sustainability of AI capex tsunami in the face of diminishing returns

- Circular deal structures raise concerns

- Shift to more debt financing for AI infrastructure brings new systemic risks

- AI factor risk permeates across seemingly disparate asset classes

- Investors should approach AI opportunities with a clear-eyed assessment of both potential and risk

The artificial intelligence (AI) sector is experiencing an unprecedented investment surge that presents both extraordinary opportunities and serious concerns. While AI technology shows genuine promise for productivity improvements and economic transformation, the scale of capital deployment, elevated stock valuations, uncertain return profiles, and historical parallels to previous market bubbles warrant scrutiny.

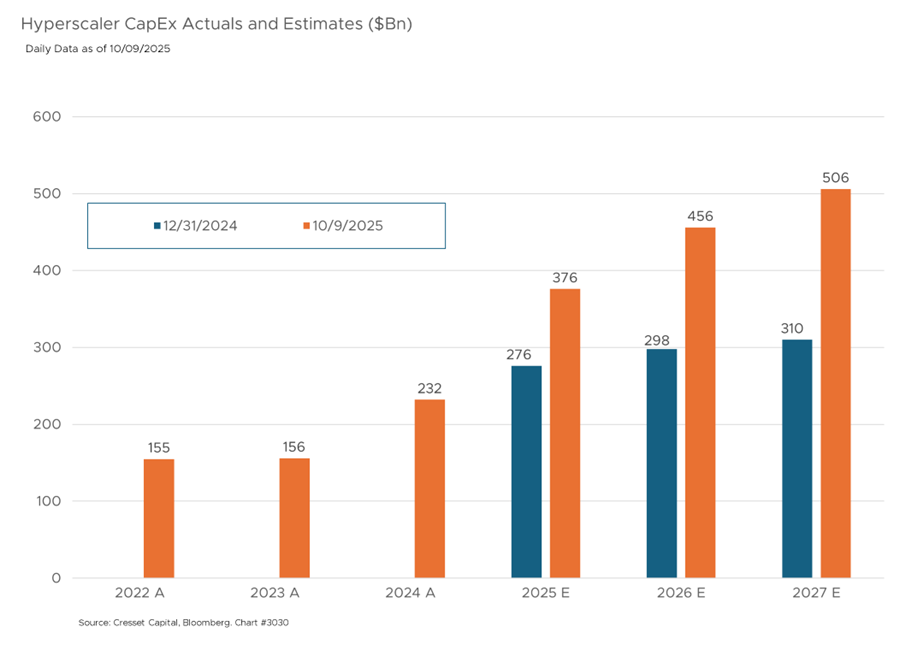

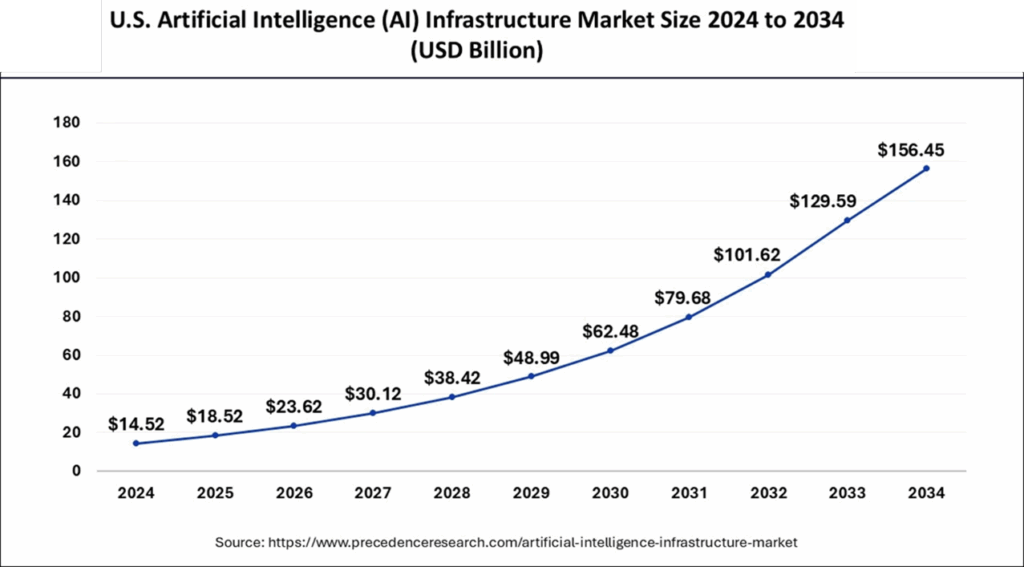

Sustainability of AI Capex Tsunami Questionable

AI-related capital expenditures could reach two per cent of GDP in 2025, approximately $1,800 per American, driving economic growth from an estimated rate of one per cent to nearly two per cent. While this investment is currently supporting economic expansion, the sustainability of this spending level depends on whether corresponding revenue materializes.

OpenAI has committed to purchasing AMD chips worth tens of billions of dollars, signed a potential $100 billion infrastructure agreement with Nvidia, and arranged for $300 billion in cloud computing with Oracle. Yet OpenAI, like the other hyperscalers, expects to burn through $115 billion in cash through 2029, while generating $13 billion in revenue this year. The sector’s path to profitability is cloudy.

Deal Structures Raise Legitimate Concerns

More troubling are the circular financing arrangements emerging across the sector. The industry’s largest players are investing in customers who then use those proceeds to buy their products, creating artificial demand that masks underlying economics. Nvidia agreed to invest up to $100 billion in OpenAI’s data center buildout, with OpenAI using proceeds to purchase Nvidia’s chips. Oracle signed a $300 billion cloud computing deal with OpenAI, essentially providing infrastructure that generates Oracle revenue. AMD’s multibillion-dollar deal with OpenAI includes equity warrants, aligning incentives while AMD supplies chips to OpenAI.

These structures resemble patterns seen in previous market manias, including the Japanese market bubble of the late 1980s, the Irish property boom, and the Enron-era energy trading bubble, where artificial demand masked underlying economic fragility. Additionally, these transactions potentially mask a lack of independent market demand at levels required to justify current valuations and spending.

Valuation Concerns Are Real

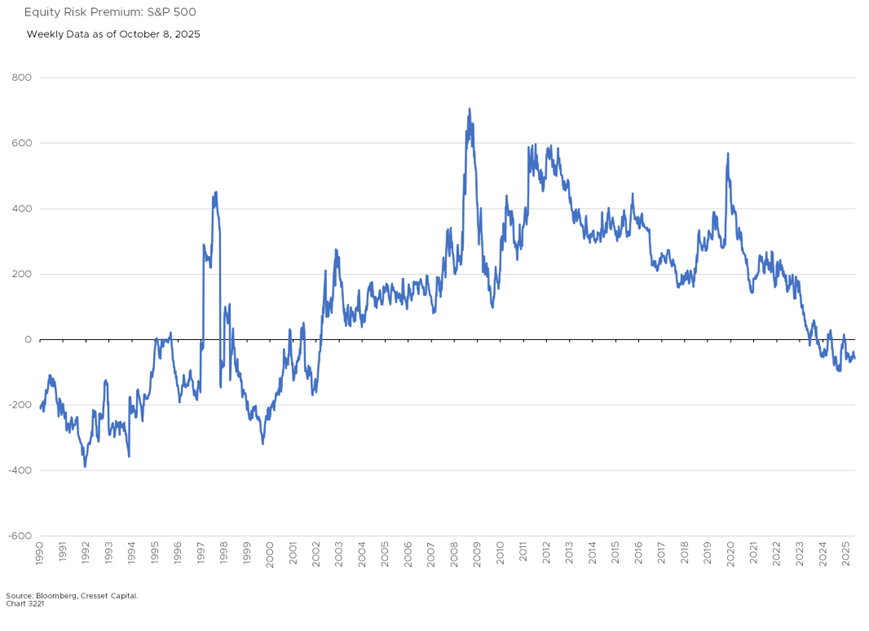

The S&P 500’s forward price-earnings ratio of 23x represents its highest level since early 2021 and approaches levels seen only during the dot-com bubble peak. The top 10 companies now represent over 40 per cent of the Index, the highest concentration since at least 1972. This means passive Index investors have unprecedented exposure to a small number of highly valued technology stocks. The equity risk premium – the difference between the market’s forward earnings yield and the 10-year Treasury yield – slipped into negative territory in 2023 for the first time in 20 years and has been fighting a downward trend since then.

Individual AI companies show even more extreme valuations. OpenAI recently raised capital at a $500 billion valuation despite being on track for $13 billion in revenue, a 38x revenue multiple comparable to that of Cisco at the dot-com peak. Thinking Machines Labs raised $2 billion at a $10 billion valuation without any revenue or even a disclosed product. These valuations require near-perfect execution and massive market expansion to justify current prices.

The Technology Select Sector SPDR ETF trades at 28x next year’s earnings estimates, up from 21x in late 2022. While bulls argue this time is different because today’s companies have real profits, skeptics note that stretched valuations leave little room for disappointment.

Revenue/Spending Gap and Enterprise Adoption Issues Raising Red Flags

Bain & Company estimates that by 2030, AI companies will need $2 trillion in combined annual revenue to justify current spending levels, yet will likely fall up to $800 billion short. This gap isn’t merely concerning; it represents a fundamental question about whether sufficient demand exists at price points that can support the required returns.

Enterprise adoption tells a sobering story. MIT researchers found that 95 per cent of organizations saw zero return on their AI investments. Most enterprise AI projects are being abandoned due to lack of ROI. A Qualtrics poll found that 95 per cent of UK consumers prefer not to interact with chatbots. Harvard and Stanford researchers have documented AI-generated content that appears useful but lacks substance, potentially costing large organizations millions in lost productivity.

Meanwhile, OpenAI’s ChatGPT, with 700 million weekly users, generates most of its revenue from a product that costs far more to provide than users pay. The business model depends on eventually charging dramatically higher prices as AI becomes more capable, an assumption that’s reasonable, but unproven.

Diminishing Returns as ‘Scaling Laws’ Break Down

After years of dramatic improvements from simply scaling models larger, AI developers are encountering diminishing returns. OpenAI’s GPT-5 received mixed reviews despite months of hype. Sam Altman himself conceded the company is “still missing something quite important” needed to reach artificial general intelligence.

The “scaling laws” that underpinned AI optimism – the belief that more computing power and data automatically yield proportional improvements – appear to be breaking down. This doesn’t mean AI won’t continue advancing, but it suggests the path forward may be more difficult and expensive than anticipated.

Competition from China, particularly after DeepSeek’s demonstration of cost-effective AI development, threatens to commoditize AI capabilities and compress margins. If AI becomes a competitive, low-margin business rather than a winner-take-most market, current valuations will be much harder to justify.

Shift to More Debt Financing for AI Infrastructure Brings New Systemic Risks

Meta secured $26 billion in financing for a Louisiana data center complex. JPMorgan and Mitsubishi are leading a $22 billion loan for Vantage Data Centers. Private equity firms are channeling pension and insurance capital into AI infrastructure through special purpose vehicles.

Real estate investment trusts (REITs) have moved approximately 20 per cent of their assets into data centers. Since 60 per cent of data center costs are computing chips that become obsolete every few years, these are fundamentally different, and riskier, than traditional real estate assets, particularly since the asset will likely be situated in the middle of nowhere.

AI Factor Risk Permeates Across Seemingly Disparate Asset Classes

Investors seeking diversification by spreading capital across stocks, bonds, REITs, and private equity might not realize how correlated their portfolios have become. Nvidia’s data center division alone generates more revenue than most chipmakers’ total sales. The company’s dominant position means that any slowdown in AI infrastructure spending would have an immediate impact on valuations across multiple asset classes. American retirement accounts increasingly hold private credit and private equity with substantial AI infrastructure positions. This hidden correlation means portfolios may be far riskier than their apparent diversification suggests. During a downturn, assets that should provide ballast may decline simultaneously.

Is this a Bubble?

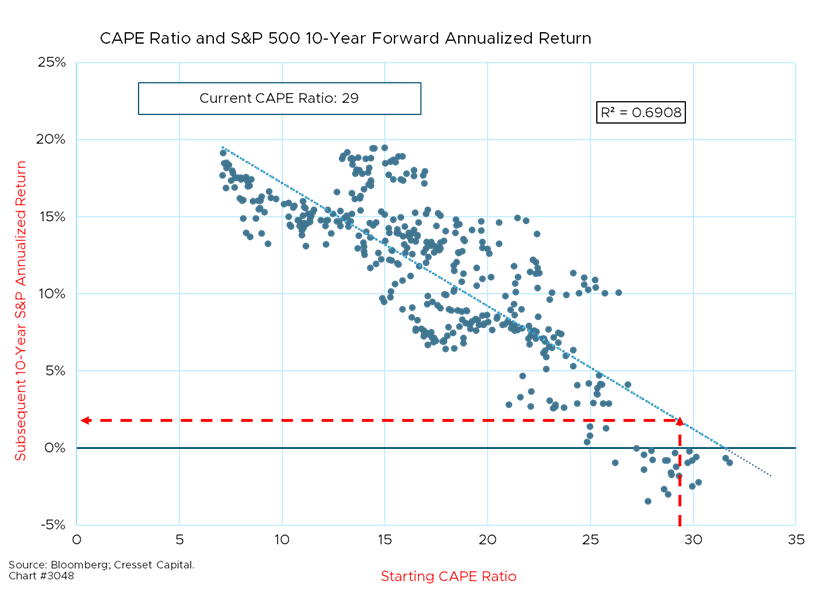

The S&P 500 is trading at levels not seen since the 2000 tech bubble, while 40 per cent of the market’s capitalization is concentrated in mega-cap technology names. The cyclically adjusted price-earnings ratio (CAPE), a concept pioneered by Nobel laureate Robert Shiller, is currently 29x, representing the 97th percentile of its nearly 50-year history. While the regression trend line projects a 10-year annualized return of about two per cent, history shows that every time the CAPE ratio exceeded 27x the subsequent 10-year annualized return was under water.

With the AI industry’s largest players investing in customers who then use those proceeds to buy their products, this circularity creates artificial demand that masks underlying economics. Independent market demand at levels needed to justify current valuations and spending could be wanting.

The Case for Measured Optimism: It’s not Dot-Com Bubble 2.0

Despite these concerns, we believe AI’s potential shouldn’t be dismissed. Domain-specific AI applications deliver genuine value. AI-enabled permit processing and specialized healthcare diagnostics demonstrate practical benefits beyond hype.

Unlike dot-com startups, today’s AI leaders have massive existing businesses, substantial cash flows, and balance sheets that can sustain multi-year investments even without immediate AI returns. By contrast, internet-era leaders were selling a dream while burning cash.

Even if specific companies fail, data centers, chip manufacturing capacity, and AI expertise will retain value. The fiber-optic networks built during the telecom bubble eventually became critical infrastructure. While pure scaling shows diminishing returns, advances in efficiency, edge computing, and specialized models suggest multiple paths forward. Meanwhile, the network effect can’t be minimized. ChatGPT’s 700 million weekly users represent genuine mass-market adoption, not just enterprise pilots or experimental use.

Steps Investors Can Take to Balance AI Opportunities and Risks

A balanced approach to investing requires acknowledging both opportunity and risk. Investors can take several steps to balance upside opportunities with downside protection:

- Diversification is crucial. The S&P 500’s 40 per cent weight in 10 companies creates excessive exposure. Given their recent success, consider rebalancing back to target weights. That likely means reducing US large-cap equity exposure and shifting into bonds.

- Understand your factor exposure to AI across all holdings. Review whether supposedly diversified holdings in REITs, private equity, and bonds have become correlated through AI infrastructure investments.

- Focus on quality and profitability. Companies with proven business models, strong cash generation, and reasonable valuations offer better risk-adjusted returns than speculative pure plays.

- Think long-term, but plan for volatility. AI’s ultimate impact might be transformative, but its path could include severe drawdowns. Position sizing should reflect this risk. The dot-com bubble saw the S&P 500 decline 47 per cent over two years.

Bottom Line:

The AI investment wave represents both genuinely transformative technology and genuinely excessive speculation – and both of these things can be true at the same time. The internet revolutionized commerce and communication, but that didn’t prevent a market crash that destroyed trillions of dollars of wealth in the process. Investors should approach AI opportunities with clear-eyed assessment of both potential and risk. AI technology will almost certainly have lasting positive impact on productivity and economic growth. However, current valuations, market concentration, circular financing structures, uncertain revenue profiles, and historical parallels to previous bubbles all suggest substantial downside risk.

The prudent approach acknowledges AI’s importance while avoiding the assumption that importance automatically translates to investment returns at current prices. Diversification, quality focus, and appropriate position sizing remain essential. Those who maintained discipline during previous technology bubbles, neither completely avoiding opportunity nor embracing speculation, ultimately achieved the best risk-adjusted returns.