Key Observations:

- Governments address excessive debt via default, inflation, or financial repression

- But not all debt exit strategies are in the issuer’s hands

- Carry trade unwinding with JGB selloff could affect US Treasurys

- Japanese government faces hard choices that could exacerbate global selling and aggravate problems faced by heavily indebted nations like the US

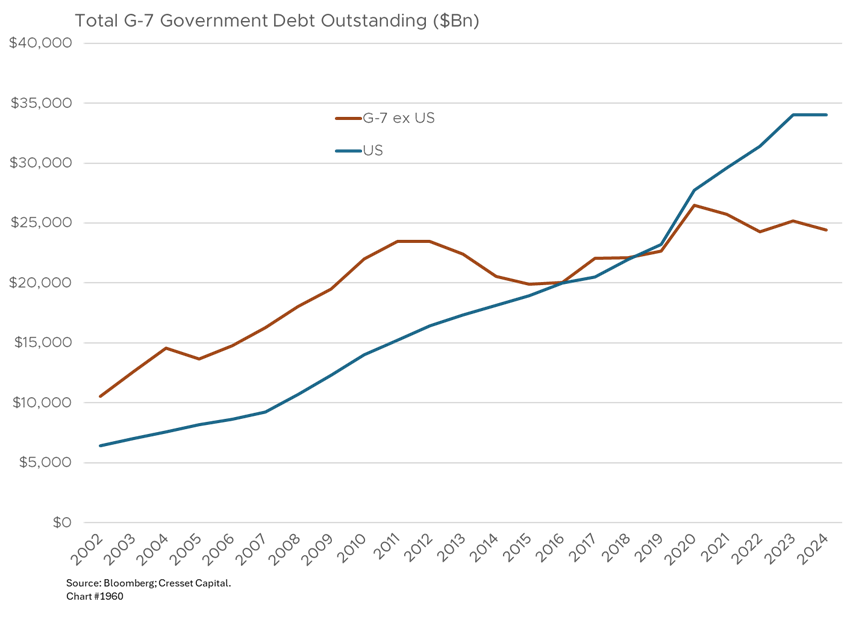

The reconciliation bill that passed the House last week left budget hawks disappointed. The Congressional Budget Office estimates that the bill now moving to the Senate would add nearly $2.5 trillion to deficits over the next decade, bringing US Treasury debt to nearly $50 trillion by 2034. Since 2018, US debt has exceeded the total debt of the rest of the G-7 countries combined. It’s clear that Congress has no appetite for belt tightening. Adding to the burden, an ongoing crisis in the Japanese government bond market could accelerate global bond selling and exacerbate the problems faced by heavily indebted nations like the United States.

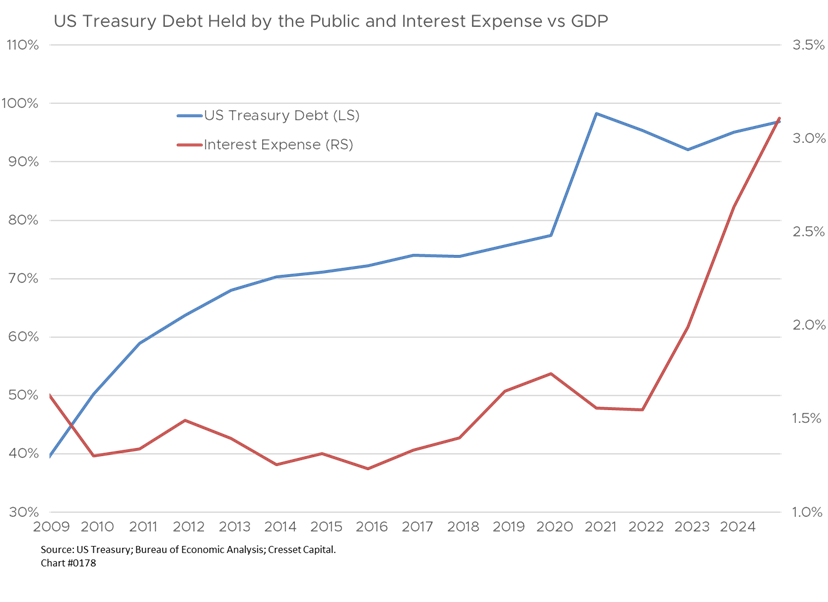

Rate Normalization Doubled US Interest Expense as Share of GDP

For decades, Democrats embraced spending increases and Republicans embraced tax cuts. Deficits and debt accumulation allowed both parties to have their cake and eat it, too. Even though US debt more than doubled between 2009 and 2024, interest expense as a share of GDP remained flat thanks to low interest rates in the wake of the financial crisis and the pandemic. Between 2022, when interest rates were normalized, and 2024, interest expense doubled as a share of GDP, creating budget challenges. Credit rating agency Moody’s downgraded US debt two weeks ago siting lawmakers’ continual unwillingness to make difficult fiscal decisions.

Governments Address Excessive Debt Via Default, Inflation, or Financial Repression

History suggests that governments address their budgetary profligacy and decadent debt levels via:

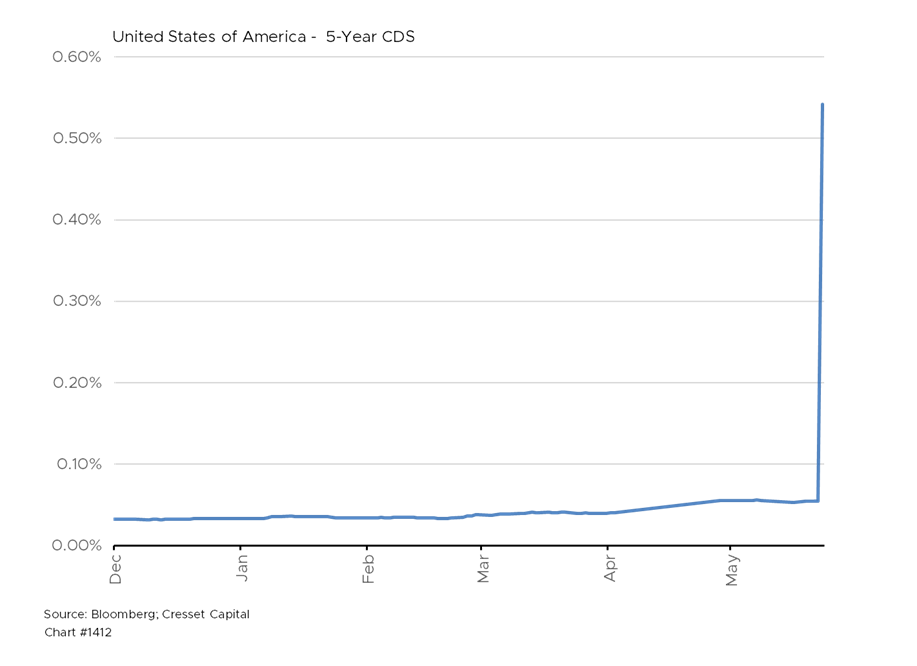

- Default. Since 2000, about a dozen countries have defaulted on their debt, including Argentina (four times), Ecuador (twice), Greece, and Russia. However, a US debt default is not an option, particularly when we hold the key to the dollar printing press. It should be noted that the cost of insuring US Treasury debt against default rose dramatically last week.

- Inflation. Since 90% of US Treasury debt is not indexed to CPI, inflation could be an appealing avenue for policymakers to shrink our debt in “real” terms. But the cost would be an increase in the cost of living for American households, eroding savings and putting retirement out of reach.

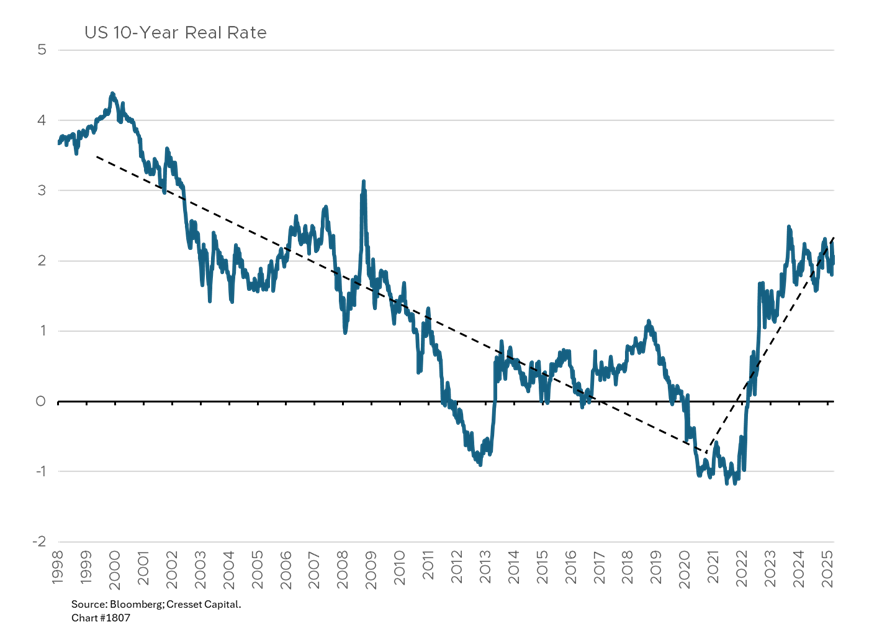

- Artificially low interest rates. Financial repression helped lower our debt-to-GDP ratio after World War II and between 2009 and 2022. Keeping interest rates below the inflation rate would weaken the dollar, particularly if our trading partners don’t simultaneously execute a parallel strategy, as they did after 2009. Between one quarter and one third of Treasury debt is held by foreigners, so the value of their holdings would shrink in local currency. But dollar weakness means the cost of imported goods would rise for US consumers, pushing inflation higher.

But Not All Debt Exit Strategies Are in the Issuer’s Hands

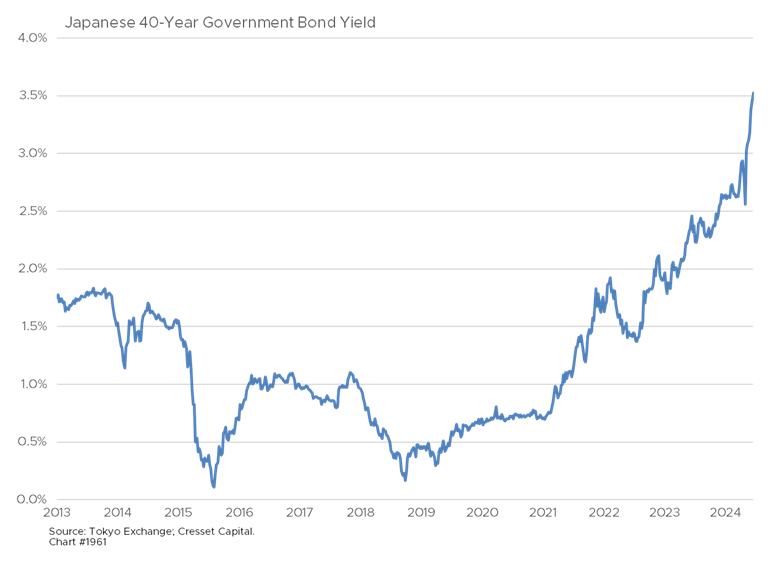

The $140 trillion global bond market itself could also impose discipline on profligacy. The US 30-year Treasury bond pushed above five per cent for the first time in two years in reaction to the Moody’s downgrade. Meanwhile, Japan’s government bond (JGB) market is experiencing a historic collapse that has pushed 40-year yields to levels not seen since the late 1990s. The turmoil intensified after Japan’s dismal 20-year bond auction last week, which showed the weakest demand since 1987. Prime Minister Shigeru Ishiba described Japan’s finances as “worse than Greece,” referring to the country’s debt-to-GDP ratio exceeding 250 per cent, the highest among developed nations.

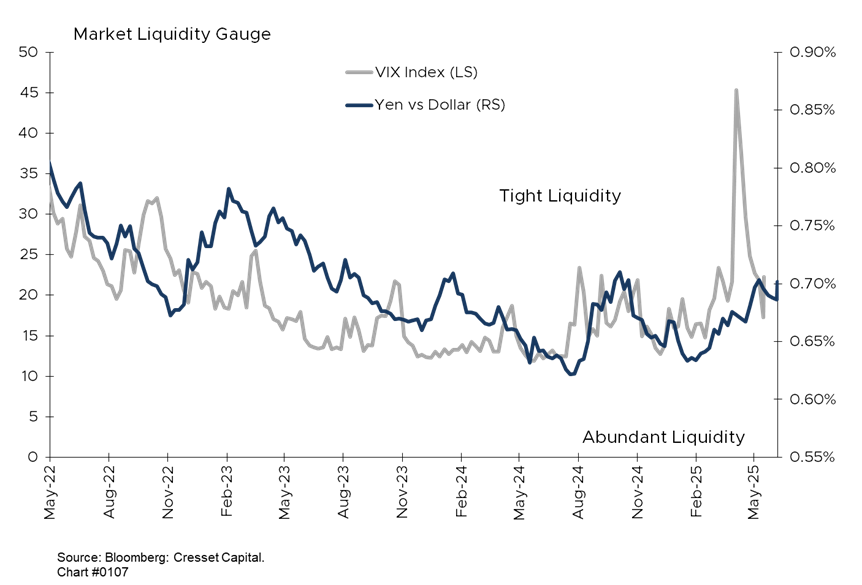

Carry Trade Unwinding with JGB Selloff Could Affect US Treasurys

Though the JGB crisis might appear to be unconnected to the fortunes of US Treasurys, there is indeed a relationship. The Japanese bond selloff is an unwinding of the “yen carry trade.” Thanks to comparatively low Japanese interest rates and a cheap yen, global investors borrow yen to invest in higher-yielding assets worldwide, particularly US Treasurys and blue-chip stocks. We estimate nearly $4 trillion was deployed globally using yen funding. As Japanese yields rise, the carry trade becomes less attractive, forcing unwinding that pushes the yen higher and US stocks and bonds lower. Moreover, Japanese investors collectively hold $1.13 trillion in US Treasuries and they could repatriate their holdings as JGBs become competitive again.

Japan’s bond turmoil appears to be washing up on our shores. The 30-year Treasury yield surged past five per cent last week, its highest level since 2008, with much of the recent move attributed to the Japanese market rather than domestic factors. The US 10-year term premium – the yield differential between short-term and intermediate-maturity Treasurys – has climbed to nearly one per cent, a level not seen since 2014, as investors demand higher compensation for long-term risk.

Japan Faces Difficult Choices that Could Accelerate Global Selling

The Bank of Japan could accelerate interest rate hikes, but this risks economic disruption. Higher rates would boost the value of the yen and accelerate carry trade unwinding. The Ministry of Finance could reduce long-term bond issuance, but previous attempts using this measure failed. Most concerning, any intervention requiring Japanese institutions to support the domestic bond market would likely involve selling foreign holdings, particularly US Treasurys, potentially accelerating global selling.

Bottom Line:

Japan’s bond crisis represents a major turning point in the unprecedented monetary policies adopted globally after 2008. Recent developments are concerning, given the interconnectedness of international bond markets and the massive scale of yen-funded investments worldwide. The yield the US Treasury must pay over the expected inflation rate has risen dramatically over the last few years to levels not seen since the financial crisis. Easy government borrowing is over, with potentially severe consequences for heavily indebted nations like the United States.