Key Observations:

- Equity investors are shrugging off tariff and trade uncertainty

- Near-term economic strength pushing equities higher despite rising bond yields

- Dollar weakening despite widening overnight yield advantage vs Euro

- Debt level immaterial, but debt service level a tangible quantity and cause for concern

Picture, if you will: US large caps are personified by President Trump, and long-dated US Treasurys are personified by Elon Musk. The S&P 500, focused on the cyclical economy, is celebrating recent tariff progress and the economy’s resilience, while longer-dated Treasury bonds and dollar markets are wringing their hands over secular fiscal imbalances as Congress negotiates the reconciliation bill. You have entered the Twilight Zone between short-term growth and long-term imbalances; we present for your approval our analysis of what that means for investors.

Equity Investors Are Shrugging Off Tariff and Trade Uncertainty

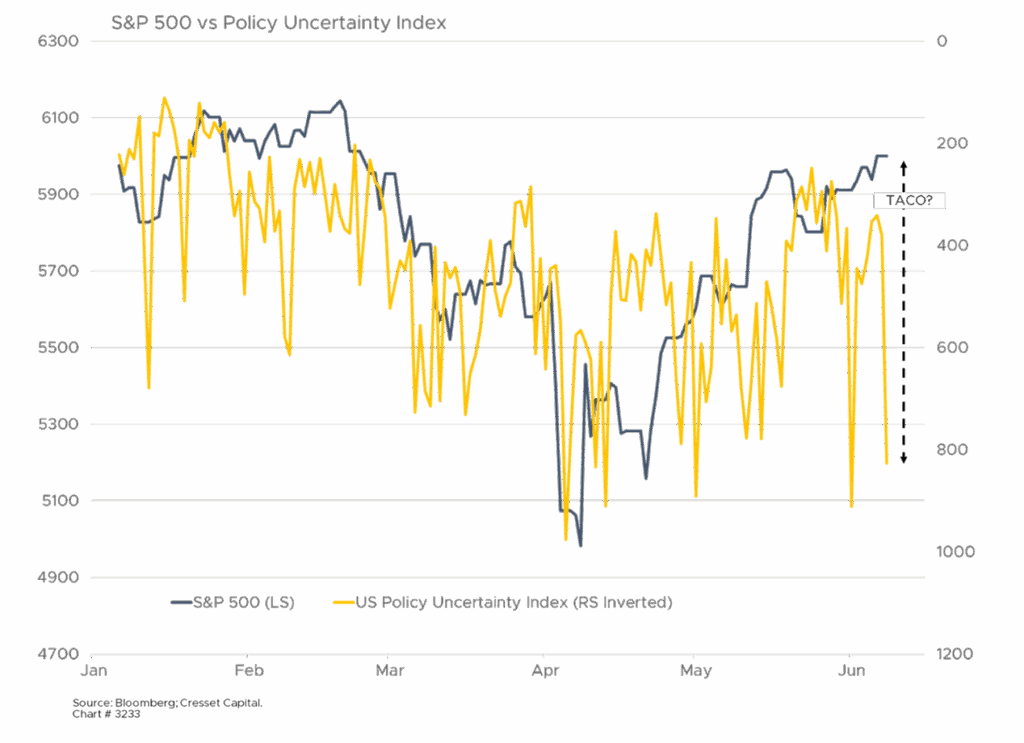

Global markets enjoyed strong performance last week, with the S&P 500 gaining nearly 20 per cent from its April lows. The MSCI All-Country World Index reached all-time highs, driven by solid fundamentals including resilient economic data, easing trade tensions, and strong corporate earnings. Technology stocks led gains, particularly AI-related companies, as Meta Platforms signed a major contract with Constellation Energy. Equity investors are shrugging off the uncertainty surrounding ongoing trade negotiations with China even though Chinese exports to the US fell by more than a third last month compared to a year ago. US stock investors appear to be emboldened by expectations that tariff threats might not be fully enforced or sustained.

Near-Term Economic Strength Pushing Equities Higher Despite Rising Bond Yields

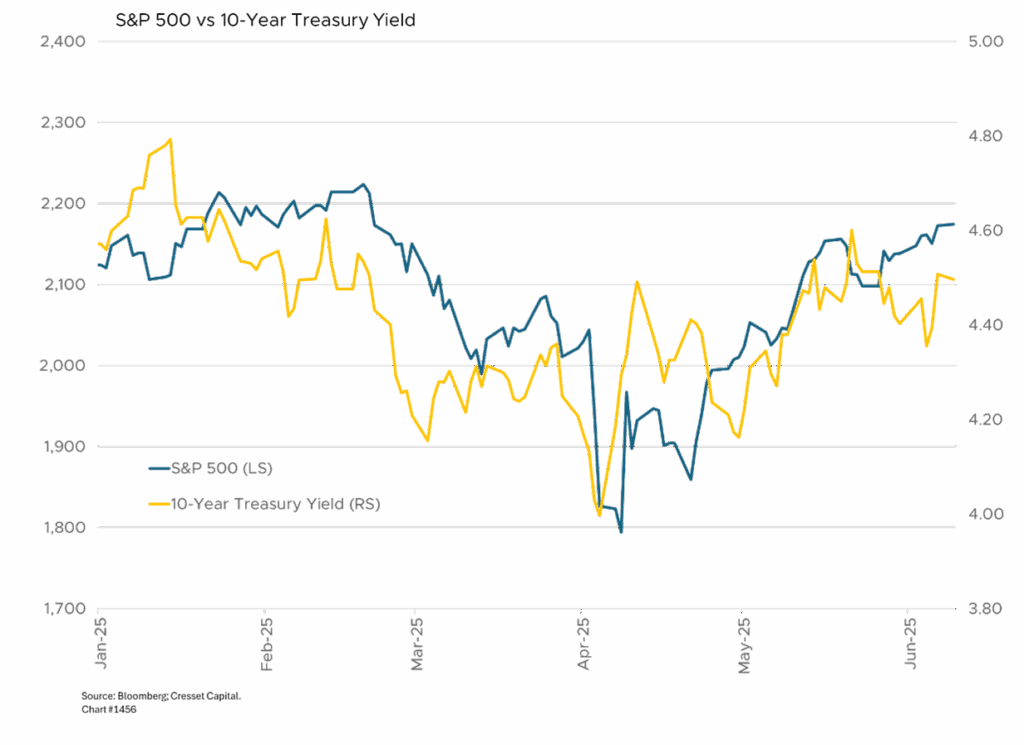

At the ground level, the coast is clear. A robust employment market helped boost investor optimism. TheMay jobs report released last week showed the US economy added 139,000 jobs, slightly above expectations, while unemployment held steady at 4.2 per cent. Despite some cooling, the labor market remains healthy with wage growth continuing to outpace inflation. Manufacturing employment declined by 8,000 jobs, potentially reflecting tariff impacts. Both US large caps and 10-year Treasury yields appear to be responding to near-term economic strength, as yields and equities rise and fall in lockstep. Higher yields have historically posed a headwind for equities, tending to compress market multiples – but this year they’re expanding in the face of higher yields.

Dollar Weakening Despite Widening Overnight Yield Advantage vs Euro

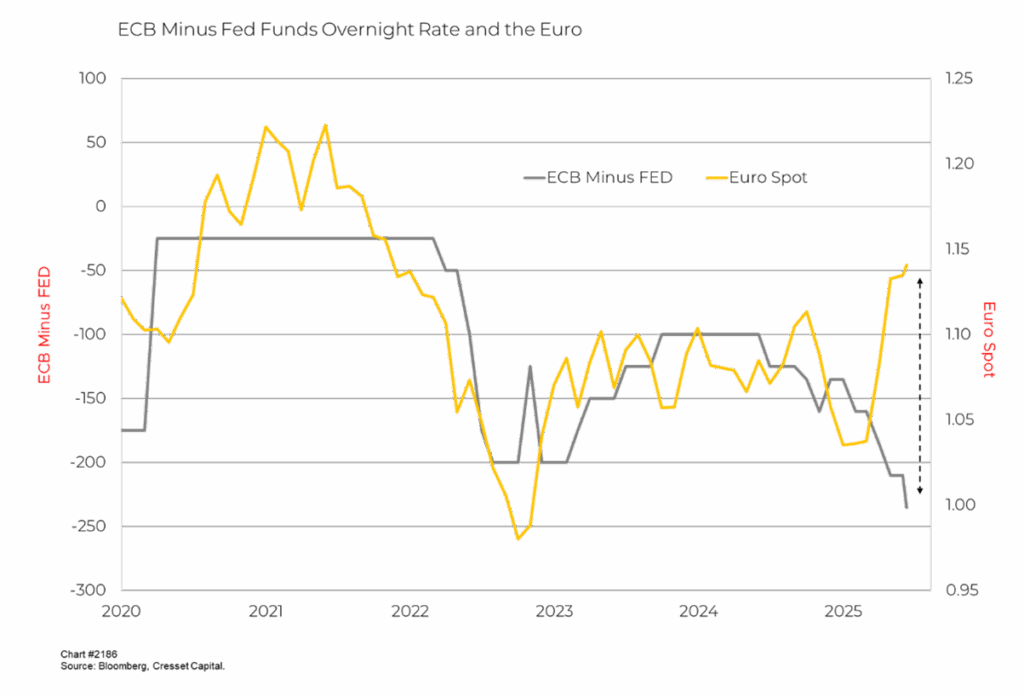

The “One Big Beautiful Bill” reconciliation package passed the House and moved to the Senate, creating fiscal policy uncertainty ahead of debt ceiling deadlines. The debate over the bill epitomizes the financial dissonance between short-term growth (to which equity markets respond) and long-term imbalances (which cause currency and bond markets to fret). The 30-year Treasury bond yield recently broke above five per cent and is close to hitting its highest level in nearly 20 years. It’s unusual for a currency to weaken when its overnight yield advantage widens, yet the dollar weakened against the Euro even though the ECB cut rates twice in recent weeks while the Fed stood pat.

Debt Level Immaterial, but Debt Service Level a Tangible Quantity and Concern

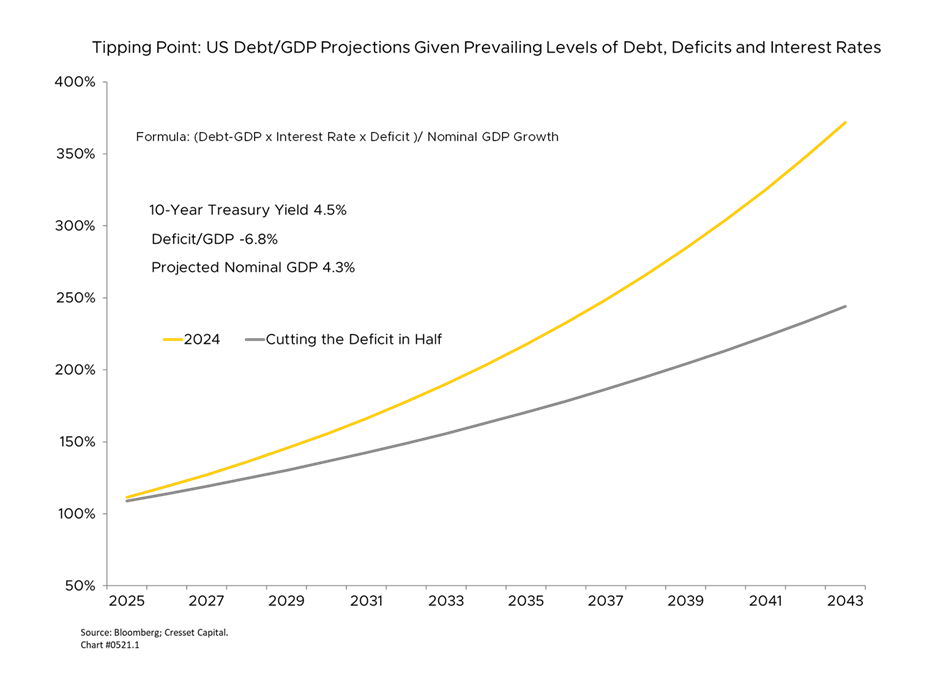

Part of the reason why investors and lawmakers aren’t concerned about the level of Treasury debt relative to the size of the economy is because it’s intangible. Whether debt is 60 per cent of GDP or 160 per cent of GDP is immaterial, since its level doesn’t affect us. We estimate US government debt as a share of GDP could double if current deficit spending patterns persist and could hit 150 per cent of GDP in 10 years even if we cut our deficits in half.

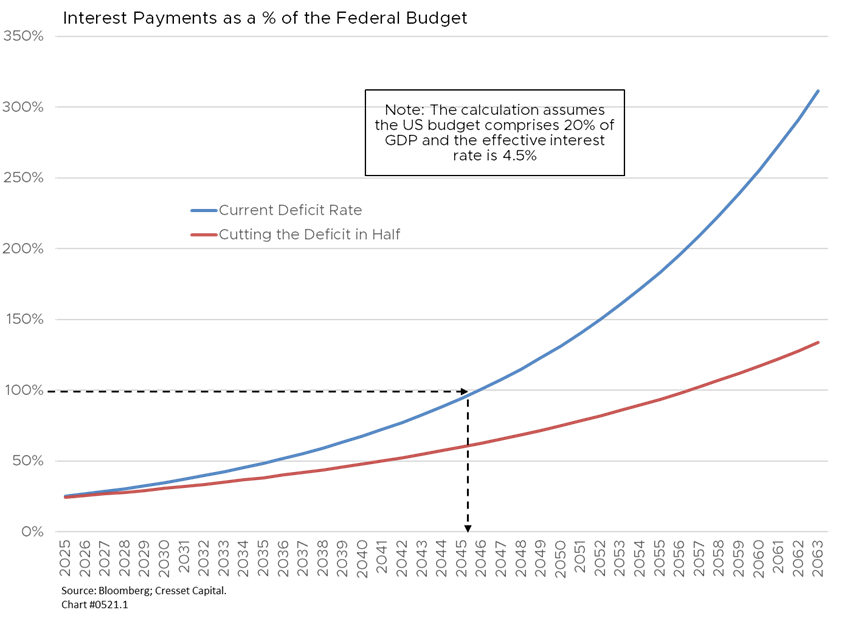

While debt levels are immaterial, the interest we pay to service the debt is tangible. At about $900 billion annually, interest expense represents nearly 14 per cent of the federal budget, and it has been expanding fast: it was as little as four per cent of the budget as recently as 2021. We estimate, assuming the Treasury’s effective interest rate is the 10-year Treasury yield and our budget is held at 20 per cent of GDP, our interest expense could envelop our entire budget in 20 years, if we continue to run deficits at their current pace. It will represent more than 60 per cent of the budget even if we cut our deficits in half.

Bottom Line:

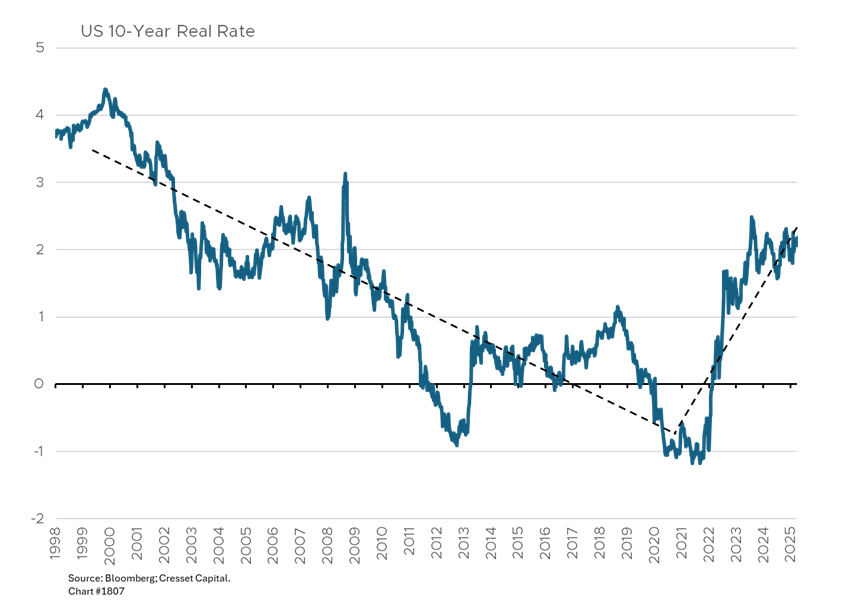

Equity markets are celebrating cyclical growth while the bond market is worried about long-term imbalances. Even though US interest expense is currently manageable, it is a fast-growing share of the budget. Bond investors worry that expanding our debt load financed at higher interest rates will quickly crowd out the budget. In the financial Twilight Zone in which we now find ourselves, we expect bond investors will tag Treasurys with increasingly higher real rates, a trend already underway. We believe quality global companies that generate strong cash flow will be able to navigate in an environment of tightening financing costs.