Israel launched an unprecedented attack on Iranian nuclear facilities and military targets early Friday morning, killing at least 78 people including senior military officials according to Iran’s UN envoy. The strikes targeted Iran’s nuclear enrichment facilities at Natanz and Fordow, killing top Iranian military commanders including Revolutionary Guards Commander-in-Chief General Hossein Salami, Armed Forces Chief of Staff Major General Mohammad Bagheri, and at least six nuclear scientists. The operation, dubbed “Rising Lion,” was described as Israel’s attempt to cripple Iran’s nuclear weapons program before it could produce atomic bombs.

Iran responded with retaliatory airstrikes dubbed “Operation Severe Punishment,” launching hundreds of ballistic missiles at Israel, with explosions heard in Jerusalem, Tel Aviv, and Haifa. The Iranian counterattack resulted in casualties on both sides, with Israeli emergency services reporting dozens injured from shrapnel.

While US officials have distanced themselves from Israel’s operation, the relationship between US diplomatic pressure and Israeli military planning remains ambiguous, with some Israeli officials claiming coordination while Secretary of State Marco Rubio suggested Israel acted unilaterally. Either way, from Israel’s point of view, their military action was deemed necessary given Iran’s rapid nuclear advancement and the failure of diplomatic solutions.

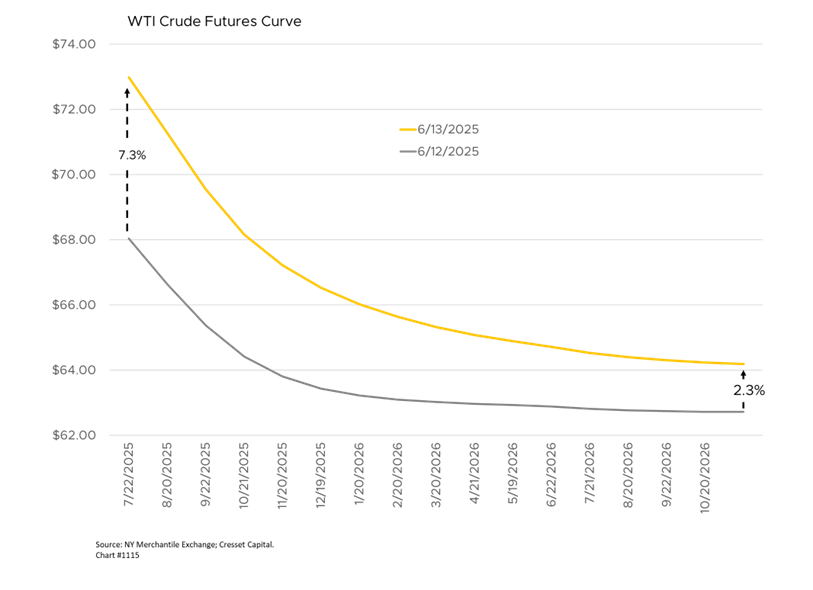

From an investment perspective, geopolitical uncertainty has spiked, as the operation fundamentally altered Middle Eastern dynamics. Iran’s leadership was forced to make rapid military appointments to replace killed commanders, while protesters in Iran were reported both condemning and praising the strikes. The conflict has raised oil prices and disrupted regional aviation. WTI crude spiked more than seven per cent to over $70/bbl. Most of the move was concentrated in the front months, suggesting the potential for supply shocks will be short lived.

Meanwhile, investors must grapple with a broad pallet of scenarios ranging from an Iranian regime change to broader regional war involving the United States. It should also be noted that the Iranian state is a powerful cyberwarfare actor, and we should consider cyber-attacks as part of Iran’s arsenal. It’s also possible that Iran or one of its proxies could attack or block oil and other trade shipments in the Strait of Hormuz.

Market Reaction

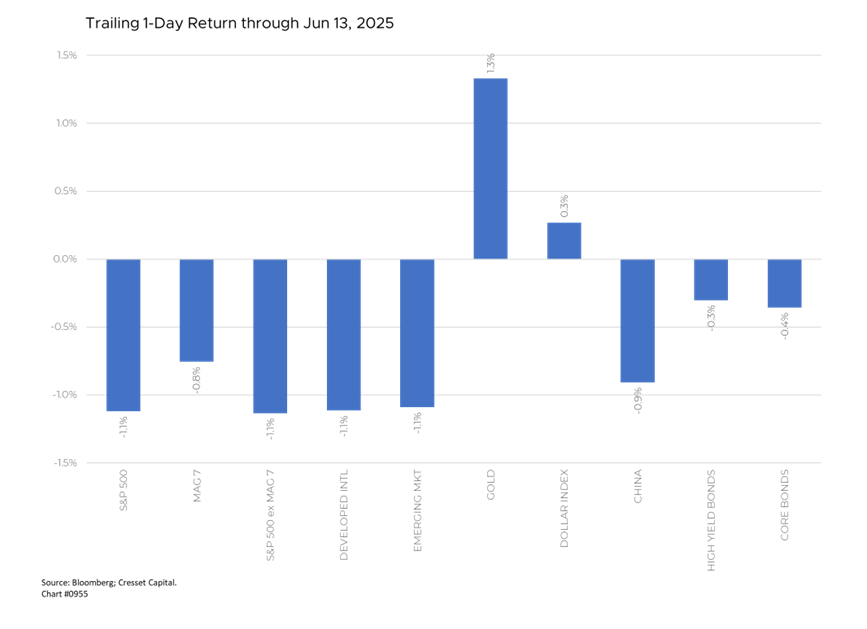

The heightened risk environment took its toll on risk assets on Friday, with most major equity markets selling off more than one percent on the day. US Treasury bonds, considered a safe haven asset, fell in price as yields rose as investors gauged the prospect of higher inflation. Only gold and the dollar rose in reaction to the escalating conflict.

Bottom Line:

Friday’s hostilities marked the most significant Middle Eastern conflict since the major wars of 1967 and 1973. We are attempting to assess whether it will result in a positive outcome, like Iranian democratization, or negative consequences like prolonged regional instability. We will continue to monitor ongoing developments as the news evolves. In the meantime, we are comfortable with our current positioning, holding a diversified allocation of high-quality, cash flowing companies and investment-grade bonds on the public side, and quality cash-flowing equity and credit on the private side.

Please feel free to reach out if we can be of assistance.